UDR Bundle

How Does UDR Stack Up in the Apartment Arena?

The multifamily real estate sector is a dynamic battleground, constantly reshaped by economic tides and shifting resident preferences. UDR, Inc., a prominent REIT, is a key player in this environment, but how does it fare against its rivals? Understanding the UDR SWOT Analysis is crucial to grasping its position.

This analysis will dissect the UDR competitive landscape, providing a comprehensive UDR market analysis to identify its primary competitors and evaluate its strategic positioning. We'll explore UDR's business strategy and how it differentiates itself within the industry. This deep dive into UDR's competitive advantages and disadvantages will offer valuable insights for investors and stakeholders, helping them assess its future prospects in a challenging market.

Where Does UDR’ Stand in the Current Market?

UDR, Inc. focuses on owning, operating, acquiring, and developing apartment communities. Its core operations involve managing a portfolio of properties, ensuring high occupancy rates, and generating rental income. The company's value proposition centers on providing high-quality living spaces in desirable locations, catering to a diverse range of renters, and delivering consistent returns to shareholders.

The company's business strategy emphasizes strategic geographic diversification and a focus on high-growth, supply-constrained markets. This approach allows for leveraging diverse economic drivers and demographic shifts. UDR's commitment to operational excellence, coupled with a focus on customer satisfaction, underpins its ability to maintain a strong market position and adapt to changing market conditions. For more insights, explore the Marketing Strategy of UDR.

UDR's primary product offerings consist of apartment communities, ranging from luxury high-rises to more moderately priced units. The company strategically targets urban and infill locations to attract a professional demographic seeking convenience and amenities. This has enabled UDR to command higher rents and maintain strong occupancy rates, which stood at 96.6% as of March 31, 2024.

UDR operates within the multifamily real estate sector, competing with other large REITs and property management companies. The UDR competitive landscape is characterized by a mix of public and private entities, all vying for market share. Key factors influencing competition include property location, amenities, rental rates, and management quality.

Major UDR competitors include Equity Residential, AvalonBay Communities, and Essex Property Trust. These companies share similar business models, focusing on owning and operating apartment communities. The competitive landscape also includes regional players and private equity firms that acquire and manage multifamily properties.

UDR's market share is significant within its targeted submarkets. While precise figures for the entire U.S. multifamily market are difficult to ascertain, UDR's substantial portfolio of approximately 57,000 apartment homes (as of early 2024) indicates a leading presence. The company strategically positions itself in high-growth areas to maximize returns.

UDR's competitive advantages include its strategic geographic diversification, high-quality properties, and focus on customer service. The company employs various strategies to maintain its edge, such as investing in property upgrades, leveraging technology, and optimizing operational efficiency. These strategies help UDR attract and retain residents.

UDR's financial performance is a key indicator of its competitive standing. The company reported Funds From Operations (FFO) of $0.60 per diluted share for the first quarter of 2024. This financial health, combined with strategic market focus, underscores UDR's ability to generate consistent returns.

- Analysis of UDR's financial performance vs. competitors reveals its ability to maintain profitability.

- UDR's strategic initiatives include property acquisitions and developments in high-demand markets.

- Key challenges include managing rising operating costs and adapting to changing market dynamics.

- UDR's growth strategies involve expanding its portfolio and enhancing operational efficiency.

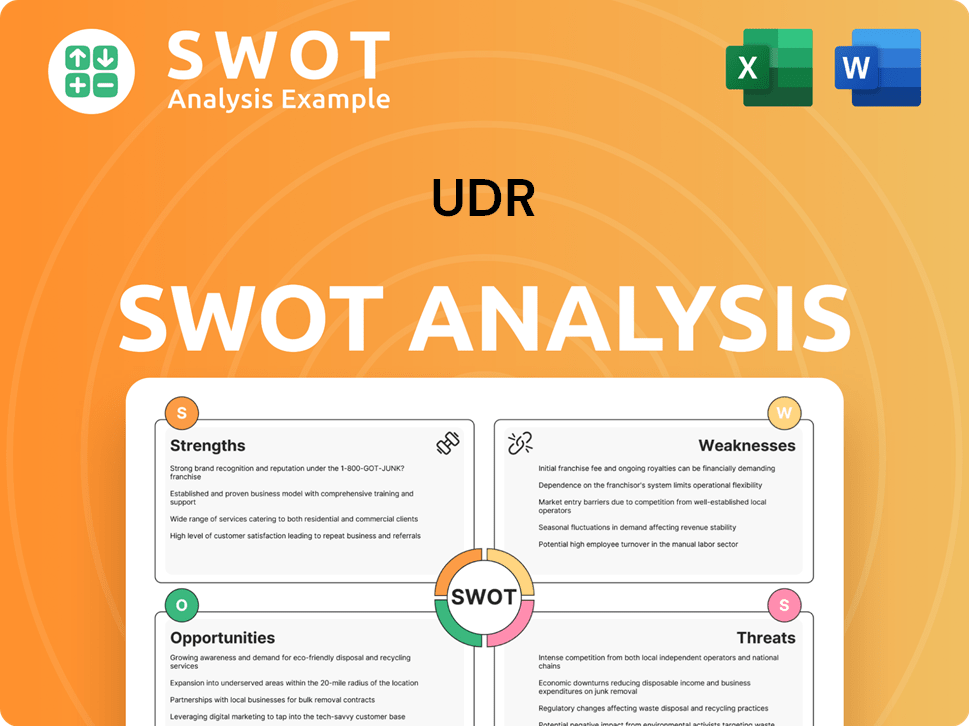

UDR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging UDR?

Understanding the UDR competitive landscape is crucial for assessing its market position and future prospects. The company operates within a dynamic multifamily real estate market, where competition is fierce. This analysis of UDR competitors provides insights into the key players and their strategies.

This UDR market analysis reveals the challenges and opportunities within the sector. The real estate market is influenced by economic cycles, technological advancements, and evolving consumer preferences. Examining these factors helps to understand how UDR navigates its competitive environment and maintains its position.

For a deeper understanding of the company's origins, consider reading the Brief History of UDR.

UDR's most significant direct competitors are publicly traded residential REITs. These REITs have substantial portfolios in similar high-growth, supply-constrained markets. They compete directly for tenants and investment opportunities.

Key direct competitors include Equity Residential (EQIX), AvalonBay Communities (AVB), Essex Property Trust (ESS), and Camden Property Trust (CPT). Each brings unique strengths to the market, influencing UDR's strategic decisions.

These competitors challenge UDR through price competition, innovation in property management, and the use of technology. They often employ aggressive leasing incentives and rapid expansion into emerging markets to gain market share.

Beyond direct REIT rivals, UDR faces indirect competition from private real estate investment firms, institutional investors, and individual property owners. Single-family rental companies and short-term rental platforms also pose indirect competitive pressures.

The competitive landscape is shaped by mergers and acquisitions, which can consolidate market power. Economic factors, such as interest rates and housing supply, significantly impact the competitive position of UDR and its rivals.

Innovation in smart home technology and resident services plays a crucial role in attracting and retaining tenants. Competitors may offer advanced digital platforms for leasing and maintenance, or incorporate cutting-edge amenities.

UDR's competitive advantages include its portfolio of high-quality properties and its focus on strategic markets. However, it faces challenges from rising interest rates and increasing competition in key markets. Analyzing these aspects is crucial for a comprehensive UDR company overview.

- Market Share: Assessing UDR's market share compared to its competitors provides insights into its position within the industry.

- Financial Performance: Analyzing UDR's financial performance versus competitors helps to evaluate its profitability and efficiency.

- Strategic Initiatives: Examining UDR's strategic initiatives in the competitive landscape reveals its plans for growth and market positioning.

- Adaptation to Market Conditions: Understanding how UDR is adapting to changing market conditions is vital for assessing its long-term prospects.

- Innovation: UDR's approach to innovation in the apartment industry, including technology adoption and resident services, is a key differentiator.

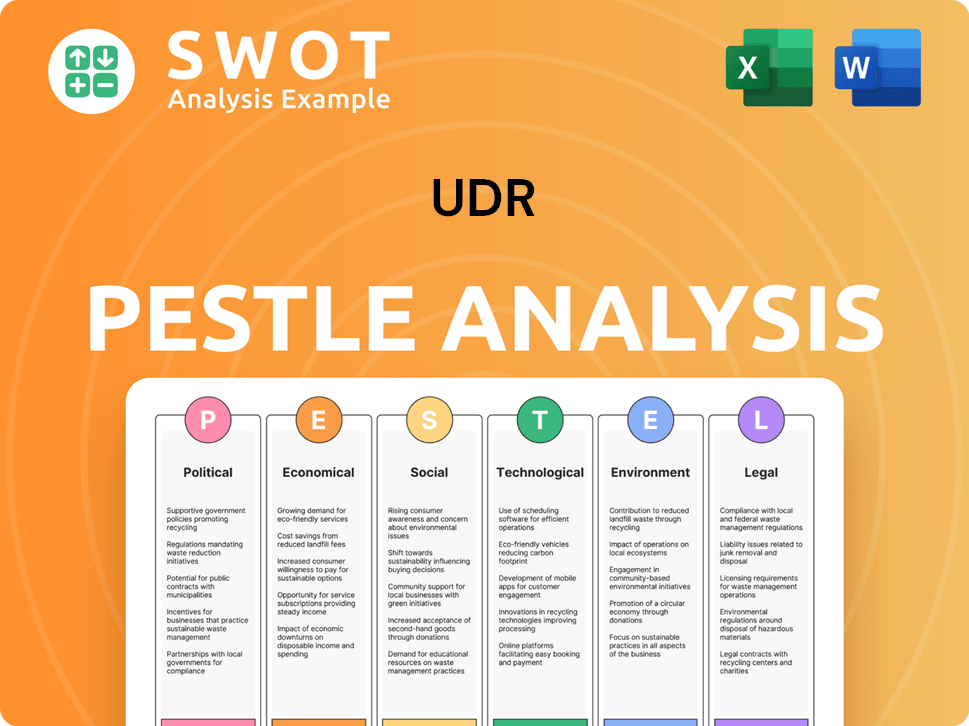

UDR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives UDR a Competitive Edge Over Its Rivals?

The competitive advantages of UDR stem from its strategic portfolio allocation, operational efficiencies, and commitment to innovation. Focusing on high-growth, supply-constrained markets across the United States, particularly in urban and infill locations, allows the company to capitalize on strong demographic trends and limited new supply. This approach typically leads to higher occupancy rates and rent growth potential, contributing to a strong competitive position in the UDR competitive landscape.

Operational excellence and technological integration are significant differentiators for UDR. The company leverages data analytics and technology to optimize property management, revenue management, and resident engagement. Utilizing sophisticated pricing algorithms maximizes rental income and maintains competitive occupancy levels. Digital platforms enhance the resident experience, fostering customer loyalty and contributing to lower operating expenses and higher net operating income. This focus on efficiency is a key element of its UDR business strategy.

UDR's strong financial health and access to capital markets provide a competitive edge, enabling strategic acquisitions and developments. This allows for portfolio expansion and enhanced market presence, outperforming smaller, less capitalized competitors. However, UDR faces threats from imitation as other REITs adopt similar technological solutions and investment strategies. The company's established brand equity, market knowledge, and relationships provide a sustainable foundation for its competitive position, as highlighted in an article about Owners & Shareholders of UDR.

UDR strategically invests in high-growth, supply-constrained markets. This focus on urban and infill locations allows the company to benefit from strong demographic trends and limited new supply. Its portfolio diversification across coastal and Sunbelt markets mitigates regional economic downturns.

UDR leverages data analytics and technology to optimize property management, revenue management, and resident engagement. Sophisticated pricing algorithms maximize rental income and maintain competitive occupancy levels. Digital platforms enhance the resident experience, fostering customer loyalty.

UDR's strong financial health and access to capital markets enable strategic acquisitions and developments. This allows for portfolio expansion and enhanced market presence. The company can more effectively expand its portfolio and enhance its market presence than smaller competitors.

UDR's established brand equity, extensive market knowledge, and long-standing relationships provide a sustainable foundation. These factors help UDR maintain its competitive position. This is a key factor in the UDR market analysis.

UDR's competitive advantages include strategic portfolio allocation, operational excellence, and financial strength. These advantages enable the company to achieve higher occupancy rates and rent growth. The company's focus on technology and customer experience further enhances its market position.

- Strategic Portfolio Allocation: Focus on high-growth markets and diversification.

- Operational Excellence: Leveraging data analytics and technology for efficiency.

- Financial Strength: Access to capital for strategic acquisitions and developments.

- Brand Equity: Established brand and market knowledge.

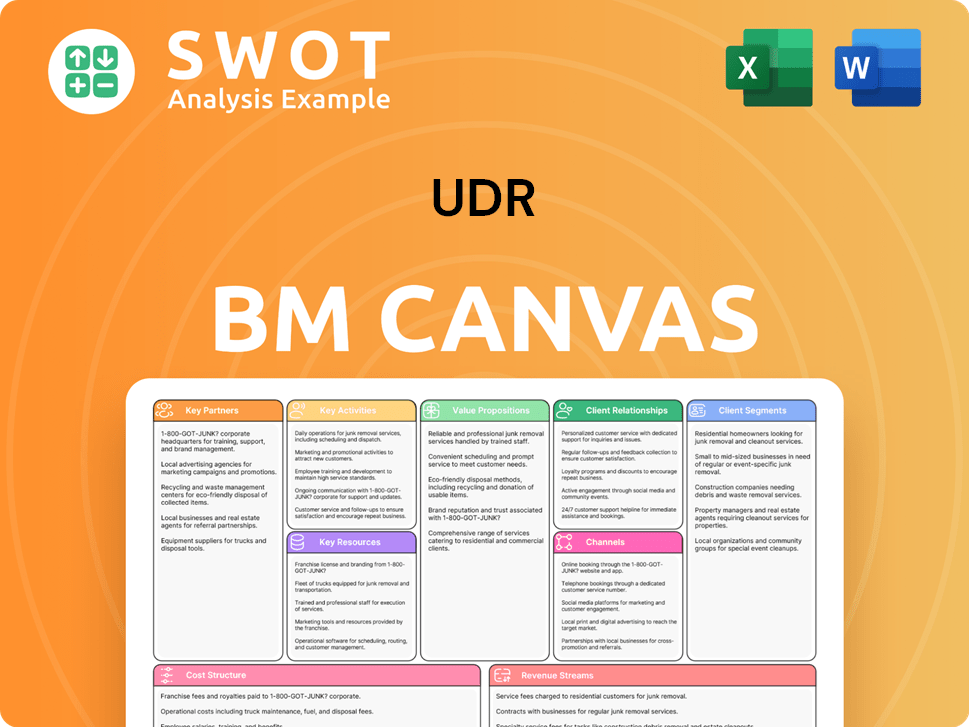

UDR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping UDR’s Competitive Landscape?

The multifamily real estate sector is currently undergoing significant shifts that influence the UDR competitive landscape. These changes present both challenges and opportunities for UDR and its competitors. Understanding these trends is crucial for effective UDR market analysis and strategic planning.

Technological advancements, regulatory changes, and evolving consumer preferences are reshaping the industry. UDR's business strategy must adapt to these factors to maintain its competitive edge. The company's future success depends on its ability to navigate these dynamics effectively.

Technological advancements, including smart home tech, AI-driven property management, and data analytics, are transforming the industry. Regulatory changes, such as zoning laws and rent control, impact development. Shifts in consumer preferences, like demand for flexible living and amenity-rich properties, are also significant.

Managing rising operating expenses, particularly labor and insurance costs, is a key challenge. Potential oversupply in some submarkets and economic uncertainties, including interest rate fluctuations, pose risks. ESG factors also present both challenges and opportunities for the company.

Strategic acquisitions in undersupplied markets and value-add renovations offer growth potential. Expanding digital service offerings and exploring new developments in high-demand areas can also drive growth. Enhancing sustainability initiatives can attract environmentally conscious residents and investors.

Adapting to these trends, investing in technology and sustainable practices, and focusing on high-quality assets are crucial. UDR's competitive analysis report should highlight these factors. The company must maintain a focus on resilience in its target markets.

UDR's approach involves strategic acquisitions, value-add renovations, and digital service expansion. These initiatives aim to enhance property appeal, create new revenue streams, and strengthen resident loyalty. The company's market positioning is influenced by its ability to adapt and innovate.

- Focus on high-quality assets in resilient markets.

- Investment in technology and sustainable practices.

- Enhancing operational efficiency and resident experiences.

- Expanding digital service offerings and exploring new developments.

UDR's ability to navigate these industry dynamics will determine its future success. For a deeper understanding of UDR's strategic direction, consider exploring the Growth Strategy of UDR. The company must continue to adapt to changing market conditions to maintain its competitive advantage. The key to success lies in a proactive approach to innovation and strategic investment.

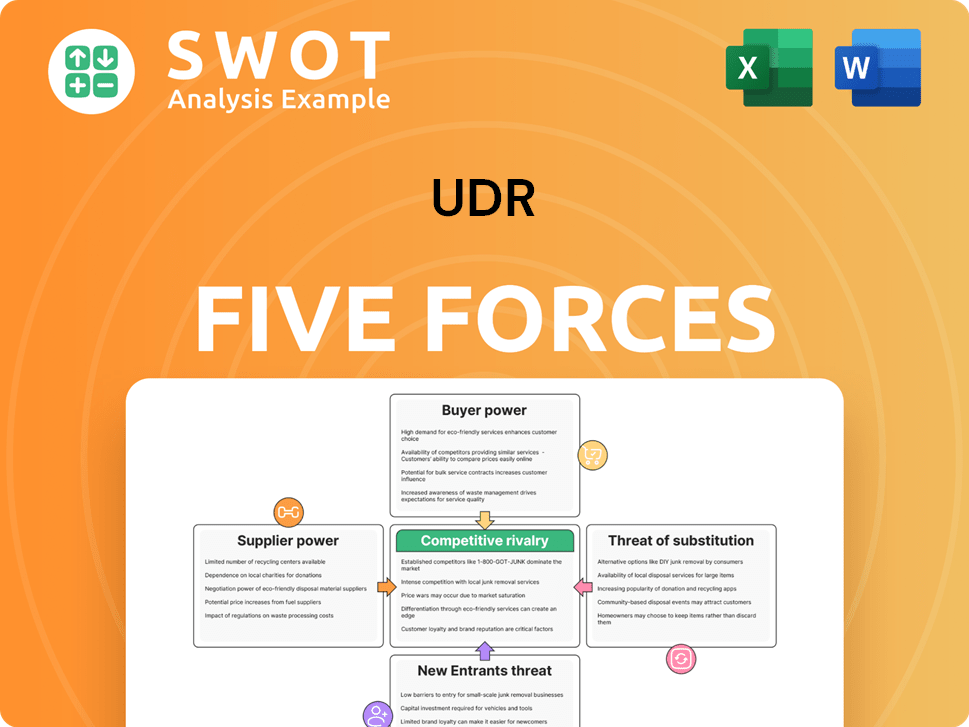

UDR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UDR Company?

- What is Growth Strategy and Future Prospects of UDR Company?

- How Does UDR Company Work?

- What is Sales and Marketing Strategy of UDR Company?

- What is Brief History of UDR Company?

- Who Owns UDR Company?

- What is Customer Demographics and Target Market of UDR Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.