ASX Bundle

How Does the ASX Stack Up in the Financial Arena?

The Australian Securities Exchange (ASX) is the heartbeat of Australia's financial markets, but what does its competitive landscape truly look like? In a world of constant change, understanding the forces shaping the ASX is critical for anyone involved in the Australian stock market. From its humble beginnings to its current stature, the ASX's journey is a compelling story of adaptation and resilience.

This exploration delves into the ASX SWOT Analysis, examining its rivals, strategic strengths, and future prospects. We'll dissect the ASX competitive landscape, providing insights into key competitors and market positioning strategies. This deep dive will equip you with the knowledge to navigate the complexities of the ASX industry overview and make informed decisions, whether you're analyzing financial performance of ASX competitors or seeking to identify growth opportunities for ASX companies.

Where Does ASX’ Stand in the Current Market?

The Australian Securities Exchange (ASX) holds a dominant position within the Australian financial market infrastructure. It functions as the primary provider of integrated exchange, clearing, and settlement services for equities and derivatives. This near-monopoly in the Australian listed equities market is a cornerstone of its business model.

In 2023, the company demonstrated a strong financial performance, reporting an underlying profit after tax of A$500.4 million. This reflects its robust market standing and operational efficiency. The company's core offerings include equities, derivatives, and fixed income trading, alongside essential post-trade services such as clearing, settlement (through CHESS), and registry services.

Geographically, the company primarily focuses on the Australian market, catering to a diverse range of customers. These include institutional investors, brokers, and retail participants. The company's strategic focus involves enhancing its technology infrastructure and diversifying revenue streams, especially in data and information services.

The company's core operations encompass equities, derivatives, and fixed income trading. It also provides essential post-trade services, including clearing, settlement, and registry services. Its infrastructure supports the entire lifecycle of financial transactions.

The company offers a secure, reliable, and efficient platform for trading and post-trade services. It provides access to the Australian financial market for a wide range of participants. Its value lies in its role as the central market infrastructure provider.

The company holds a dominant market share in Australian listed equities trading. While specific figures vary across segments, its near-monopoly in this area is well-established. This strong position is a key factor in its financial performance.

In its half-year results for FY2024, the company reported a 6.7% increase in revenue to A$502.9 million. This growth was driven by its listings, trading, and post-trade services. This indicates continued strength in its core businesses.

While the company has a strong hold on its domestic market, it faces competition from global players in certain segments, particularly in derivatives and data services. Its integral role in the Australian financial ecosystem and consistent financial performance underscore its stable market position.

- The company's primary competitors are global exchanges and data providers.

- The company's competitive advantages include its established infrastructure and regulatory position.

- Understanding the Marketing Strategy of ASX is crucial for competitive analysis.

- Key market trends include the increasing demand for data and technology solutions.

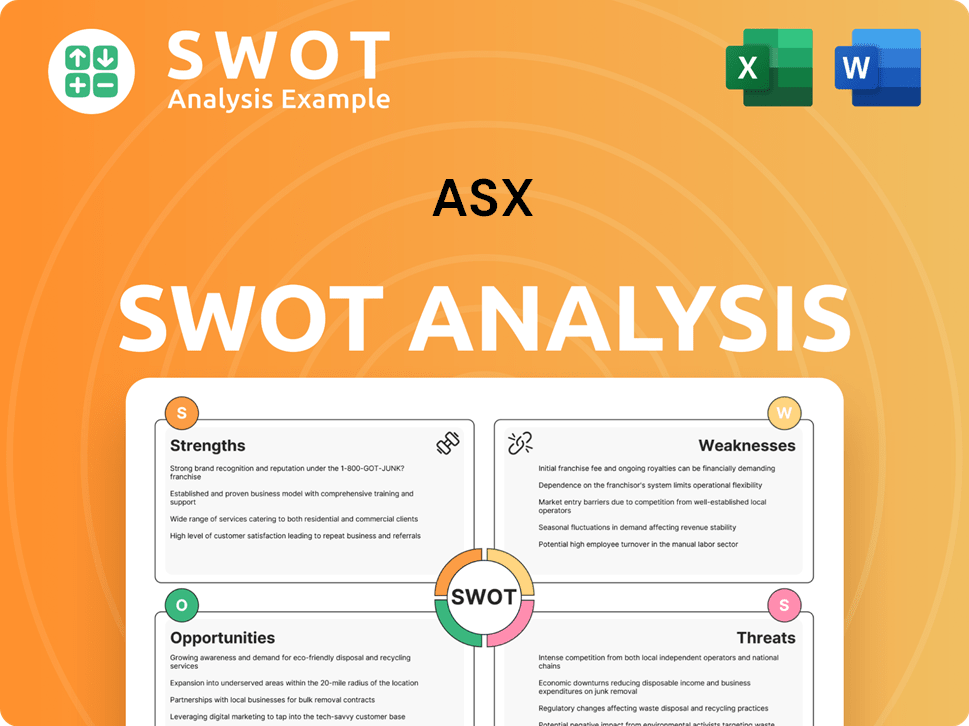

ASX SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ASX?

The Growth Strategy of ASX highlights the competitive dynamics within the Australian Securities Exchange (ASX). While ASX holds a significant position in the Australian equities market, it faces competition across various segments. Understanding the key competitors is crucial for a comprehensive ASX company analysis.

The ASX's competitive landscape is shaped by both direct and indirect competitors. Direct competition is limited in the core equities trading space, but alternative trading venues and dark pools present a challenge. Indirect competition comes from global exchanges and financial technology firms, each vying for market share in different areas. This analysis provides insights into the competitive forces influencing the ASX.

The ASX operates in a complex competitive environment. The exchange faces competition from various entities, including other exchanges, financial technology firms, and data providers. These competitors challenge the ASX in different areas, such as attracting international listings, derivatives trading, and offering data and technology services. The competitive landscape is constantly evolving due to technological advancements and regulatory changes.

Direct competitors to ASX are primarily alternative trading venues and dark pools. These platforms offer alternative methods for trading equities, though their market share remains smaller compared to ASX. Analyzing their trading volumes and market share provides insights into the direct competitive pressures on ASX.

Global exchanges such as the Intercontinental Exchange (ICE), London Stock Exchange Group (LSEG), and Nasdaq are indirect competitors. These exchanges compete with ASX for international listings, derivatives trading, and data services. Their scale and technological capabilities pose a significant challenge.

In the derivatives market, ASX faces competition from global exchanges offering a wider range of international contracts. While ASX is strong in Australian equity derivatives, global exchanges may have a more established presence in FX or commodity derivatives. This competition affects ASX's market share in specific derivative classes.

Numerous fintech firms and data providers compete with ASX by offering specialized analytics, market insights, and trading tools. These players leverage agile development and niche expertise to gain market share. Their innovative approaches challenge ASX's dominance in data and technology services.

Potential new entrants leveraging blockchain technology for market infrastructure represent another competitive factor. However, regulatory hurdles and capital investment requirements pose significant barriers to entry. The evolution of technology and regulations continues to shape these dynamics.

ASX's competitive advantages include its established market position, robust infrastructure, and regulatory compliance. However, competitors can leverage technological advancements and specialized services to gain market share. Understanding these advantages is crucial for ASX company analysis.

Analyzing the financial performance of ASX's competitors involves assessing their revenue, market share, and profitability. Key metrics include trading volumes, listing fees, and data service revenue. These metrics provide insights into the competitive landscape and the financial health of each player.

- Market Share: Assessing the market share of ASX and its competitors in various segments.

- Revenue Streams: Analyzing revenue from trading, clearing, settlement, and data services.

- Profitability: Evaluating the profitability of competitors through financial statements.

- Technological Investments: Examining investments in technology and infrastructure.

- Regulatory Compliance: Understanding the impact of regulations on competitors.

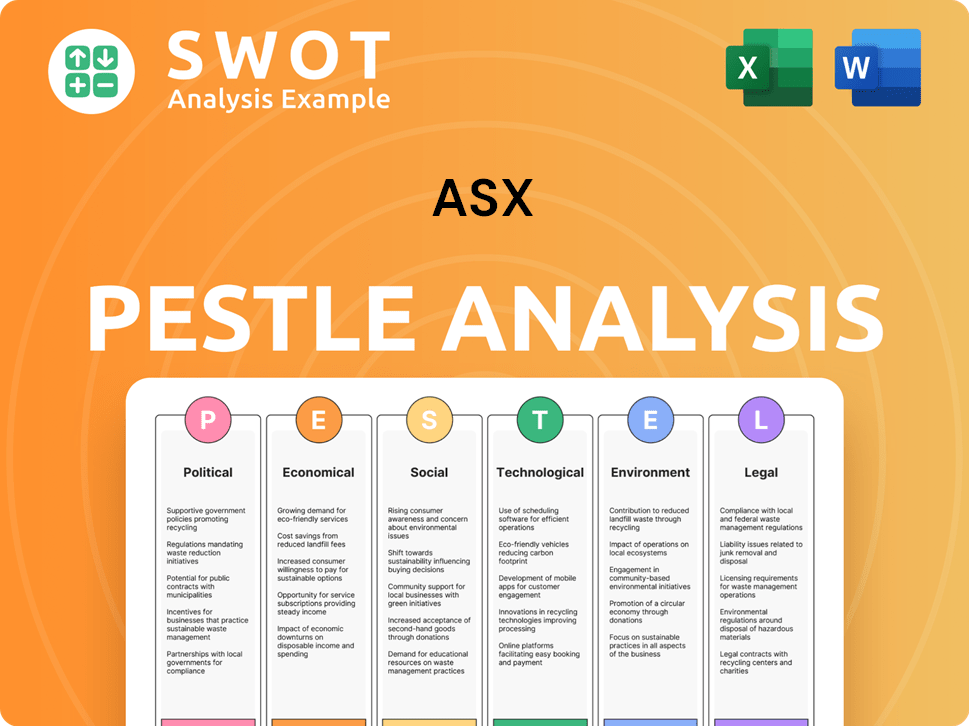

ASX PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ASX a Competitive Edge Over Its Rivals?

The core competitive advantages of the ASX are built on its established infrastructure, regulatory standing, and comprehensive service offerings, creating significant barriers for potential rivals. Its near-monopoly in providing integrated exchange, clearing, and settlement services for Australian equities gives it strong network effects and economies of scale. The CHESS platform, a proprietary technology for settling equity transactions, is a critical part of the national financial infrastructure, offering high reliability and efficiency. This technology and the associated intellectual property are difficult and costly to replicate.

The ASX benefits from strong brand equity and customer loyalty within the Australian financial community. Decades of operation have fostered trust and familiarity among market participants, making it the default choice for listing and trading Australian securities. This is reinforced by its robust regulatory framework and oversight by the Australian Securities and Investments Commission (ASIC) and the Reserve Bank of Australia (RBA), which instill confidence in the market's integrity and stability. The ASX's extensive distribution network, encompassing brokers, institutional investors, and data vendors, ensures broad market access and liquidity.

Ongoing investment in technology, including exploring blockchain for post-trade services, demonstrates a commitment to innovation that aims to maintain its technological edge and enhance operational efficiencies. The sustainability of these advantages depends on the ASX's ability to innovate, adapt to market changes, and fend off niche competitors in specific product or service areas. The ASX's market capitalization reached approximately $2.5 trillion in 2024, reflecting its dominant position in the Australian stock market.

The ASX's integrated services, including exchange, clearing, and settlement, create substantial network effects. The CHESS platform, a proprietary system, is a key component of national financial infrastructure. This leads to operational efficiencies and cost advantages that are difficult for competitors to match.

Decades of operation have built strong brand equity and trust within the Australian financial community. This makes the ASX the preferred choice for listing and trading securities. The regulatory framework, overseen by ASIC and the RBA, further reinforces market confidence.

The ASX has a broad distribution network that includes brokers, institutional investors, and data vendors. This ensures broad market access and high liquidity. This extensive network supports efficient price discovery and trading activities.

Ongoing investment in technology, including exploring blockchain for post-trade services, is a key advantage. These innovations aim to maintain a technological edge and improve operational efficiency. The ASX's commitment to innovation helps it stay competitive.

The ASX's competitive advantages are multifaceted, stemming from its established market position and strategic initiatives. These advantages are crucial for maintaining its dominance in the Australian stock market. Understanding these factors is essential for a thorough ASX company analysis.

- Monopoly in Integrated Services: The ASX's control over exchange, clearing, and settlement services provides significant advantages.

- Strong Brand and Trust: Decades of operation have fostered trust and loyalty among market participants.

- Regulatory Framework: Oversight by ASIC and the RBA ensures market integrity and stability.

- Technological Advancements: Ongoing investment in technology, including exploring blockchain, enhances operational efficiency.

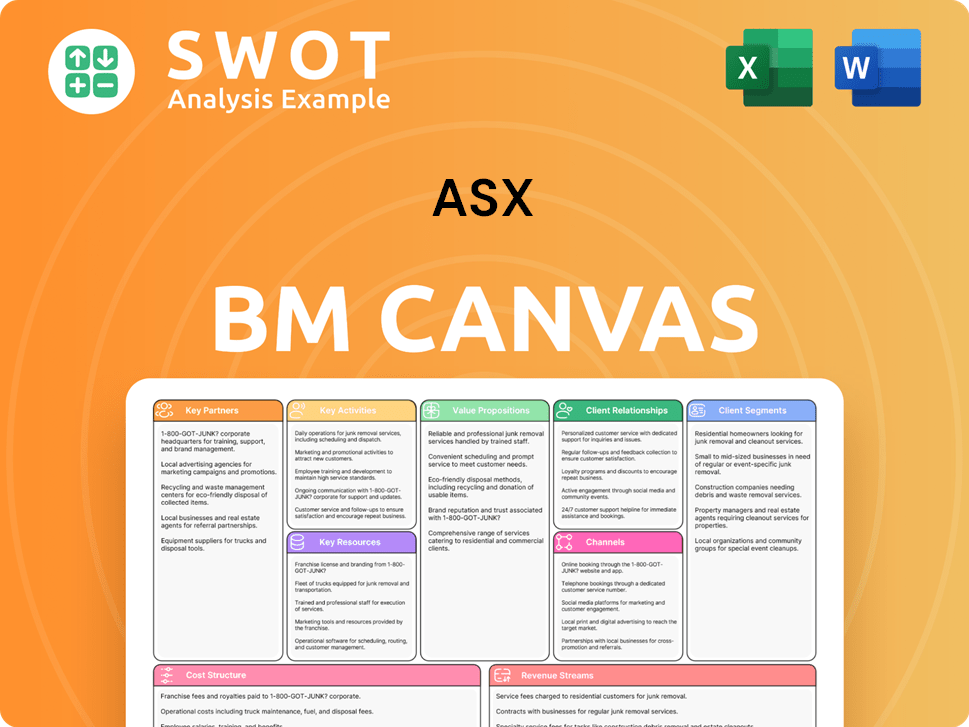

ASX Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ASX’s Competitive Landscape?

The Australian Securities Exchange (ASX) operates within a complex and dynamic industry. The Target Market of ASX is influenced by technological advancements, regulatory changes, and global economic conditions. Understanding the ASX competitive landscape requires a keen eye on industry trends, potential challenges, and emerging opportunities.

The ASX's position is shaped by its role as the primary securities exchange in Australia, facing competition from both domestic and international players. Risks include cybersecurity threats, regulatory changes, and economic volatility. The future outlook depends on the ASX's ability to adapt to industry shifts, capitalize on new opportunities, and maintain its competitive edge.

A key trend is the increasing adoption of distributed ledger technology (DLT), or blockchain. There's also a growing demand for real-time data and analytics, driving competition in information services. Regulatory changes, particularly those aimed at fostering competition, could also impact the ASX's dominant position.

Managing cybersecurity risks associated with interconnected digital platforms is a significant challenge. Navigating global competition in derivatives and international listings is another. Geopolitical shifts and economic volatility could influence trading volumes and investor confidence.

Expanding into new asset classes, such as ESG-related products, presents an opportunity. Strengthening its position in the Asia-Pacific region through strategic partnerships is another avenue for growth. Further automation and digitalization of services could enhance efficiency and profitability.

The ASX's market capitalization continues to be a significant portion of the Australian economy. In 2024, the average daily turnover on the ASX was approximately $6.5 billion. The ASX's revenue streams are primarily from listing fees, trading fees, and information services, with data services contributing significantly to overall revenue. The ASX's ability to maintain and grow its market share depends on its ability to adapt to changing market dynamics and investor preferences.

The ASX's success depends on several key factors. These include technological innovation, regulatory compliance, and strategic partnerships. Maintaining a strong position in the competitive landscape requires continuous adaptation and a focus on customer needs.

- Embracing DLT for improved efficiency and reduced costs.

- Expanding data offerings to meet the growing demand for real-time analytics.

- Developing and promoting ESG-related products to attract socially responsible investors.

- Strengthening its presence in the Asia-Pacific region through strategic alliances.

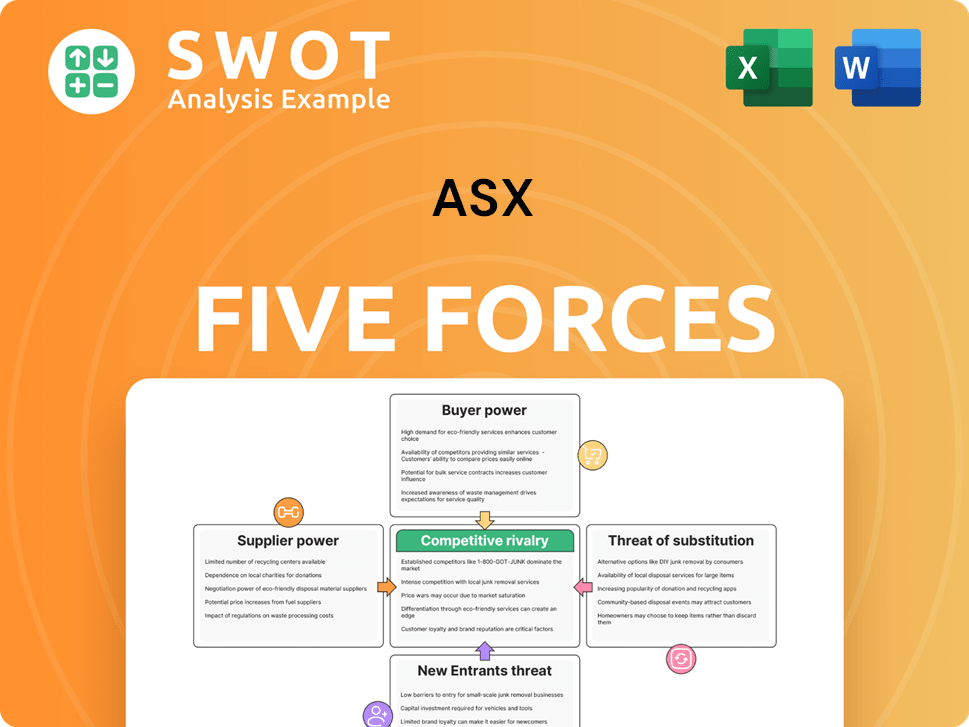

ASX Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASX Company?

- What is Growth Strategy and Future Prospects of ASX Company?

- How Does ASX Company Work?

- What is Sales and Marketing Strategy of ASX Company?

- What is Brief History of ASX Company?

- Who Owns ASX Company?

- What is Customer Demographics and Target Market of ASX Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.