ASX Bundle

Who Really Owns the ASX?

Understanding the ownership of an ASX-listed company is crucial for any investor or business strategist. From IPOs to mergers, the dynamics of who holds the shares directly impacts a company's future. This exploration dives deep into the ASX SWOT Analysis, offering a comprehensive look at the Australian Securities Exchange.

The Australian stock market, a vital part of the global financial landscape, holds significant influence. Knowing the ASX company ownership structure, including major shareholders ASX, is key to making informed decisions. Discovering who owns ASX shares can unlock valuable insights into a company's strategic direction and potential for growth. This analysis will help you navigate the complexities of identifying the ultimate owners of an ASX company.

Who Founded ASX?

Understanding the ownership of an ASX company requires a look at its unique history. Unlike companies with individual founders, the Australian Securities Exchange (ASX) was formed through the amalgamation of existing stock exchanges. This means the initial ownership structure wasn't based on traditional founders but rather on the members of the pre-existing exchanges.

The formation of the ASX on April 1, 1987, brought together six state-based stock exchanges. This pivotal event laid the groundwork for the modern ASX. The shift from independent state exchanges to a unified national exchange marked a significant change in the Australian stock market.

The demutualization and subsequent listing of the ASX on October 14, 1998, marked a significant turning point. The former members of the amalgamated exchanges became the initial shareholders. This event made the ASX the first exchange globally to be listed on its own market.

The Sydney Stock Exchange, established in 1871, was one of the early exchanges. These exchanges had their own rules for stockbrokers.

The Australian Associated Stock Exchanges (AASE), formed in 1937, set common listing requirements. It also introduced uniform brokerage rules across the state exchanges.

The transition to a national exchange transformed former exchange members into initial shareholders. This structure set the foundation for the ASX's ownership.

Demutualization allowed the ASX to list on its own market. This was a pioneering move in the global financial landscape.

Specific equity holdings from the pre-ASX era aren't readily available. The shift created a new ownership model.

The ASX's formation was through legislative action. This unique origin distinguishes it from typical company structures.

To understand Growth Strategy of ASX, it's essential to recognize that the ASX's ownership structure evolved from the amalgamation of state-based exchanges. This unique origin means that instead of individual founders, the initial ownership was distributed among the former members of these exchanges. The demutualization in 1998 and subsequent listing on its own market further shaped the ASX's ownership landscape. Researching the current shareholders of an ASX listed company provides insights into the present-day ownership structure. The largest shareholders often include institutional investors, which can be found through publicly available reports and company filings. Understanding who owns ASX shares is crucial for anyone looking to invest in or analyze the Australian stock market.

The ASX's unique formation impacts its ownership structure.

- The ASX was formed through the amalgamation of state-based stock exchanges.

- Initial ownership was distributed among former exchange members.

- Demutualization and listing occurred in 1998.

- Shareholder information can be found in public reports.

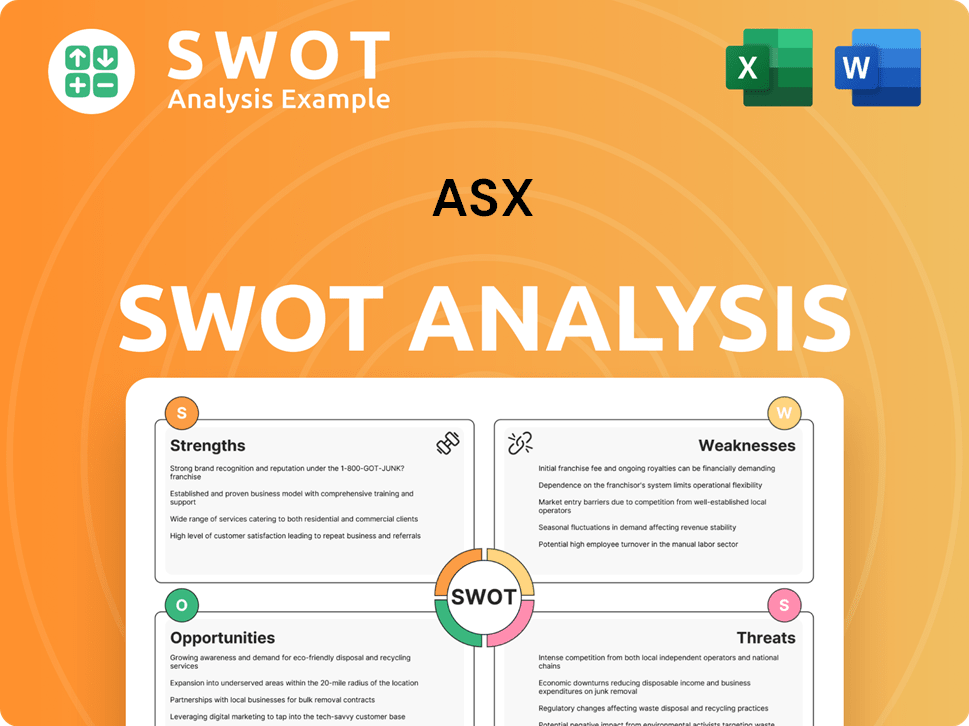

ASX SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ASX’s Ownership Changed Over Time?

The ownership of ASX Limited, an ASX company, has undergone significant changes since its inception in 1987. Initially, the demutualization process transformed former exchange members into shareholders. This shift marked a crucial step in establishing its current ownership structure. The merger with the Sydney Futures Exchange in 2006 further consolidated its market position and expanded its product range, influencing the composition of its shareholder base.

As a publicly listed entity, the major shareholders of ASX primarily consist of institutional investors. The evolution of ownership reflects broader trends in the Australian stock market, where institutional investors play a significant role. Understanding the dynamics of ASX company ownership is key for investors and stakeholders alike.

| Event | Impact on Ownership | Year |

|---|---|---|

| Demutualization | Transformed exchange members into shareholders. | 1998 |

| Merger with Sydney Futures Exchange | Consolidated market position and expanded product range, potentially influencing shareholder composition. | 2006 |

| Ongoing Market Dynamics | Continuous shifts in institutional and retail investor holdings. | Ongoing |

Institutional investors are the largest ownership category globally, holding approximately 44% of global stock market capitalization. In Australia, institutional investors own around 29% of ASX-listed equities by value as of the OECD Corporate Governance Factbook 2023. Super funds, for instance, hold about 38% of the Australian bourse. Changes in ownership can influence company strategy and governance, with a focus on shareholder value. The ASX is committed to ensuring its governance arrangements align with regulatory requirements and stakeholder expectations.

The ownership structure of ASX has evolved significantly since its formation, with institutional investors as major shareholders.

- Institutional investors are the largest shareholder group.

- Changes in ownership can influence company strategy and governance.

- The ASX is committed to aligning governance with regulations and stakeholder expectations.

- Understanding the ownership structure is crucial for investors.

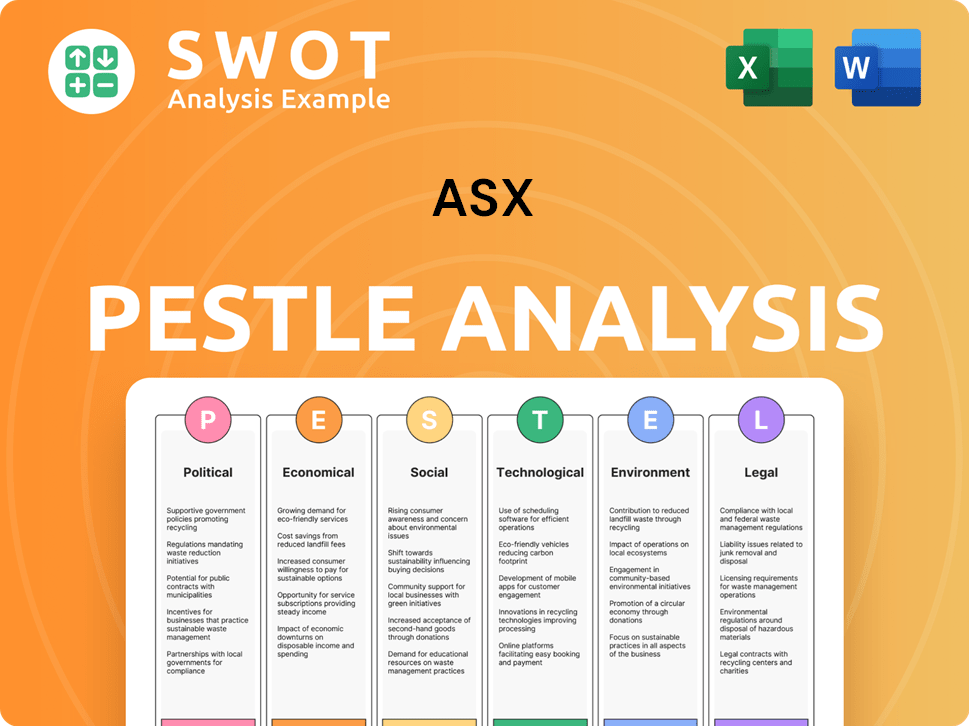

ASX PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ASX’s Board?

The Board of Directors of ASX Limited oversees the company's corporate governance and strategic direction. As of August 16, 2024, the board includes Helen Lofthouse as CEO. The board's responsibilities include setting the corporate governance framework, developing strategies, and monitoring performance. The ASX follows the ASX Corporate Governance Council Principles and Recommendations, which emphasize clear divisions of responsibility between the Board and management.

Fifty percent of the directors are female, including the CEO. While specific details on which board members represent major shareholders are not typically disclosed, large institutional investors often engage with the board. The board also ensures fair remuneration, effective composition, and succession planning.

| Board Role | Name | As of |

|---|---|---|

| CEO | Helen Lofthouse | August 16, 2024 |

| Board Composition | 50% Female Directors | August 16, 2024 |

| Governance Framework | Follows ASX Corporate Governance Council Principles | Ongoing |

The voting structure for ASX Limited operates on a one-share-one-vote basis, standard for Australian listed companies. There is no evidence of dual-class shares or similar structures that would grant outsized control. The ASX Corporate Governance Council's proposed changes for the 5th Edition of its Principles and Recommendations, expected in early 2025 and potentially effective from July 1, 2025, aim to enhance governance and increase transparency for investors.

Understanding ASX company ownership involves examining the board of directors and the voting structure. The board is responsible for strategic oversight, while the voting structure typically follows a one-share-one-vote system. The ASX Corporate Governance Council is working to increase transparency.

- The board of directors sets the corporate governance framework.

- Voting generally operates on a one-share-one-vote basis.

- Proposed changes aim to increase transparency for investors.

- Major shareholders often engage with the board.

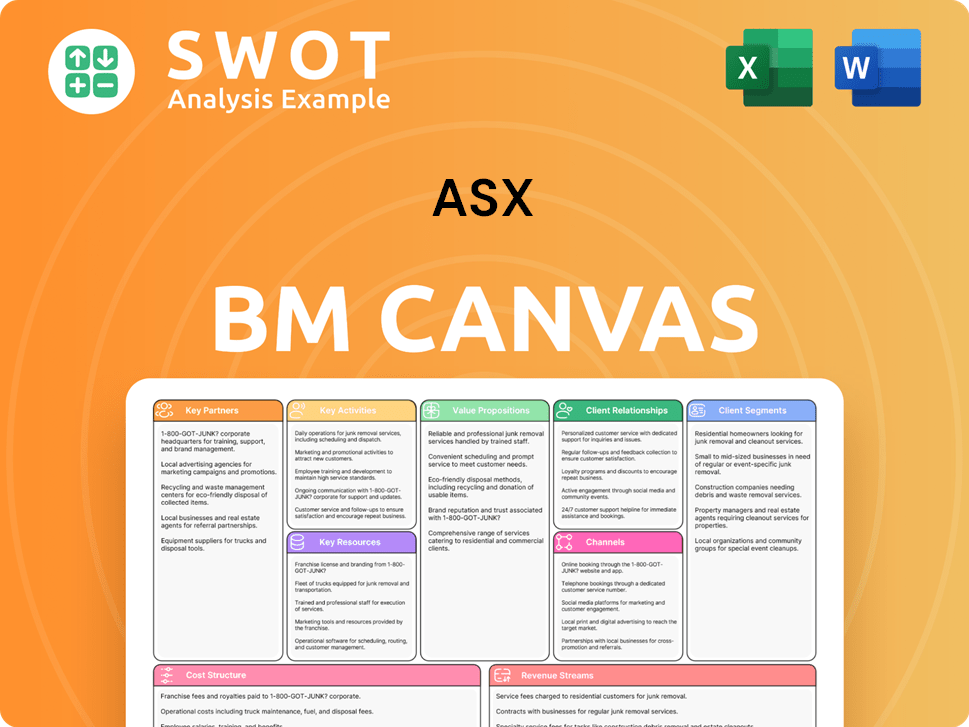

ASX Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ASX’s Ownership Landscape?

Over the past few years, the ownership landscape of ASX-listed companies has seen shifts, reflecting broader market trends. While specific buybacks or secondary offerings from ASX Limited aren't detailed, the Australian market has experienced significant merger and acquisition (M&A) activity. The total market capitalization of companies leaving the ASX due to takeovers exceeded $175 billion since FY22. However, the ASX states that net new capital added to the exchange since July 1, 2017, is $452 billion, and $138 billion since July 1, 2021, indicating the ASX is not shrinking.

Industry trends show an increase in institutional ownership. Globally, institutional investors hold 44% of the stock market capitalization. In Australia, they own 29% of ASX-listed equities. Super funds are projected to increase their ownership to 41% by 2030, although their direct ownership of the ASX is under 15%.

| Metric | Data | Period |

|---|---|---|

| Total Market Cap of Companies Leaving ASX via Takeovers | Over $175 billion | Since FY22 |

| Net New Capital Added to ASX | $452 billion | Since July 1, 2017 |

| Institutional Ownership of Global Stock Market | 44% | Current |

| Institutional Ownership of ASX-Listed Equities | 29% | Current |

| Projected Super Fund Ownership of Australian Bourse | 41% | By 2030 |

Leadership changes have also occurred, with Helen Lofthouse replacing Dominic Stevens as CEO in 2022. In the broader ASX 200, there were 27 CEO departures in 2024, and Q1 2025 saw the lowest number of CEO departures on record for the ASX 200. Looking ahead, the Australian M&A market is expected to see increased activity in the second half of 2025.

Institutional investors globally hold a significant portion of the stock market. In Australia, their ownership of ASX-listed equities is a key factor. Super funds are projected to increase their ownership.

The Australian market has seen substantial M&A activity, with many companies being taken over. The second half of 2025 is expected to see an increase in M&A driven by economic factors.

Executive changes can influence investor confidence and sentiment. The ASX has seen changes in leadership. There were notable CEO departures in the broader ASX 200 in 2024.

The M&A market is expected to be active in the second half of 2025. ASIC's consultation may lead to reforms. Private equity and institutional investors are pursuing 'take-private' transactions.

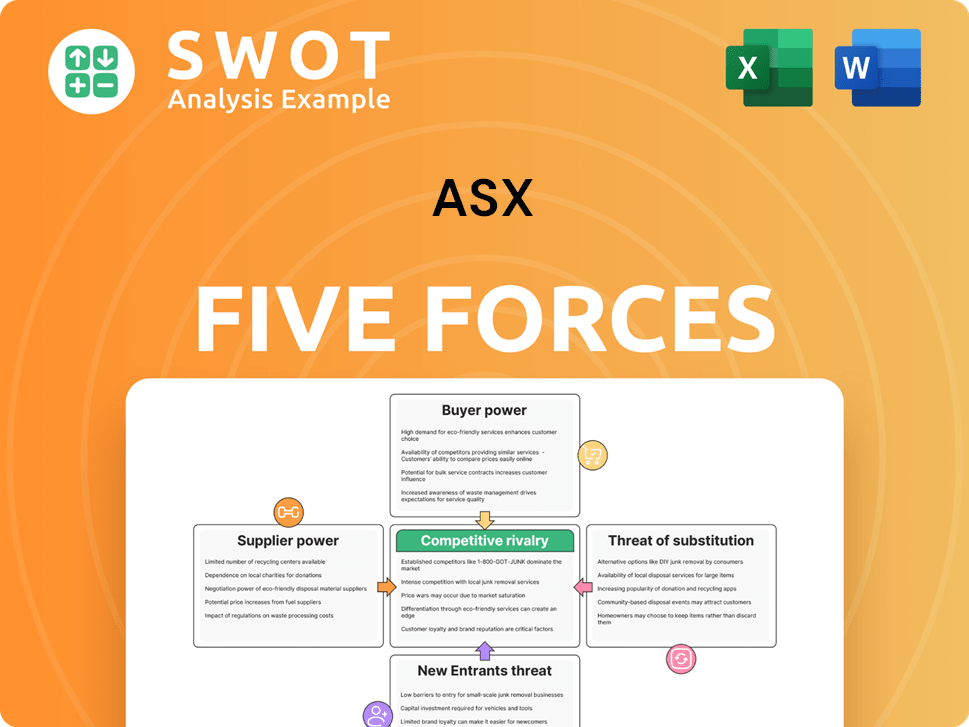

ASX Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASX Company?

- What is Competitive Landscape of ASX Company?

- What is Growth Strategy and Future Prospects of ASX Company?

- How Does ASX Company Work?

- What is Sales and Marketing Strategy of ASX Company?

- What is Brief History of ASX Company?

- What is Customer Demographics and Target Market of ASX Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.