UDR Bundle

How Does UDR Thrive in the Real Estate Market?

UDR, Inc. is a leading real estate investment trust (REIT) dominating the multifamily housing sector. Its strategic property acquisitions and strong operational performance make it a key player. Focused on high-growth markets, UDR provides quality apartment homes and aims to deliver superior customer service.

To truly grasp the potential of UDR SWOT Analysis, one must understand its core operations and business model. This includes examining how UDR manages properties, its tenant screening process, and its approach to UDR customer support. Understanding UDR services and its financial performance is crucial for anyone evaluating UDR investment opportunities, or simply seeking UDR company reviews and ratings.

What Are the Key Operations Driving UDR’s Success?

The core of the UDR company lies in its ability to acquire, develop, and manage apartment communities. This real estate investment trust (REIT) focuses on providing high-quality rental properties in high-growth markets across the United States. Their primary goal is to offer attractive living spaces and superior customer service, leveraging technology to enhance the resident experience.

UDR's value proposition centers on creating desirable living environments. They cater to various customer segments, including individuals, couples, and families seeking convenient and amenity-rich rental housing. The company's operations are multifaceted, encompassing property management, asset management, and development activities.

UDR services include property management, which involves day-to-day operations such as leasing, resident services, and maintenance. Asset management focuses on optimizing the performance of existing properties through strategic renovations and expense management. Development activities involve identifying and acquiring land, overseeing construction, and bringing new apartment communities to market. This approach ensures a consistent quality of living for residents.

The UDR business model revolves around owning and operating apartment communities. They generate revenue through rental income and aim to increase property values through strategic improvements and efficient management. Their focus on high-growth markets helps to mitigate risks and sustain rental growth.

UDR operations are streamlined through property management, asset management, and development. Property management handles daily operations, while asset management focuses on optimizing existing properties. Development involves acquiring land and overseeing construction. Their 'Next Generation Operating Platform' (NGOP) enhances efficiency and resident satisfaction.

UDR customer support is enhanced through digital platforms that streamline communication and service requests. They utilize technology to improve the resident experience. This includes seamless leasing processes and responsive maintenance. The company focuses on providing a consistent quality of living.

UDR focuses on markets with strong job growth and limited new supply. This disciplined investment strategy helps mitigate market volatility and sustain rental growth. They aim to provide attractive living spaces and superior customer service. This approach allows them to differentiate themselves in a competitive market.

UDR's operational processes are designed to maximize efficiency and enhance the resident experience. They focus on markets with strong demographics and limited new supply. Their use of technology, like the NGOP, is a key differentiator, improving operational efficiency and resident satisfaction.

- Property Management: Day-to-day operations including leasing and maintenance.

- Asset Management: Optimizing existing properties through renovations and expense management.

- Development: Acquiring land and overseeing construction of new communities.

- Technology Integration: Utilizing the NGOP for enhanced efficiency and resident satisfaction.

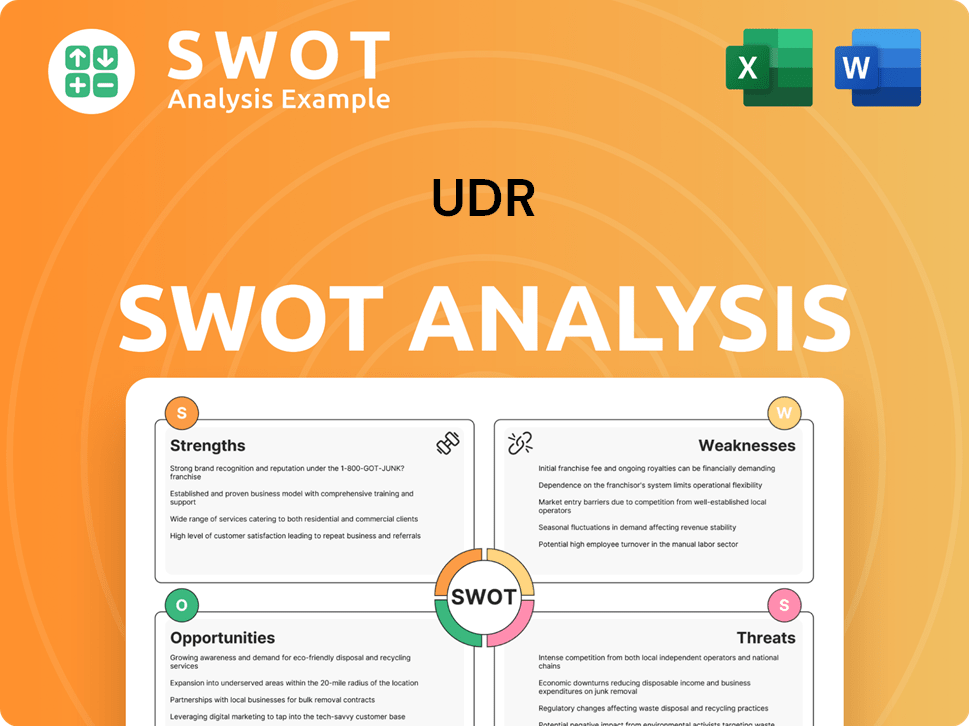

UDR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does UDR Make Money?

The UDR company generates revenue primarily through rental income from its portfolio of apartment communities, which is the core of its real estate investment trust (REIT) business model. This revenue stream is the foundation of how UDR operates and achieves its financial goals. The company's ability to lease apartment units and collect monthly rent is central to its financial performance and overall strategy.

Rental income typically accounts for the vast majority of UDR's total revenue. While specific percentages for 2024-2025 will be detailed in upcoming financial reports, historical data indicates that rental income constitutes over 95% of the company's revenue. In Q1 2024, UDR reported a net income of $15.5 million and Funds From Operations (FFO) as adjusted of $0.52 per share, with total revenues reaching $397.6 million, demonstrating the significance of rental income.

Other revenue streams, although smaller, include ancillary services such as pet fees, parking fees, and utility reimbursements. These additional income sources contribute to the overall financial health of the company but do not match the scale of rental income. The company's approach to property management is key to its financial success.

UDR's monetization strategies focus on maximizing rental income through dynamic pricing, tiered pricing, and value-add initiatives. These strategies are supported by the 'Next Generation Operating Platform' (NGOP), which uses data analytics to inform decisions and improve operational efficiencies. These approaches help UDR optimize its revenue generation and maintain a competitive edge in the market. You can learn more about their strategies in this article: Marketing Strategy of UDR.

- Dynamic pricing models adjust rents based on market demand and competitor pricing to maximize revenue per available unit.

- Tiered pricing caters to a range of resident preferences and budgets by offering different unit types and amenity packages.

- Value-add strategies, such as property renovations, enable higher rents upon completion.

- The NGOP provides data analytics to inform pricing, operational efficiencies, and marketing efforts, enhancing revenue.

- Strategic focus on high-growth, supply-constrained markets supports sustained rental growth and occupancy rates.

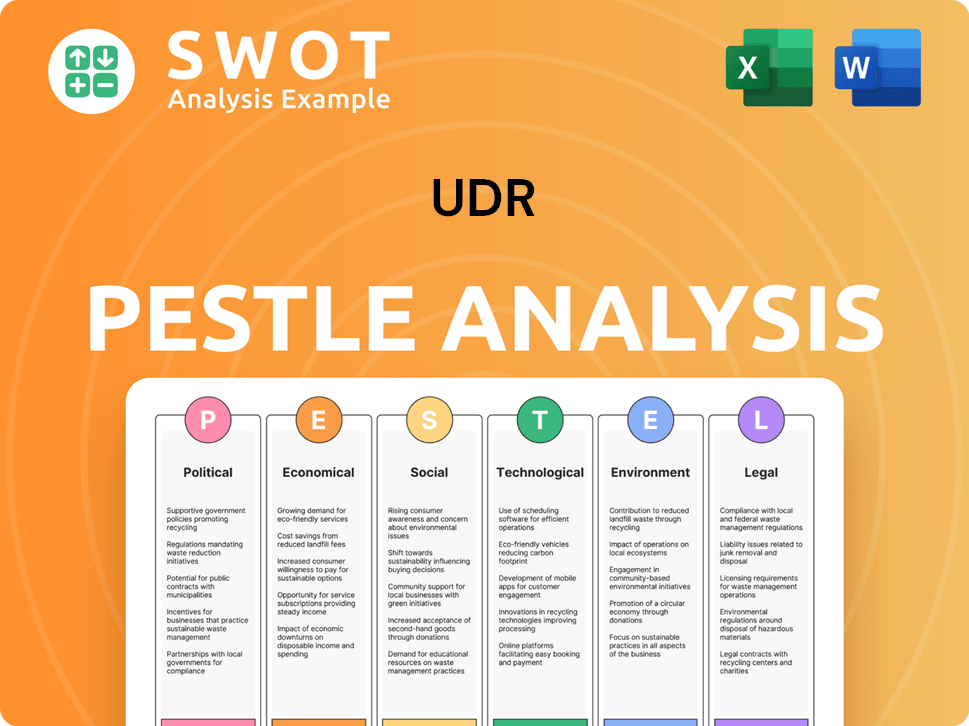

UDR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped UDR’s Business Model?

The UDR company has built its success on strategic moves and key milestones, primarily focusing on acquiring and developing properties in high-growth markets. Its approach involves a deep understanding of real estate dynamics, allowing it to capitalize on demographic shifts and job market expansions. This focus has been instrumental in driving consistent performance and adapting to market changes.

A key element of UDR's business model is its geographic diversification strategy. By spreading its investments across coastal and Sunbelt markets, the company has minimized risks associated with over-reliance on a single region. This diversification has positioned UDR operations to benefit from varied economic conditions and growth opportunities across different areas.

Operational challenges, such as fluctuating interest rates and market downturns, have been addressed through proactive financial management and flexible strategies. UDR has maintained a strong balance sheet and adapted its leasing terms to navigate economic uncertainties. The company's ability to adjust its strategies demonstrates its resilience and commitment to long-term value creation.

Strategic geographic expansion into high-growth markets. Implementation of advanced technology platforms to enhance operational efficiency. Consistent focus on value-add renovations and smart home technology to meet evolving resident preferences.

Acquisition and development of properties in supply-constrained markets. Maintaining a strong balance sheet to manage interest rate risk. Flexible leasing terms and resident support during economic downturns. Investing in sustainability initiatives and flexible living options.

The company's competitive edge is built on several factors, including brand strength, technology leadership, and economies of scale. These advantages enable UDR services to deliver superior value and maintain a strong position in the market. The company continually adapts to new trends to stay ahead of the competition.

- Brand Strength: Reputation for quality properties and excellent customer service.

- Technology Leadership: 'Next Generation Operating Platform' (NGOP) for optimized pricing and operational efficiency.

- Economies of Scale: Cost efficiencies in property management and procurement due to a large portfolio.

- Capital Allocation: Disciplined approach to acquisitions and value-add renovations.

For further insights into UDR's strategic approach, consider reading about the Growth Strategy of UDR. This article offers additional details on how the company navigates the real estate market and achieves its objectives.

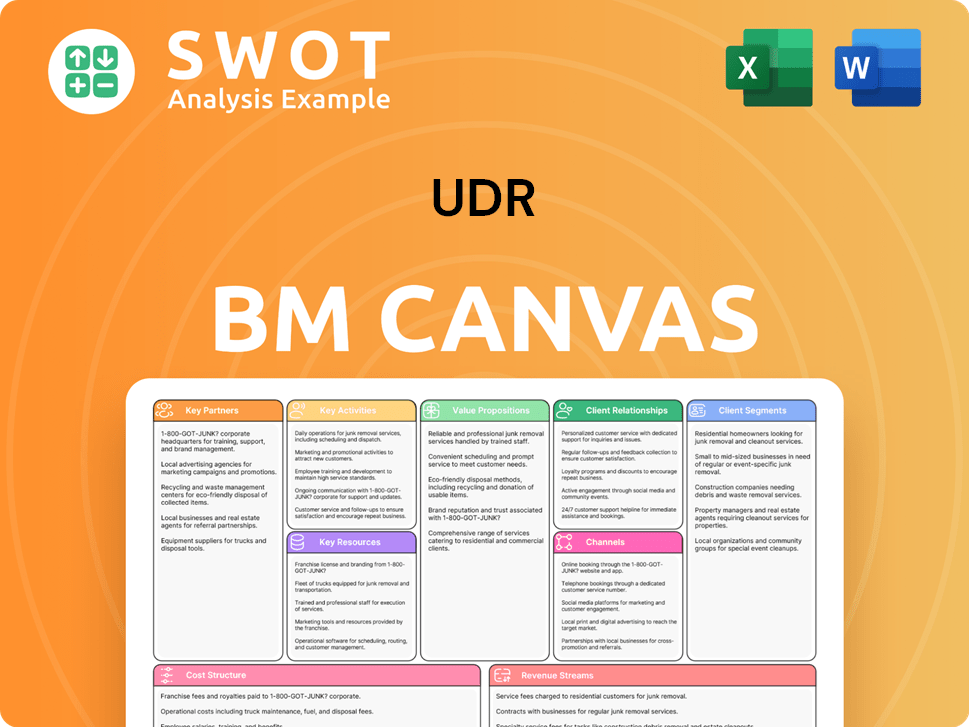

UDR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is UDR Positioning Itself for Continued Success?

The UDR company holds a prominent position within the U.S. multifamily housing market. As a leading real estate investment trust (REIT), it competes with other large public REITs and private real estate investors, focusing on high-growth, supply-constrained coastal and sunbelt markets. UDR's emphasis on quality properties and customer service supports strong customer loyalty, reflected in consistent occupancy and renewal rates. The company's operations are strictly within the United States, aligning with its domestic multifamily property strategy.

Despite its solid market standing, UDR faces risks such as interest rate fluctuations, regulatory changes, and increased competition. Technological disruption and economic downturns also pose challenges. The company's success hinges on adapting to these factors while maintaining its focus on operational efficiency and resident experience. Understanding the UDR business model is crucial for assessing its long-term viability.

UDR is a major player in the U.S. multifamily housing sector. It focuses on high-growth markets and competes with other large REITs. Customer loyalty is strong, supported by high occupancy rates.

Key risks include interest rate changes, regulatory shifts, and increased competition. Technological advancements and economic downturns also present challenges. The UDR company must navigate these risks to maintain its market position.

UDR plans to invest in its 'Next Generation Operating Platform' for efficiency and resident experience. The company will continue acquisitions and developments in strong markets. UDR aims for consistent shareholder returns through rental income growth and asset appreciation.

UDR offers property management services, focusing on high-quality assets. The company's customer support is crucial for maintaining resident satisfaction. For more details, read about the Growth Strategy of UDR.

UDR is investing in its 'Next Generation Operating Platform' to improve efficiency. It focuses on acquisitions and value-add renovations. The company emphasizes disciplined capital allocation and sustainability.

- Investment in technology to enhance operational performance.

- Strategic acquisitions and developments in key markets.

- Focus on value-add renovations to maximize returns.

- Commitment to sustainability and shareholder value.

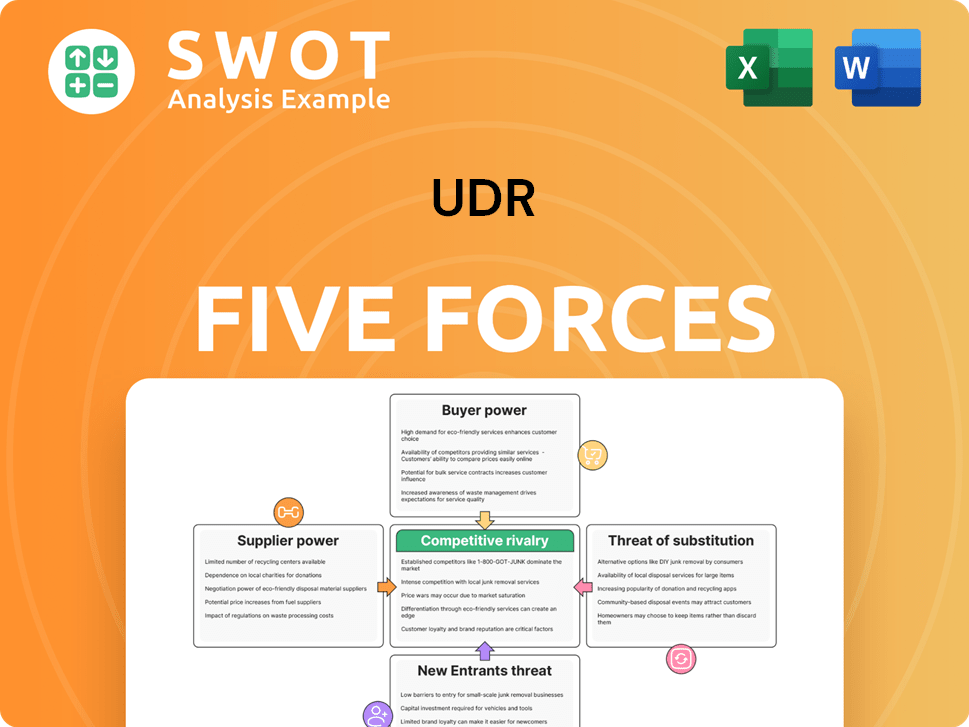

UDR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UDR Company?

- What is Competitive Landscape of UDR Company?

- What is Growth Strategy and Future Prospects of UDR Company?

- What is Sales and Marketing Strategy of UDR Company?

- What is Brief History of UDR Company?

- Who Owns UDR Company?

- What is Customer Demographics and Target Market of UDR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.