Fortum Bundle

How Does the Fortum Company Power the Future?

Fortum, a prominent Fortum SWOT Analysis, is a leading European

This deep dive into

What Are the Key Operations Driving Fortum’s Success?

The Fortum company operates as an integrated energy company, focusing on power generation, sales, and related services. Its core business revolves around providing electricity and heat to customers, primarily in the Nordic and Baltic regions. The company's operations are designed to provide reliable and sustainable energy solutions.

The Fortum business model emphasizes a diverse energy mix, including hydro, nuclear, thermal, wind, and solar power. This approach allows for flexibility and resilience in response to market changes and environmental regulations. Fortum also invests in energy efficiency services and waste-to-energy solutions.

The value proposition of Fortum lies in its ability to offer a stable and increasingly sustainable energy supply. This is achieved through a combination of operational expertise, strategic partnerships, and investments in renewable energy sources. The company aims to reduce carbon emissions and provide long-term value to its stakeholders.

The core operations include power generation from various sources, such as hydro, nuclear, and renewables. It involves the efficient management of power plants and the optimization of energy production based on market demand and fuel prices. The company also focuses on energy sales and related services, including district heating and cooling.

The value proposition centers around providing reliable and sustainable energy solutions. Fortum offers a diverse energy mix, ensuring flexibility and resilience. The company's expertise in operating complex assets and its commitment to renewable energy translate into a reliable and environmentally friendly energy supply for its customers.

Key activities include power plant management, fuel procurement, energy sales, and the development of renewable energy projects. Fortum also focuses on maintaining and upgrading its infrastructure to ensure reliable energy delivery. Strategic partnerships are crucial for technology development and joint ventures.

Fortum serves a variety of customer segments, including industrial, municipal, and residential customers. Its primary markets are in the Nordic and Baltic countries, with operations also in Russia and Poland. The company tailors its energy solutions to meet the specific needs of each customer segment.

In 2024, Fortum continued to focus on its strategic priorities, including the growth of renewable energy and the decarbonization of its operations. The company's investments in wind and solar power projects are increasing its renewable energy capacity. Fortum is also actively involved in exploring and implementing innovative energy solutions.

- Expansion of renewable energy capacity through new wind and solar projects.

- Continued investments in energy efficiency and waste-to-energy solutions.

- Strategic partnerships to advance technology and market development.

- Focus on reducing carbon emissions and promoting sustainable energy practices.

For a deeper dive into the company's history, you can read a Brief History of Fortum.

Fortum SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fortum Make Money?

The Fortum company generates revenue through a diverse set of streams, primarily focusing on electricity sales, heat sales, and energy-related services. The Fortum business model is designed to capitalize on the evolving energy landscape, integrating traditional and renewable energy sources. In 2024, the company's comparable operating profit was €1,927 million, indicating strong financial performance across its various segments.

The company strategically monetizes its operations through several key methods. This includes optimizing its generation portfolio to benefit from fluctuating energy prices in wholesale markets. Fortum also employs tiered pricing for electricity sales and bundles services for industrial and municipal clients, combining energy supply with energy efficiency solutions.

The Consumer Solutions segment, which focuses on electricity sales to residential and small and medium-sized business customers, also represents a substantial revenue stream. Additionally, Fortum earns revenue from its City Solutions segment, which provides district heating and cooling and waste-to-energy solutions to municipalities and industrial customers.

The Energy company leverages several key strategies to generate and maximize revenue. The Generation segment, which includes large-scale power production, remains a dominant contributor to overall profitability. The company is also investing in Renewable energy sources to diversify its portfolio. Read more about the Marketing Strategy of Fortum.

- Electricity Sales: Revenue from selling electricity to various customer segments.

- Heat Sales: Income generated from providing heating solutions, particularly through district heating.

- Energy-Related Services: Revenue from services such as energy efficiency solutions and consulting.

- Wholesale Market Optimization: Strategic trading in wholesale energy markets to capitalize on price fluctuations.

- Tiered Pricing and Bundled Services: Offering different pricing structures and combining energy supply with value-added services.

Fortum PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Fortum’s Business Model?

The Fortum company has navigated significant shifts in the energy sector, marked by strategic decisions and operational adjustments. A key milestone was the divestment from its Russian operations in 2023, which streamlined its structure and reduced geopolitical risks. This strategic move allowed Fortum to focus on its core markets and renewable energy investments.

Another critical aspect of Fortum's business strategy involves continuous investment in renewable energy sources, especially wind power projects. This aligns with the European energy transition goals. The company has also addressed challenges like volatile energy prices and regulatory changes by optimizing its generation mix and enhancing cost efficiencies.

The company's competitive edge comes from its strong market presence, a diversified energy portfolio including hydro, nuclear, and thermal power, and its growing expertise in renewable energy technologies. Its economies of scale and established customer relationships provide a significant advantage. The company is also investing in smart energy solutions and exploring new business models, such as hydrogen production, to maintain its leadership in the evolving energy landscape. For more details on their growth strategy, see Growth Strategy of Fortum.

The divestment from Russian operations in 2023 was a pivotal strategic move for Fortum. This decision allowed the company to streamline its operations and reduce its exposure to geopolitical risks. This strategic shift enabled Fortum to concentrate on its core markets and investments in renewable energy, which is crucial for its future growth.

Fortum has consistently invested in renewable energy, particularly wind power projects. This aligns with the broader European energy transition goals. The company has also focused on optimizing its generation mix and improving cost efficiencies to address volatile energy prices and regulatory changes. These moves are crucial for Fortum's long-term sustainability.

Fortum's competitive advantages include a strong brand presence, a diversified energy portfolio, and growing expertise in renewable energy. The company benefits from economies of scale and established customer relationships. Fortum is also investing in smart energy solutions and exploring new business models, such as hydrogen production, to maintain its leadership in the evolving energy landscape.

In 2024, Fortum continued to develop new wind power projects, demonstrating its commitment to renewable energy. The company's focus on optimizing its generation mix and cost efficiencies reflects its proactive approach to market challenges. These initiatives are key to Fortum's sustained success in the energy sector.

Fortum benefits from a strong market presence, a diversified energy portfolio, and growing expertise in renewable energy technologies. The company's economies of scale and established customer relationships provide a significant competitive edge. The company's strategic focus on renewable energy and smart energy solutions positions it well for future growth.

- Strong Brand Presence: Established in core markets.

- Diversified Portfolio: Includes hydro, nuclear, and thermal power.

- Renewable Energy Expertise: Growing focus on wind power and other renewables.

- Economies of Scale: Benefits from large-scale power generation.

- Customer Relationships: Established customer base provides stability.

Fortum Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Fortum Positioning Itself for Continued Success?

The Fortum company holds a prominent position in the Nordic and Baltic regions, acting as a key player in electricity and heat generation and sales. This Energy company's extensive infrastructure and diverse generation assets contribute significantly to customer loyalty and a broad market reach. However, the European energy market is highly competitive, with other major utilities vying for market share.

Several risks could impact Fortum's business. These include regulatory changes, such as carbon pricing or incentives for renewables, which can affect profitability. Volatility in commodity prices, especially for fuels used in thermal power, also poses a risk. Furthermore, new competitors, particularly those focused on renewable energy or decentralized solutions, could challenge Fortum's traditional business model. Technological advancements, such as in energy storage or smart grids, could also reshape the industry.

Fortum is a major player in the Nordic and Baltic energy markets. It has a significant market share in electricity and heat generation and sales. Its infrastructure and diverse assets contribute to a strong customer base.

Regulatory changes, like carbon pricing, can affect Fortum's profitability. Volatility in commodity prices, especially for fuels, is a concern. Competition from new entrants in renewable energy poses a challenge. Technological disruptions could also reshape the industry.

Fortum is investing in renewable energy, including wind and solar. It is modernizing its assets to improve efficiency and reduce emissions. The company is also exploring green hydrogen opportunities.

Fortum is committed to sustainable growth and a carbon-neutral future. It aims to optimize its energy mix and enhance customer solutions. The company is actively involved in developing a cleaner and more reliable energy system.

Fortum is focused on sustainable growth and aims to achieve carbon neutrality. The company is actively investing in renewable energy projects, such as wind and solar power. Recent reports show Fortum's commitment to optimizing its energy mix and enhancing customer solutions to maintain and expand profitability.

- Renewable Energy Investments: Fortum continues to allocate significant capital to wind and solar projects, aiming to increase its renewable energy capacity.

- Operational Efficiency: The company is modernizing its existing assets to improve efficiency and reduce emissions, aligning with its sustainability goals.

- Green Hydrogen: Fortum is exploring opportunities in new energy technologies, including green hydrogen, to diversify its energy portfolio.

- Customer Solutions: Fortum is enhancing its customer solutions to meet evolving energy needs and improve customer satisfaction.

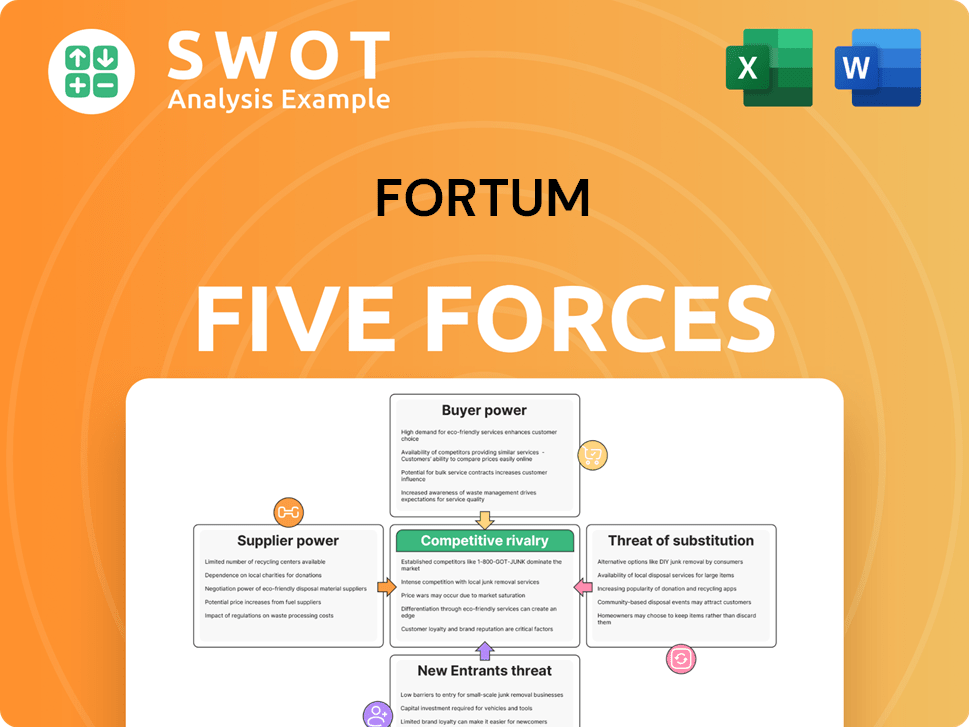

Fortum Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fortum Company?

- What is Competitive Landscape of Fortum Company?

- What is Growth Strategy and Future Prospects of Fortum Company?

- What is Sales and Marketing Strategy of Fortum Company?

- What is Brief History of Fortum Company?

- Who Owns Fortum Company?

- What is Customer Demographics and Target Market of Fortum Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.