AIG Bundle

How Does AIG Thrive in Today's Market?

American International Group (AIG), a global insurance powerhouse, has weathered numerous economic storms, evolving into a crucial provider of risk management solutions. Its vast operations and diverse offerings make it a key player for both businesses and individuals seeking financial security. Curious about the inner workings of this industry giant?

This deep dive into AIG SWOT Analysis will uncover the intricacies of AIG company's operations, from its core insurance products to its strategic initiatives. We'll explore how AIG works, examining its revenue streams and business model to understand its financial performance and its place in the insurance landscape. Whether you're an investor evaluating AIG stock or a customer interested in AIG insurance, understanding AIG's operations is essential.

What Are the Key Operations Driving AIG’s Success?

The AIG company creates value through its wide range of insurance and financial services. It operates primarily through two main segments: General Insurance and Life and Retirement. This structure allows AIG to serve a diverse global clientele, offering tailored solutions for various needs.

The core of How AIG works involves managing complex risks and delivering financial security. Its operations are multifaceted, including underwriting, claims management, and investment management. AIG leverages its global presence and expertise to provide comprehensive services, differentiating it from competitors.

The value proposition of AIG lies in its ability to offer financial stability and comprehensive solutions. This is achieved through a combination of its broad product offerings, global distribution network, and sophisticated risk management capabilities. The company's focus on customer service and technological advancements further enhances its value proposition.

This segment provides property casualty insurance products. It serves businesses of all sizes, multinational corporations, and individual consumers globally. This includes commercial, personal, and specialty coverages, offering diverse solutions.

This segment offers life insurance, annuities, and group retirement products. It caters to individuals seeking financial security and businesses offering employee benefits. This segment helps clients plan for their long-term financial goals.

Key processes include underwriting, claims management, risk assessment, and investment management. Advanced analytics are used to underwrite complex risks. Technology enhances digital platforms for policy issuance and claims processing.

AIG's supply chain involves brokers, agents, and other distribution channels. It has a global distribution network, serving clients in over 70 countries and jurisdictions. This extensive reach is a key differentiator.

AIG's ability to manage significant global risks and its broad product offerings set it apart. This results in comprehensive solutions and financial stability for clients. The company's focus on innovation and customer service further strengthens its position.

- Global presence and expertise in managing complex risks.

- Comprehensive suite of insurance and financial products.

- Advanced analytics and technology for efficient operations.

- Extensive distribution network serving clients worldwide.

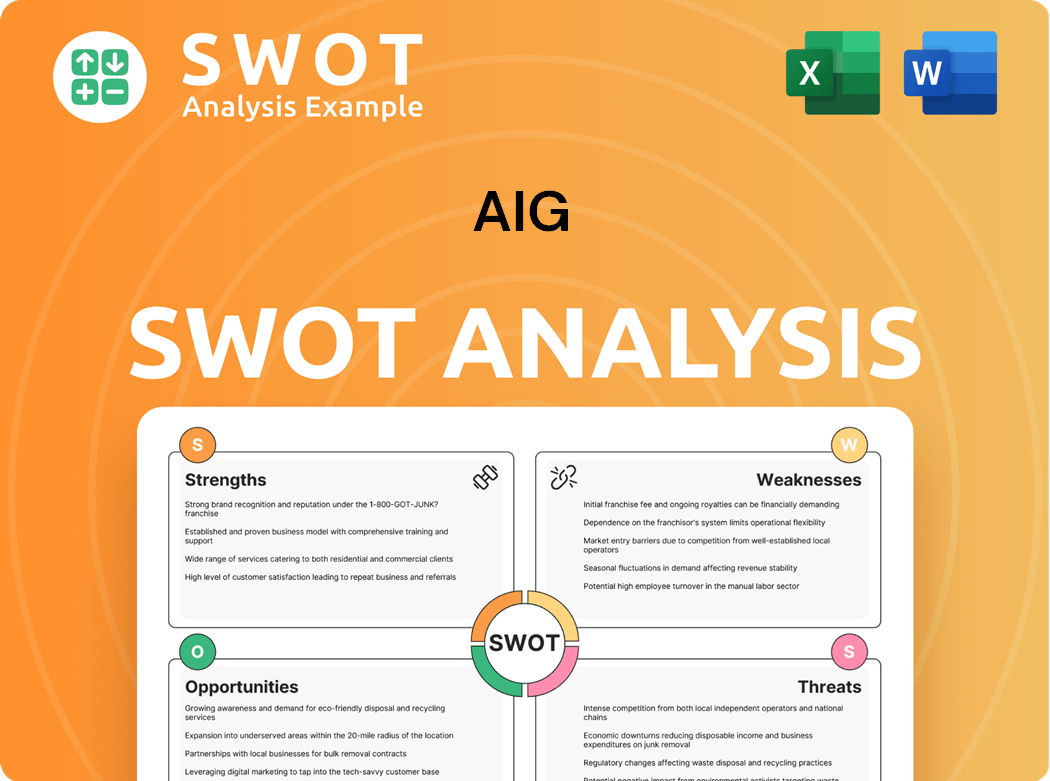

AIG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AIG Make Money?

The AIG company generates revenue through a multifaceted approach, primarily centered on insurance premiums and investment income. Its financial performance is largely driven by two key segments: General Insurance and Life and Retirement. This structure allows AIG to diversify its revenue streams and manage risk effectively.

Understanding how AIG works involves examining its revenue streams and monetization strategies, which are crucial for its financial health. These strategies are designed to maximize profitability and adapt to market dynamics and regulatory changes. The company continually refines its approach to maintain a competitive edge.

The AIG business model relies on a combination of insurance premiums, investment returns, and fees. This diversified approach helps the company navigate economic cycles and maintain its financial stability. The company's ability to generate revenue from various sources is a key factor in its long-term success.

The General Insurance segment of AIG insurance primarily earns revenue from net premiums on property casualty policies. This segment offers a range of insurance products, including commercial property, casualty, and financial lines. Monetization strategies involve risk-based pricing and tailored policy structures.

- In Q1 2024, AIG reported general insurance net premiums written of $6.7 billion.

- This represents a 5% increase on a constant currency basis.

- The segment focuses on specialized coverage for complex and emerging risks.

- Risk assessment and pricing are key factors in maximizing profitability.

The Life and Retirement segment generates revenue from life insurance premiums, retirement product deposits, and fees for advisory and asset management services. This segment uses tiered pricing for annuity products and cross-selling strategies. Investment income is another significant component of this segment's revenue.

- In Q1 2024, the Life and Retirement segment reported premiums and deposits of $6.9 billion.

- Tiered pricing helps to attract different customer segments.

- Cross-selling life insurance with retirement planning services enhances revenue.

- Investment income from the portfolio is a critical revenue source.

Investment income is a crucial revenue component for AIG, derived from its substantial investment portfolio. The company invests the premiums it collects until claims are paid, generating significant returns. The investment strategy is a key element of AIG's overall financial performance.

- AIG's investment portfolio is diversified across various asset classes.

- Investment returns contribute substantially to overall profitability.

- The company actively manages its portfolio to optimize returns and manage risk.

- Investment income is essential for covering future claim payments.

To learn more about the history of the company, you can read a brief history of AIG.

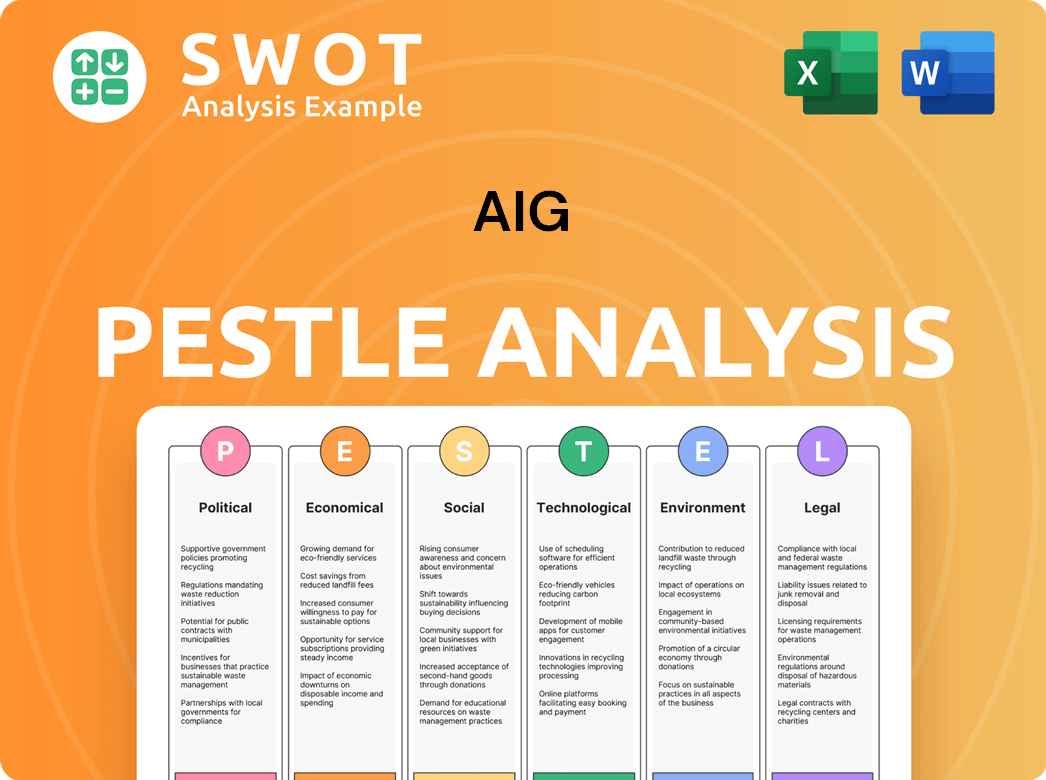

AIG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AIG’s Business Model?

The journey of the AIG company has been marked by significant milestones and strategic shifts that have profoundly shaped its operations and financial performance. A pivotal moment was the financial crisis of 2008, which necessitated a massive government bailout. The company's subsequent restructuring and repayment of the bailout funds demonstrated its resilience and commitment to long-term stability. Recent strategic moves include the partial separation of its Life and Retirement business, now operating as Corebridge Financial, which aimed to unlock shareholder value and streamline AIG's focus on its General Insurance operations.

Operational challenges have included navigating complex global regulatory environments and adapting to evolving risk landscapes, such as climate change and cyber threats. AIG has responded by enhancing its risk management frameworks and investing in technology to improve underwriting and claims processing efficiency. Its competitive advantages stem from its strong global brand recognition, extensive distribution network, and deep underwriting expertise across diverse and complex risks. The company's ability to offer a broad range of products to multinational corporations provides a significant edge.

AIG continues to adapt to new trends by focusing on data analytics and artificial intelligence to refine its risk assessment models and enhance customer experience, ensuring its business model remains robust amidst technological shifts and competitive pressures. The partial separation of Corebridge Financial, completed in 2023, was a major step in simplifying its structure, with AIG retaining a significant stake. This strategic move allows AIG to concentrate on its core General Insurance business.

The 2008 financial crisis and subsequent government bailout were critical events for the AIG company. The restructuring and repayment of the bailout demonstrated its resilience. The partial separation of Corebridge Financial in 2023 was a major strategic move.

AIG has focused on streamlining its operations and enhancing shareholder value. The separation of Corebridge Financial is a key example. The company is investing in technology and data analytics to improve its risk assessment capabilities.

AIG benefits from strong global brand recognition and an extensive distribution network. It has deep underwriting expertise across diverse risks. The ability to serve multinational corporations provides a significant advantage. You can find more information about AIG's growth strategy in this article: Growth Strategy of AIG

AIG is using data analytics and AI to refine risk models and enhance customer experience. This ensures the business model remains robust. The company is also focused on adapting to evolving regulatory environments and risk landscapes.

In 2024, AIG's focus remains on its General Insurance operations following the Corebridge Financial separation. The company is leveraging technology to improve underwriting and claims processing. AIG's strong global presence and diverse product offerings continue to be key strengths.

- AIG's strategic focus is on its General Insurance business.

- The company is investing in technology and data analytics.

- AIG maintains a strong global brand and extensive distribution network.

- The company is adapting to changes in the regulatory environment.

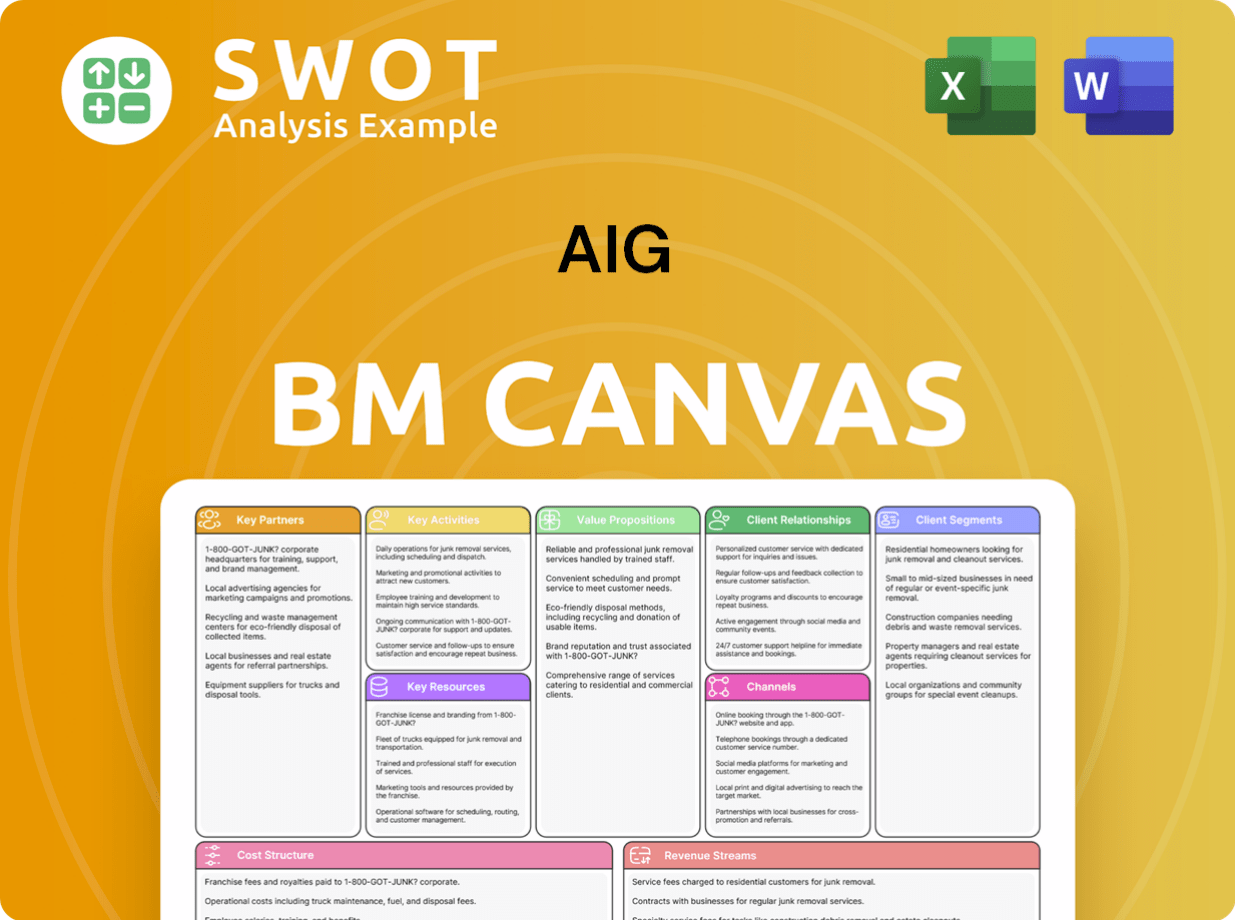

AIG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AIG Positioning Itself for Continued Success?

The AIG company holds a prominent position in the global insurance industry. As one of the largest and most diversified insurance organizations, AIG insurance competes with major players like Chubb and Allianz. Its extensive global reach and established relationships contribute to its market share in property casualty and life and retirement segments.

However, AIG faces several key risks. These include exposure to catastrophic events, interest rate fluctuations, and regulatory changes. The increasing frequency of climate-related events and cyberattacks also pose significant financial risks. The company's strategic initiatives focus on profitable growth, capital structure optimization, and operational efficiency.

AIG is a major player in the global insurance market, competing with companies like Chubb and Allianz. The company has a strong market share in property casualty and life and retirement segments. AIG's global presence and established broker relationships are key to its success.

AIG is exposed to catastrophic events, interest rate changes, and regulatory shifts. Cyberattacks and climate-related events pose increasing operational and financial risks. Natural disasters can significantly impact underwriting results.

AIG plans to focus on profitable growth, capital optimization, and operational efficiency. Digitalization will improve underwriting and claims processes. The partial separation of Corebridge Financial allows AIG to focus on its core strengths.

AIG aims to leverage technology for better underwriting and customer experience. The company is committed to disciplined underwriting and strong risk management. Returning capital to shareholders remains a priority.

In recent financial reports, AIG has emphasized its focus on disciplined underwriting and operational efficiency. The company is actively managing its capital structure and returning capital to shareholders. AIG's strategy involves leveraging its global presence and diversified product offerings to deliver consistent value.

- AIG's General Insurance business is a key area of focus for profitable growth.

- The company is investing in technology to improve underwriting and claims processes.

- AIG is committed to strong risk management practices.

- The partial separation of Corebridge Financial is a strategic move.

AIG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AIG Company?

- What is Competitive Landscape of AIG Company?

- What is Growth Strategy and Future Prospects of AIG Company?

- What is Sales and Marketing Strategy of AIG Company?

- What is Brief History of AIG Company?

- Who Owns AIG Company?

- What is Customer Demographics and Target Market of AIG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.