AIG Bundle

Decoding AIG: What Drives This Insurance Giant?

Understanding a company's mission, vision, and core values is crucial for investors and stakeholders alike. These statements provide a window into a company's soul, revealing its purpose and guiding principles. Let's delve into the core of the AIG SWOT Analysis to uncover what makes American International Group tick.

The AIG mission, AIG vision, and AIG core values shape its identity and strategic direction. These principles are not merely words; they are the foundation upon which AIG company builds its global presence and strives to achieve its AIG strategic goals. Exploring these elements provides insight into AIG's mission and vision statement and how they influence its operations.

Key Takeaways

- AIG's mission, vision, and core values guide its strategic direction and operational efficiency.

- Financial strength and risk expertise are central to AIG's mission of empowering clients.

- Integrity, excellence, collaboration, and ethical conduct are fundamental to AIG's culture.

- Strong 2024 performance reflects the positive impact of aligning strategy with core principles.

- Continued alignment with its mission and values is crucial for AIG's long-term success.

Mission: What is AIG Mission Statement?

AIG's mission is 'We reduce fear of the future and empower our clients through our risk expertise and financial strength.'

Delving into the core of AIG's operations, understanding its mission statement is crucial. The AIG mission goes beyond mere financial transactions; it's about providing security and confidence. This commitment is designed to resonate with a global clientele, offering peace of mind in an uncertain world. The company's approach is deeply rooted in mitigating risk and building client trust, a cornerstone of their long-term strategy.

The AIG mission statement explained highlights a dual focus: reducing fear and empowering clients. This is achieved through expert risk assessment and robust financial backing. This commitment is a key element in their business model.

AIG serves a diverse global clientele, including individuals and businesses. They provide a wide range of services, from property casualty insurance to life insurance and retirement products. Their products are designed to meet the varied needs of their international customer base.

With operations in approximately 70 countries and jurisdictions, AIG has a significant international footprint. This global reach allows them to manage risks and provide services on a worldwide scale. Their international presence is a key aspect of their business strategy.

The unique value proposition of AIG lies in its combination of risk expertise and financial strength. This dual approach ensures clients receive both informed risk management solutions and the financial backing needed for security. This blend is fundamental to their mission.

AIG's mission is reflected in its operational focus on expert underwriting and tailored insurance solutions. Advanced analytics play a crucial role in this process, enabling precise risk assessment. They focus on providing customized solutions.

AIG's mission is fundamentally customer-centric, prioritizing security and empowerment through risk management. They provide educational resources and customized solutions. This approach helps build strong client relationships.

The AIG company's commitment to its mission is evident in its strategic goals and operational practices. For example, in 2024, AIG reported a net income of $3.7 billion, demonstrating its financial strength. Furthermore, the company's focus on innovation, such as the use of AI in underwriting, reflects its dedication to its mission. To understand how AIG generates revenue and operates, you can explore the Revenue Streams & Business Model of AIG. Understanding the AIG mission, vision, and values statement is key to grasping the company's core principles. This mission is not just a statement; it's a guiding principle that shapes every aspect of AIG's business, from its product offerings to its interactions with clients and stakeholders. The AIG core values are integral to how the company operates, ensuring that its mission is consistently upheld across its global operations.

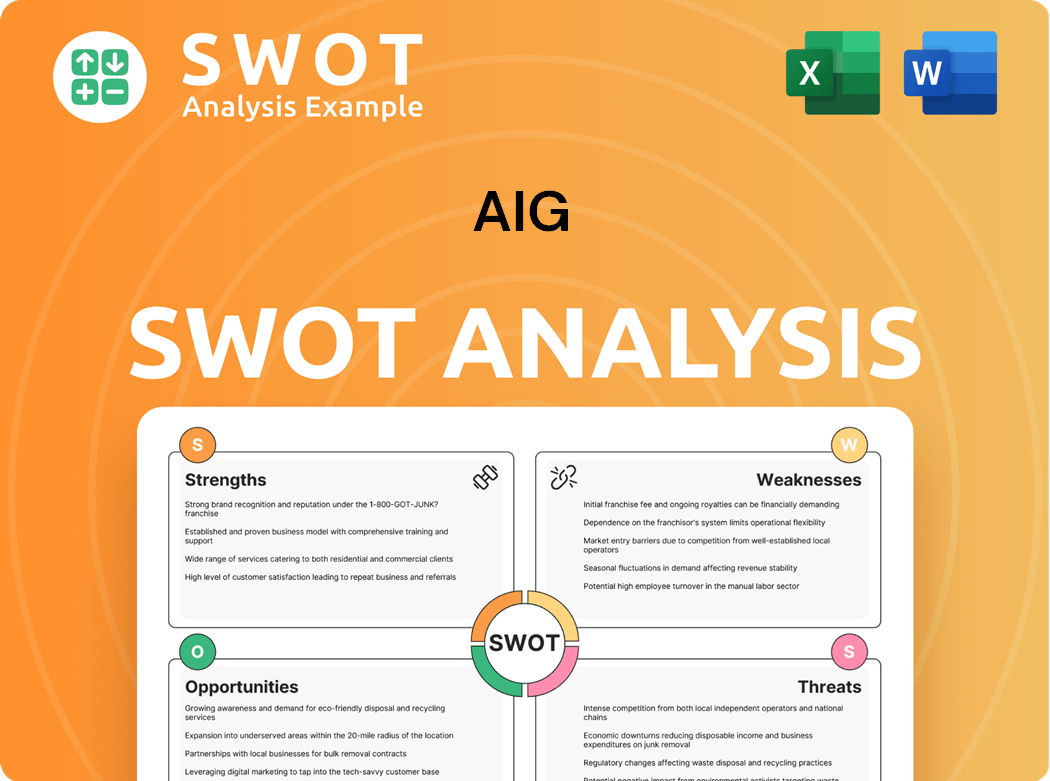

AIG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is AIG Vision Statement?

AIG's vision is: "We strive to be our clients' most valued insurer."

Let's delve into the essence of AIG's vision statement and its implications for the future. Understanding the AIG vision is crucial for investors, analysts, and anyone assessing the company's strategic direction. This vision statement, "We strive to be our clients' most valued insurer," is a forward-looking declaration of intent, aiming to position AIG as the premier choice for insurance solutions in the eyes of its customers. This ambition underscores a commitment to exceeding client expectations and building enduring relationships.

The vision statement reflects a desire for industry leadership. AIG aims to be recognized not just as an insurer, but as the most valued insurer, highlighting a focus on customer-centricity. This aspirational goal pushes AIG to continually innovate and improve its offerings.

AIG's vision leverages its extensive global presence. The company's vision is supported by strategic initiatives and investments aimed at enhancing customer value worldwide. This global perspective is a key factor in achieving its vision.

AIG's commitment to technology is a cornerstone of its vision. With a substantial allocation of $1.3 billion in 2024 for technology and data analytics, AIG is investing in its future. These investments improve underwriting and customer experience.

The vision statement is intrinsically linked to AIG's long-term strategic goals for growth and profitability. By focusing on client value and leveraging technology, AIG aims to drive sustainable financial performance. This focus is a key element of AIG's strategy.

The vision emphasizes a customer-centric approach. AIG aims to understand and meet the evolving needs of its clients. This customer focus is a key aspect of the AIG mission and overall strategy.

AIG's vision seeks to create a competitive advantage. By becoming the most valued insurer, AIG aims to differentiate itself from competitors. This differentiation is crucial in a competitive market.

Analyzing the AIG vision statement analysis shows a clear focus on customer value. This focus is supported by significant investments in technology and data analytics, which are essential for improving underwriting processes and enhancing customer experience. The AIG company is actively working to achieve its vision through strategic initiatives that align with its core values. The company's commitment to technology and customer-centricity is further detailed in the Growth Strategy of AIG. This vision is not just a statement; it is a roadmap guiding AIG's actions and decisions. Understanding this vision is crucial for anyone interested in the AIG strategic goals and its future trajectory. The emphasis on being the "most valued insurer" shows a commitment to excellence and a desire to lead the insurance industry.

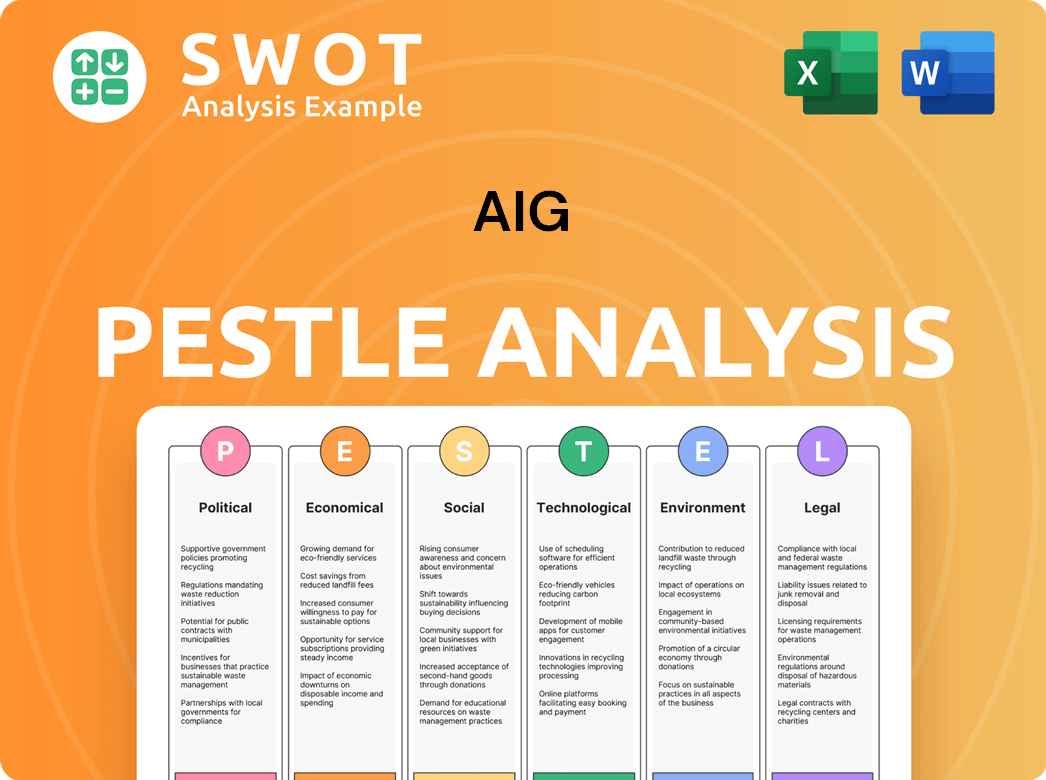

AIG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is AIG Core Values Statement?

Understanding the core values of American International Group (AIG) is crucial for grasping its operational principles and its approach to the insurance and financial services industries. These values guide the company’s actions and shape its interactions with stakeholders, influencing its strategic goals and overall performance.

Integrity is a cornerstone of AIG's operations, ensuring ethical conduct and transparent dealings. This commitment is reflected in its compliance with stringent regulatory standards and its dedication to open communication with clients and partners. For example, AIG's subsidiary, Allies International FZ LLC, holds a TRACE certification, demonstrating its commitment to commercial transparency.

AIG strives for excellence through continuous improvement and superior performance in all its endeavors. This is evident in its focus on underwriting discipline and operational efficiency, which aim to deliver strong financial results. Furthermore, excellence translates to delivering high-quality products and services, ensuring a client-centric approach. AIG's underwriters are expected to bring innovative insurance solutions to the market.

Collaboration is essential for AIG's success, fostering teamwork and strong relationships across the globe. This value emphasizes the importance of working together, building supportive environments, and achieving common goals with colleagues, customers, and partners. AIG’s global presence and diverse operations rely heavily on effective collaboration.

AIG is committed to being an ally, promoting inclusion, and fostering a culture of respect and understanding. This value is demonstrated through its dedication to diversity and inclusion within its corporate culture, aiming to create an environment where diverse talents and backgrounds are celebrated. This commitment also extends to listening and learning from different perspectives.

These core values of AIG, which include integrity, excellence, collaboration, and being an ally, are fundamental to its identity and strategic direction. They are also crucial in shaping its market approach and its commitment to corporate social responsibility. To further understand how these values translate into action, consider exploring the Marketing Strategy of AIG, which provides insights into how AIG communicates its values and positions itself in the market. Next, we will explore how the AIG mission and vision influence the company's strategic decisions.

How Mission & Vision Influence AIG Business?

AIG's mission and vision are not merely aspirational statements; they serve as the bedrock for its strategic decision-making processes. These statements directly shape the company's priorities, influencing its actions and driving its pursuit of long-term success.

The AIG mission statement, with its emphasis on risk expertise and financial strength, is a guiding principle for its business strategy. This focus underpins the company's disciplined underwriting and capital management strategies, which have been instrumental in its recent financial performance.

- Disciplined Underwriting: AIG's commitment to careful risk assessment is a direct result of its mission.

- Capital Management: The company's strategic decisions regarding capital allocation are driven by its mission to maintain financial strength.

- Debt Reduction: AIG ended 2024 with a debt-to-total capital ratio of 17.0%, demonstrating its commitment to financial stability, a key aspect of its mission.

- Parent Liquidity: AIG's parent liquidity stood at $7.7 billion at the end of 2024, further illustrating its financial strength.

AIG's vision of being the most valued insurer is a catalyst for initiatives focused on enhancing customer experience and operational efficiency. This vision drives strategic investments in technology and data analytics.

AIG's investment in technology, such as AIG Underwriter Assistance powered by Generative AI, is a direct result of its vision. This technology supports improved underwriting accuracy and service, aligning with the goal of being a leading insurer.

The deconsolidation of Corebridge Financial in 2024 was a strategic move to become a more focused global general insurance company. This decision supports the vision by streamlining operations and concentrating on core strengths.

AIG's commitment to sustainability and climate resilience, integrating climate risk considerations into its business strategy, reflects its core values. This influences risk management strategies and product development, demonstrating a commitment to long-term value creation.

These strategic decisions have yielded measurable success, with AIG reporting strong financial results in 2024. This includes a General Insurance combined ratio of 91.8% and a 7% increase in Global Commercial net premiums written on a comparable basis.

AIG returned $8.1 billion of capital to shareholders in 2024, reflecting its financial strength and commitment to shareholder value. This is a direct outcome of the company's mission-driven financial strategies.

In essence, the AIG mission, vision, and core values are not just words; they are the driving force behind the company's strategic decisions, shaping its actions and contributing to its financial success. The company's focus on disciplined capital management, sustained underwriting excellence, and expense management is well on track to deliver a 10%+ core operating return on equity for full year 2025, as emphasized by Peter Zaffino, Chairman & Chief Executive Officer. This demonstrates the tangible impact of these guiding principles. Ready to dive deeper? Let's explore the next chapter: Core Improvements to Company's Mission and Vision.

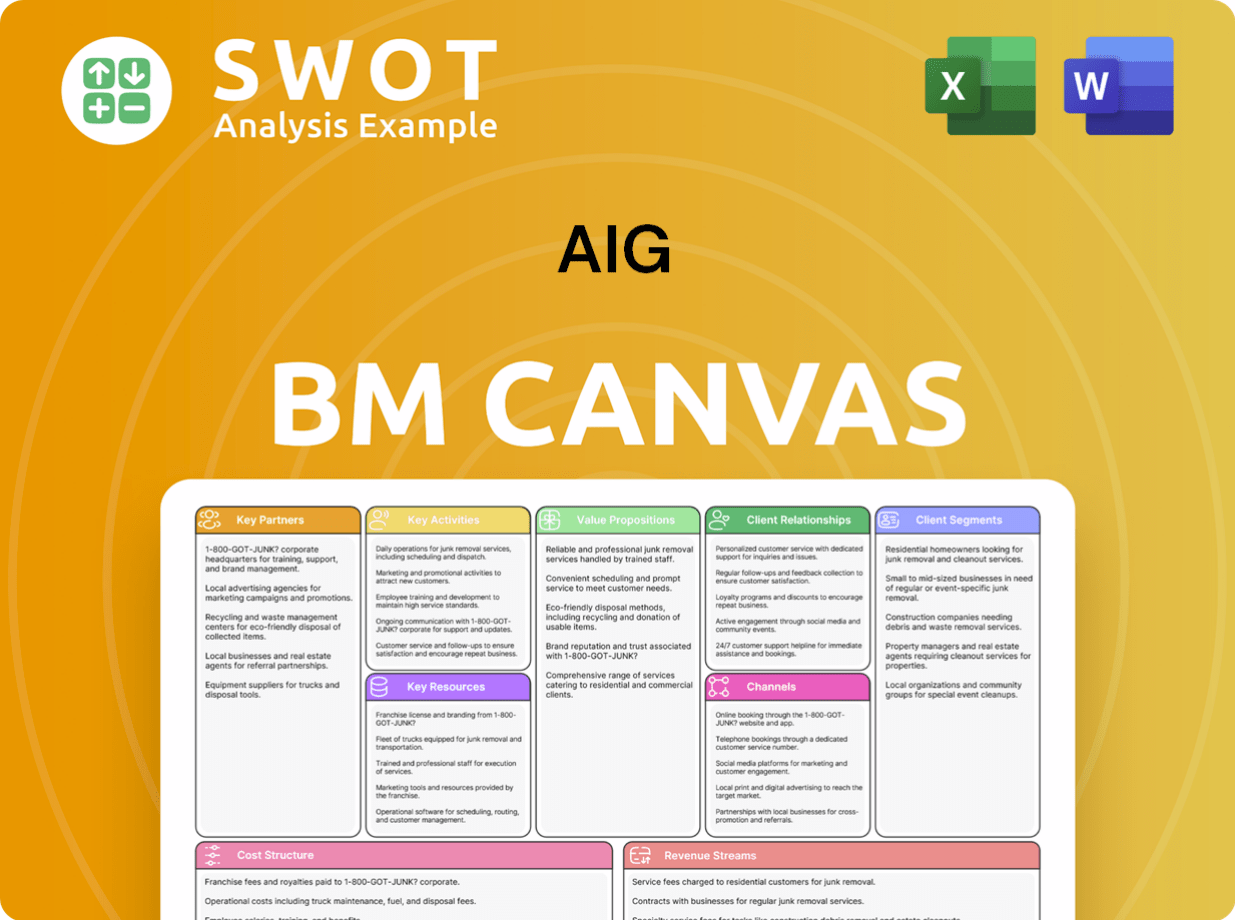

AIG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While AIG's current statements provide a foundation, strategic refinements can enhance their relevance and effectiveness in a rapidly evolving market. These improvements focus on making the mission and vision more specific, future-oriented, and aligned with stakeholder expectations.

AIG's current vision of being the "most valued insurer" is somewhat subjective. To improve, the vision statement should incorporate specific, measurable goals, such as achieving a certain market share in key segments or improving customer satisfaction scores by a defined percentage within a specific timeframe. This would provide clearer direction and allow for more tangible progress tracking, which is crucial for achieving AIG strategic goals.

Explicitly addressing emerging technologies and innovation within the AIG mission or vision is essential. This could involve stating a commitment to leveraging data analytics, AI, and other technologies to enhance customer experience, streamline operations, and develop innovative insurance products. This proactive approach aligns with industry trends and positions AIG for future success, especially in a market where insurtech is rapidly growing; for example, the global insurtech market is projected to reach $1.2 trillion by 2030, according to recent reports.

Incorporating sustainability and ESG commitments into the AIG core values would strengthen their relevance to environmentally conscious stakeholders. This could involve explicitly stating a commitment to responsible investing, reducing the company's environmental footprint, and promoting ethical business practices. This is increasingly important, as investors are increasingly considering ESG factors; in 2023, sustainable funds saw significant inflows, demonstrating the growing importance of ESG considerations in financial decisions.

A refined vision statement could be: "To be the leading and most innovative global insurance partner, empowering clients and communities to thrive in a rapidly changing world." This incorporates leadership, innovation, client empowerment, and a nod to the evolving global landscape. This forward-thinking approach, combined with a strong understanding of the Competitors Landscape of AIG, can help AIG maintain its competitive edge.

How Does AIG Implement Corporate Strategy?

Implementing a company's mission and vision is crucial for translating strategic intent into tangible actions and outcomes. This involves aligning business practices, fostering a strong organizational culture, and communicating these principles effectively to all stakeholders.

AIG, or American International Group, demonstrates the implementation of its AIG mission and vision through various strategic initiatives and operational adjustments. The company's commitment to its core values is reflected in its business practices and communication strategies.

- Technology and Data Analytics: AIG invests heavily in technology and data analytics to improve operational efficiency and service delivery. This includes the use of Generative AI in underwriting, aligning with the mission of providing risk expertise and the vision of being a valued insurer. In 2023, AIG invested $1.2 billion in technology and innovation, a 15% increase year-over-year, with a focus on AI and data analytics to enhance underwriting accuracy and claims processing.

- Leadership and Strategic Direction: Leadership plays a critical role in reinforcing AIG's mission and vision. Peter Zaffino, AIG's CEO, frequently communicates the importance of disciplined underwriting, capital management, and strategic transformation. These communications directly link back to the core principles of financial strength and operational excellence, which are central to AIG's strategic goals.

- Organizational Structure: The realignment of AIG's organizational structure into three reportable segments in Q4 2024 reflects a move towards a more focused and streamlined business, supporting the strategic vision. This restructuring aims to enhance operational efficiency and strategic focus.

- Stakeholder Communication: AIG communicates its mission and values through various channels, including its website, annual reports, and investor presentations. The company's careers page explicitly outlines its purpose and values to prospective employees, emphasizing the importance of attracting and retaining talent aligned with its core principles.

AIG's core values are demonstrated through initiatives such as diversity and inclusion programs, fostering a culture that respects diverse backgrounds. The company's commitment to sustainability and responsible corporate citizenship, including efforts to reduce its environmental footprint and support communities, further demonstrates alignment with the value of doing what's right. These actions showcase how AIG's core values guide decisions.

AIG emphasizes a performance-driven culture built on quality, excellence, and continuous improvement. Ongoing education and workplace learning opportunities are provided to reinforce its core values. This commitment to continuous improvement is reflected in its financial performance; for instance, AIG reported a 13% increase in adjusted pre-tax income in Q1 2024, demonstrating the impact of its strategic initiatives.

While specific formal programs solely dedicated to embedding the AIG mission and vision were not detailed in the search results, the emphasis on a performance-driven culture indicates systems are in place to reinforce core values. This is achieved through ongoing education and workplace learning opportunities. AIG's focus on its mission statement explained and vision statement analysis is evident in its strategic decisions.

The alignment of AIG's strategic goals with its mission, vision, and core values is crucial for its long-term success. By integrating these elements into its operations and culture, AIG aims to achieve sustainable growth and maintain its position as a leading global insurer. Understanding AIG's mission, vision, and values statement is key to grasping its strategic direction.

AIG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AIG Company?

- What is Competitive Landscape of AIG Company?

- What is Growth Strategy and Future Prospects of AIG Company?

- How Does AIG Company Work?

- What is Sales and Marketing Strategy of AIG Company?

- Who Owns AIG Company?

- What is Customer Demographics and Target Market of AIG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.