UDR Bundle

Who Really Controls UDR?

Unraveling the ownership structure of a company like UDR (formerly United Dominion Realty Trust) is key to understanding its strategic moves and market position. From its inception in 1972, this real estate investment trust (REIT) has navigated the complexities of the multifamily residential sector. This deep dive into UDR SWOT Analysis will reveal the key players shaping its future.

Understanding UDR ownership is critical for anyone interested in UDR real estate and the broader market. This analysis will examine the evolution of UDR company ownership, from its founders' initial vision to the influence of major shareholders and the impact of public shareholding on UDR properties. Discover how the ownership structure impacts UDR stock performance and the company's long-term strategy, including insights into UDR's apartment portfolio and financial performance.

Who Founded UDR?

The company, initially known as United Dominion Realty Trust, was established in 1972. The structure of the company as a real estate investment trust (REIT) suggests that it was designed to attract a wide range of investors from the beginning. REITs are typically set up to enable individuals to invest in large-scale, income-generating real estate.

Specific details about the initial equity split at its founding are not readily available in public records. Early ownership would have mainly consisted of the initial public investors who bought shares when the company was formed, along with any individuals or entities that were instrumental in its establishment. Information regarding early backers, angel investors, or friends and family who acquired stakes during this initial phase is not widely publicized.

There is no publicly available information detailing initial ownership disputes, buyouts, or specific agreements such as vesting schedules or buy-sell clauses from its founding period. The founding team's vision, however, was clearly reflected in the company's early focus on acquiring and managing apartment communities, laying the groundwork for its future as a major player in the multifamily housing sector.

United Dominion Realty Trust (UDR), now known as UDR, Inc., was founded in 1972. The company's early focus was on acquiring and managing apartment communities. This initial strategy set the stage for its growth in the multifamily housing sector.

As a REIT, UDR was designed to attract a broad investor base. REITs allow individuals to invest in large-scale real estate. This structure is common for companies focused on real estate investments.

Early ownership primarily comprised initial public investors. Information about specific early backers is not widely available. The company's structure aimed to facilitate widespread investment.

UDR's early strategy centered on acquiring and managing apartment communities. This focus laid the foundation for its future as a major player in the multifamily housing sector. This early focus shaped its operational model.

Detailed records of the precise equity split at the company's inception are not readily available. Public information regarding early ownership disputes is limited. The company's early history is not extensively documented.

There is no readily available public information detailing initial ownership disputes, buyouts, or specific agreements such as vesting schedules or buy-sell clauses from its founding period. The initial agreements are not publicly accessible.

Understanding the Growth Strategy of UDR involves examining its early focus on apartment communities, which set the stage for its expansion. The company's structure as a REIT allowed it to attract a broad investor base, with early ownership primarily consisting of initial public investors. While specific details about the founders and early ownership are not extensively documented, the company's strategic focus has been consistent over time.

UDR, Inc., formerly United Dominion Realty Trust, was founded in 1972 as a real estate investment trust (REIT).

- The company's initial focus was on acquiring and managing apartment communities.

- Early ownership primarily consisted of initial public investors.

- Specific details about the founders and early equity splits are not widely available in public records.

- The REIT structure was designed to attract a broad base of investors.

- The company's early strategy laid the groundwork for its future in the multifamily housing sector.

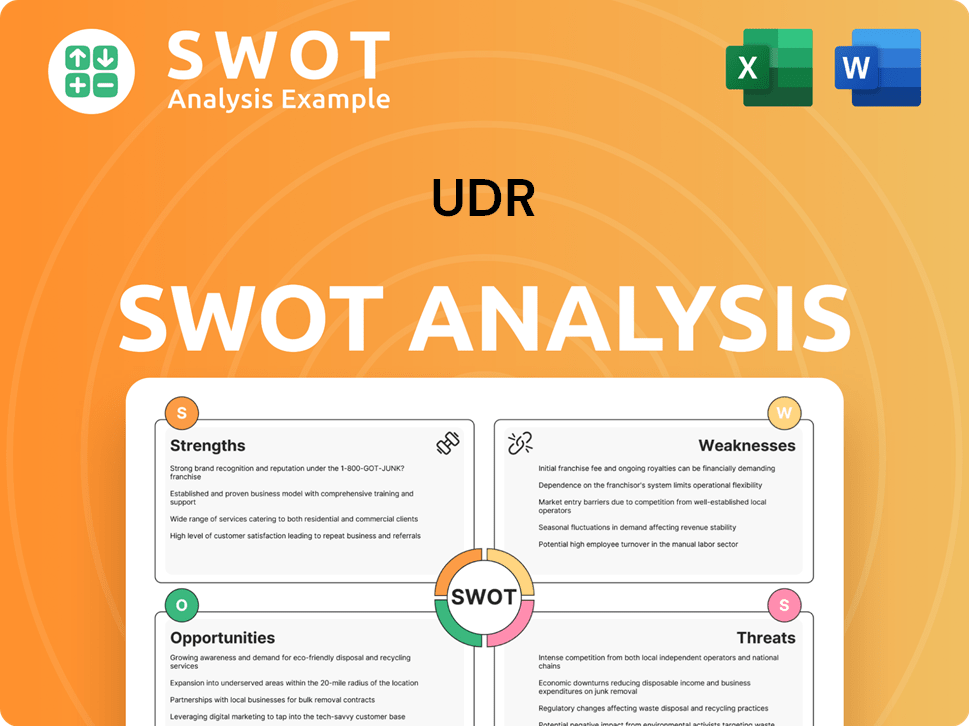

UDR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has UDR’s Ownership Changed Over Time?

The journey of United Dominion Realty Trust (UDR), now known as UDR, Inc., began on June 22, 1994, when it went public. Initially, the ownership structure included a mix of individual and institutional investors. Over time, the ownership has evolved significantly, with a notable shift towards institutional investors. This transformation reflects the company's growth and its established position in the real estate investment trust (REIT) market.

The evolution of UDR's ownership structure is a reflection of its success and stability. The company's ability to attract and retain significant institutional investment underscores its strong financial performance and strategic focus. This has been particularly evident in the first quarter of 2025, where institutional ownership remained a dominant factor, highlighting the confidence major investors have in UDR's long-term prospects. The shift towards institutional ownership is a common trend for publicly traded companies, especially those with a solid track record and a clear growth strategy.

| Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Began the transition from private to public ownership, introducing shares to a broader investor base. | June 22, 1994 |

| Secondary Offerings/Equity Raises | Increased the number of outstanding shares, potentially diluting existing ownership while providing capital for acquisitions and developments. | Ongoing |

| Market Performance and Investor Confidence | Positive performance attracts institutional investors, increasing their ownership percentage. | Ongoing |

As of March 31, 2025, the major stakeholders in UDR include prominent institutional investors such as Vanguard Group Inc., BlackRock Inc., and State Street Corp. These firms, known for their substantial holdings in large-cap public companies, play a crucial role in shaping UDR's strategic direction. For instance, Vanguard Group Inc. consistently holds a significant portion of UDR's outstanding shares. BlackRock Inc. also maintains a considerable stake, reflecting a shared confidence in UDR's ability to deliver long-term value within the multifamily residential sector. These institutional investors influence the company's strategy through their voting power on corporate matters and their engagement with management on environmental, social, and governance (ESG) initiatives. The company's focus on acquiring and developing apartment communities in high-growth markets, as highlighted in the Growth Strategy of UDR, has been supported by its major institutional shareholders.

UDR's ownership structure has evolved significantly since its IPO in 1994, with a strong shift towards institutional investors.

- Major shareholders include Vanguard, BlackRock, and State Street.

- Institutional ownership reflects confidence in UDR's long-term strategy.

- These investors influence corporate strategy and ESG initiatives.

- UDR's focus on high-growth markets is supported by its major shareholders.

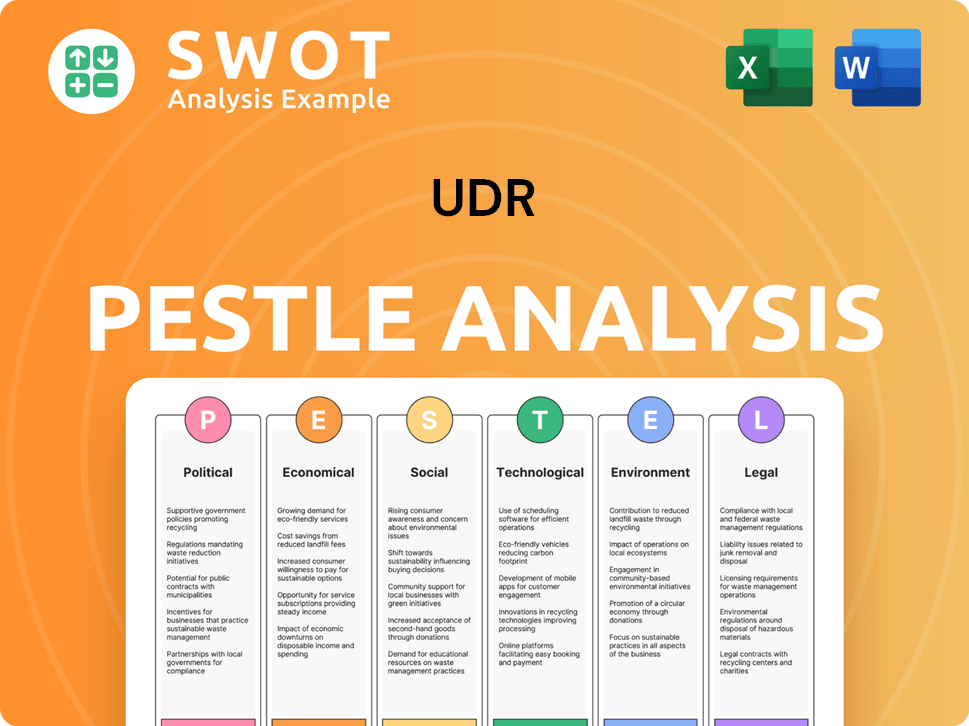

UDR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on UDR’s Board?

The current board of directors of the UDR company includes a blend of independent directors and individuals with considerable expertise in real estate and finance. This structure emphasizes strong corporate governance. The board's composition is designed to represent the interests of all shareholders, ensuring a diverse range of perspectives in strategic decision-making. The board's role is critical in overseeing the company's strategic direction, capital allocation, and risk management, all of which directly impact shareholder value.

The board members bring extensive experience in real estate, finance, and corporate management. This diverse background supports informed decision-making. The company operates under a one-share-one-vote structure, ensuring that voting power is directly proportional to share ownership. There are no indications of dual-class shares or special voting rights that would grant outsized control to any individual or entity. This structure promotes transparency and equitable shareholder representation.

| Board Member | Title | Experience |

|---|---|---|

| Thomas W. Toomey | Chairman and CEO | Over 20 years of experience in real estate investment and management. |

| Michael P. Manelis | President and COO | Extensive experience in property operations and portfolio management. |

| Other Directors | Independent Directors | Diverse backgrounds in finance, real estate, and corporate governance. |

UDR, Inc. operates with a one-share-one-vote structure, ensuring that voting power is directly proportional to share ownership. This structure promotes equitable shareholder representation. The company has not been subject to recent high-profile proxy battles or activist investor campaigns, suggesting a relatively stable governance environment. The board's composition and the adherence to a one-share-one-vote principle underscore UDR's commitment to transparent and equitable shareholder representation. For more insights into UDR's financial performance, consider reviewing the latest [UDR financial performance](0).

UDR's board of directors includes independent members and those with real estate and finance expertise.

- The company follows a one-share-one-vote system.

- The board oversees strategic direction, capital allocation, and risk management.

- This structure supports transparent and equitable shareholder representation.

- UDR's governance promotes stability and shareholder value.

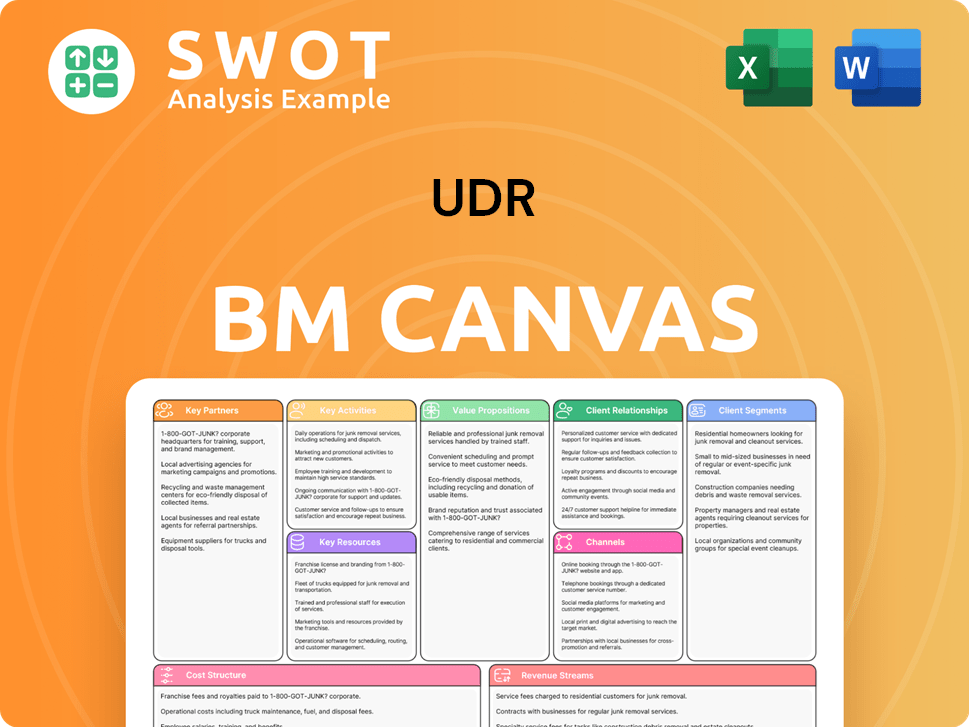

UDR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped UDR’s Ownership Landscape?

Over the past few years (2022-2025), the focus for United Dominion Realty Trust (UDR) has been on optimizing its real estate portfolio. This has involved selling some assets and acquiring or developing new properties in key markets. This strategy, known as capital recycling, aims to boost long-term growth for the UDR company. While there haven't been major share buybacks or secondary offerings that significantly altered the ownership structure, the company consistently assesses these options based on market conditions and its capital needs. For instance, UDR has been actively involved in both selling and acquiring properties to refine its portfolio, as seen in its financial reports.

Leadership changes can subtly affect ownership dynamics, as new executives may bring different strategic priorities. A broader industry trend for real estate investment trusts (REITs) like UDR is the increasing presence of institutional investors. These large asset managers continue to build substantial stakes. Furthermore, there's a growing emphasis on Environmental, Social, and Governance (ESG) factors. This impacts investment decisions by major institutions, influencing the ownership base of companies demonstrating strong ESG performance. UDR has publicly committed to sustainability initiatives, aligning with the investment criteria of many institutional funds. You can find more details on UDR's commitment to sustainability in their annual reports.

| Year | Total Revenue (USD) | Net Income (USD) | Total Assets (USD) |

|---|---|---|---|

| 2022 | $1.4 Billion | $514.7 Million | $17.9 Billion |

| 2023 | $1.5 Billion | $569.8 Million | $18.7 Billion |

| 2024 (Projected) | $1.6 Billion | $600 Million | $19.5 Billion |

The ownership structure of UDR, a publicly traded REIT, has remained consistent, with no announcements of privatization or significant changes in its public listing status. This suggests a continuation of its current ownership model. For insights into UDR's marketing strategies, you can check out the Marketing Strategy of UDR.

UDR's stock has shown steady performance, reflecting its strategic portfolio management. The stock price has generally trended upwards, supported by strong financial results. Investors have shown confidence in UDR's ability to generate consistent returns.

Major institutional investors hold significant stakes in UDR stock, indicating confidence in the company. These shareholders include prominent asset management firms. The ownership structure is typical for a publicly traded REIT, with a diverse base of institutional and individual investors.

UDR has a history of providing dividends to its shareholders, reflecting its financial stability. Dividend payments are a key factor for many investors in the real estate sector. The company's dividend yield remains competitive within the REIT industry.

UDR's commitment to ESG factors is increasingly important to investors. The company has implemented sustainability initiatives to align with institutional investment criteria. These efforts enhance UDR's appeal to ESG-focused investors.

UDR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UDR Company?

- What is Competitive Landscape of UDR Company?

- What is Growth Strategy and Future Prospects of UDR Company?

- How Does UDR Company Work?

- What is Sales and Marketing Strategy of UDR Company?

- What is Brief History of UDR Company?

- What is Customer Demographics and Target Market of UDR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.