ASX Bundle

How Does the ASX Dominate the Australian Stock Market?

The Australian Securities Exchange (ASX) is more than just a stock market; it's the engine driving Australia's financial landscape. Understanding the ASX SWOT Analysis is crucial for anyone looking to navigate the complexities of the Australian stock market. But how does the ASX maintain its position at the forefront, and what strategies fuel its continued success?

This deep dive into the ASX's sales and marketing strategy reveals the tactics behind its enduring influence. From its origins as a unified exchange to its current focus on digital transformation, the ASX's ASX sales strategy and ASX marketing strategy are constantly evolving. We'll explore how the company adapts its ASX company strategy to stay ahead in a competitive global market, examining key campaigns and initiatives designed to attract and retain investors.

How Does ASX Reach Its Customers?

The sales channels of the Australian Securities Exchange (ASX) are designed to cater to a diverse clientele, including individual investors, financial professionals, listed entities, and market participants. The core of the ASX sales strategy revolves around its electronic trading platform, ASX Trade. This platform is a critical component, processing a significant volume of daily orders.

Complementing the trading platform is a comprehensive website, which serves as a central hub for market data, company announcements, and investor resources. While the ASX itself does not operate physical retail locations for direct sales to individual investors, its services are distributed through a network of member organizations. These members, including stockbrokers and investment banks, act as crucial touchpoints for retail and institutional clients, facilitating access to the ASX's trading and listing services.

Direct sales teams within the ASX focus on engaging with corporate clients for listings, capital raisings, and other bespoke services. The ASX's approach to sales is characterized by a multi-faceted strategy, reflecting the varied needs of its client base and the dynamic nature of the financial markets. This approach is key to the ASX marketing strategy.

ASX Trade is the primary sales channel, processing a high volume of daily orders. In 2024, the platform processed 7.2 million daily orders. This digital platform is critical for the business strategy.

The ASX website provides market data, company announcements, and investor resources. It serves as a central hub for information, supporting investor engagement and market participation. The website is a key component of the Australian stock market's sales efforts.

Stockbrokers, investment banks, and financial advisors act as intermediaries. They facilitate access to trading and listing services for retail and institutional clients. These organizations are essential for the Sales and marketing of ASX services.

Direct sales teams engage with corporate clients for listings and capital raisings. These teams focus on providing bespoke services to listed entities. They are a key part of the ASX company strategy.

The ASX is strategically shifting towards digital adoption and omnichannel integration to enhance efficiency and user experience. Key initiatives include the CHESS replacement project, with the first industry test environment planned for early 2025. Strategic partnerships and exclusive distribution deals are also crucial for broadening the reach of ASX's offerings.

- In February 2025, average daily trades increased by 29%, and average daily value traded on-market increased by 20% compared to the previous period.

- In April 2025, the average daily number of trades was up 53% on the prior corresponding period.

- The average daily value traded on-market increased by 43% in April 2025.

- These figures highlight the ongoing growth and market activity on the ASX.

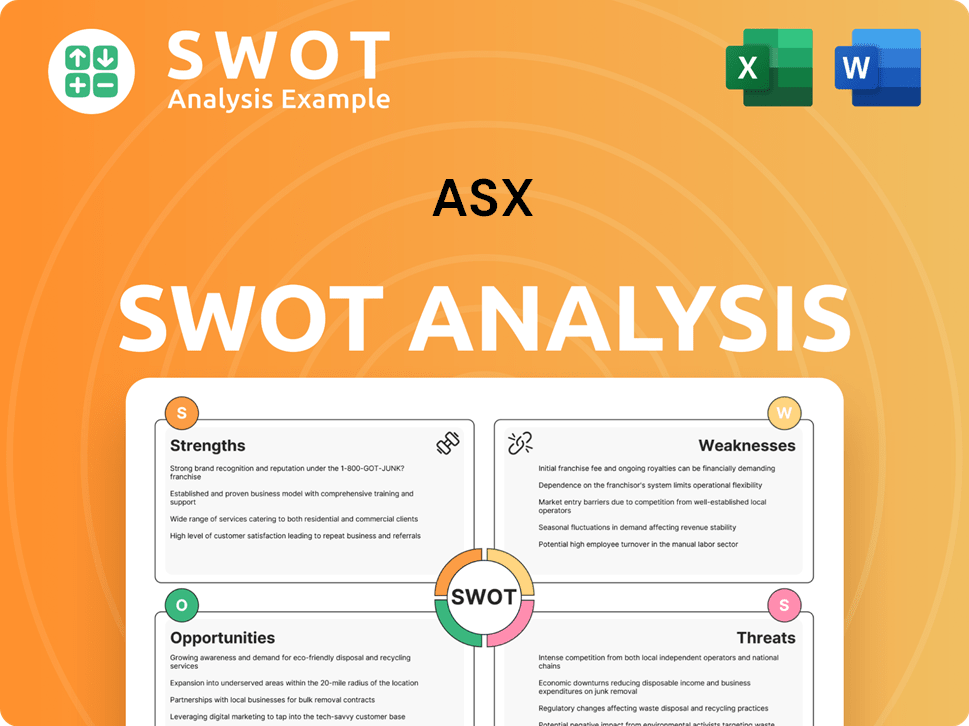

ASX SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does ASX Use?

The marketing tactics employed by the Australian Securities Exchange (ASX) are designed to enhance brand awareness, generate leads, and foster engagement across its diverse stakeholder groups. The strategy involves a blend of digital and traditional methods, focusing on reaching investors, listed companies, and financial professionals. This approach is crucial for maintaining a strong presence in the Australian stock market and supporting its growth.

Digital strategies form the core of the ASX's marketing efforts. This includes leveraging its website as a primary content marketing platform, utilizing search engine optimization (SEO), and employing targeted paid advertising. Email marketing and social media also play significant roles in disseminating information and engaging with the financial community. These tactics are designed to provide market insights and educational resources to a broad audience.

Traditional marketing methods remain relevant, particularly for reaching senior executives and institutional investors. The ASX also focuses on data-driven marketing, using customer segmentation to personalize communications and tailor product offerings. This approach is supported by technology modernization and advanced analytics tools to measure campaign effectiveness and inform strategic decisions, ensuring the marketing mix adapts to technological advancements and market dynamics.

The ASX's digital marketing strategy centers on its website, which serves as a content hub. SEO is critical for visibility. Paid advertising targets specific financial professionals and potential listed entities.

The website provides market data, news, and educational resources. SEO ensures the site is easily found by investors and businesses. This focus helps drive organic traffic and engagement.

Email marketing distributes market updates, research, and event invitations. Social media is used to share news and engage with the financial community. These channels support direct communication.

Traditional media includes print advertising in financial publications. Participation in industry events and conferences remains important. These tactics reach senior executives and institutional investors.

Extensive customer segmentation is used for personalized communication. Advanced analytics tools track user behavior and measure campaign effectiveness. This approach ensures strategic decisions are data-informed.

Technology modernization supports a progressive user experience. The digital brand identity launch in 2020 highlighted digital transformation. This ensures the company remains competitive.

The ASX's marketing strategy is multifaceted, incorporating both digital and traditional methods to achieve its goals. The focus on digital channels, content marketing, and data analytics reflects a commitment to adapting to market dynamics and providing a user-friendly experience. For a deeper understanding of the ASX's history, you can read more in this Brief History of ASX.

The ASX's marketing strategy is designed to build brand awareness, generate leads, and drive engagement across various stakeholder groups. It employs a mix of digital and traditional tactics, with a strong emphasis on data-driven decision-making.

- Digital Marketing: This includes website content, SEO, paid advertising, email marketing, and social media engagement.

- Traditional Marketing: Targeted print advertising and participation in industry events.

- Customer Segmentation: Tailoring communications and product offerings based on audience segments (individual investors, brokers, listed companies, and financial institutions).

- Data Analytics: Utilizing advanced tools to track user behavior, measure campaign effectiveness, and inform strategic decisions.

- Technology Modernization: Continuous focus on digital transformation to enhance user experience.

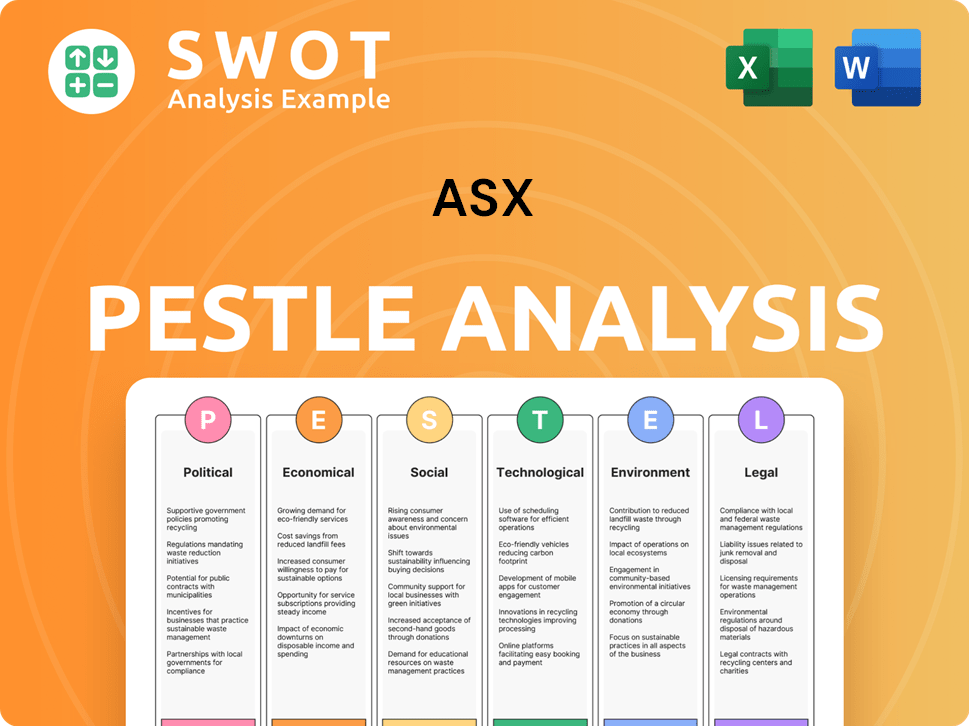

ASX PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is ASX Positioned in the Market?

The core brand positioning of the ASX is centered on its role as the 'heart of Australia's financial markets.' This emphasizes its critical and central position within the national economy. This positioning differentiates it by highlighting its comprehensive services, including trading, clearing, settlement, and registry functions, making it a key player in the Australian stock market.

The visual identity, refreshed in November 2020, moved towards a more user-friendly interface, while maintaining a professional and cohesive corporate branding. This was achieved through clean layouts, consistent corporate branding, and effective geometric elements. The brand's signature blue tones and subtle gradients reinforce consistency across all materials, projecting precision and modernity. This approach supports the overall ASX company strategy.

The brand's tone of voice is authoritative, reliable, and informative, reflecting its role as a trusted source of financial information. The customer experience it promises is one of efficiency, transparency, and security in financial transactions. The ASX sales strategy is geared towards financial professionals and stakeholders, leveraging its unique selling proposition as the primary, regulated marketplace for Australian securities. This appeals to those seeking a robust and credible platform for investment and capital raising.

The brand is positioned as the central hub of Australian financial markets. It highlights its comprehensive services, including trading, clearing, settlement, and registry. This emphasizes its indispensable role in the national economy, which is a key component of the ASX marketing strategy.

The visual identity, updated in November 2020, features a modern, user-friendly design. It maintains a professional corporate branding with clean layouts and consistent use of blue tones. This design projects precision and modernity, which is crucial for sales and marketing.

The tone is authoritative, reliable, and informative, reflecting its role as a trusted source. It aims to provide efficiency, transparency, and security in financial transactions. This approach builds trust among financial professionals and stakeholders. This is a critical part of the business strategy.

The primary target audience includes financial professionals and stakeholders. The unique selling proposition is its position as the primary, regulated marketplace. This appeals to those seeking a robust and credible platform for investment and capital raising, which is an important factor in the Australian stock market.

While specific brand perception data or awards from 2024-2025 are not readily available in public documents, the company's continuous efforts in stakeholder engagement, including extensive workshops and the establishment of advisory groups, indicate a commitment to understanding and responding to market sentiment. Brand consistency is maintained across its digital platforms, official communications, and print collaterals, ensuring a unified and recognizable presence. The company's response to shifts in consumer sentiment or competitive threats is demonstrated by its ongoing investment in technology modernization and its proactive engagement with industry stakeholders to refine its services and policies, such as the consultation on its new clearing and settlement pricing policy released in May 2025. For more insights, you can explore the article on sales and marketing strategies for ASX companies.

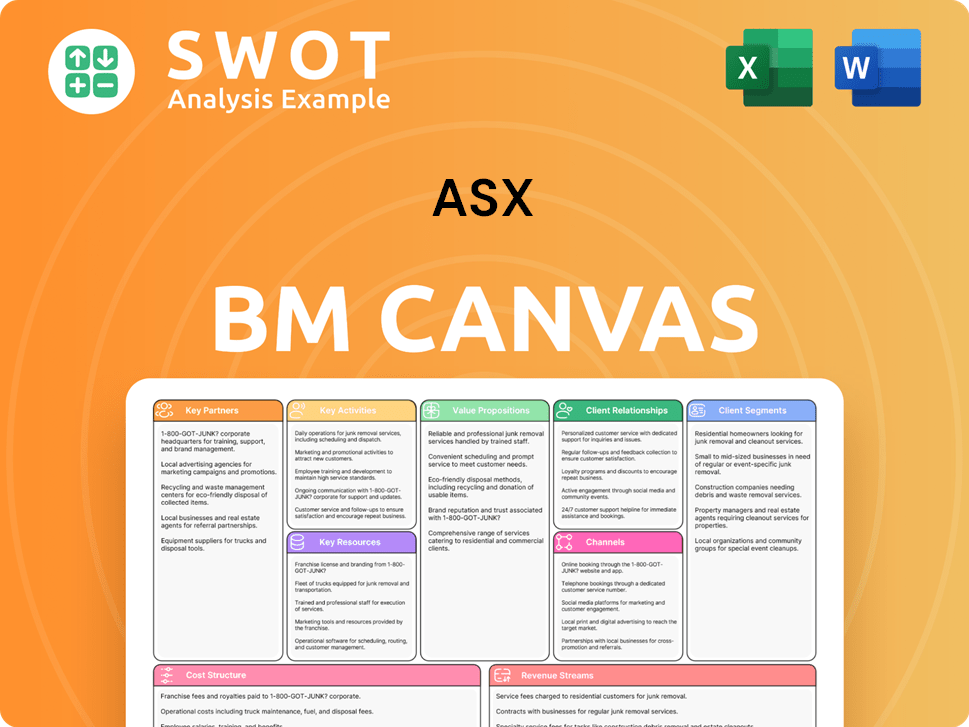

ASX Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are ASX’s Most Notable Campaigns?

The Growth Strategy of ASX incorporates several key campaigns that are essential for its sales and marketing strategy. These campaigns are designed to enhance market functionality, foster stakeholder trust, and drive overall business growth. As a market infrastructure provider, the focus is on strategic initiatives and technological advancements rather than traditional product-centric marketing campaigns.

One of the most significant ongoing initiatives is the CHESS replacement project, aimed at modernizing the clearing and settlement system. This complex project involves extensive communication and engagement with industry participants to ensure a smooth transition and maintain market integrity. Another critical area of focus is the promotion of ASX's strategic priorities, which are communicated through various channels, including annual reports and investor presentations, to ensure transparency and build consensus.

ASX's sales and marketing strategy also involves active engagement with stakeholders through forums like the ASX Business Committee and the Cash Equities Clearing and Settlement Advisory Group. These efforts are vital for building consensus and supporting key market initiatives, contributing to the overall health and growth of the Australian financial markets. The success of these campaigns is measured by stakeholder adoption, system stability, and the smooth transition to new platforms, all of which are crucial for maintaining market confidence.

This is a major campaign to modernize the clearing and settlement system. It involves industry consultations, technical specifications, and progress updates. The goal is to enhance efficiency and resilience in Australia's post-trade infrastructure.

These priorities include regulatory and risk management uplift and technology modernization. They are communicated through annual reports and investor presentations. The initiatives focus on growth in key divisions like Markets, Technology & Data, and Securities & Payments.

ASX actively engages with stakeholders through forums like the ASX Business Committee. These engagements are crucial for building consensus and support for key market initiatives. This contributes to the overall health and growth of Australian financial markets.

Focus on providing high-quality market data and advanced technology solutions. This includes enhancements to trading platforms and data analytics tools. These initiatives support the broader goals of improving market efficiency and transparency.

In March 2024, ASX released a consultation paper on the staged implementation approach for CHESS replacement. The first industry test environment for Release 1 is targeted to open in early 2025. This is a key milestone in the modernization effort.

The 2025 Half-Year Results Market Release highlighted progress on strategic priorities. This emphasized growth in the Markets, Technology & Data, and Securities & Payments divisions. These priorities are key to the ASX company strategy.

ASX actively engages with investors through various channels, including investor presentations and financial reports. These efforts aim to provide transparency and build investor confidence. This is part of the ASX company sales growth strategies.

ASX utilizes digital channels to communicate updates and engage with stakeholders. This includes website updates, social media, and email campaigns. Digital marketing strategies are essential for ASX company sales growth.

ASX's sales performance is closely monitored and analyzed to assess the effectiveness of its strategies. Key metrics include trading volumes, market share, and customer satisfaction. Analyzing sales performance is crucial for ASX businesses.

Measuring marketing ROI helps ASX assess the effectiveness of its campaigns. This involves tracking key performance indicators (KPIs) and analyzing the impact of marketing efforts on business outcomes. This is part of the effective marketing campaigns for ASX stocks.

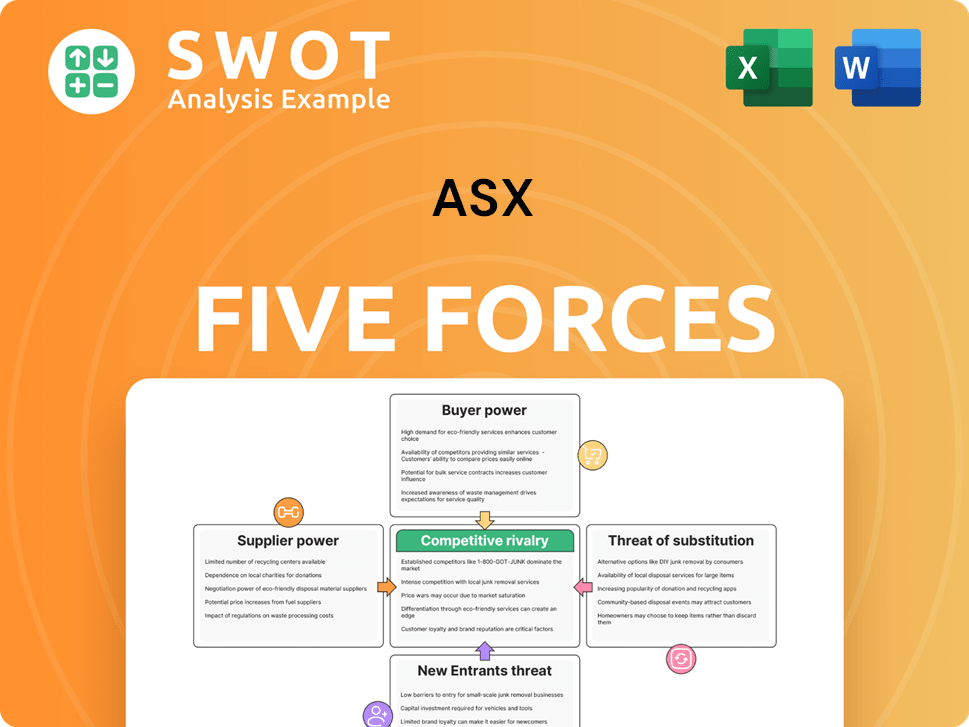

ASX Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASX Company?

- What is Competitive Landscape of ASX Company?

- What is Growth Strategy and Future Prospects of ASX Company?

- How Does ASX Company Work?

- What is Brief History of ASX Company?

- Who Owns ASX Company?

- What is Customer Demographics and Target Market of ASX Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.