ASX Bundle

Who are the ASX Company's Key Players?

The success of any ASX company hinges on a deep understanding of its customer demographics and target market, a factor intrinsically linked to the broader Australian economic landscape. The performance of the ASX, as demonstrated in 2024, reflects this interplay, with sector-specific gains and losses highlighting the impact of evolving investor preferences. This dynamic underscores the critical need to analyze who the ASX's customers are and how they shape the market.

The ASX, evolving from its 19th-century origins, now caters to a diverse audience, from institutional investors to individual retail participants. Understanding the ASX SWOT Analysis is crucial for identifying customer demographics and tailoring strategies to enhance shareholder value. This includes conducting thorough market analysis and investor relations to meet the dynamic needs of its varied customer base and drive sustainable growth for the ASX company.

Who Are ASX’s Main Customers?

Understanding the customer demographics and target market of an ASX company is crucial for strategic planning and investor relations. The Australian Securities Exchange (ASX) primarily operates in a business-to-business (B2B) model, facilitating capital markets and providing services to financial institutions. However, it also indirectly serves consumers through its platform and regulatory oversight.

This analysis focuses on the primary customer segments of the ASX, detailing the key players and their roles within the ecosystem. This will provide insights into the ASX's revenue streams and how it adapts to market trends. Conducting thorough market analysis is essential for long-term shareholder value.

The ASX's customer base is diverse, encompassing both businesses and individual investors. The primary focus remains on B2B operations, which drive the majority of its revenue. The following outlines the key customer segments and their significance to the ASX's operations.

These are corporations listed on the ASX to raise capital. In 2024, the ASX facilitated significant capital raising, ranking first globally by volume of transactions for the seventh consecutive year. Notable IPOs in 2024 included Guzman y Gomez, raising $335 million, and Digico, raising close to $2 billion. The ASX also saw four dual listings in 2024, all in the resources sector.

This segment includes brokers, fund managers, and investment banks that use the ASX's trading, clearing, and data services. These institutions are a major source of revenue for the ASX, particularly through trading volumes and data subscriptions. ASX accounted for 79.6% of the total dollar turnover in equity market products in the December 2024 quarter.

The ASX provides market data and technology services to financial data vendors, software providers, and IT departments. These services support the wider financial ecosystem, enhancing market efficiency and access to information. This segment contributes to the diversification of the ASX's revenue streams.

Individual investors access the market through brokers and utilize the ASX's educational resources. The ASX Investor Education Portal had 850,000 active users as of 2024. A University of Sydney study noted that the ASX's simulator reduced first-time investor errors by 58%. These investors often show interest in diversified portfolios, with a growing focus on technology and financials.

The largest revenue share for the ASX comes from its B2B services, particularly equity market products and listings. The ASX continuously focuses on diversifying revenue streams and enhancing its reputation as a listing venue. This includes a focus on Exchange Traded Products (ETPs), resources, renewables, technology, and healthcare sectors. Changes in target segments are often driven by market research and external trends, such as the increasing demand for new listings in sectors like technology and financials in 2024.

- The ASX's focus on technology and financial sectors reflects current market demands.

- Investor education programs are crucial for attracting and retaining retail investors.

- Understanding the customer demographics is essential for strategic planning.

- The ASX's ability to adapt to market trends is key to its sustained success.

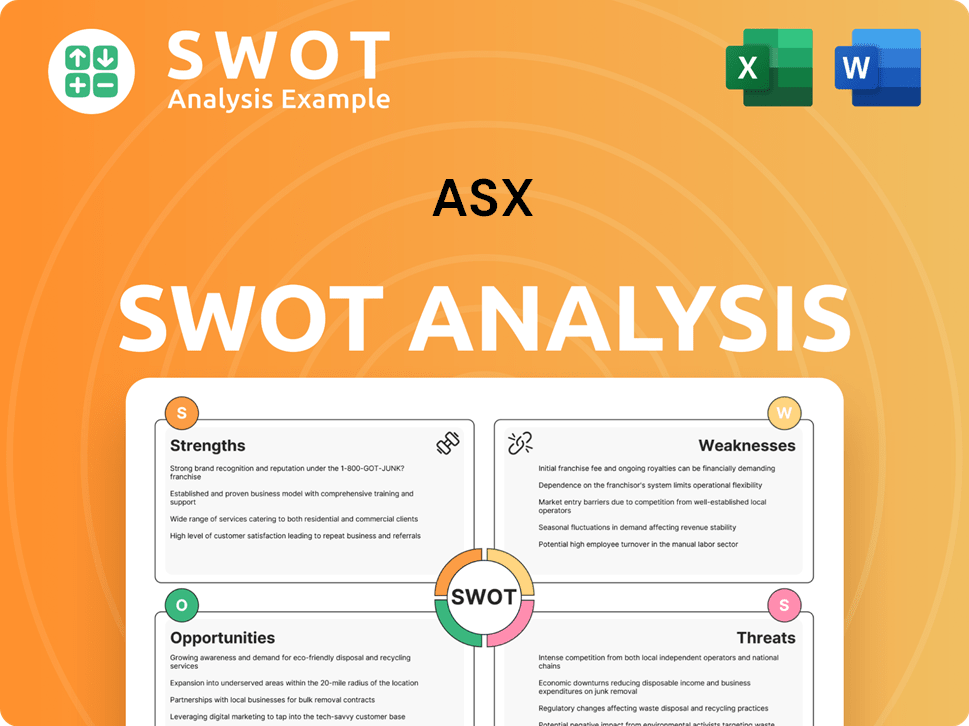

ASX SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do ASX’s Customers Want?

Understanding the customer needs and preferences is crucial for an ASX company to succeed. The diverse customer base of an ASX company includes institutional clients, listed companies, and individual investors, each with unique requirements. A detailed market analysis helps in tailoring services and strategies to meet these specific needs, ultimately driving shareholder value.

For institutional clients and listed companies, efficiency, transparency, liquidity, and a robust infrastructure are paramount. Individual investors, on the other hand, prioritize ease of access, educational resources, and reliable market data. Meeting these varied needs is essential for maintaining customer loyalty and driving growth.

The ASX company continually works to improve its services, including technology modernization and business efficiency. For example, the Australian Securities and Investments Commission (ASIC) oversees planned system refreshes and upgrades to clearing platforms. These efforts are designed to meet the evolving needs of its customers.

Institutional clients and listed companies depend on a reliable marketplace for capital allocation, price discovery, and risk management. The ASX's operational processes must be resilient to prevent financial repercussions. Failures can lead to reduced customer service and an inability to provide services.

Individual investors value ease of access and educational resources. The ASX provides these through its Investor Education Portal and simulation trading platforms. These resources help investors make informed decisions.

Both institutional and retail participants value transparency and integrity in the market. The ASX maintains a well-regulated environment to ensure fair practices. This fosters trust and supports market stability.

Listed companies focus on raising capital effectively and accessing a broad investor base. A well-regulated environment is crucial for attracting investors. This helps companies grow and expand their operations.

Financial institutions prioritize efficient trading, clearing, and settlement services. They constantly interact with the exchange's platforms for trading, data consumption, and post-trade services. This constant interaction is vital for managing operations.

Loyalty is built on trust, market integrity, and continuous service enhancements. The ASX's commitment to technology modernization and business efficiency is crucial. This ensures that the ASX meets evolving customer needs.

To effectively serve its diverse customer base, an ASX company must focus on several key areas. This includes understanding the specific needs of each customer segment and ensuring that services meet those needs. Continuous improvement and adaptation are critical for long-term success.

- Market Analysis: Conduct thorough market analysis to understand customer demographics, preferences, and behaviors.

- Service Enhancement: Continuously enhance services to meet evolving customer needs, including technology upgrades and efficiency improvements.

- Regulatory Compliance: Maintain a strong focus on regulatory compliance to ensure market integrity and build trust.

- Investor Relations: Develop strong investor relations to communicate effectively with shareholders and attract new investors.

- Customer Feedback: Actively seek and incorporate customer feedback to improve services and address concerns.

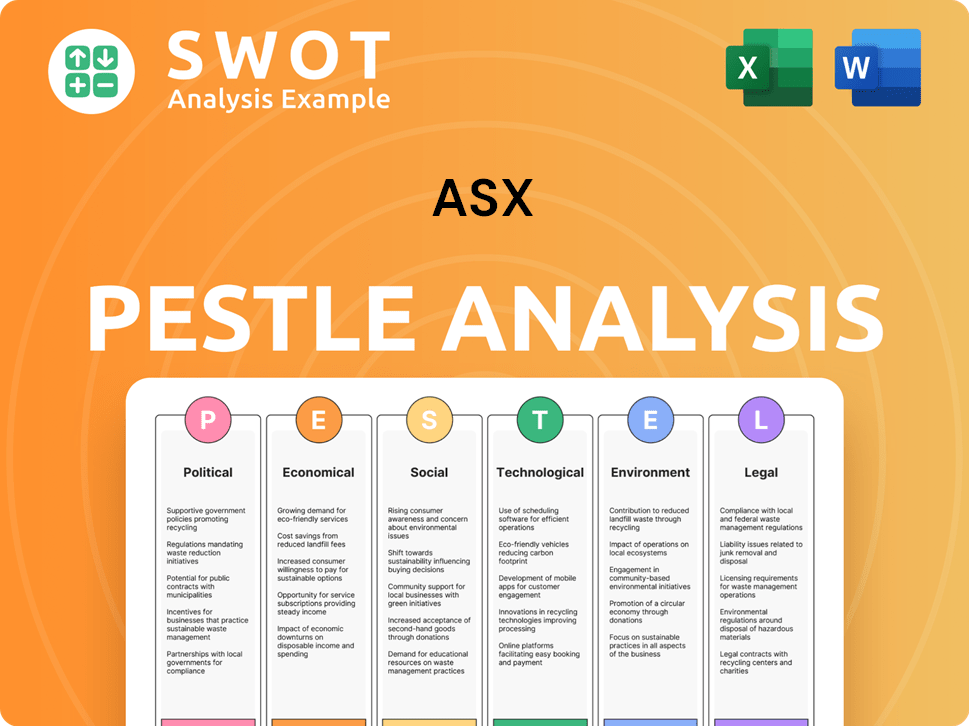

ASX PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does ASX operate?

The ASX, as the primary securities exchange in Australia, has a geographical market presence that is predominantly focused on the Australian market. Its operations are centered within Australia, providing a platform for trading shares, derivatives, and other financial products. This focus is evident in its strong market share and the concentration of its activities in major Australian cities and regions.

Despite its domestic focus, the ASX also has a global reach, attracting international participants and listings. This is achieved through dual listings from international exchanges and by providing access to the Australian capital market for both domestic and international companies. The increasing number of international listings and the accessibility of its services to offshore participants show a strategic effort to broaden its geographic influence.

The ASX tailors its offerings to align with Australian financial market regulations and investor expectations, ensuring a regulated and transparent environment. Its marketing and partnerships are designed to attract both domestic and international companies, reflecting its role as a national exchange with a growing global presence. The Growth Strategy of ASX highlights the company's efforts to expand its reach.

In the December 2024 quarter, the ASX held a significant market share, accounting for 79.6% of the total dollar turnover in equity market products. This demonstrates its strong position within the Australian market.

In 2024, the ASX facilitated dual listings from international exchanges, primarily in the resources sector. These listings offer access to the Australian market and its pool of investable assets, which includes a substantial $3.5 trillion in superannuation funds.

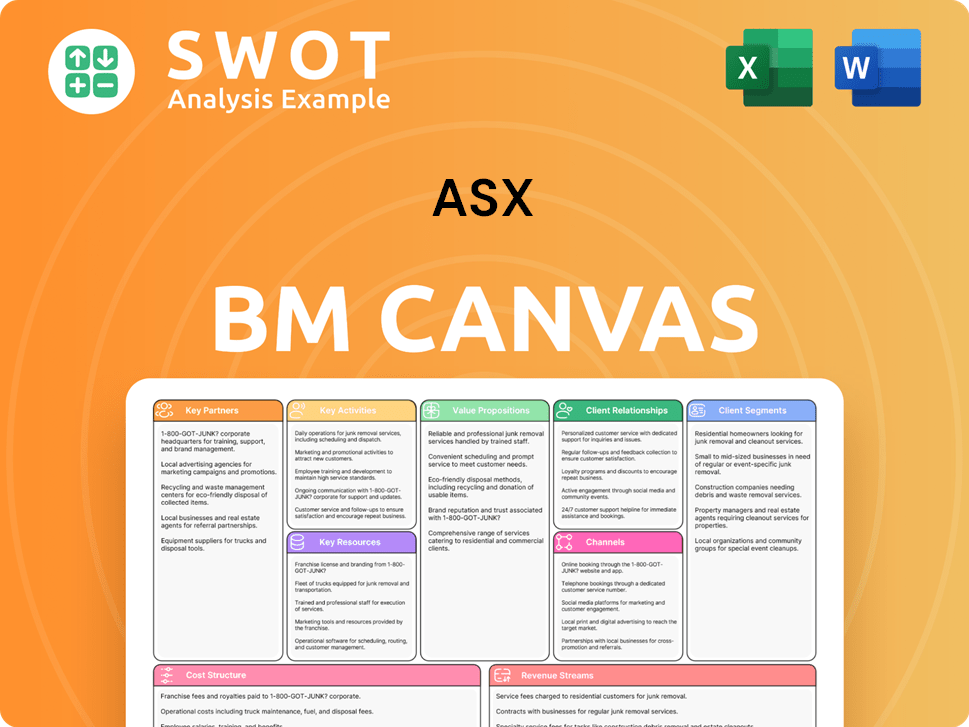

ASX Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does ASX Win & Keep Customers?

The core of the customer acquisition and retention strategy for an ASX company involves a multifaceted approach, focusing on both its institutional clients (B2B) and, indirectly, the retail investor base (B2C). This strategy is driven by continuous enhancements to its market infrastructure and services. The goal is to attract new listings and trading participants while retaining existing ones, ensuring a robust and efficient market ecosystem.

A key element of this strategy is the commitment to technology modernization and business efficiency. This is particularly crucial for maintaining a competitive edge and fostering trust among stakeholders. The exchange's focus on operational resilience and quality of services is paramount for financial institutions and trading participants who rely on the stability of the exchange.

For retail investors, while not direct customers, the ASX indirectly acquires and retains them by providing accessible educational resources and tools. The ASX Investor Education Portal, with 850,000 active users in 2024, and its simulation trading platforms play a significant role in engaging and informing this segment. This fosters a more knowledgeable investor base, which in turn benefits the overall market.

The ASX emphasizes its role as a transparent, liquid, and diversified market to attract new companies. In 2024, the ASX facilitated $35.9 billion in capital raised through 1,271 transactions. The ASX ranked first globally by volume of transactions for the seventh consecutive year, demonstrating its success in attracting new listings.

Operational resilience is a cornerstone of the ASX's strategy to retain its diverse customer base. This ensures the continuity and quality of services. This is critical for financial institutions and trading participants who rely on the exchange's stability for their operations.

The ASX indirectly acquires and retains retail investors by providing accessible educational resources and tools. The ASX Investor Education Portal, with a significant user base, plays a key role in engaging and informing this segment. This supports a more informed investor base.

The ASX continually seeks to introduce new domestic and international participants to its trading markets and clearing and settlement facilities. This includes adapting to technological advancements and global market trends to maintain its competitive position.

The ASX's strategic planning implicitly considers customer data and segmentation. This influences the development of new products and services to meet evolving customer needs. While traditional loyalty programs are not directly applicable, customer loyalty is fostered through the reliability, integrity, and efficiency of its services, as well as its commitment to market development and innovation. To learn more about the company's strategies, you can read about the Growth Strategy of ASX.

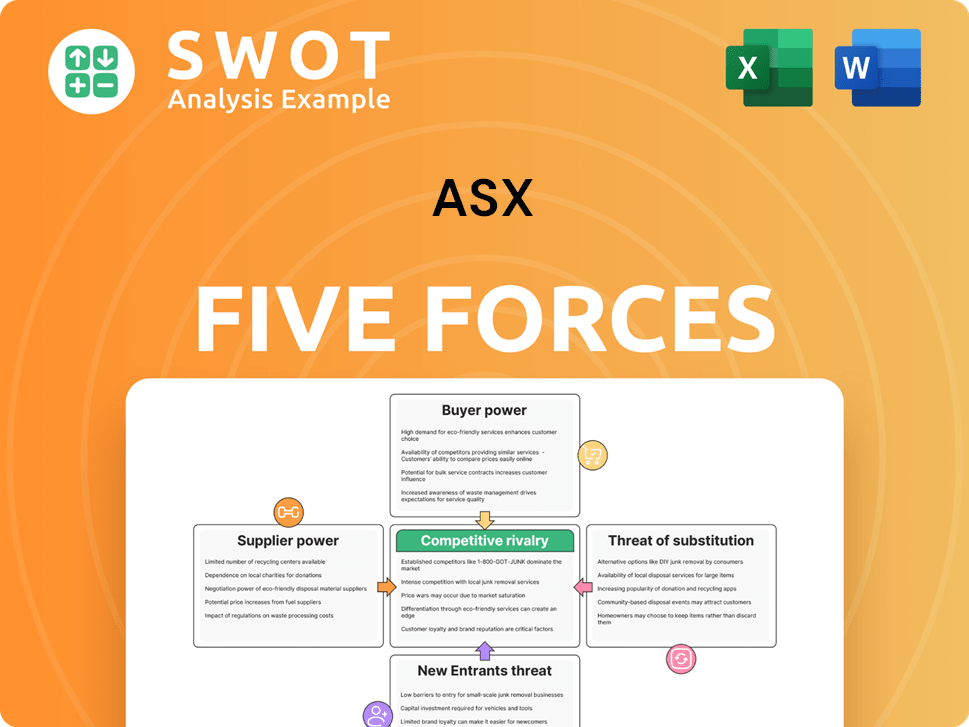

ASX Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.