AIG Bundle

How Did AIG Rise to Become a Global Financial Powerhouse?

From a modest start in Shanghai to a global insurance giant, the AIG SWOT Analysis reveals a fascinating story of ambition and resilience. The AIG company weathered the storms of the 2008 financial crisis, a pivotal moment that tested its very existence. Understanding the AIG history is crucial for grasping the complexities of the financial world.

The American International Group, or AIG, has a rich and complex AIG timeline that spans over a century, marked by periods of remarkable growth and significant challenges. Exploring its early years, expansion history, and eventual role in the 2008 financial crisis provides valuable insights into the company's evolution. Examining the AIG financial performance and its AIG insurance products offers a comprehensive understanding of its impact on the industry.

What is the AIG Founding Story?

The brief history of AIG insurance company begins with a visionary named Cornelius Vander Starr. In 1919, he laid the foundation for what would become a global insurance giant. Starr's entrepreneurial spirit and strategic foresight were instrumental in shaping the early trajectory of the American International Group (AIG).

On December 19, 1919, at the age of 27, Cornelius Vander Starr established American Asiatic Underwriters (AAU) in Shanghai, China. This marked the genesis of AIG, starting as a modest two-room insurance agency. Starr recognized the potential for insurance services in the region, setting the stage for future expansion and diversification.

The initial business model of AAU revolved around being a general insurance agency, acting as an underwriter for various insurance companies operating in Shanghai. This approach allowed the company to gain a foothold in the market and build a foundation for growth. Within two years, Starr expanded into life insurance, showcasing his adaptability and understanding of the evolving needs of the market.

By the late 1920s, AAU had established a significant presence throughout China and Southeast Asia. This expansion highlighted the company's growing influence and its ability to capitalize on opportunities in the region.

- In 1926, Starr opened the first office in the United States, named American International Underwriters (AIU) Corporation.

- AIU served as an underwriter for U.S.-owned risks outside of North America and also functioned as a general agent.

- Starr also recognized opportunities in Latin America, and AIU entered Havana, Cuba, in the late 1930s.

- The growth in Latin America proved crucial, offsetting the decline in business from Asia due to the impending World War II.

In 1939, as World War II loomed, Starr made a strategic move, relocating the headquarters from Shanghai to New York City. This decision ensured the company's continuity and provided access to the financial resources of the United States. This move was a pivotal moment in AIG's history, setting the stage for its evolution into a global insurance leader.

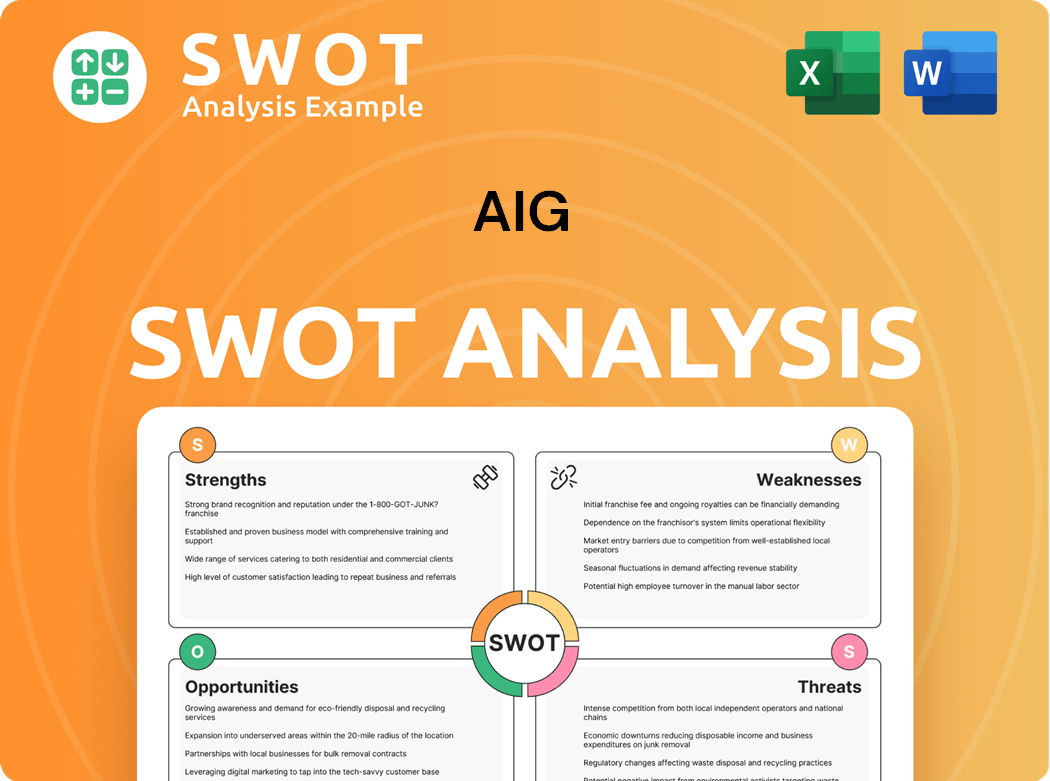

AIG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of AIG?

The early growth and expansion of the American International Group (AIG) marked a significant phase in its development, transforming it from a small firm into a global insurance powerhouse. Following World War II, AIG's American International Underwriters (AIU) subsidiary spearheaded international expansion, entering new markets. This period was characterized by strategic acquisitions and the development of specialized insurance products, laying the foundation for AIG's future success.

After World War II, the AIG company, through its AIU subsidiary, strategically expanded its reach internationally. Key markets included Japan and Germany, where it provided insurance services to American military personnel. This expansion continued into Europe, with offices opening in France, Italy, and the United Kingdom, solidifying its global footprint during the late 1940s and early 1950s.

In 1952, C.V. Starr shifted focus to the American market, acquiring Globe & Rutgers Fire Insurance Company and its subsidiary, American Home Fire Assurance Company. By the end of the 1950s, the organization had established a vast network of agents and offices across over 75 countries. This expansion was crucial for the AIG timeline.

A pivotal moment in AIG's history occurred in 1960 with the hiring of Hank Greenberg to build an international accident and health business. Greenberg's strategy focused on selling insurance through independent brokers, which helped reduce operational costs. This approach significantly impacted AIG's financial performance.

In 1967, American International Group, Inc. (AIG) was incorporated as an umbrella organization. Greenberg was named Starr's successor in 1968 and became president and CEO in 1967. The company went public in 1969, marking a significant step in AIG's evolution. Learn more about the Mission, Vision & Core Values of AIG.

The 1970s brought challenges in the Middle East and Southeast Asia. However, AIG continued to expand by introducing specialized insurance products for niche industries, including energy, transportation, and shipping. Throughout the 1980s, AIG broadened its market reach, offering products like pollution liability and political risk insurance.

AIG listed its shares on the New York Stock Exchange (NYSE) in 1984. In 1987, it became the first foreign insurance company listed on the Tokyo Stock Exchange. These milestones highlight AIG's global presence and its impact on the insurance industry. By 2024, AIG's total assets were approximately $500 billion.

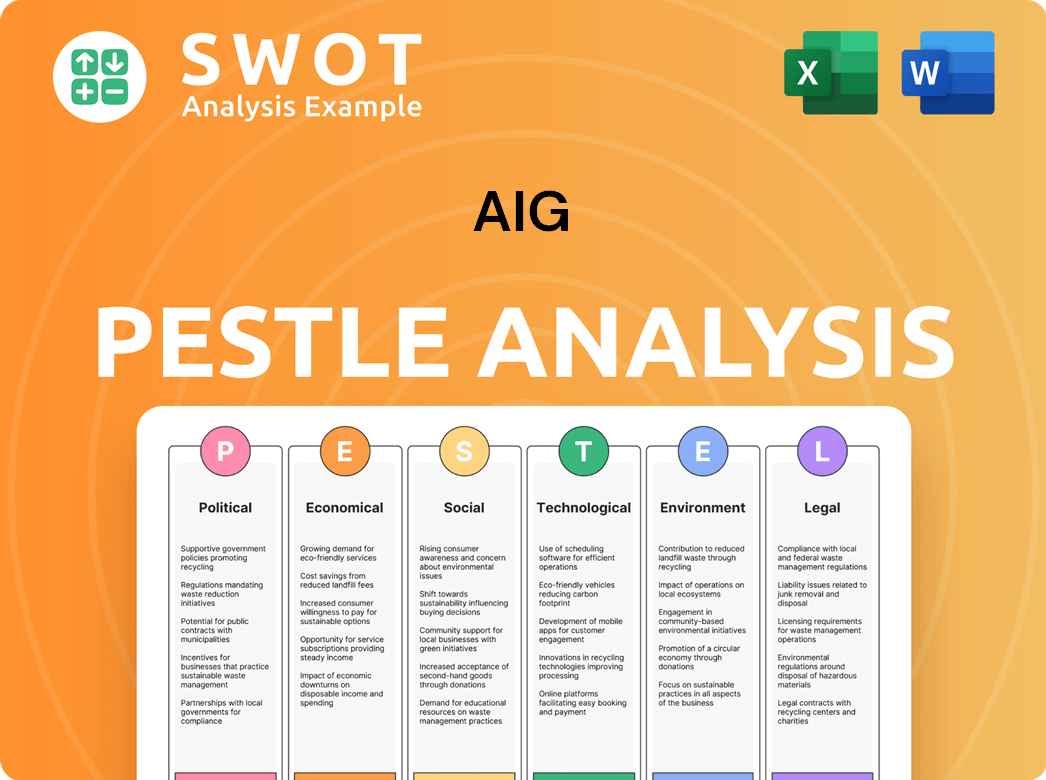

AIG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in AIG history?

The AIG history is marked by significant achievements and pivotal moments that have shaped its trajectory in the insurance industry. AIG company has navigated through various phases of growth, innovation, and challenges, establishing itself as a key player in the global financial landscape.

| Year | Milestone |

|---|---|

| 1919 | AIG was founded in Shanghai, China, by Cornelius Vander Starr. |

| 1926 | The company expanded its operations to the United States, establishing a presence in New York. |

| 1992 | AIG became the first foreign company to receive an insurance license in China in over four decades. |

| 2008 | AIG faced the most significant challenge in its history, requiring a substantial government bailout during the financial crisis. |

| 2022 | Corebridge Financial, AIG's life and retirement business, began trading as a separate public company. |

AIG has been a pioneer in developing specialized insurance products, including directors and officers liability and environmental protection insurance. The company has consistently adapted to changing market needs, expanding its global footprint and product offerings to meet diverse customer demands. For more information, read about the Target Market of AIG.

AIG was a pioneer in creating specialized insurance products, such as directors and officers liability, kidnap/ransom, and environmental protection insurance. These products required skilled underwriters to assess and price the new risks.

AIG was the first foreign company to be granted an insurance license in China in 1992, and the first to write life insurance policies in Japan and other parts of Asia. This expansion marked a significant step in its global presence.

Following the 2008 financial crisis, AIG underwent significant restructuring and asset sales to repay government loans. This involved streamlining operations and focusing on core businesses.

AIG has invested in technology to enhance operational efficiency. The company is exploring the use of Generative AI in the future of insurance.

The 2008 financial crisis posed a significant challenge, necessitating a government bailout and leading to public scrutiny. Despite these setbacks, AIG has demonstrated resilience, focusing on strategic growth and returning capital to shareholders.

The 2008 financial crisis brought AIG to the brink of collapse due to massive losses from credit default swaps issued by its subsidiary, AIG Financial Products (AIGFP). This resulted in a substantial government bailout, the largest of a private company in U.S. history at the time.

AIG continues to face challenges related to catastrophe losses. These losses can significantly impact the company's financial performance and require robust risk management strategies.

The changing political landscape in the Middle East and Southeast Asia in the 1970s led to the curtailment or cessation of operations in those regions. AIG must navigate geopolitical risks to maintain its global presence.

The insurance industry is subject to evolving regulatory changes. AIG must adapt to new regulations to ensure compliance and maintain its competitive edge.

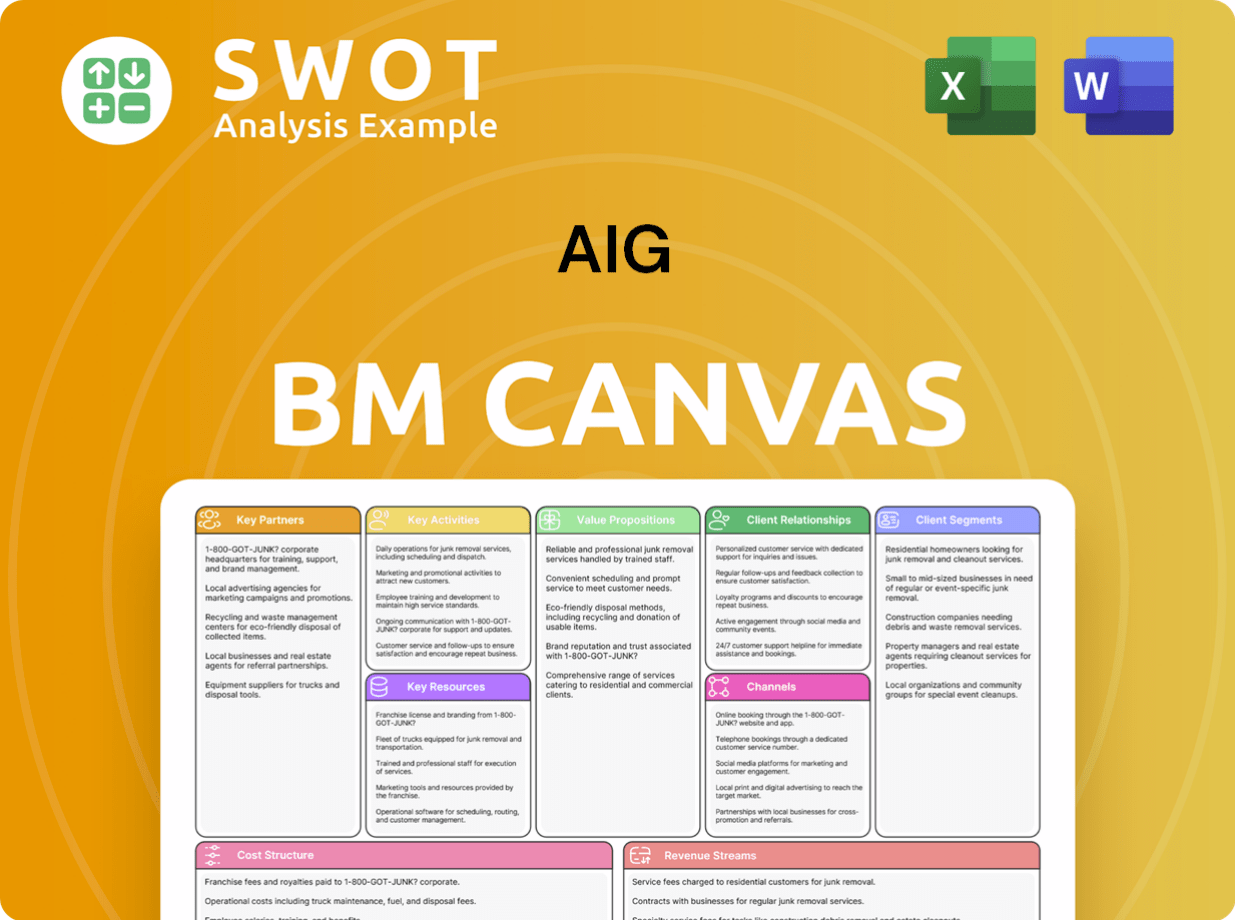

AIG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for AIG?

The AIG history is marked by significant milestones, from its founding in Shanghai to its evolution into a global insurance leader. The company's journey includes early expansion, strategic acquisitions, and navigating the complexities of the financial crisis, ultimately leading to its current market position and future prospects.

| Year | Key Event |

|---|---|

| 1919 | Cornelius Vander Starr establishes American Asiatic Underwriters (AAU) in Shanghai, China, marking the beginning of the company's global presence. |

| 1921 | Starr forms Asia Life Insurance Company (ALICO) in Shanghai, expanding the company's insurance offerings. |

| 1926 | Starr opens the first U.S. office, American International Underwriters (AIU) Corporation, in New York, initiating its entry into the U.S. market. |

| 1939 | Starr moves his headquarters from Shanghai to New York City, reflecting a shift in strategic focus. |

| 1952 | Starr acquires Globe & Rutgers Fire Insurance Company, bolstering its presence in the U.S. market. |

| 1967 | American International Group, Inc. (AIG) is incorporated, setting the stage for future growth. |

| 1969 | AIG goes public, providing access to capital for expansion. |

| 1984 | AIG lists its shares on the New York Stock Exchange, enhancing its visibility and investor base. |

| 1992 | AIG receives the first foreign insurance license in China in over 40 years, demonstrating its commitment to international markets. |

| 2008 | AIG faces a liquidity crisis and receives a government bailout during the global financial crisis. |

| 2012 | The U.S. Treasury sells its remaining shares of AIG common stock, signifying the company's recovery. |

| 2021 | Peter Zaffino is named AIG's CEO, leading the company into a new era. |

| 2022 | AIG's life and retirement business, Corebridge Financial, begins publicly trading, allowing for strategic focus. |

| 2024 | AIG reports strong full-year results with General Insurance net premiums written of $23.9 billion. The company executes $9.7 billion of capital management actions. |

| 2025 | AIG reports excellent first-quarter results with earnings per share of $1.17 and net premiums written of $4.5 billion. The company increases its quarterly dividend by 12.5% to $0.45 per share. |

AIG is focused on sustainable growth and continued innovation, aiming to expand its market share and strengthen its position as a leading insurance provider. Strategic initiatives include further digital transformation to enhance customer experience and streamline operations. The company is also exploring the integration of Generative AI in its operations.

AIG is expanding internationally, including through its joint venture in India with the Tata Group. The company's global reach and local expertise are key to its strategy. Analysts anticipate continued growth in revenue and earnings, particularly in the International Commercial unit.

AIG's forecast earnings growth is projected at 10.7% per year, with revenue growth at 4.4% per year. The company aims for a 10% or greater return on common equity (ROCE) in the future. This demonstrates a commitment to delivering value to shareholders and achieving financial stability.

AIG's forward-looking vision remains connected to the founding principle of adapting to change and seizing opportunities in the global insurance landscape. This includes leveraging technology, expanding into new markets, and focusing on customer-centric solutions to drive future success.

AIG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of AIG Company?

- What is Growth Strategy and Future Prospects of AIG Company?

- How Does AIG Company Work?

- What is Sales and Marketing Strategy of AIG Company?

- What is Brief History of AIG Company?

- Who Owns AIG Company?

- What is Customer Demographics and Target Market of AIG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.