UDR Bundle

Can UDR Company Continue Its Ascent in the Apartment Market?

The real estate investment trust (REIT) landscape is constantly shifting, especially within the multifamily housing sector, demanding a laser focus on growth. UDR, Inc., a major player in the apartment community arena, has a rich history. From its humble beginnings, UDR has become a significant force in the apartment market, but what does the future hold?

Understanding the UDR SWOT Analysis is crucial for investors and strategists alike. This article will dissect UDR's growth strategy, examining its expansion plans and financial performance. We'll explore the future prospects of UDR company, considering market trends and potential investment opportunities within the dynamic real estate investment landscape, providing insights into the UDR stock and the broader apartment market.

How Is UDR Expanding Its Reach?

The growth strategy of the UDR company is centered around expanding its presence in high-growth markets within the United States. This approach includes both strategic acquisitions and development projects, focusing on areas with strong employment growth and favorable demographic trends. The company's expansion initiatives aim to enhance its portfolio and increase shareholder value, making it a key player in the real estate investment sector.

UDR's focus on the apartment market is evident in its strategic allocation of capital. The company actively seeks properties that align with its investment criteria, particularly in regions experiencing robust population and job growth. This targeted approach allows UDR to capitalize on market opportunities and maintain a competitive edge. The Revenue Streams & Business Model of UDR highlights the company's financial strategies.

The company's commitment to a disciplined approach to capital allocation is crucial for its long-term growth strategy. This includes the potential sale of older, non-core assets to fund new investments or developments that offer higher growth potential. UDR's proactive asset management strategy is designed to maximize the value of its existing properties and identify opportunities for redevelopment or densification, ensuring sustained financial performance.

UDR prioritizes expansion in high-growth, supply-constrained markets across the U.S. This includes targeting sunbelt markets, which have shown significant population and job growth. The company's strategy is to acquire properties that fit its investment criteria, focusing on areas with strong economic fundamentals.

UDR actively enhances its existing portfolio through renovations and redevelopments. This includes upgrading unit interiors, common areas, and amenities to meet evolving resident demands. The goal is to increase property value and rental income, ensuring a competitive edge in the apartment market.

UDR employs a disciplined approach to capital allocation, which includes potential dispositions of older assets to fund new investments. Strategic capital allocation for 2024 and beyond prioritizes investments that generate attractive risk-adjusted returns. This approach supports long-term financial performance.

Partnerships are key, especially in development projects, allowing UDR to share risk and leverage expertise. The company collaborates with developers to enhance its market presence and achieve its growth objectives. These partnerships are crucial for expanding its reach.

UDR's expansion strategy involves both acquisitions and strategic development projects, focusing on high-growth markets. The company's disciplined capital allocation and portfolio enhancement efforts support its long-term financial goals. The company's strategic planning is designed to capitalize on market opportunities.

- Acquisitions in high-growth markets, particularly in the Sunbelt.

- Renovations and redevelopments to enhance existing properties.

- Disciplined capital allocation, including potential asset dispositions.

- Strategic partnerships to leverage expertise and share risk.

UDR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does UDR Invest in Innovation?

The UDR company's growth strategy heavily relies on innovation and technology to boost operational efficiency, improve resident experiences, and optimize property performance within the real estate investment sector. This approach is a key element in its long-term plans, focusing on digital transformation to enhance its market position and financial performance. The integration of smart home technologies, online platforms, and sophisticated property management systems showcases this commitment.

By embracing technological advancements, UDR aims to stay ahead in the competitive apartment market. This strategy not only improves the value proposition for residents but also contributes to the company's sustainability goals. The company's ability to integrate technology effectively is crucial for its future prospects and sustained growth in the real estate investment landscape.

The company's focus on technology extends beyond in-unit features to include back-end systems. These systems streamline maintenance requests, rent collection, and resident communication. This holistic approach to technology integration supports UDR's strategic goals, contributing to its overall financial health and competitive advantage in the apartment market.

The implementation of smart apartment features, such as smart locks, thermostats, and lighting controls, enhances resident convenience and contributes to energy efficiency. These technologies are becoming increasingly important in attracting and retaining residents. This focus aligns with broader industry trends toward tech-enabled living spaces.

Online leasing platforms streamline the rental process, making it easier for prospective residents to find and apply for apartments. These platforms also improve efficiency for UDR's leasing teams. This digital approach enhances the overall customer experience and supports the company's growth strategy.

Sophisticated property management systems are used to streamline operations, manage maintenance requests, and handle rent collection efficiently. These systems provide valuable data insights, helping UDR make informed decisions. These systems improve operational efficiency and enhance the resident experience.

Data analytics and artificial intelligence are used to inform pricing strategies, identify market trends, and optimize marketing efforts. This data-driven approach allows for more informed decisions regarding rent adjustments and capital improvements. This helps to improve financial performance.

The company's sustainability initiatives include energy-efficient systems and environmentally friendly practices. These efforts contribute to long-term operational savings and appeal to environmentally conscious residents. This aligns with broader industry trends towards sustainable practices.

Back-end systems streamline maintenance requests, rent collection, and resident communication. These systems improve operational efficiency and enhance the overall resident experience. This focus on efficiency supports the company's financial goals.

The integration of technology and innovation is a cornerstone of UDR's growth strategy, directly contributing to its ability to improve operational efficiency, reduce costs, and enhance the overall value proposition of its properties. For example, in 2024, the company reported that its investments in smart home technology have led to a 15% reduction in energy consumption in some properties. Furthermore, data analytics have improved rent optimization, resulting in a 3% increase in revenue across its portfolio. These technological capabilities are essential for UDR to maintain a competitive edge and achieve its long-term financial goals. According to a recent article, the company's strategic use of technology positions it well for future growth in the real estate market; read more about it in this UDR's growth strategy analysis.

These advancements are crucial for enhancing UDR's competitive advantage and ensuring its future prospects in the apartment market. The company's commitment to innovation is evident in its consistent integration of technology across its operations.

- Smart Home Integration: Offering smart locks, thermostats, and lighting controls.

- Data-Driven Decision Making: Using data analytics and AI for pricing and marketing.

- Operational Efficiency: Streamlining maintenance and rent collection through advanced systems.

- Sustainability Initiatives: Implementing energy-efficient systems and eco-friendly practices.

UDR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is UDR’s Growth Forecast?

The financial outlook for the UDR company reflects a strategic focus on sustainable growth and disciplined capital management. The company's projections for 2024 anticipate Funds From Operations (FFO) per share to be between $2.26 and $2.34, indicating an increase from the previous year. This positive forecast is supported by the expectation of increased revenue in existing properties, projected to grow between 2.5% and 4.0% during the same period. These financial targets are rooted in strong demand within its core markets and effective management of occupancy and rental rates.

UDR's financial strategy emphasizes a strong balance sheet and conservative leverage, providing flexibility for future growth initiatives. Investment decisions are made strategically, with capital allocated to value-adding acquisitions, development projects, and property enhancements designed to yield attractive returns. The company's long-term financial goals include consistent FFO per share growth, healthy dividend payouts, and a robust net asset value (NAV) per share. The financial performance of UDR is often evaluated against industry benchmarks like the FTSE Nareit Equity REITs Index, with the company aiming to outperform through strategic investments and operational efficiencies.

The company's approach to funding its growth typically involves utilizing existing credit facilities, disposing of non-core assets, or issuing additional equity or debt as needed. The financial narrative surrounding UDR's strategic plans is centered on prudent capital allocation, operational excellence, and a commitment to delivering long-term value to its shareholders. For additional insights, consider exploring the Target Market of UDR.

The company's financial outlook for 2024 includes an anticipated FFO per share in the range of $2.26 to $2.34. This projection highlights the expectation of improved financial performance and strategic financial planning. This growth is a key indicator of the company's financial health and its ability to generate returns.

UDR anticipates same-store revenue growth between 2.5% and 4.0% for 2024. This growth is supported by strong demand in its target markets and effective management of rental rates and occupancy levels. This growth demonstrates the company's ability to capitalize on market opportunities and optimize its existing portfolio.

UDR strategically allocates capital towards value-add acquisitions, development projects, and property enhancements. These investments are expected to generate attractive returns and contribute to the company's long-term growth strategy. The focus is on projects that enhance shareholder value.

The company maintains a strong balance sheet and a conservative leverage profile, which provides financial flexibility for future growth initiatives. This approach allows UDR to adapt to changing market conditions and pursue strategic opportunities. This is crucial for long-term sustainability.

UDR has set several key financial goals to drive long-term shareholder value. These goals are designed to ensure consistent growth and financial stability in the competitive apartment market.

- Consistent FFO per share growth.

- Healthy dividend payouts.

- Strong net asset value (NAV) per share.

- Outperformance compared to industry benchmarks.

UDR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow UDR’s Growth?

The UDR company's growth strategy faces several potential risks and obstacles inherent in the real estate investment sector. These challenges can impact the company's financial performance and its ability to capitalize on future prospects. Understanding these risks is crucial for assessing the long-term viability of UDR's investments in the apartment market.

Market competition remains a significant factor, with numerous developers and REITs competing for properties and residents. Regulatory changes, especially at the local and state levels, pose another challenge, potentially affecting development timelines and costs. Additionally, supply chain issues, technological disruptions, and internal resource constraints can hinder growth, influencing the UDR stock.

UDR employs a comprehensive risk management framework to address these challenges, including portfolio diversification and scenario planning. However, emerging risks like rising interest rates and shifts in remote work trends continue to evolve, requiring ongoing adaptation. For more insights on the company's structure, consider exploring Owners & Shareholders of UDR.

Intense competition from other real estate investment trusts (REITs) and developers in target markets can impact occupancy rates and rental growth. This competition can also affect the pricing of property acquisitions, potentially squeezing profit margins. The apartment market is highly competitive, requiring constant innovation and strategic adjustments to maintain a competitive edge.

Changes in zoning laws, rent control measures, and environmental regulations at local and state levels can affect development timelines and costs. Stricter rent control policies, for instance, could limit UDR's ability to maximize rental income in certain markets. Compliance with evolving regulations adds to operational expenses and can delay project completion.

Supply chain issues, particularly for materials and labor, can lead to delays and increased costs for development and renovation projects. These disruptions can impact project timelines and profitability. The volatility in material costs and labor availability requires careful management and strategic sourcing to mitigate risks.

Failure to keep pace with technological innovations such as smart home technology, property management software, and online leasing platforms could put UDR at a disadvantage. Competitors adopting new technologies can attract residents and streamline operations. Staying current with technological advancements is crucial for maintaining a competitive edge.

The availability of skilled personnel for property management, development, and technology implementation can hinder growth. Attracting and retaining qualified staff is essential for efficient operations and project execution. Resource constraints can limit the company's ability to scale its operations effectively.

Increased interest rates can raise borrowing costs, impacting the profitability of new acquisitions and development projects. Higher rates can also affect the demand for apartments as housing affordability decreases. Managing debt and interest rate risk is critical for maintaining financial stability.

UDR employs various strategies to mitigate these risks. Diversifying its portfolio across high-growth markets helps to reduce the impact of regional economic downturns. Scenario planning allows the company to assess and prepare for adverse market conditions and regulatory shifts. These strategies aim to enhance the company's resilience and ensure sustainable growth.

Shifts in remote work trends can influence demand for urban versus suburban apartments, affecting occupancy rates and rental income. The company must adapt its property portfolio and marketing strategies to align with evolving resident preferences. Monitoring and responding to these shifts is crucial for maintaining a competitive position.

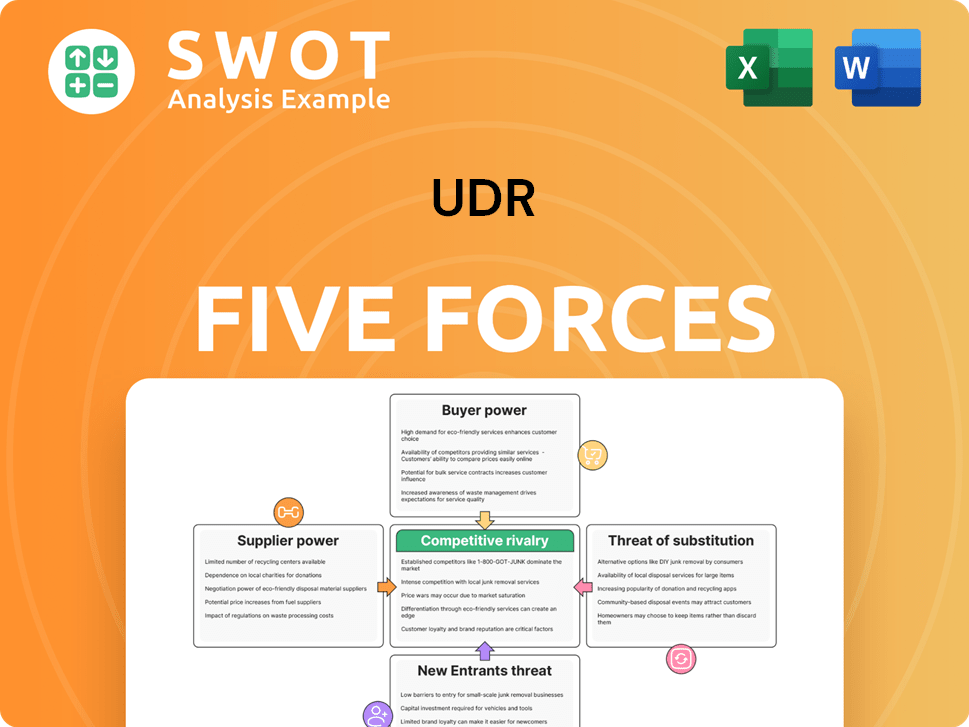

UDR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.