ASX Bundle

How Does the ASX Company Thrive?

The Australian Securities Exchange (ASX) is the powerhouse of Australia's financial landscape, and its performance is a key indicator of the nation's economic health. In 1H25, the ASX company reported record operating revenue, highlighting its sustained influence and critical role in capital formation. Understanding the inner workings of the ASX SWOT Analysis is essential for anyone looking to navigate the complexities of the stock market Australia.

As the primary exchange for ASX listed companies, the ASX provides a vital platform for trading shares, derivatives, and other financial instruments. Its comprehensive ecosystem, including post-trade services, supports market participants and reflects broader investor confidence. For those considering investing in ASX or studying publicly traded companies, a deep dive into the ASX's operations and revenue streams is crucial.

What Are the Key Operations Driving ASX’s Success?

The core operations of an ASX company involve facilitating the trading of securities and providing related services. This includes operating a marketplace for cash equities, derivatives, and other financial products. The company also offers clearing, settlement, and registry services, essential for the smooth functioning of the Australian financial market.

The value proposition of an ASX company revolves around its integrated exchange group model. This model offers a full suite of services, from listings and trading to clearing, settlement, and information services. This integrated approach aims to provide efficiency and reduce counterparty risk for market participants, benefiting both investors and listed companies.

The ASX serves a diverse customer base, including individual and institutional investors, brokers, and listed companies. Its operational processes are technologically advanced, with a sophisticated electronic trading platform forming the backbone of Australia's financial markets. The infrastructure includes a state-of-the-art data center and a dedicated fiber network, ASX Net, ensuring reliable and low-latency connections to global financial hubs.

The ASX operates a marketplace for trading cash equities, derivatives, and other financial products. This involves matching buy and sell orders, ensuring price discovery, and providing real-time market data. The trading platform is designed to handle high volumes of transactions efficiently.

Clearing and settlement services are critical for ensuring the integrity of the market. The ASX clearing house processes millions of contracts daily. Settlement involves the transfer of securities and funds between buyers and sellers, completing the transaction.

The ASX provides listing services for companies seeking to raise capital through the stock market. This includes setting listing requirements, overseeing compliance, and providing ongoing support to listed companies. Listing on the ASX offers companies access to a wide pool of investors.

Registry services involve maintaining records of share ownership and facilitating corporate actions, such as dividend payments and share issues. This ensures accurate and efficient management of shareholder information. These services are essential for the smooth operation of the market.

The ASX operates with impressive efficiency and reliability, reflected in key metrics. These metrics demonstrate the scale and importance of the ASX in the Australian financial market.

- The ASX clearing house, ASX Clear, processes over 5 million derivatives contracts daily.

- The system uptime for ASX Clear is maintained at 99.99%, ensuring minimal disruption.

- In the December 2024 quarter, ASX accounted for 79.6% of the total dollar turnover in equity market products.

- The ASX Net fiber network provides low-latency connections, such as 17ms to the Hong Kong Exchange.

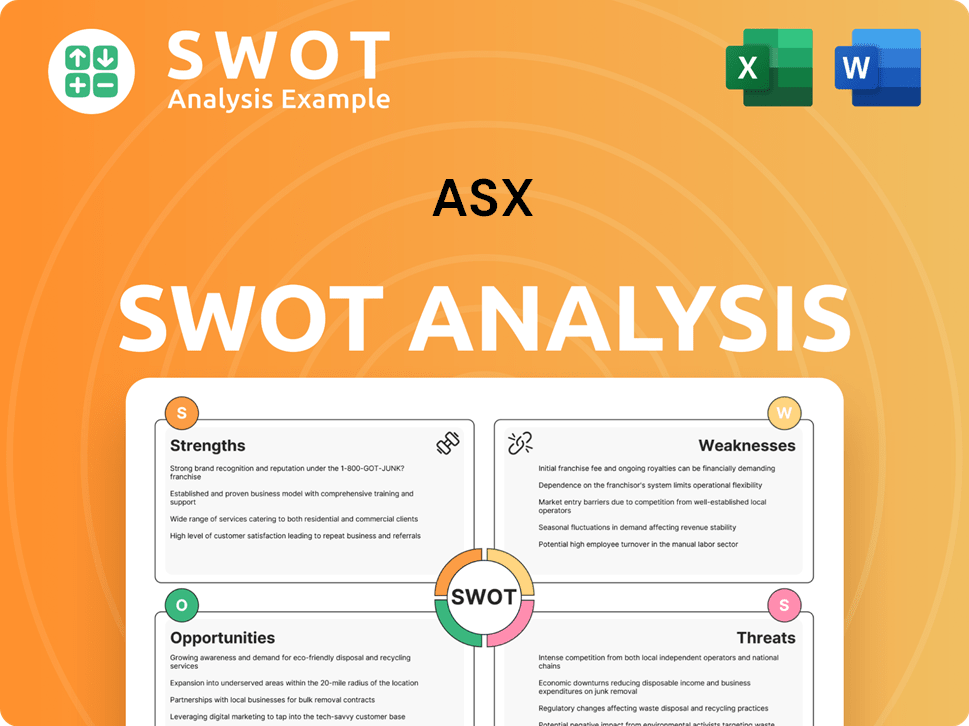

ASX SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ASX Make Money?

The Australian Stock Exchange (ASX) generates revenue through a diverse range of services. These services are primarily categorized into Listings, Markets, Technology & Data, and Securities & Payments. In the first half of the 2025 financial year (1H25), the ASX reported record operating revenue, demonstrating its robust financial performance.

Understanding the revenue streams and monetization strategies of an ASX company is crucial for investors. This knowledge provides insights into how the exchange makes money and its financial health. Investors interested in Owners & Shareholders of ASX can gain further insights.

The ASX's revenue model is multifaceted, with each segment contributing differently. Key revenue sources include listing fees, trading activities, technology solutions, and securities and payments services. Net interest income also plays a significant role in the exchange's overall financial performance.

The ASX's revenue streams are diverse, with each segment contributing to its financial health. The following details the major revenue streams and their contributions in the first half of the 2025 financial year (1H25):

- Listings Revenue: Stable at $104.9 million. Annual listing fees, driven by market capitalization, increased by 3.7% to $55.5 million due to higher market capitalization in May 2024.

- Markets Revenue: Cash market trading revenue increased by 11.3% to $33.4 million, driven by an 11.0% increase in total ASX on-market value traded. Auctions traded value increased by 18.8%. Equity options revenue decreased by 2.3% to $8.6 million.

- Technology & Data Revenue: Strong growth, increasing by 6.7% to $132.9 million.

- Securities & Payments Revenue: Contributed to strong revenue growth.

- Net Interest Income: Increased by 9.4% to $43.1 million, supported by higher net interest from cash and collateral balances. Net interest from participant balances was up 30.2% to $22.4 million.

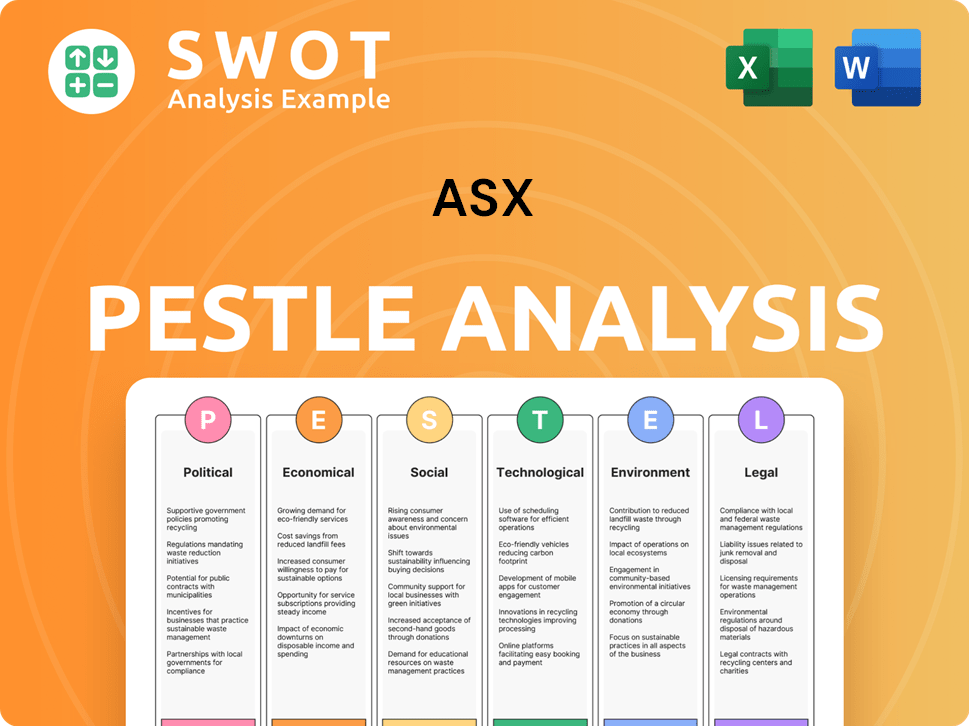

ASX PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ASX’s Business Model?

The Australian Stock Exchange (ASX) has navigated significant strategic shifts and operational challenges, shaping its trajectory in the financial market. A key strategic initiative involves its new five-year strategy, launched in June 2023, which outlines new organizational goals and measures of success. This strategy prioritizes technology modernization and regulatory compliance to enhance long-term shareholder value. Understanding these milestones is crucial for anyone looking into the evolution of the ASX.

A major operational challenge has been the CHESS replacement project. Following a significant loss of $176.3 million after tax in 1H24 related to the non-cash derecognition charge and wind-down costs of the CHESS replacement project, ASX has confirmed the staged implementation of the CHESS replacement. In March 2025, the Reserve Bank of Australia (RBA) and the Australian Securities and Investment Commission (ASIC) expressed deep concerns regarding operational risk management at ASX following a CHESS batch settlement failure incident on December 20, 2024. The regulators have directed ASX to prioritize immediate remediation and engage an expert for a technical review of CHESS.

The company's competitive advantages are multifaceted, stemming from its brand strength and dominant position in the Australian market. This strong market presence provides a strong network effect, increasing platform value with more participants and liquidity. Furthermore, ASX's sophisticated electronic trading infrastructure ensures high system uptime and efficient transaction processing. The company's commitment to investing in its business, including technology modernization, is critical to its strategy and future growth.

The new five-year strategy, launched in June 2023, sets clear goals and measures of success. It focuses on technology modernization and regulatory commitments. These initiatives aim to support long-term shareholder value.

The CHESS replacement project has presented significant challenges, including financial losses. Regulatory concerns from the RBA and ASIC regarding operational risk management have led to remediation efforts and a technical review.

ASX benefits from its brand strength and leading market position, controlling approximately 80% of Australia's equity market. Its electronic trading infrastructure enhances efficiency. Continued investment in technology is a key strategic advantage.

ASX adapts to new trends and regulatory changes, such as exploring a move from T+2 to T+1 trading for cash equities settlement. The company continues to focus on cyber risks and their governance implications.

In FY25, technology capital expenditure is guided to be between $160 million and $180 million. The CHESS replacement project resulted in a loss of $176.3 million after tax in 1H24.

- ASX holds approximately 80% of Australia's equity market.

- The company is focused on technology modernization to enhance its infrastructure.

- The RBA and ASIC have directed ASX to prioritize immediate remediation.

- ASX is exploring a move from T+2 to T+1 trading for cash equities settlement.

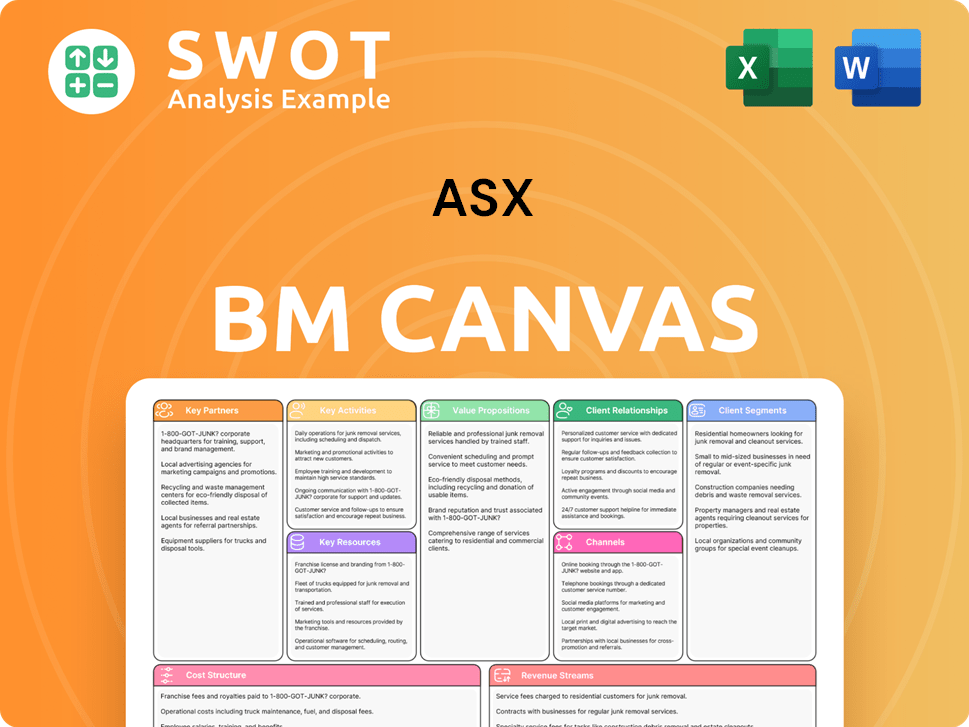

ASX Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ASX Positioning Itself for Continued Success?

The Australian Stock Exchange (ASX) maintains a dominant position in the Australian financial market. In the December 2024 quarter, the ASX held a significant share of the equity market products, with a turnover of 79.6%, while Cboe accounted for the remaining 20.4%. The S&P/ASX 200, representing about 80% of Australia's equity market, underlines the ASX's central role.

Despite its strong market position, the ASX faces risks. Operational risks, especially concerning its critical infrastructure like the CHESS system, are a key concern. Regulatory changes and macroeconomic factors also present challenges. The future outlook involves technology modernization and continued investment in core businesses.

The ASX holds a dominant position in the Australian financial market. Its market share, measured by the Herfindahl-Hirschman Index (HHI), remained stable at 0.65 in the December quarter of 2024. Cross-margining agreements with international exchanges enhance its global reach, facilitating efficient capital utilization for global market participants.

Operational risks, particularly those linked to critical infrastructure, are a significant concern. Regulatory changes, including new climate reporting requirements, also pose challenges. Competition from alternative trading venues and macroeconomic factors, such as high interest rates, present further headwinds for the broader Australian equity market.

The focus is on technology modernization and sustained investment in core businesses. The company aims to boost revenue through strategic initiatives. Increased listing activity is expected in 2025, driven by investor demand.

FY25 technology capital expenditure is guided to be between $160 million and $180 million. ASX intends to maintain its dividend payout ratio of between 80% and 90% of underlying net profit after tax. ASX is exploring innovative initiatives, such as exploratory work with the Clean Energy Regulator to develop an Australian Carbon Exchange.

Understanding the dynamics of the Australian Stock Exchange is vital for investors. The ASX's market dominance and the risks it faces should be carefully evaluated. Investors should monitor technology modernization efforts and the company's strategic initiatives.

- Assess the impact of operational risks and regulatory changes.

- Consider macroeconomic factors such as interest rates and global economic conditions.

- Evaluate the potential for increased listing activity and its impact on revenue.

- Stay informed about the company's dividend payout ratio.

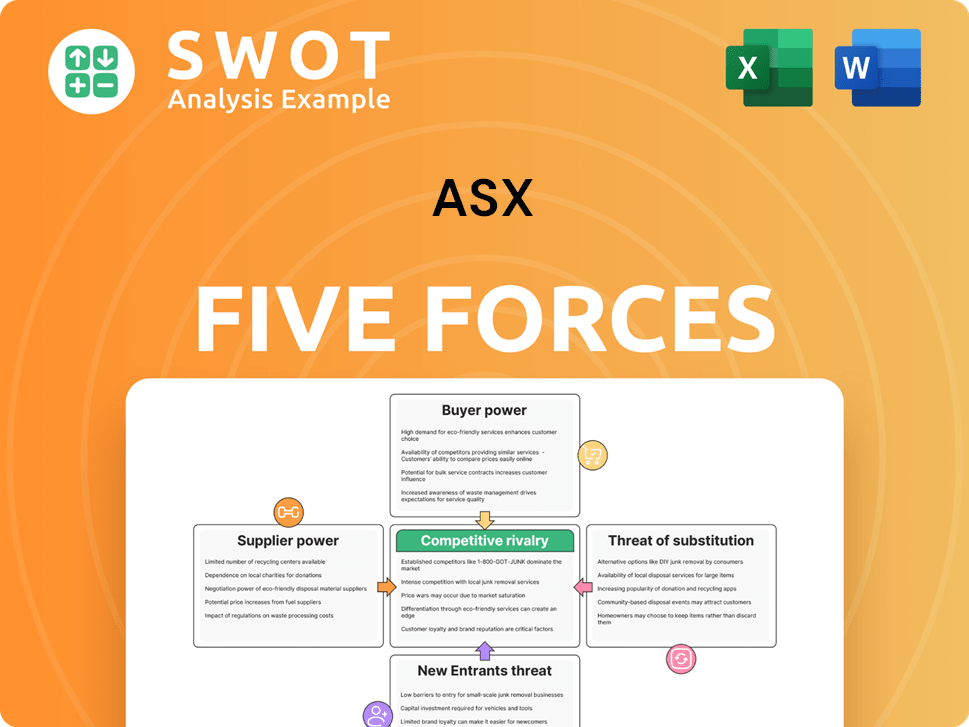

ASX Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ASX Company?

- What is Competitive Landscape of ASX Company?

- What is Growth Strategy and Future Prospects of ASX Company?

- What is Sales and Marketing Strategy of ASX Company?

- What is Brief History of ASX Company?

- Who Owns ASX Company?

- What is Customer Demographics and Target Market of ASX Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.