UDR Bundle

Who Does UDR Company Serve?

In the ever-evolving real estate landscape, understanding the UDR SWOT Analysis is crucial for success. Knowing the customer demographics and target market is paramount for UDR Company, a leading real estate investment trust (REIT). Demographic shifts, such as the rise of urban living and remote work, directly influence how UDR positions its properties and services. This deep dive explores UDR's customer base.

This exploration will uncover key insights into the UDR Company's target market, including customer demographics such as age range, income levels, and lifestyle characteristics. We'll analyze market segmentation strategies and delve into the customer profile to understand who the typical UDR resident is and how the company adapts to their needs. Furthermore, this analysis will provide valuable context for investment decisions in the real estate investment sector.

Who Are UDR’s Main Customers?

Understanding the Marketing Strategy of UDR involves a deep dive into its customer demographics and target market. As a real estate investment trust (REIT) focused on multifamily housing, UDR primarily caters to a business-to-consumer (B2C) market. Its success hinges on accurately identifying and serving its core customer segments.

The UDR Company’s target market generally includes young professionals, millennials, and empty nesters. These groups often seek urban or suburban living in desirable locations, prioritizing convenience, amenities, and easy access to employment centers and entertainment. The company's market segmentation strategies are geared towards attracting and retaining these specific customer profiles.

While specific data on age, gender, income, education, and occupation for UDR Company's residents are proprietary, trends in the multifamily sector offer insights. The demand is strong from individuals and couples with moderate to high incomes, frequently holding bachelor's degrees or higher, and working in professional or technology-related fields. Family status varies, with a significant portion being single individuals or couples without children, although some properties accommodate small families.

The UDR Company’s customer demographics are typically characterized by young professionals and millennials, often seeking urban or suburban living. These individuals value convenience and access to amenities. The company’s market research data helps refine its understanding of these preferences.

The UDR Company’s target market is defined by its focus on high-growth, supply-constrained markets. These markets attract individuals relocating for job opportunities or seeking a vibrant lifestyle. The company’s renter profile often includes those willing to pay a premium for quality housing.

Market segmentation for UDR Company involves focusing on specific geographic areas and lifestyle preferences. This approach allows the company to tailor its offerings to meet the needs of its target audience. This strategy is crucial for attracting the right customer profile.

The customer profile of UDR Company includes individuals with moderate to high incomes, often holding bachelor's degrees or higher. These individuals value amenities and access to employment centers. Understanding customer buying behavior is key to their strategy.

The UDR Company’s target audience is defined by a combination of demographic and lifestyle factors. Understanding these characteristics is crucial for effective real estate investment strategies. The company's geographic market focus remains on high-growth areas.

- Income Levels: Moderate to high, reflecting the premium pricing in desired locations.

- Education: A significant portion holds bachelor's degrees or higher, indicating professional or white-collar employment.

- Lifestyle: Emphasis on convenience, access to amenities, and proximity to employment and entertainment.

- Family Status: A mix of single individuals, couples without children, and small families.

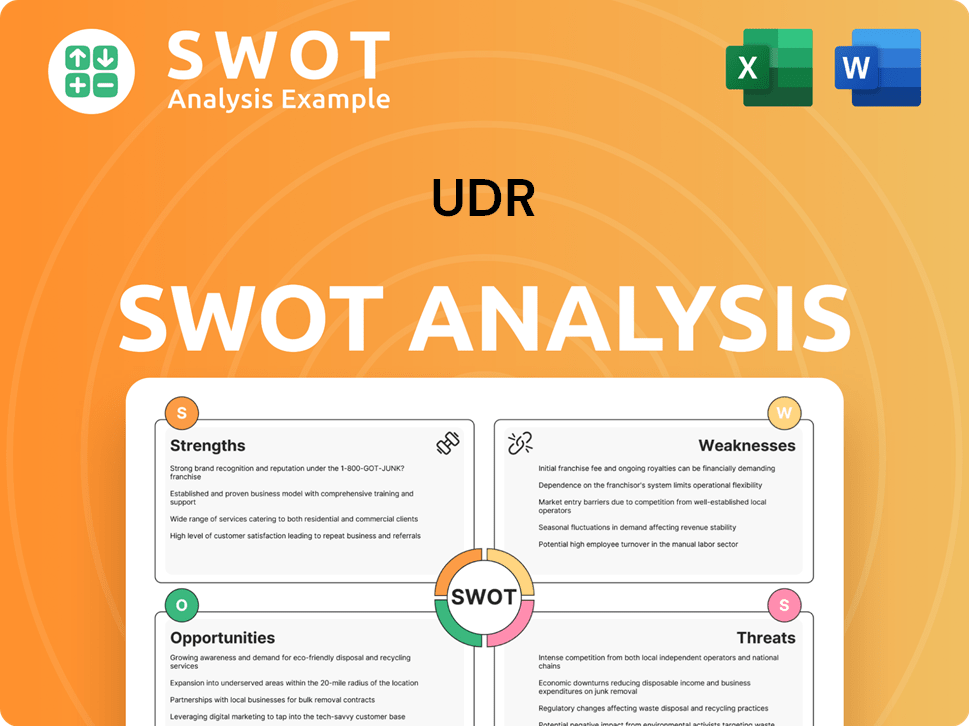

UDR SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do UDR’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the UDR Company. The company focuses on providing a living environment that prioritizes convenience, quality of life, and value for its residents. This approach helps UDR to attract and retain residents, ensuring a steady stream of revenue and fostering a strong brand reputation within the real estate investment market.

The purchasing behaviors of UDR's customers are significantly influenced by factors such as location, property amenities, and the overall resident experience. These factors are carefully considered to meet the diverse needs of the target market. UDR's ability to adapt to changing customer preferences and market trends is a key element of its long-term strategy.

UDR's customer base shows a high level of engagement with digital platforms for various services. This includes rent payments, maintenance requests, and community engagement. Loyalty is fostered through positive experiences, efficient problem-solving, and the creation of a strong sense of community. The company's focus on these aspects helps UDR to maintain a competitive edge in the real estate market.

Customers are driven by needs for a comfortable and secure living space, aspirational living in desirable neighborhoods, and the practical benefits of renting. Renting offers flexibility and fewer maintenance responsibilities compared to homeownership. This understanding helps UDR tailor its offerings to meet these needs effectively.

UDR addresses customer pain points by focusing on reliable maintenance, transparent communication, and a seamless move-in/move-out process. Addressing these issues enhances customer satisfaction and contributes to positive reviews. This customer-centric approach is vital for building trust and loyalty.

Customer feedback, gathered through surveys and online reviews, directly influences product development and service enhancements. For example, if residents consistently request better internet connectivity or package locker systems, UDR incorporates these features into new developments or renovations. This iterative approach ensures that UDR remains responsive to customer needs.

UDR tailors its marketing by showcasing lifestyle benefits relevant to its target segments. This includes vibrant community events for young professionals and convenient access to parks for pet owners. Highlighting these benefits helps attract the right customers and create a sense of community. This also supports the company's overall marketing strategy.

Property features are designed with modern living in mind, reflecting preferences for open layouts and updated finishes. These design choices enhance the living experience and attract residents who value contemporary aesthetics. This is a key part of UDR's strategy to stay current with market trends.

UDR's customers frequently use digital platforms for rent payments, maintenance requests, and community engagement. This high utilization rate underscores the importance of user-friendly digital tools. According to recent data, over 90% of UDR residents use online portals for rent payments, reflecting a shift towards digital convenience.

Understanding the customer demographics and target market is crucial for UDR Company's success. UDR's ability to meet the needs of its customer base is reflected in its financial performance. For example, in 2024, UDR reported a high occupancy rate of around 96% across its portfolio, indicating strong demand and customer satisfaction. To learn more about the company's history and development, you can read the Brief History of UDR.

UDR focuses on key elements to meet customer needs and preferences. These include location, amenities, and the overall resident experience. By understanding these factors, UDR can tailor its offerings to attract and retain residents effectively.

- Location: Proximity to work, transportation, and entertainment options is a primary consideration for residents.

- Amenities: Fitness centers, co-working spaces, and pet-friendly policies are highly valued.

- Resident Experience: The responsiveness of property management and the sense of community significantly impact satisfaction.

- Pricing and Terms: Rental price and lease terms are key decision-making factors.

- Apartment Features: Modern appliances and smart home technology are increasingly important.

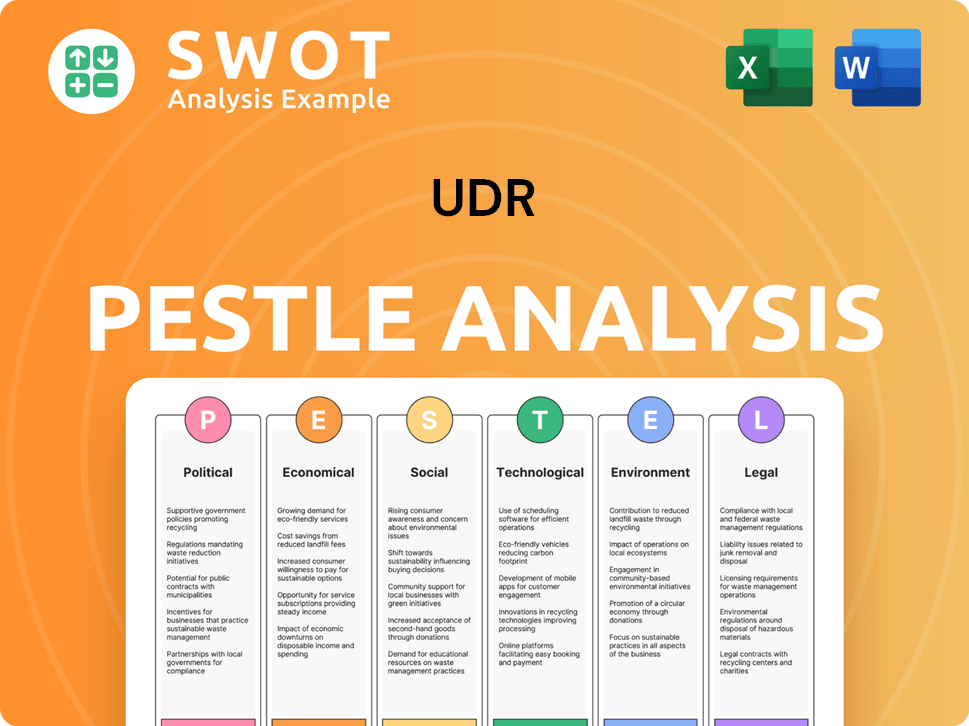

UDR PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does UDR operate?

The geographical market presence of the UDR Company is strategically concentrated in areas with high growth potential and limited housing supply across the United States. This approach is a key element of its real estate investment strategy. The company focuses on major metropolitan areas and regions that offer strong economic fundamentals and a robust renter base.

UDR's key markets include coastal cities like Boston, New York, Washington D.C., Seattle, San Francisco, and Los Angeles, as well as Sunbelt regions such as Dallas, Austin, and Orlando. These locations are chosen for their diverse economies, job growth, and a consistent demand for rental properties. This targeted market segmentation allows for a more focused approach to customer acquisition and property management.

The company's success in these markets is reflected in its financial performance. The Q1 2025 earnings report highlighted strong occupancy rates and rental growth across its portfolio, with particularly strong performance in Sunbelt markets. This indicates a strategic allocation of resources to areas demonstrating sustained demand and favorable market conditions, which is further detailed in Growth Strategy of UDR.

UDR employs market segmentation strategies to tailor its offerings to specific customer demographics and preferences. This involves analyzing local market conditions, including economic indicators, job growth, and population trends. This helps in creating a detailed customer profile.

The customer demographics vary across different regions. For example, tech-focused markets on the West Coast may see a preference for smart home technology and co-working spaces. In contrast, Sunbelt cities might prioritize larger living spaces and outdoor amenities. Understanding these differences is crucial for attracting the target market.

UDR customizes its apartment designs, amenity packages, and marketing messages to resonate with the specific demographics and lifestyle preferences of each region. This includes adapting to local architectural styles, community norms, and recreational opportunities to meet customer needs.

The company's expansion efforts have recently focused on building its presence in attractive, high-growth markets, particularly in the Sunbelt. These areas have shown consistent demand and favorable market conditions, contributing to the company's overall growth. The focus on these areas is part of the company's broader real estate investment strategy.

The Q1 2025 earnings report showed strong occupancy and rental growth, showcasing the effectiveness of UDR's market strategy. This financial performance highlights the company's ability to capitalize on market opportunities and meet the needs of its target market. The company continues to monitor market research data to refine its approach.

UDR conducts a competitive analysis of its target market to understand the landscape and identify opportunities for differentiation. This involves assessing the offerings of other real estate investment companies in the same geographic areas. This helps in refining its customer buying behavior strategies.

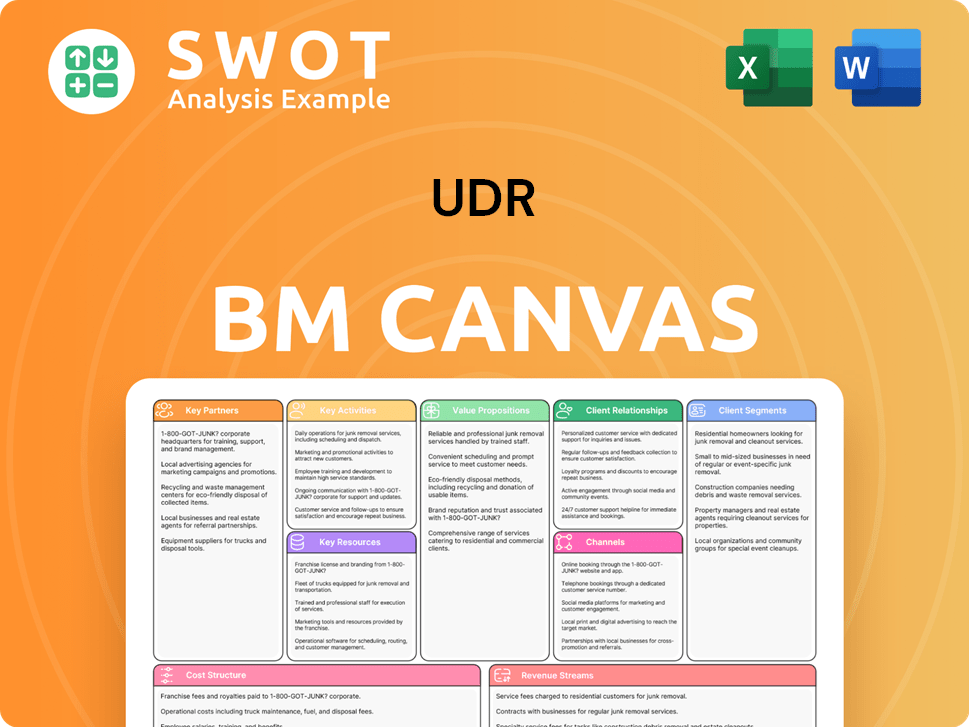

UDR Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does UDR Win & Keep Customers?

The focus of the company's customer acquisition and retention strategies is a multi-channel approach, combining digital and traditional methods to attract and retain residents. Digital marketing, including online listings, social media, SEO, and email campaigns, is crucial for reaching potential renters. Traditional methods, such as local advertising and community partnerships, also play a role. Sales efforts highlight property amenities, community benefits, and personalized tours to convert inquiries into leases.

A key element of the strategy is superior customer service throughout the resident lifecycle, from initial contact to move-out. The company utilizes customer data and CRM systems for market segmentation and personalized marketing. This data-driven approach helps tailor outreach efforts, understand renter preferences, and maximize effectiveness. Retention efforts include proactive communication, resident feedback mechanisms, and community-building events.

The company's strategies have likely evolved to increasingly rely on digital platforms and data analytics for more targeted and efficient customer acquisition and retention, impacting customer lifetime value and reducing churn rate. This evolution is a response to changing market dynamics and renter expectations, ensuring the company remains competitive in the real estate investment sector. The goal is to maintain high occupancy rates and resident satisfaction, which are vital for financial performance.

The company leverages online listing platforms, social media advertising, and SEO to reach potential renters. Targeted email campaigns are also used to promote specific properties or offers. These digital strategies are designed to improve visibility and generate leads in a cost-effective manner.

Traditional methods include local advertising, community partnerships, and referral programs. Sales tactics focus on showcasing property amenities, highlighting community benefits, and providing personalized tours. These methods complement digital efforts by building local presence and trust.

The company uses customer data and CRM systems to segment its audience and personalize marketing campaigns. This data-driven approach ensures that promotional messages are relevant to specific renter profiles. This helps the company understand renter preferences and tailor its outreach efforts.

Retention efforts include proactive communication, resident feedback mechanisms, and fostering a sense of community through on-site events. These initiatives aim to improve resident satisfaction and reduce churn. Community events can include seasonal celebrations or resident appreciation gatherings.

The shift towards digital platforms and data analytics has likely improved customer acquisition and retention. These strategies increase customer lifetime value and reduce churn rate. The company's investment in digital marketing and data analytics is crucial for long-term success.

- Increased website traffic and lead generation.

- Improved targeting of marketing campaigns.

- Enhanced ability to measure and optimize marketing ROI.

- Better understanding of customer preferences and behaviors.

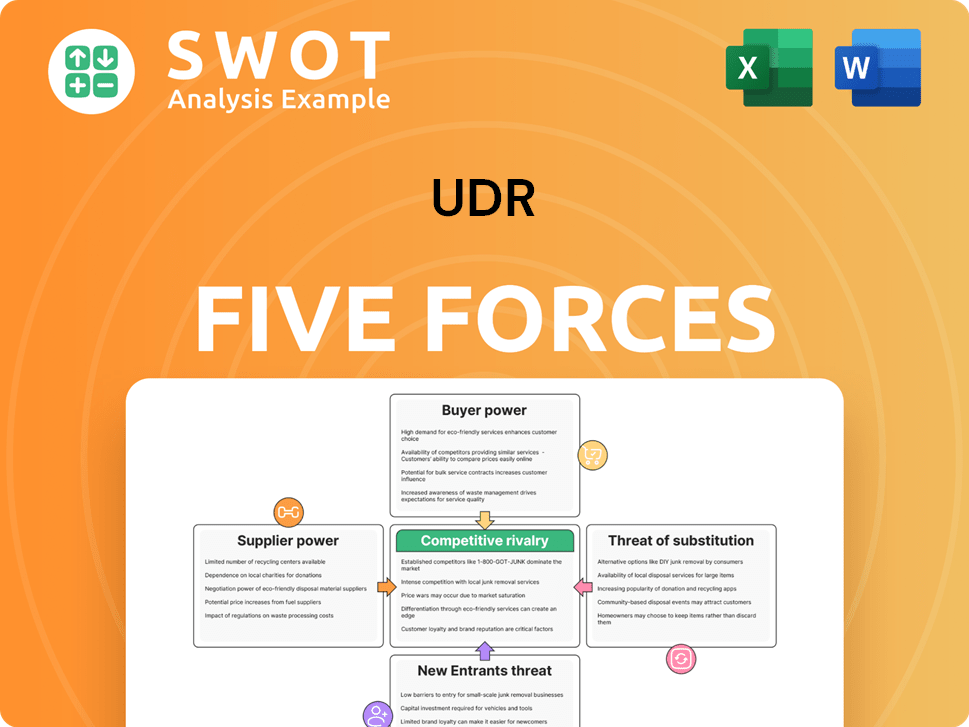

UDR Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.