ASX Bundle

Decoding the ASX: What Drives Australia's Financial Heartbeat?

Ever wondered what principles guide the Australian Securities Exchange (ASX)? Unveiling the ASX SWOT Analysis, mission, vision, and core values provides a crucial window into its strategic direction and how it shapes the financial landscape.

Understanding the ASX's mission, vision, and core values is pivotal for anyone seeking to navigate the complexities of the Australian financial market. These elements are not just words; they are the bedrock of the company strategy ASX, influencing everything from daily operations to long-term goals. This exploration will help you understand how the Australian Stock Exchange company values impact its interactions with ASX listed companies, investors, and the broader economy, providing valuable insights for both seasoned professionals and those new to the market.

Key Takeaways

- ASX's mission and vision are fundamental to its role as Australia's leading securities market operator.

- A focus on a fair and dynamic marketplace and a strong financial system is key to ASX's guiding principles.

- Maintaining alignment with mission and vision is crucial for trust, capital formation, and adaptation.

- ASX's purpose is to connect issuers and investors, supporting economic growth and wealth creation.

Mission: What is ASX Mission Statement?

ASX's mission is 'powering a stronger economic future by enabling a fair and dynamic marketplace for all.'

Let's delve into the intricacies of the ASX's mission statement and its implications for the Australian financial landscape.

The core of the Mission, Vision & Core Values of ASX lies in its commitment to fostering a robust Australian economy. This is achieved by providing a platform that facilitates capital formation and investment. The ASX plays a crucial role in the nation's financial ecosystem.

A 'fair and dynamic marketplace' is a cornerstone of the ASX's mission. This involves ensuring market integrity, transparency, and equal opportunities for all participants. The ASX strives to maintain a level playing field.

The ASX's mission is strongly oriented towards market facilitation. This includes offering a platform for companies to raise capital and for investors to trade securities. This facilitation is key to the mission.

Regulatory oversight is a crucial element of the ASX's mission. The goal is to ensure market integrity and transparency. This is achieved through the implementation of rules and regulations.

The ASX's influence on economic activity is substantial. The ASX 200 index, which tracks the largest 200 companies, reflects a significant portion of the nation's equity market value. The ASX plays a pivotal role.

The Australian Securities and Investments Commission (ASIC) plays a vital role in market oversight. ASIC's focus on consistency and transparency aligns with the ASX's mission. This ensures market integrity.

Understanding the mission statement provides insights into the ASX's role and its impact on the Australian economy. The ASX's commitment to enabling a strong economic future, operating a fair marketplace, and ensuring dynamism is reflected in its core operations and regulatory oversight. The ASX's mission is crucial for investors, financial professionals, and business strategists when making decisions in the Australian market. As of late 2024, the ASX continues to be a central hub for capital markets, with a market capitalization of approximately $2.5 trillion AUD, underscoring its importance in the Australian and global financial landscape.

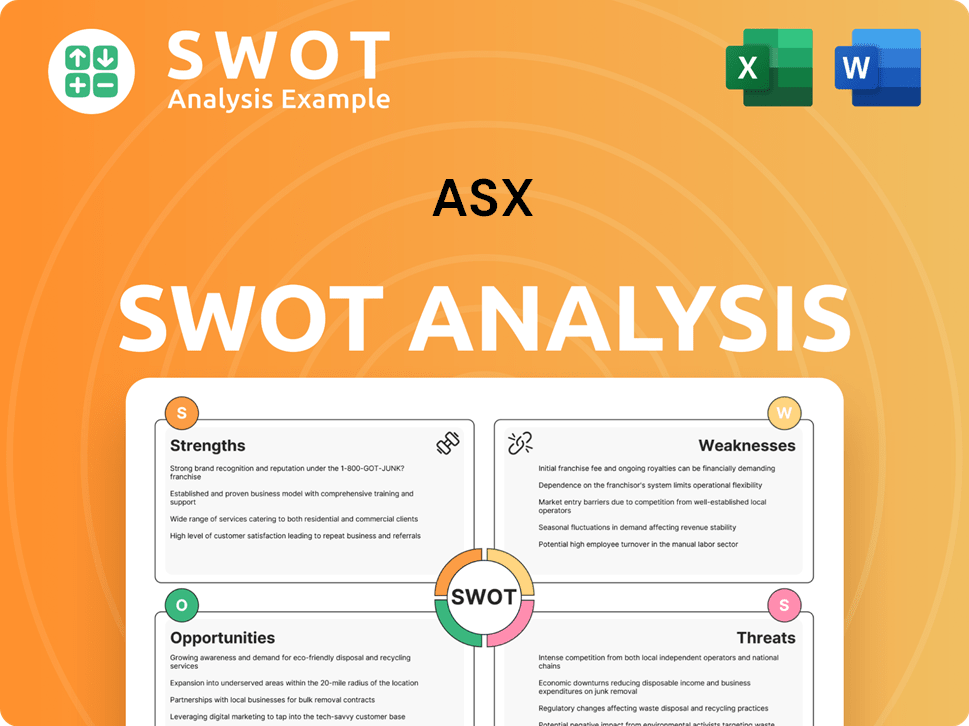

ASX SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is ASX Vision Statement?

Considering the close alignment with ASIC, the ASX's vision can be understood as striving 'to power a stronger economic future by enabling a fair and dynamic marketplace for all Australians,' contributing to 'A fair, strong and efficient financial system for all Australians.'

Let's delve deeper into the vision of the Australian Securities Exchange (ASX), focusing on its aspirations for the future.

The vision for the ASX, as implied by its alignment with ASIC, is inherently national in scope. It's about fostering a robust financial ecosystem that benefits all Australians. This extends beyond just the company itself, encompassing the entire market and its participants.

The vision is distinctly future-focused, emphasizing the ongoing development of a 'stronger economic future.' This implies a commitment to continuous improvement, innovation, and adaptation to the ever-changing global financial landscape. The goal is not static; it's about sustained progress.

Key to the vision is the creation of a 'fair and dynamic marketplace.' This suggests a dedication to transparency, equal opportunities for all participants, and efficient market operations. It also implies the ability to adapt to new technologies and market dynamics. The Target Market of ASX includes a diverse range of participants, all of whom benefit from this focus.

While ambitious, the vision is grounded in realistic goals. The pursuit of a 'fair, strong and efficient' financial system is an ongoing endeavor, requiring constant vigilance, adaptation, and collaboration. This is reflected in the ASX's commitment to corporate governance ASX and its efforts to enhance market integrity.

This vision has a profound impact on various stakeholders. For investors, it means a more trustworthy and reliable market. For listed companies, it offers a platform for growth and access to capital. For the broader economy, it fosters stability and economic expansion. The ASX mission vision directly influences the financial performance of ASX listed companies.

Success can be measured through various metrics, including market capitalization, trading volumes, investor confidence, and the efficiency of capital allocation. Data from the ASX, such as the average daily turnover, which reached $7.5 billion in FY23, and the number of listed companies, which stood at over 2,200, provide insights into the progress towards this vision. Analyzing the mission vision of an ASX company helps understand these metrics.

Understanding the vision of the ASX is crucial for anyone seeking to engage with the Australian financial market. It provides a framework for understanding the company's strategic direction and its commitment to the long-term health and prosperity of the Australian economy. The difference between vision and mission ASX lies in their scope; the vision paints a picture of the future, while the mission outlines the steps to get there. The impact of mission vision on ASX stock price, while complex, is undeniable, as it influences investor sentiment and confidence.

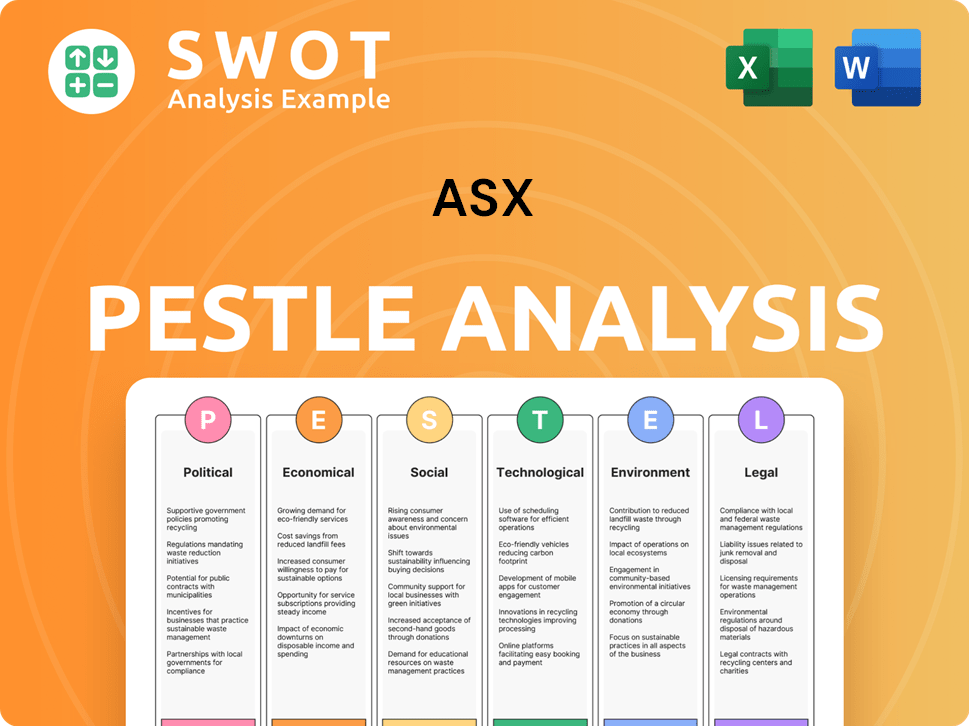

ASX PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is ASX Core Values Statement?

Understanding the core values of the Australian Securities Exchange (ASX) is crucial for grasping its operational principles and its role in the Australian financial market. While a specific, publicly available list isn't always readily accessible, the principles guiding ASX operations are reflected in its actions and regulatory framework.

Integrity is paramount for the ASX, ensuring the highest ethical standards are maintained. This commitment manifests through rigorous compliance with regulations, transparent reporting, and a strong stance against market misconduct. This focus is essential for building and maintaining investor trust, which is critical for the health of the market. For example, in 2023, the ASX reported a 99.9% compliance rate with its own regulatory requirements, demonstrating its dedication to ethical operations.

Transparency is a cornerstone of a fair and efficient market. The ASX promotes this through its listing rules and continuous disclosure requirements, ensuring that information is disseminated openly and promptly. This commitment to transparency is reflected in the fact that over 90% of ASX-listed companies meet their continuous disclosure obligations within the required timeframes, fostering investor confidence and informed decision-making.

Resilience is crucial for withstanding and recovering from operational and market disruptions. The ASX invests heavily in robust technology and infrastructure to ensure market stability and continuity. This is evident in the ASX's significant investments in its trading and clearing systems, with approximately $150 million allocated annually to technology upgrades and enhancements, ensuring the market can weather unforeseen events.

Innovation is key to adapting to technological advancements and evolving market needs. The ASX continually explores new technologies and services to enhance market efficiency and user experience. This is reflected in the ASX's ongoing research and development efforts, with a focus on areas like blockchain technology and data analytics, aimed at improving market functionality and providing value to stakeholders. You can learn more about how the ASX approaches its overall strategic direction by reading about the Growth Strategy of ASX.

These core values collectively define the ASX's corporate identity and its role as a trusted and essential component of the Australian financial landscape. The next chapter will delve into how these core values, along with its mission and vision, influence the company's strategic decisions.

How Mission & Vision Influence ASX Business?

The ASX's mission and vision are not merely aspirational statements; they are fundamental drivers of its strategic decisions. These guiding principles shape the company's approach to market operations, technological advancements, and regulatory compliance, ensuring a robust and efficient financial ecosystem.

The ASX's mission, to enable a 'fair and dynamic marketplace,' directly influences its strategic direction. This includes investments in technology, product development, and regulatory compliance to maintain market integrity and efficiency.

- Technology Investment: Modernizing trading platforms and clearing systems to ensure efficiency and resilience.

- Product Development: Introducing new financial products and services to meet evolving market needs.

- Regulatory Engagement: Upholding listing rules and promoting good corporate governance among ASX listed companies.

The vision of a 'fair, strong and efficient financial system' underpins the ASX's role in market infrastructure. This ensures the reliability and stability of the Australian financial markets, fostering investor confidence.

The ASX's commitment to good corporate governance is a direct outcome of its mission and vision. This influences decisions related to compliance monitoring and enforcement, protecting market participants.

While specific metrics are not always explicitly tied to the mission and vision, market performance serves as an indicator. Trading volumes, successful capital raisings, and market capitalization growth reflect the effectiveness of the ASX's strategy.

The ASX 200 index exceeding $2.8 trillion AUD in market capitalization as of April 2025 is a testament to the scale of the market facilitated by ASX. This growth demonstrates the impact of the ASX mission vision on market value.

The $34.5 billion raised through secondary markets in 2023 highlights the capital formation aspect of their mission. This supports economic growth and provides investment opportunities.

Prioritizing market integrity, efficiency, and stakeholder confidence is a key outcome. These guiding principles shape both long-term planning and day-to-day operations.

The influence of the ASX mission vision is evident in its strategic initiatives and market performance. Understanding these core principles is crucial for anyone analyzing the Australian Stock Exchange and its listed companies. Now, let's explore the next chapter: Core Improvements to Company's Mission and Vision.

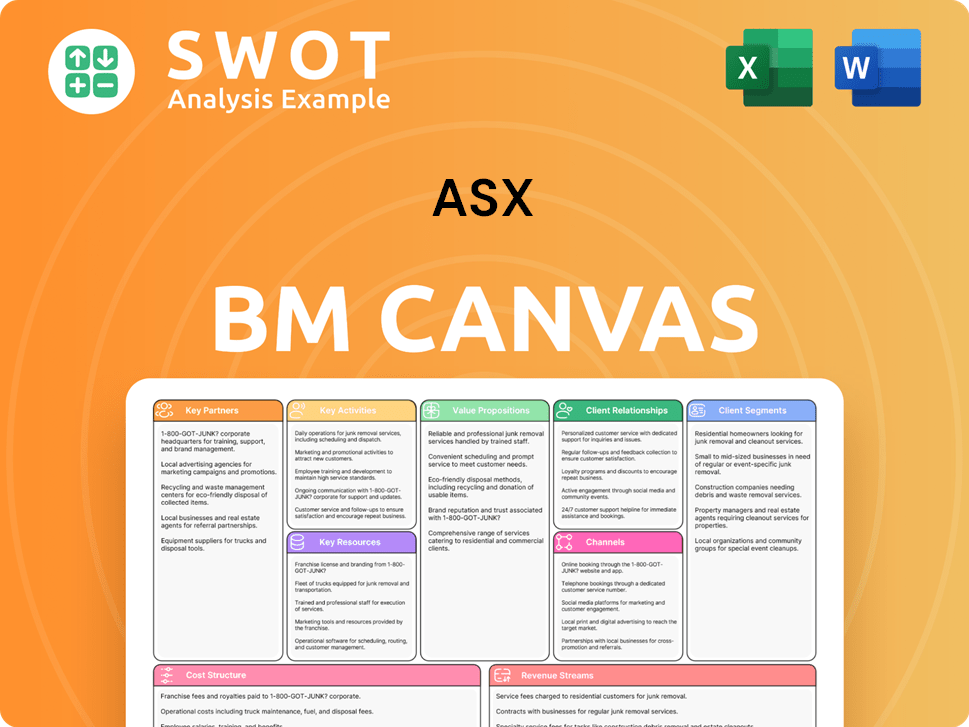

ASX Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While the current articulation of the ASX mission vision and core values provides a foundation, there's room for strategic enhancements. These refinements can better position the Australian Stock Exchange for future growth and stakeholder alignment in a rapidly evolving market.

The current mission could be strengthened by explicitly incorporating sustainability. This could involve a commitment to fostering a sustainable financial ecosystem, reflecting the increasing importance of Environmental, Social, and Governance (ESG) considerations. This aligns with the growing investor demand for sustainable investments; in 2023, ESG-focused assets reached an estimated $30 trillion globally, representing a significant portion of investment strategies.

The vision could be enhanced by articulating a clear ambition for technological innovation. This involves positioning ASX as a leader in adopting emerging technologies like blockchain and artificial intelligence within market infrastructure. This proactive approach is crucial, as the global fintech market is projected to reach over $300 billion by 2025, highlighting the need for exchanges to stay ahead of technological advancements.

The

The mission and vision statements should be complemented by measurable strategic goals. This includes setting specific, measurable, achievable, relevant, and time-bound (SMART) objectives related to sustainability, technological innovation, and stakeholder engagement. This ensures that the

How Does ASX Implement Corporate Strategy?

The successful integration of the ASX's mission, vision, and core values into its operational framework is critical for long-term sustainability and stakeholder trust. This implementation is multifaceted, involving strategic initiatives, leadership commitment, and transparent communication.

The ASX actively translates its mission and vision into concrete actions through various business initiatives and operational practices. This ensures that the stated goals are not merely aspirational but are embedded in the day-to-day operations of the organization. These initiatives are designed to enhance market efficiency, transparency, and investor confidence, directly reflecting the core values of the Australian Stock Exchange company values.

- Technology Modernization: Ongoing programs to upgrade trading platforms and infrastructure to improve speed, reliability, and resilience.

- Regulatory Enhancements: Continuous review and updates to listing rules and compliance frameworks to maintain a fair and transparent market.

- Stakeholder Engagement: Regular communication and consultation with listed companies, investors, and other stakeholders to gather feedback and address concerns.

- Corporate Governance: Implementation of robust corporate governance practices to ensure accountability and ethical conduct.

Leadership plays a pivotal role in embedding the ASX mission vision and core values throughout the organization. Senior management sets the tone from the top, demonstrating commitment to these principles through their actions and decisions. This commitment fosters a culture of integrity, transparency, and accountability, which is crucial for maintaining stakeholder trust and confidence. Furthermore, the way leadership communicates the company strategy ASX is key.

Effective communication is essential for ensuring that the ASX’s mission, vision, and core values are understood and embraced by all stakeholders. This is achieved through various channels, including corporate reports, public statements, and direct engagement. The annual report, corporate governance statements, and investor presentations are key mechanisms for communicating the company's priorities and performance, including aspects related to its mission and values. Finding the mission vision and values of an ASX company is made easier through these public communications.

Specific initiatives exemplify the mission and vision in action. For instance, technology modernization programs are aimed at improving market efficiency and resilience. Efforts to enhance listing rules and enforce compliance demonstrate the commitment to a fair and transparent marketplace. While specific details on formal programs for ensuring alignment may vary, the emphasis on corporate governance and regulatory compliance suggests established systems are in place to uphold stated values and practices. The Marketing Strategy of ASX also plays a role in communicating these initiatives.

The ASX likely employs various metrics to assess the effectiveness of its mission and vision implementation. These might include measures of market efficiency, investor confidence, regulatory compliance, and stakeholder satisfaction. Continuous improvement is an ongoing process, with the ASX regularly reviewing its practices and policies to ensure they remain aligned with its core values and strategic objectives. For example, the ASX's efforts to reduce trading delays and improve system uptime directly reflect its commitment to operational excellence.

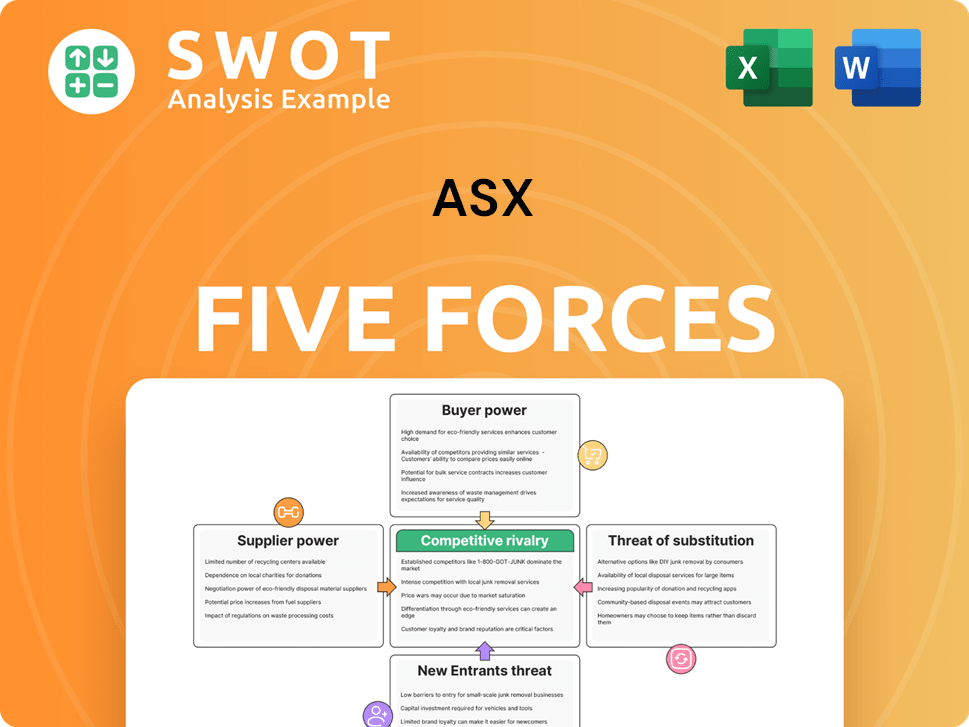

ASX Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASX Company?

- What is Competitive Landscape of ASX Company?

- What is Growth Strategy and Future Prospects of ASX Company?

- How Does ASX Company Work?

- What is Sales and Marketing Strategy of ASX Company?

- Who Owns ASX Company?

- What is Customer Demographics and Target Market of ASX Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.