Fortum Bundle

How Does Fortum Stack Up in Today's Energy Arena?

The European energy sector is in the midst of a dramatic transformation, driven by the urgent need for decarbonization and geopolitical shifts. Fortum, a leading Nordic energy company, is at the center of this change, having recently refocused its strategy. Understanding the Fortum SWOT Analysis is crucial to grasping its position within this complex landscape.

Fortum's strategic pivot, including the divestment of Uniper, has significantly altered its operational focus, making a thorough Fortum SWOT Analysis even more vital. This shift places a spotlight on its competitive positioning within a sector increasingly defined by renewable energy and energy security. This in-depth Fortum SWOT Analysis will dissect the company's standing within the Finnish energy market and beyond, assessing its key rivals and its strategies for navigating the evolving energy sector competition.

Where Does Fortum’ Stand in the Current Market?

Fortum holds a significant position in the Nordic power generation market, especially in hydropower and nuclear energy. The company is consistently among the top power producers in the region. Its core operations involve electricity generation, wholesale power sales, and energy-related services for both industrial and residential customers.

Geographically, Fortum's primary markets are the Nordic and Baltic countries, with additional operations in Poland. Following the divestment of Uniper, Fortum has focused on these regions, aiming to strengthen its position in clean energy and circular economy solutions. The company's strategic shift towards decarbonization includes substantial investments in wind and solar power, alongside expertise in hydrogen and energy storage.

Fortum's financial health remains robust. Its Q1 2025 results reflect strong operational performance and a solid balance sheet, supported by proceeds from the Uniper divestment. This financial strength enables further investments in its strategic areas. This positions Fortum well within the Fortum competitive landscape.

Fortum is a leading power producer in the Nordic region. While precise 2024-2025 market share data is still emerging, the company consistently ranks among the top players. The company's strong presence in Finland and Sweden, due to its hydro and nuclear assets, provides a stable baseload power supply. This contributes to its competitive advantage in the energy sector competition.

Fortum is strategically focused on clean energy and circular economy solutions. This includes investments in renewable energy sources like wind and solar. The company is also developing expertise in hydrogen and energy storage. This strategic shift is detailed further in the Growth Strategy of Fortum.

Fortum's financial performance is strong, supported by the Uniper divestment. The company's Q1 2025 results reflect a solid balance sheet and strong operational performance. This financial strength allows for further investments in core strategic areas, supporting the company's long-term growth and competitiveness. This is crucial for Fortum's market analysis.

The company's core markets are the Nordic and Baltic countries, with operations also in Poland. Following the Uniper divestment, Fortum has sharpened its focus on these regions. This strategic concentration aims to strengthen its position in clean energy and circular economy solutions, enhancing its ability to compete within the Finnish energy market.

Fortum's competitive advantages include its strong position in hydro and nuclear power, providing a stable baseload. Challenges include expanding its renewable portfolio and competing in nascent renewable technologies. The company's strategic shift towards decarbonization and sustainable solutions is crucial for its long-term competitiveness.

- Strong presence in hydro and nuclear power.

- Strategic focus on renewable energy.

- Financial strength from Uniper divestment.

- Expansion into new renewable technologies.

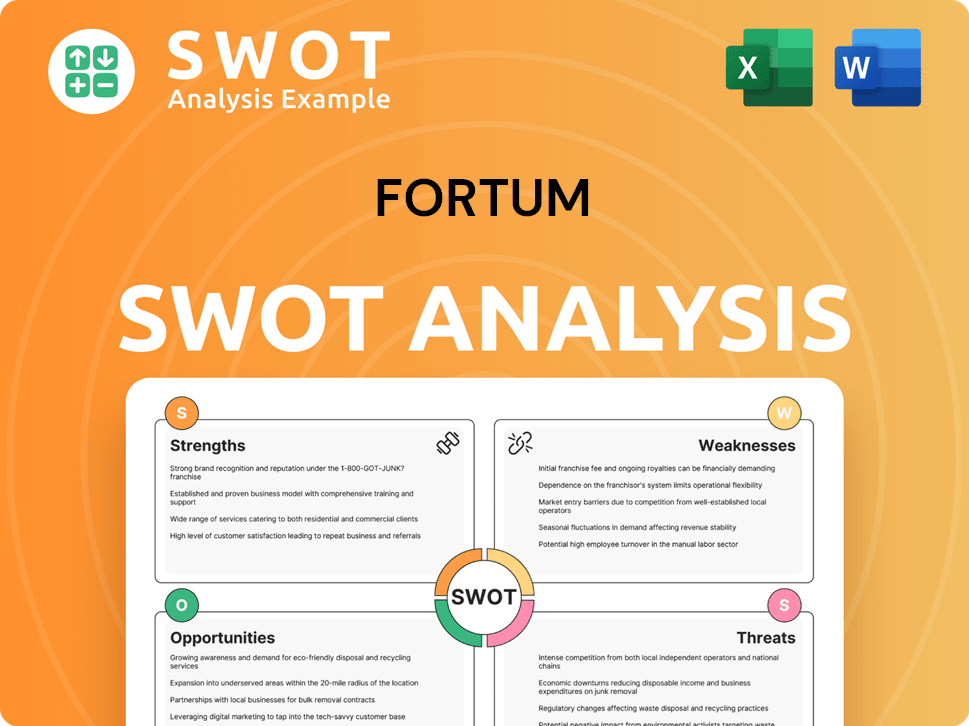

Fortum SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Fortum?

The Brief History of Fortum reveals its position within a dynamic energy sector, highlighting its competitive landscape. Fortum faces significant competition in the Nordic power generation and retail markets. This competition is shaped by established players and emerging entities, each vying for market share and investment opportunities.

Understanding the competitive environment is crucial for assessing Fortum's strategic positioning and future prospects. The energy market is constantly evolving, driven by technological advancements, regulatory changes, and shifting consumer preferences. Analyzing Fortum's main rivals and their strategies provides insights into the challenges and opportunities the company faces.

The competitive landscape for Fortum is characterized by a mix of large, integrated utilities and specialized renewable energy companies. These competitors challenge Fortum in various aspects, from power generation and retail to renewable energy project development and attracting green investments. The energy sector is experiencing rapid changes, including the growth of renewable energy sources, the rise of distributed energy resources, and increasing demand for sustainable energy solutions.

Fortum's main rivals include Vattenfall, Statkraft, and Ørsted. These companies compete directly in the Nordic power generation and retail markets. Each competitor brings unique strengths and strategies to the table, influencing Fortum's market position.

Vattenfall is a Swedish state-owned energy company and a major integrated utility. It operates extensively in power generation, distribution, and sales across Northern Europe. Vattenfall's diverse portfolio, including nuclear, hydro, and wind power, makes it a significant competitor.

Statkraft, a Norwegian state-owned company, is Europe's largest generator of renewable energy. Its primary focus is on hydropower, wind, and solar. Statkraft's strong presence in renewable energy poses a challenge to Fortum in expanding its renewable energy portfolio.

Ørsted, a Danish company, has become a global leader in offshore wind power. It presents a significant competitive threat in the renewable energy investment space. Ørsted's aggressive expansion in offshore wind challenges Fortum in securing new renewable energy projects.

Beyond these major players, Fortum faces competition from smaller energy companies. These include those specializing in renewable technologies and innovative energy solutions. New entrants, such as microgrid developers and energy efficiency service providers, also contribute to the competitive landscape.

Mergers and alliances within the European utility sector can impact competitive dynamics. Consolidation creates larger, more diversified rivals. The energy market is subject to ongoing changes, including technological advancements and regulatory adjustments.

The competitive landscape is dynamic, with companies continuously adapting their strategies. The shift towards renewable energy sources and sustainable practices is a key trend. Fortum's ability to navigate this landscape will be crucial for its financial performance and market share. For example, in 2024, Vattenfall's operating profit increased, reflecting its strong market position, while Ørsted continued to invest heavily in offshore wind, aiming to increase its installed capacity by 15 GW by 2025. Statkraft's focus on hydropower and wind energy remains a significant factor in the Nordic energy market, with plans to expand its renewable energy capacity. These factors influence the competitive advantages of Fortum and its strategies to gain market share.

Fortum faces challenges from its competitors in various areas, including securing new projects and attracting investments. Its strategic partnerships and acquisitions are crucial for maintaining its market position. The company's response to changes in the energy industry will be critical for its success.

- Competition in power generation and retail.

- Securing renewable energy projects.

- Attracting green investments.

- Adapting to market changes and technological advancements.

- Strategic partnerships and acquisitions to expand market share.

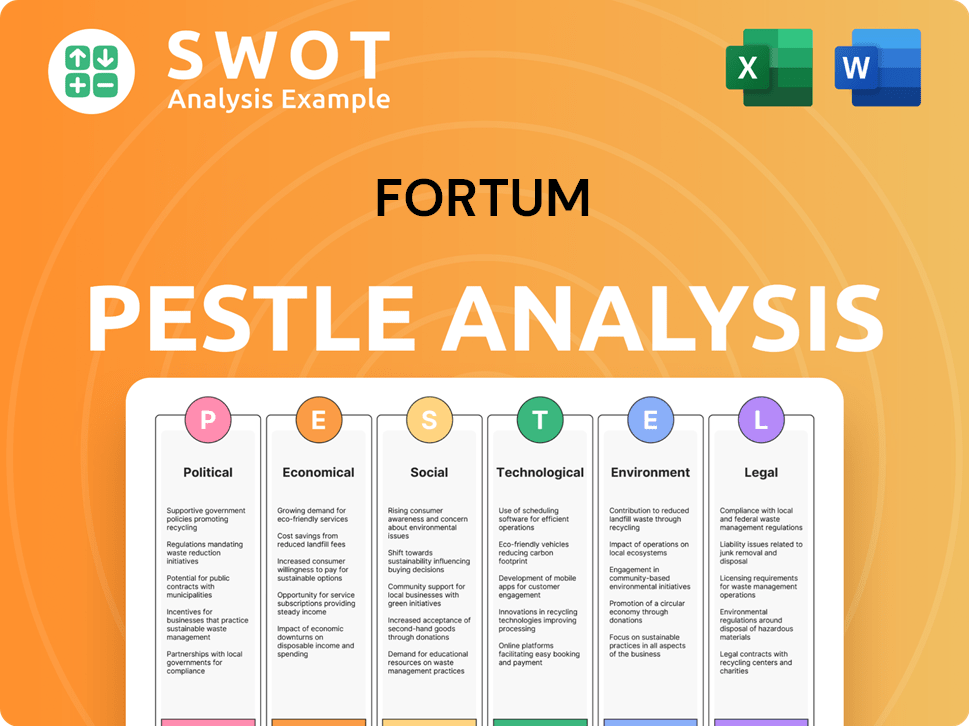

Fortum PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Fortum a Competitive Edge Over Its Rivals?

The competitive landscape for Fortum is shaped by its robust asset portfolio, financial strength, and operational expertise. Its extensive hydropower and nuclear power assets in the Nordic region provide a stable, low-carbon power supply, a significant advantage in the evolving energy sector. Fortum's strong financial position, enhanced by the Uniper divestment, allows for strategic investments in renewables and new energy technologies.

Fortum's competitive edge is also bolstered by its brand equity and customer loyalty in its key Nordic markets. It leverages expertise in energy trading and risk management to optimize its generation portfolio. The company is expanding into areas like hydrogen production, energy storage, and circular economy initiatives, further diversifying its business. This strategic approach has evolved from traditional power generation to encompass a broader scope of sustainable energy solutions.

The sustainability of Fortum's competitive advantages depends on continuous investment in new technologies, adaptation to regulatory changes, and innovation in a rapidly changing energy market. The company faces increasing competition in renewable energy development, requiring ongoing efforts to maintain its competitive edge. For a deeper understanding of the company's financial structure, consider exploring the Revenue Streams & Business Model of Fortum.

Fortum's key milestones include significant investments in renewable energy projects and strategic acquisitions to expand its market presence. The Uniper divestment in 2022 was a major strategic move, strengthening its financial position. The company has been actively involved in developing hydrogen production and energy storage solutions.

Strategic moves include focusing on renewable energy projects, particularly in solar and wind power. Fortum has been expanding its electric vehicle charging network and investing in waste-to-energy facilities. The company is also exploring partnerships to enhance its capabilities in new energy technologies.

Fortum's competitive edge stems from its diverse asset base, including hydropower and nuclear power plants. Its strong financial position allows for strategic investments in renewable energy and new technologies. The company’s operational expertise and brand recognition in the Nordic market provide a competitive advantage.

Fortum's market analysis indicates a strong position in the Nordic energy market, with a focus on sustainable energy solutions. The company is actively responding to changes in the energy industry by investing in renewable energy projects. It faces competition from other renewable energy companies and traditional energy providers.

Fortum's competitive advantages are multi-faceted, including a strong portfolio of low-carbon energy assets, particularly in hydro and nuclear power. The company's financial health, post-Uniper divestment, provides significant capital for strategic investments. Fortum's expertise in energy trading and risk management optimizes its generation portfolio.

- Low-Carbon Energy Portfolio: Significant investments in hydropower and nuclear power.

- Financial Strength: Robust financial position post-Uniper.

- Operational Expertise: Strong capabilities in energy trading and risk management.

- Market Position: Strong brand equity and customer loyalty in the Nordic region.

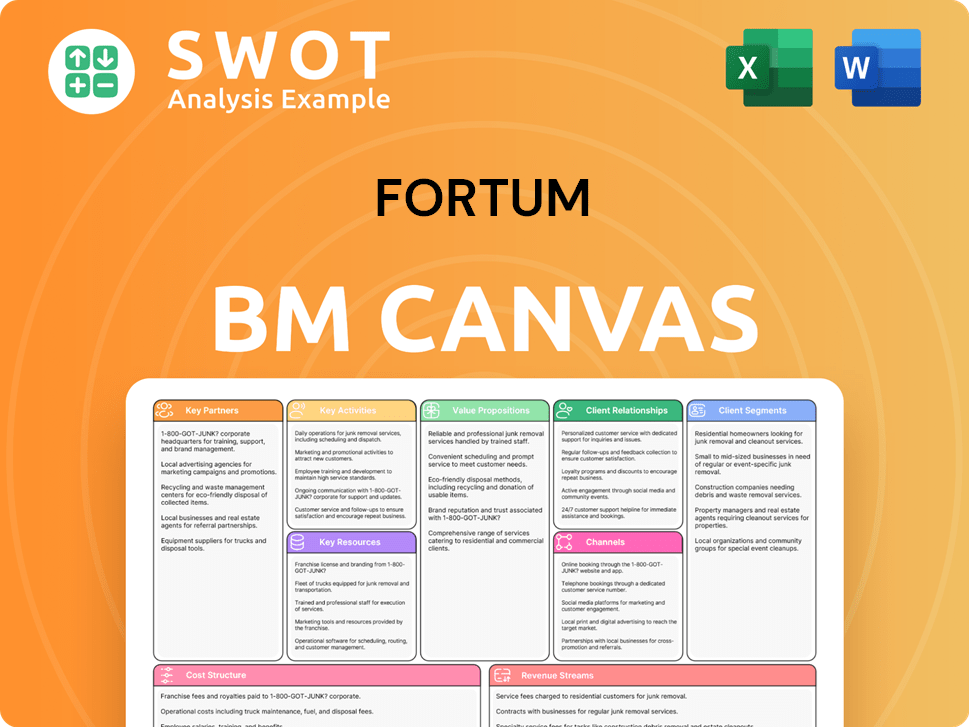

Fortum Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Fortum’s Competitive Landscape?

The Marketing Strategy of Fortum navigates a dynamic energy sector. The company's competitive landscape is shaped by the imperative of decarbonization, energy security concerns, digitalization, and evolving consumer demands. This environment presents both challenges and opportunities, requiring strategic adaptation to maintain and enhance its market position.

The energy sector is undergoing significant transformation, driven by the need to reduce emissions and the push for energy independence. These trends impact companies like Fortum, necessitating strategic adjustments to remain competitive. The company's ability to adapt to these changes will be crucial for its future success.

Key industry trends include decarbonization, which drives investment in renewables like wind and solar. Energy security concerns, particularly in Europe, are increasing the focus on energy independence and diversification of supply. Digitalization is also enabling smarter grids and enhanced energy management.

Challenges include the intermittency of renewable energy, requiring investments in grid infrastructure and storage. Increased competition in renewable energy auctions also poses a threat to profitability. Regulatory changes, such as new carbon pricing, could impact existing assets.

Opportunities for companies like Fortum include expanding wind and solar portfolios and developing energy storage solutions. The company's expertise in district heating and cooling and its focus on circular economy solutions also create opportunities. Strategic partnerships can further enhance its position.

Fortum is deploying strategies focused on disciplined capital allocation and continuous innovation. The company aims to become a leader in sustainable energy and circular economy solutions. This involves adapting to changes in the energy industry and leveraging its strengths.

Fortum's strong position in hydropower and nuclear power offers a stable foundation for the energy transition. The company's focus on sustainable energy and circular economy solutions positions it well in the evolving market. Strategic partnerships and continuous innovation are key to maintaining its competitive edge. Fortum's investments in renewable energy are crucial for future growth.

- Capital allocation is focused on strategic investments in renewable energy and related technologies.

- Partnerships are formed to enhance market reach and technological capabilities.

- Continuous innovation is pursued to improve operational efficiency and develop new products and services.

- Sustainability initiatives are central to the company's strategy, focusing on reducing carbon emissions and promoting circular economy solutions.

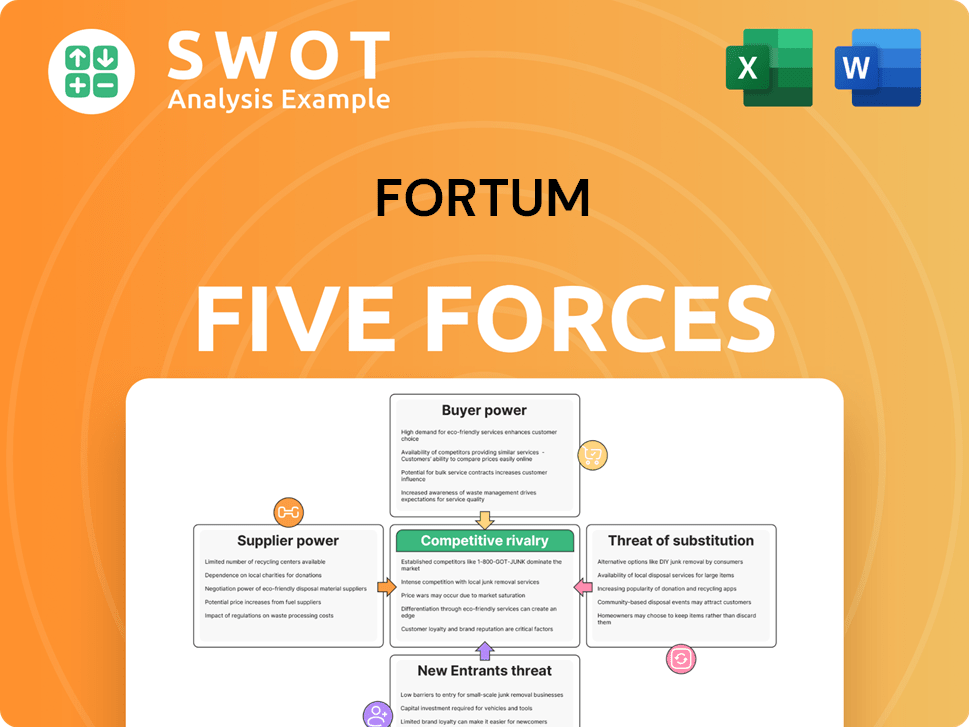

Fortum Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fortum Company?

- What is Growth Strategy and Future Prospects of Fortum Company?

- How Does Fortum Company Work?

- What is Sales and Marketing Strategy of Fortum Company?

- What is Brief History of Fortum Company?

- Who Owns Fortum Company?

- What is Customer Demographics and Target Market of Fortum Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.