ASX Bundle

Can the ASX Continue Its Reign in the Australian Market?

The Australian Securities Exchange (ASX) is a cornerstone of the Asia-Pacific financial landscape, but what does the future hold for this pivotal institution? Established in 1987, the ASX has grown into a multi-asset class exchange, facilitating trillions in market capitalization. Understanding the ASX SWOT Analysis is crucial for investors and strategists alike, as we delve into its growth strategy and future prospects.

This analysis provides a comprehensive share market outlook, examining the ASX's strategic initiatives and its ability to capitalize on emerging opportunities. We'll explore the ASX's plans for expansion, technological advancements, and the potential risks that could impact its company performance. This deep dive into ASX investment strategies will equip you with the knowledge to navigate the dynamic Australian stock market and identify the best growth stocks ASX.

How Is ASX Expanding Its Reach?

The expansion initiatives of the Australian Securities Exchange (ASX) are primarily focused on enhancing its core services and adapting to market demands. These efforts aim to strengthen its position in the Australian stock market analysis and provide better services for investors and listed companies. The initiatives reflect a commitment to innovation and efficiency, ensuring the ASX remains a competitive and reliable platform for capital markets.

A key driver of ASX's growth strategy is the ongoing modernization of its infrastructure. The CHESS replacement project is a significant undertaking designed to update the Clearing House Electronic Subregister System. This project is crucial for maintaining the efficiency and robustness of ASX's operations.

In addition to technological upgrades, the ASX continuously reviews and refines its regulatory frameworks. This includes potential changes to trading and settlement processes, such as transitioning to a T+1 settlement cycle. These adjustments are aimed at improving market efficiency and reducing risk, aligning with broader industry trends.

The CHESS replacement project is a major initiative to modernize the core infrastructure of the ASX. The clearing phase is targeted for launch in 2026, with settlement and sub-register phases expected in 2028 or 2029. This digital transformation is designed to make the system more robust, efficient, and flexible.

ASX is evaluating potential changes to its trading and settlement processes, including a move to T+1 trading. This reflects a global trend towards faster settlement cycles. The ASX also regularly updates its operating rules to ensure they are adaptable to evolving market practices, with responses to consultations released in late 2024.

ASX actively supports market expansion by facilitating new listings and capital raising. In 2024, the total market capitalization from new listings reached $12.1 billion. This demonstrates ASX's ongoing role in providing a platform for companies to access capital and grow.

ASX continuously reviews and refreshes its operating rules for clearing and settlement facilities. The goal is to ensure the regulatory framework remains robust and adaptable to evolving market practices. This is crucial for maintaining investor confidence and market integrity.

The ASX's expansion strategy involves significant investments in technology and regulatory updates to improve its services and support market growth. These initiatives are aimed at enhancing the efficiency and reliability of the exchange, ensuring it remains competitive and attractive for investors and listed companies. For more details on the ASX's structure, you can read about Owners & Shareholders of ASX.

- CHESS Replacement: Modernizing the core clearing and settlement system.

- Trading and Settlement Frameworks: Exploring faster settlement cycles and updated operating rules.

- Market Support: Facilitating new listings and capital raising to boost market capitalization.

- Regulatory Updates: Continuously improving regulatory frameworks to adapt to market changes.

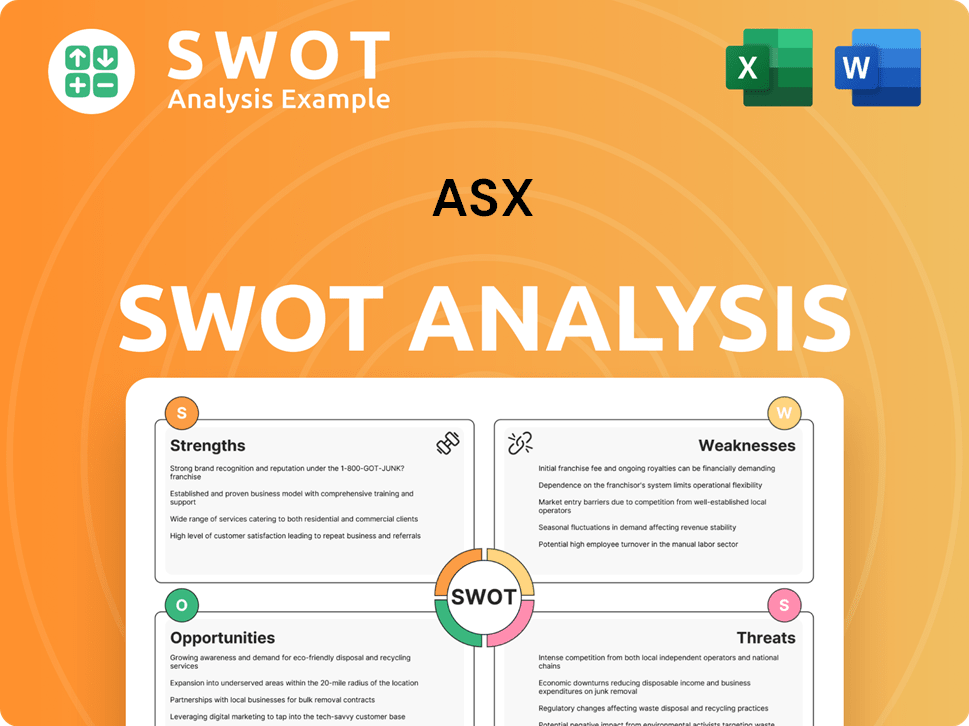

ASX SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ASX Invest in Innovation?

The innovation and technology strategy of ASX is crucial for its ongoing expansion, with a strong focus on updating its infrastructure and adopting advanced technologies. This approach is vital for maintaining a competitive edge and meeting the evolving demands of the financial market.

A key element of this strategy is the CHESS replacement project. This initiative aims to transform the existing system into a more efficient and flexible platform. This modernization is designed to enable the introduction of new services and products, supporting long-term growth and market relevance.

The company is also leveraging technologies like AI and cybersecurity to improve efficiency and customer satisfaction. This commitment to technological advancement aligns with the broader industry trend, where digital transformation is a primary concern for businesses.

The CHESS replacement project is a major digital transformation led by Tata Consulting Services. The clearing phase is scheduled for 2026, with subsequent phases in 2028 or 2029.

The company is significantly investing in technology, with capital expenditure guidance for FY25 between $160 million and $180 million. This level of investment is expected to continue through FY27.

AI and cybersecurity are being integrated to enhance operational efficiency and customer satisfaction. This reflects a proactive approach to managing technology-related risks and improving overall performance.

Over half (53%) of Australian business leaders identify digital transformation as their main concern. This highlights the importance of technology in the modern business landscape.

The S&P/ASX All Technology Index (ASX: XTX) increased by 49% in 2024. This growth demonstrates the strength of the technology sector within the Australian market.

The company focuses on cyber risks and their governance implications for listed entities. This includes amendments in Guidance Note 8 to provide best practice guidance for data breaches and ransomware attacks.

The company's commitment to innovation extends to supporting the broader technology sector in Australia. The strong performance of the S&P/ASX All Technology Index, which significantly outperformed the broader market, indicates a thriving tech ecosystem. This environment provides opportunities for Revenue Streams & Business Model of ASX and other companies to grow. The focus on cybersecurity and risk management further demonstrates a proactive approach to technology-related challenges.

The company's technological strategy includes major projects and ongoing efforts to enhance its infrastructure and services. These initiatives are designed to improve efficiency, security, and market competitiveness.

- CHESS Replacement: A multi-year project to modernize trading infrastructure.

- AI and Cybersecurity: Integration of advanced technologies to improve operations and security.

- Capital Expenditure: Significant investment in technology, with guidance for FY25 between $160 million and $180 million.

- Cybersecurity Measures: Proactive steps to manage cyber risks and protect data.

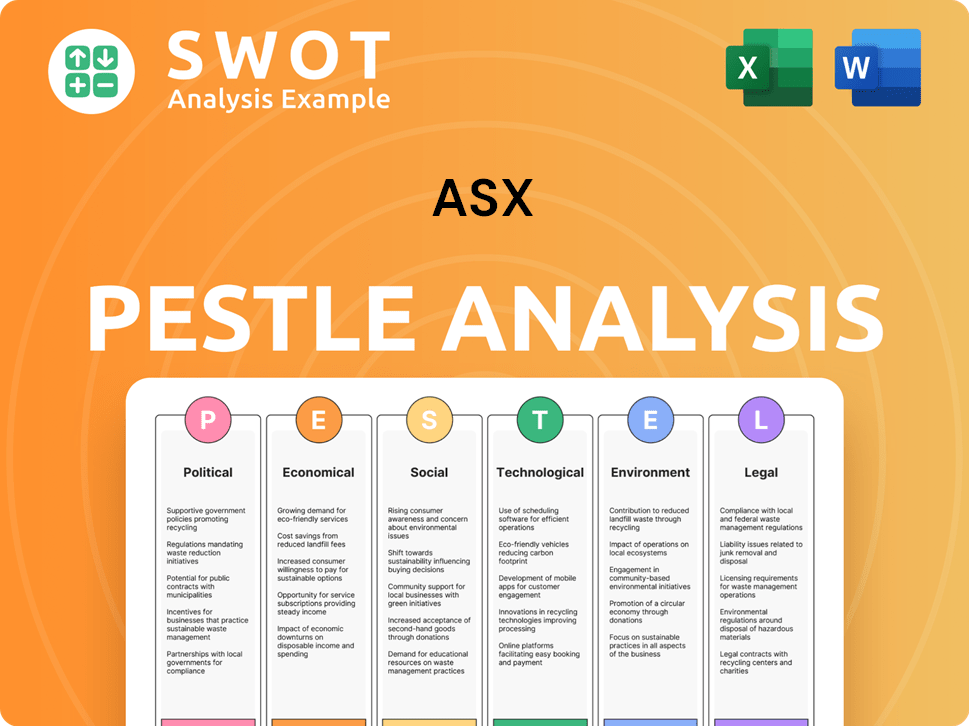

ASX PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ASX’s Growth Forecast?

The financial outlook for ASX in 2025 centers on continued investment in technology and a commitment to maintaining its dividend payout ratio. This approach reflects a strategic focus on long-term growth and shareholder value. The company's financial health and strategic investments are key factors for investors considering ASX investment.

For the half-year ending December 31, 2024, ASX reported operating revenue of $541.9 million, a 5.9% increase compared to the previous period. Listings revenue remained stable at $104.9 million. This performance indicates a solid foundation for future growth, supported by strategic investments in technology and infrastructure.

Looking ahead, ASX anticipates a total expense growth rate between 6% and 9% for FY25. This growth is primarily driven by ongoing technology-related investments, including software licensing, equipment costs, and depreciation and amortization. The company expects elevated technology capital expenditure of between $160 million and $180 million for FY25, a range expected to continue for the medium term (FY25–FY27) before starting to reduce.

The company is significantly investing in technology. This includes software licensing, equipment, and related costs. These investments are crucial for maintaining a competitive edge in the evolving financial market. This is a key aspect of the overall ASX growth strategy.

ASX aims to maintain a dividend payout ratio between 80% and 90% of underlying net profit after tax. This commitment to shareholder returns is a positive signal for investors. This strategy is important for the share market outlook.

The company plans for significant technology capital expenditure, ranging from $160 million to $180 million for FY25, and this level of investment is expected to continue for the medium term. This investment is a key component of the ASX company prospects.

ASX will continue to operate its Dividend Reinvestment Plan. New shares will be issued to satisfy DRP entitlements at a price based on the volume weighted average price of ASX shares. This is a key part of the ASX investment strategy.

As of December 31, 2024, the net assets of the ASX Group were $3,760.6 million, a 1.0% increase from June 30, 2024. Cash and financial assets were $12.8 billion, down 4.5% over the same period. This indicates the company's financial stability and strategic management of its assets, which is important for Company performance.

The financial narrative suggests a company investing in its future while aiming for consistent shareholder returns. This approach is designed to drive long-term value. This is an important aspect of Australian stock market analysis.

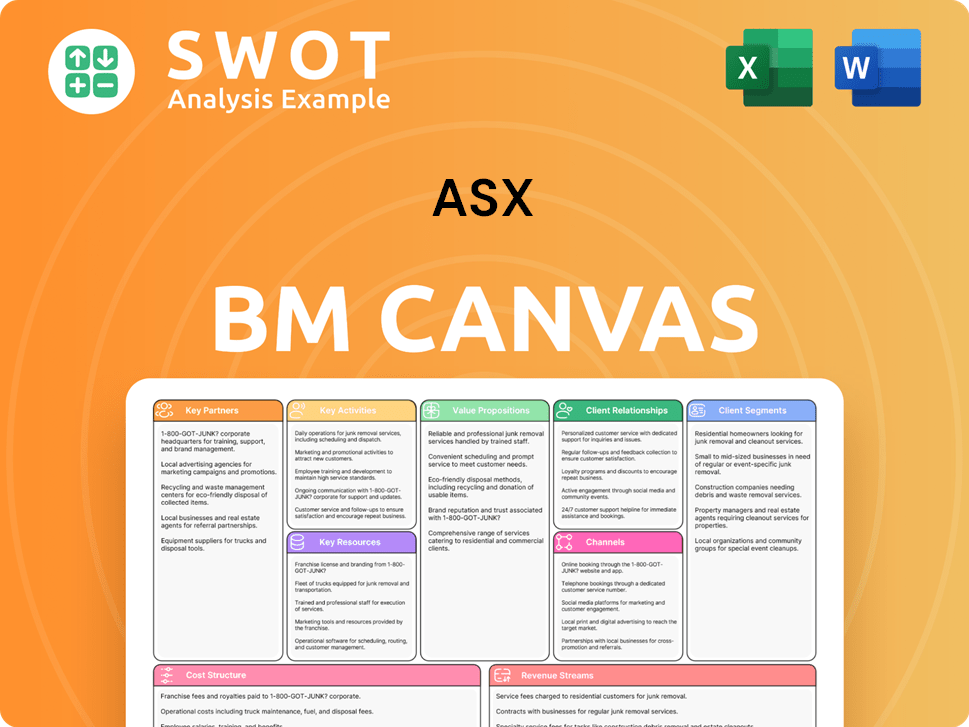

ASX Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ASX’s Growth?

The Australian Securities Exchange (ASX), as a critical financial market infrastructure, faces several strategic and operational risks that could influence its growth trajectory. These risks encompass market competition, regulatory changes, technological disruptions, and broader macroeconomic conditions. Understanding these potential obstacles is crucial for investors and stakeholders assessing the Marketing Strategy of ASX.

Market dynamics and regulatory landscapes are constantly evolving, requiring continuous adaptation and proactive risk management. The ASX must navigate these challenges to maintain its position and support its listed entities. Additionally, internal resource constraints and cybersecurity threats further compound the complexity of ensuring stable and reliable financial market operations.

The company's future prospects are intertwined with its ability to mitigate these risks. The following sections detail these risks, providing insights into their potential impacts and the strategies the company employs to address them.

The ASX faces competition from other trading platforms. Cboe accounted for 19.8% of the total dollar turnover in equity market products in the March 2024 quarter, with ASX holding 80.2%. Maintaining market share is a key challenge.

Regulatory changes are a persistent challenge. The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024 mandates climate-related financial information disclosure for certain entities. ASIC has expanded enforcement powers, particularly regarding greenwashing.

Technological disruption is a key risk. The CHESS replacement project has faced delays, highlighting the complexities of large-scale digital transformations. Cybersecurity threats continue to pose significant risks to companies and financial systems.

Large projects like CHESS replacement can strain internal resources. Efficient allocation of resources is critical for maintaining operational efficiency and achieving strategic goals. Delays or cost overruns can impact the company's performance.

Broader macroeconomic factors pose risks. Persistent inflationary pressures and potential interest rate adjustments could impact corporate profits and valuations. Geopolitical tensions can also affect the broader equity market.

Cybersecurity threats are a constant concern. The ASX has maintained its focus on cyber risks and their governance implications for listed entities. New guidance on data breaches is essential for protecting market integrity.

The ASX employs strategic planning to manage these risks, including an updated sustainability framework in 2024. This framework incorporates a materiality analysis of stakeholder perspectives. The company is committed to resilient data and cybersecurity defenses.

The company is committed to effective and reliable technology. This includes investment in cybersecurity and data protection. These measures are essential for ensuring the stability and reliability of the Australian stock market.

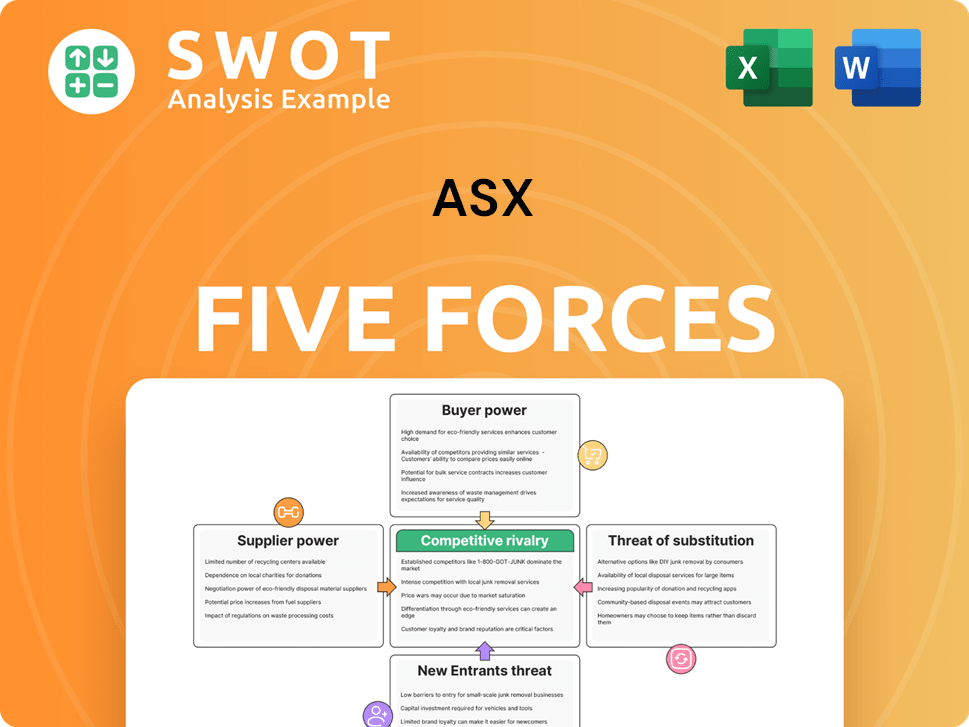

ASX Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.