AIG Bundle

Can AIG Maintain Its Dominance in Today's Insurance Arena?

American International Group (AIG), a titan in the global insurance industry, has a rich history dating back to its founding in 1919. From its origins in Shanghai to its current global footprint, AIG has navigated a complex financial landscape. Understanding the AIG SWOT Analysis is crucial to grasping its competitive standing.

This exploration delves into the AIG competitive landscape, offering a detailed AIG market analysis to assess its position. We'll examine AIG's main competitors and dissect how AIG competes with other insurance companies, evaluating its competitive advantage. The insurance industry is dynamic, and this analysis provides actionable insights into AIG's strategies for gaining market share and its future outlook.

Where Does AIG’ Stand in the Current Market?

AIG, a significant player in the insurance industry, strategically operates across multiple global segments. Its core operations encompass property casualty insurance, life insurance, and retirement solutions, serving a diverse customer base from individuals to large corporations. The company's competitive edge is shaped by its comprehensive product offerings and broad market reach, allowing it to cater to various insurance needs. This positions AIG within the competitive landscape, focusing on financial services and aiming for competitive advantage.

The company's value proposition centers on providing a wide array of insurance products that meet diverse customer needs. AIG's commitment to disciplined capital management and underwriting excellence supports its financial health and strategic goals. The company's recent performance, including growth in its global commercial segment, highlights its ability to adapt and thrive in the dynamic insurance market. For a deeper understanding, explore the Target Market of AIG.

AIG's market share, reported at 2.72% as of Q1 2025, reflects its established position within the insurance industry. The company's strategic realignment into North America Commercial, International Commercial, and Global Personal segments allows for focused market penetration and operational efficiency. AIG's financial results for Q1 2025 show a focus on disciplined capital management and underwriting excellence. The company ended the quarter with $4.9 billion in parent liquidity and a debt-to-total capital ratio of 17.1%. AIG is targeting a 10%+ core operating ROE for the full year 2025.

In Q1 2025, AIG reported net premiums written (NPW) of $4.5 billion, with growth in the global commercial segment. North America Commercial saw a 14% increase in NPW, while International Commercial grew by 8% on a comparable basis. Global Personal experienced a decline in NPW, influenced by the sale of the travel business in 2024.

AIG's primary product lines include property casualty insurance, life insurance, and retirement solutions. Key areas within general insurance include Property & Short tail, Casualty, Financial Lines, Global Specialty, Global A&H, and Auto & Homeowners. AIG serves a broad range of customer segments, from individuals and families to large international corporations.

AIG ended Q1 2025 with $4.9 billion in parent liquidity and a debt-to-total capital ratio of 17.1%. The company is targeting a 10%+ core operating ROE for the full year 2025, indicating a focus on profitability and efficient capital allocation. These metrics highlight AIG's financial stability and strategic direction.

AIG's competitive landscape involves navigating the complexities of the insurance industry, focusing on market share, and adapting to regulatory changes. The company's strategies include disciplined capital management, underwriting excellence, and strategic segment realignment to enhance its market position and achieve its financial goals.

AIG's market position is affected by its ability to manage its diverse product lines and customer segments. The company's financial performance and strategic initiatives are critical to its competitive advantage. The insurance industry's competitive landscape is constantly evolving, requiring AIG to adapt and innovate.

- AIG's market share as of Q1 2025 is 2.72%, showing its standing in the market.

- The company's strategic realignment into commercial segments supports focused market penetration.

- The financial results for Q1 2025 display a focus on disciplined capital management.

- AIG's future outlook involves achieving a 10%+ core operating ROE for the full year 2025.

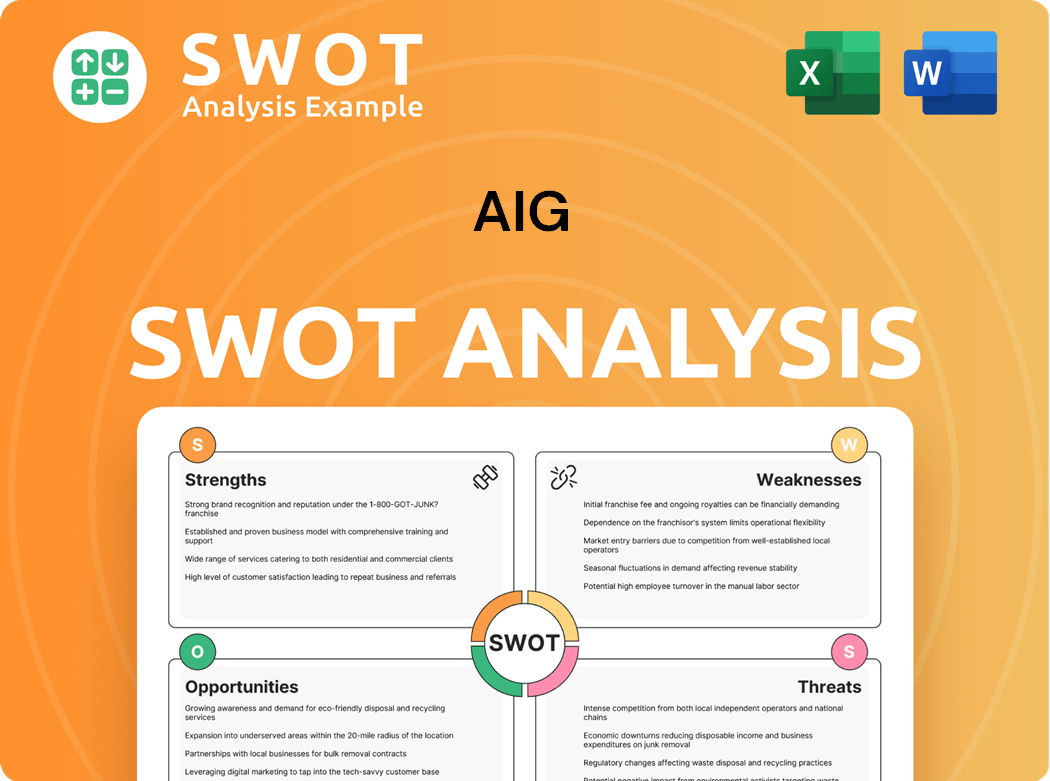

AIG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging AIG?

Understanding the AIG competitive landscape requires a close look at its key rivals across the insurance and financial services sectors. AIG operates in a highly competitive environment, facing challenges from both established players and emerging competitors. This analysis is crucial for investors, analysts, and anyone seeking to understand AIG's position in the market and its strategies for maintaining a competitive advantage.

The AIG market analysis reveals a complex interplay of factors influencing its competitive standing. These include pricing, product innovation, brand recognition, distribution networks, and technological advancements. The insurance industry, in which AIG is a major player, is subject to intense competition and pricing pressures, which constantly reshape the competitive dynamics.

AIG's competitive landscape is constantly evolving, with mergers, acquisitions, and technological advancements shaping the market. The company's ability to adapt and innovate is critical for its future success. AIG’s performance is often compared to its main competitors to assess its financial health and market position.

AIG faces competition from major players in the insurance industry. These competitors challenge AIG through various means, including pricing strategies and product innovation. The multiline insurance segment, in which AIG operates, is characterized by intense competition.

Direct competitors include well-established insurance companies. These companies compete directly with AIG across various insurance lines. Their strategies often involve aggressive pricing and extensive distribution networks.

Indirect competitors may offer specialized insurance products or operate in niche markets. Emerging players, particularly in the insurtech space, are also disrupting the traditional competitive landscape. These companies often leverage technology to enhance customer engagement.

In the life insurance sector, AIG competes with companies like New York Life and Prudential. These competitors focus on providing life insurance products and services. They often have strong brand recognition and established customer bases.

Technological advancements significantly impact the competitive landscape. Insurtech companies are using technology to offer innovative solutions. AIG's ability to adopt new technologies is crucial for maintaining its competitive advantage.

Strategic relationships can strengthen a company's market position. AIG's partnerships, such as its alliance with Blackstone, are examples of strategies aimed at enhancing its competitive edge. These alliances can provide access to new markets and resources.

AIG's main competitors employ various strategies to gain market share. These strategies include competitive pricing, innovative product offerings, and enhanced customer service. Understanding these strategies is crucial for assessing AIG's position.

- Berkshire Hathaway Inc.: Known for its diversified insurance portfolio and strong financial performance. In 2024, Berkshire Hathaway's insurance operations reported significant underwriting profits.

- Progressive Corp.: Focuses on technology and customer-centric solutions. Progressive has been a leader in usage-based insurance, leveraging telematics to assess risk.

- Allstate Corp.: Emphasizes brand recognition and customer loyalty. Allstate continues to invest in digital transformation to improve customer experience.

- Travelers Companies Inc.: Specializes in commercial and property casualty insurance. Travelers has a strong presence in the small business insurance market.

- New York Life: A major player in the life insurance sector, known for its financial strength and mutual structure. New York Life focuses on long-term financial security for its clients.

- Prudential: Offers a wide range of insurance and investment products. Prudential is expanding its global presence, particularly in emerging markets.

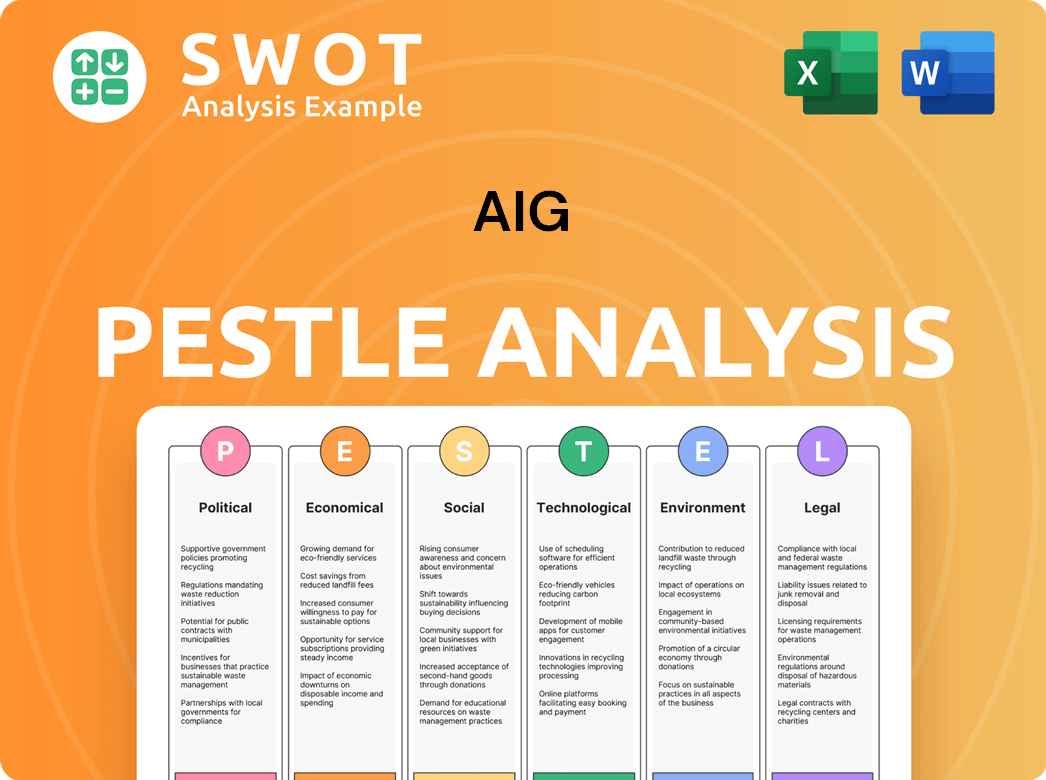

AIG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives AIG a Competitive Edge Over Its Rivals?

Understanding the Owners & Shareholders of AIG is crucial for assessing its competitive advantages. AIG's competitive landscape is shaped by its global reach and diversified business model, spanning over 80 countries. This extensive presence, coupled with a balanced portfolio across various product lines and geographies, provides a strong foundation for its operations. AIG's strategic moves, including investments in technology and AI, are designed to maintain its competitive edge in the insurance industry.

AIG’s expertise in underwriting and claims management is a significant competitive advantage. The company proactively identifies emerging trends and manages its exposure effectively. This proactive approach helps AIG to stay ahead of market changes and mitigate potential risks. The insurance industry is highly competitive, and AIG’s ability to manage risk and adapt to changes is a key differentiator.

AIG’s investments in data and digital strategies, including the deployment of GenAI and Large Language Models, are aimed at enhancing its processes. The company's AI-powered claims management system is a notable innovation designed to streamline the claims process and provide faster settlements. These technological advancements are vital for maintaining a competitive position in the financial services sector.

AIG operates in over 80 countries, providing a broad global presence. Its diversified business mix across product lines and geographies helps to mitigate risks. This extensive reach allows AIG to serve a wide range of customers and adapt to various market conditions.

AIG’s expertise in underwriting and claims management is a key strength. The company proactively identifies emerging trends and manages exposure effectively. This focus on risk management helps AIG maintain profitability and customer trust.

AIG invests heavily in data and digital strategies, including GenAI and Large Language Models. The AI-powered claims management system streamlines processes. These innovations enhance efficiency and customer service.

AIG has built strong brand equity and customer relationships over its long history. The company aims to be a trusted partner, providing tailored solutions and exceptional service. This focus on customer satisfaction helps AIG retain clients and attract new business.

AIG’s competitive advantages include its global reach, expertise in underwriting and claims, investments in technology, and strong brand equity. These factors contribute to AIG's ability to compete effectively in the insurance industry. However, AIG faces potential threats from rapid technological changes and evolving industry dynamics.

- Global Presence: Operations in over 80 countries.

- Underwriting Expertise: Proactive risk management.

- Technological Innovation: AI-powered claims management.

- Customer Relationships: Trusted partner approach.

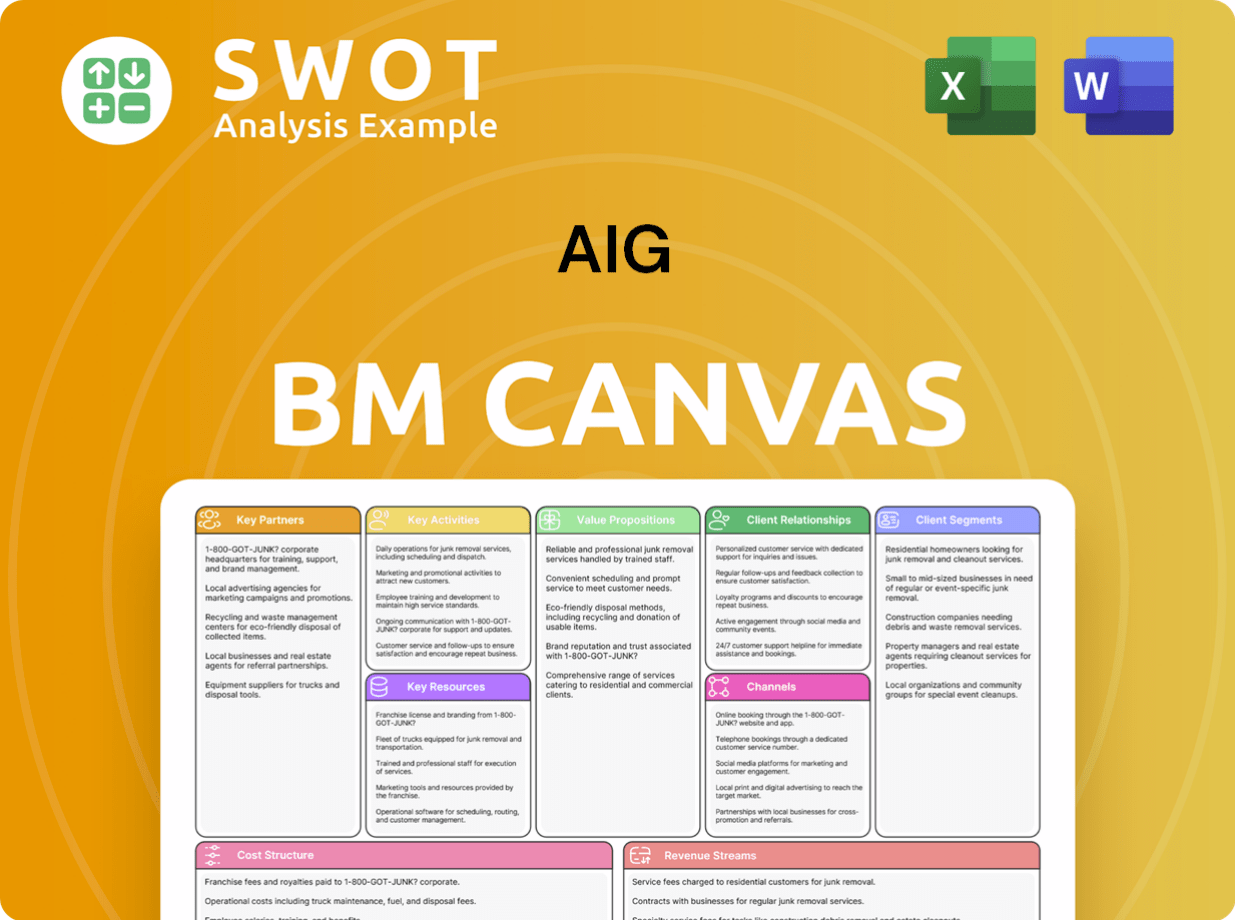

AIG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping AIG’s Competitive Landscape?

The insurance industry is experiencing significant shifts driven by technological advancements, evolving regulations, changing consumer behaviors, and global economic factors. These trends are reshaping how insurance companies operate, compete, and serve their customers. Understanding the current landscape is crucial for assessing the competitive positioning and future prospects of major players like AIG.

AIG operates within a complex and dynamic environment. Its competitive landscape is influenced by both established insurance giants and innovative insurtech companies. The company's ability to adapt to these changes, manage risks, and capitalize on emerging opportunities will determine its long-term success. This analysis provides insights into AIG's competitive position, the risks it faces, and its future outlook, drawing upon the latest available data and industry trends.

The insurance industry is undergoing a digital transformation. Insurtech companies are leveraging technology like AI and data analytics to streamline operations, improve customer experience, and develop new products. Regulatory changes, especially regarding climate risk and data privacy, are significantly impacting how insurers operate. Consumer preferences are shifting towards personalized and digitally accessible insurance solutions. Economic volatility and geopolitical tensions add further complexity.

AIG faces challenges including increased competition from traditional insurers and insurtechs, requiring continuous investment in technology. Managing climate risk and mitigating catastrophe losses are critical for financial stability. The need to adapt to evolving regulatory requirements adds to operational complexity. Maintaining a competitive edge in a rapidly changing market landscape demands strategic agility and innovation.

Technological advancements present opportunities to enhance operational efficiency, improve risk modeling, and develop innovative products. Emerging markets offer significant growth potential. Strategic partnerships can expand market reach and enhance service offerings. AIG can leverage its global presence and expertise to capitalize on these opportunities. The company's focus on profitable growth and disciplined capital management supports its strategic goals.

AIG is focusing on profitable growth, disciplined capital management, and continued investment in technology and talent. The company is streamlining operations through initiatives like AIG Next. Increasing allocation to private assets aims to grow investment income. AIG anticipates achieving meaningful organic growth, particularly in its Global Commercial business. Enhanced reinsurance programs support risk management and financial stability.

AIG's future success depends on its ability to navigate industry trends and address challenges effectively. The company's strategic initiatives, including investments in technology and talent, are designed to support long-term growth and profitability. AIG’s competitive position will be shaped by its ability to innovate, manage risks, and adapt to changing market dynamics. For more insights, read about the Marketing Strategy of AIG.

- Market Share: AIG holds a significant position in the global insurance market, with its market share varying across different segments and regions.

- Financial Performance: In 2024, AIG reported strong financial results, with improvements in underwriting profitability and investment income.

- Innovation: AIG continues to invest in technology and data analytics to improve its operations and customer service.

- Strategic Partnerships: AIG is actively pursuing strategic partnerships to expand its market reach and enhance its product offerings.

AIG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AIG Company?

- What is Growth Strategy and Future Prospects of AIG Company?

- How Does AIG Company Work?

- What is Sales and Marketing Strategy of AIG Company?

- What is Brief History of AIG Company?

- Who Owns AIG Company?

- What is Customer Demographics and Target Market of AIG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.