AIG Bundle

Who are AIG's Customers in Today's Dynamic Market?

In an era of rapid technological change and evolving consumer needs, understanding the AIG SWOT Analysis is critical to success. The insurance giant, AIG, must continuously adapt to shifts in customer demographics and market demands. Unraveling the AIG customer profile and identifying the AIG target market is essential for strategic growth and sustained competitive advantage.

This exploration will delve into the intricate details of customer demographics AIG serves, from individual consumers to large corporations. We'll examine AIG insurance customers, their needs, and AIG's strategies for acquisition and retention. Understanding the AIG market segmentation and the AIG ideal customer will provide valuable insights into the company's approach to a diverse clientele, including AIG's target market for commercial insurance and AIG's target market for high-net-worth individuals.

Who Are AIG’s Main Customers?

Understanding the customer demographics and target market for AIG is crucial for grasping its business strategy. AIG operates across both Business-to-Consumer (B2C) and Business-to-Business (B2B) sectors, offering a diverse range of insurance products and services. Following the 2024 deconsolidation of Corebridge Financial, AIG has reorganized its General Insurance business, focusing on its core strengths.

The company's structure is now centered around three key operating segments: North America Commercial, International Commercial, and Global Personal. This strategic realignment underscores AIG's commitment to serving a broad customer base with tailored insurance solutions. AIG's approach to customer segmentation and market focus is designed to meet the varied needs of its clients.

AIG's customer profile is shaped by its diverse product offerings and market presence. The company's ability to adapt and meet the evolving needs of its customers is a key factor in its long-term success. To learn more about the company's past, read the Brief History of AIG.

AIG's commercial lines primarily target businesses, including Fortune 500 corporations, financial institutions, government entities, and small and medium-sized enterprises. The Global Commercial business saw net premiums written increase by 7% on a comparable basis in 2024. This segment provides specialized insurance products such as general liability, professional liability, and cyber risk insurance. AIG's commercial insurance segment had record new business of $4.5 billion in 2024.

The Global Personal segment caters to individual consumers, offering products like personal auto, travel, and life insurance. AIG held a 1.77% market share in the life insurance sector as of December 31, 2024, with direct premiums exceeding $3.5 billion. While specific demographic data is not publicly detailed, AIG's focus on personalized experiences suggests a broad reach across various consumer profiles. The company provides accident and health insurance as well.

AIG's market segmentation strategy focuses on both commercial and personal lines, ensuring a diverse customer base. The company's target market includes a wide array of businesses and individual consumers, reflecting a broad customer demographic. AIG's customer acquisition strategy is designed to reach various demographics and industries.

- Commercial Clients: Fortune 500 companies, financial institutions, government entities, and SMEs.

- Personal Clients: Individuals seeking auto, travel, and life insurance.

- Geographic Focus: North America, International, and Global markets.

- Product Specialization: Tailored insurance solutions for specific risks and needs.

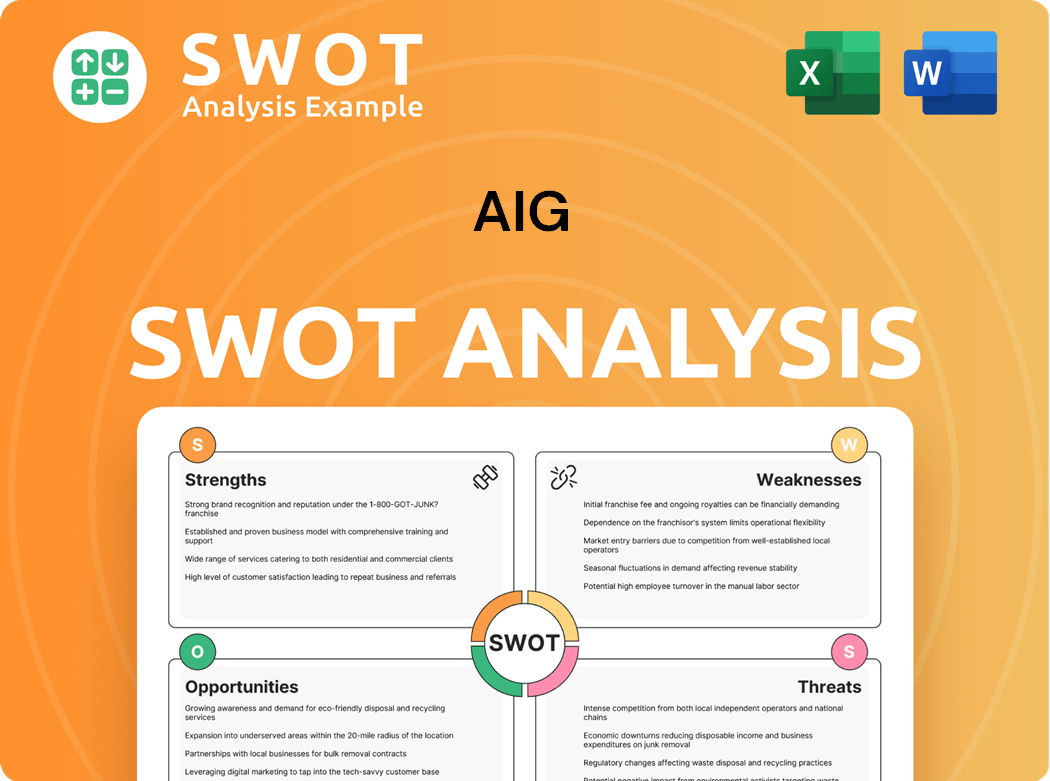

AIG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do AIG’s Customers Want?

Understanding the needs and preferences of customers is crucial for any insurance provider. For AIG, this involves a deep dive into the customer demographics and target market to tailor products and services effectively. The company focuses on delivering value through risk management solutions, financial security, and personalized insurance offerings.

AIG's customer base seeks comprehensive coverage, reliability, and efficient service. This includes a preference for transparent communication and proactive support to navigate uncertainties. The company's approach is designed to build trust and ensure customer satisfaction by addressing specific vulnerabilities and providing peace of mind.

The company is committed to innovation and adapting to the evolving needs of its clients. AIG leverages data and digital strategies, including AI, to improve processes and enhance customer experiences. This commitment is reflected in product development and service enhancements, such as sustainable insurance products.

Customers prioritize risk management and financial security. AIG provides solutions to address these needs, offering comprehensive coverage and expert support. This includes property and casualty insurance, life insurance, and retirement planning.

Purchasing behavior is influenced by reliability and efficient claims service. AIG focuses on superior claims service and a proactive approach to underwriting. The goal is to provide prompt access to funds and support when needed.

Customers value clear and transparent communication to build trust. AIG aims to provide this through its interactions, ensuring customers understand their coverage and the services available. This approach enhances customer satisfaction.

Psychological drivers include peace of mind and long-term financial protection. AIG offers solutions to mitigate potential risks and provide a sense of security. This is achieved through tailored insurance products and services.

Practical considerations involve the ability to mitigate risks and access funds promptly. AIG focuses on efficient claims processing and providing support when it's needed most. This includes streamlining processes through digital solutions.

AIG addresses pain points through digital transformation, including Generative AI and Large Language Models. This improves underwriting accuracy and claims processing. Data collection and accuracy rates in underwriting processes have improved from approximately 75% to over 90%.

AIG's customer-centric approach is evident in its product development and service enhancements. The company leverages data and digital strategies, including AI, to improve processes and customer experiences. This includes targeted marketing and personalized communication.

- AI-Driven Personalization: AIG utilizes AI for targeted marketing and personalized communication, recognizing that nearly 89% of companies see increased profit from personalized services.

- Product Innovation: The company develops new products and services to meet evolving client needs, including sustainable insurance products.

- Digital Transformation: AIG invests in digital strategies, such as Generative AI and Large Language Models, to make processes more rigorous and effective.

- Improved Efficiency: In early pilots, AIG has seen data collection and accuracy rates in underwriting processes improve significantly, while reducing processing time.

The Owners & Shareholders of AIG benefit from a customer-focused strategy. By understanding and meeting the needs of its customers, AIG can enhance its market position and drive sustainable growth. This approach is central to AIG's long-term success.

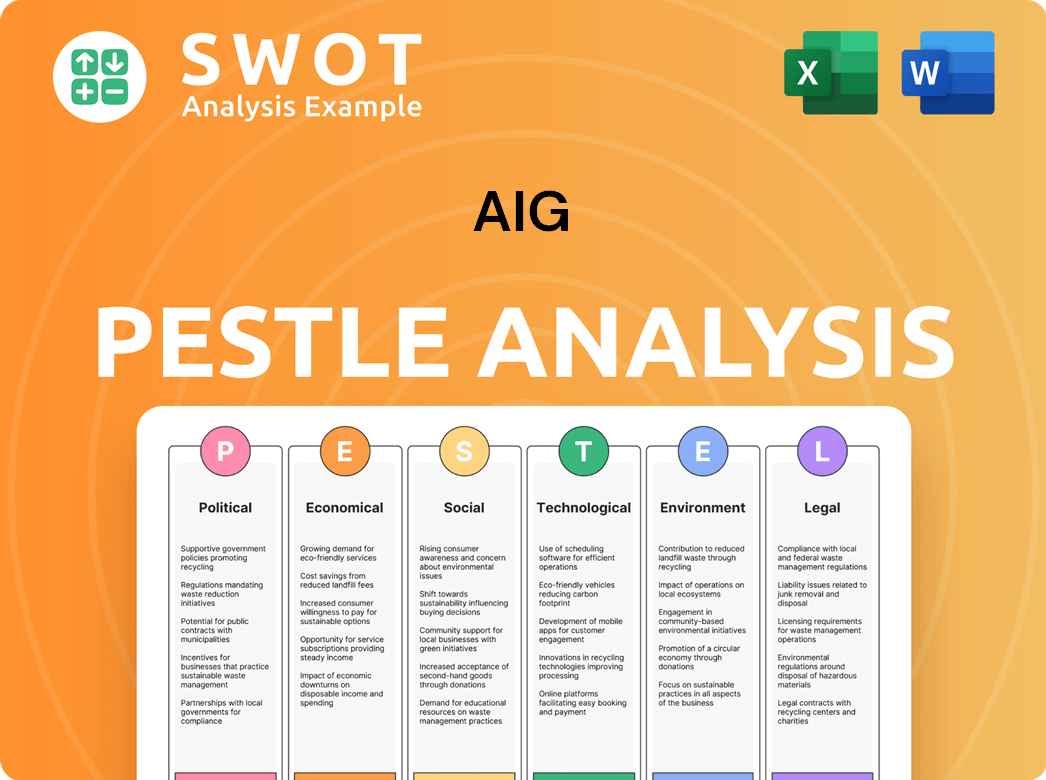

AIG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does AIG operate?

The geographical market presence of AIG is extensive, serving clients in approximately 80 countries as of 2024. Its operations are strategically divided into North America Commercial, International Commercial, and Global Personal segments. This structure reflects a focused approach on its core general insurance business, ensuring tailored strategies for diverse regional markets.

AIG's market presence is particularly strong in North America, with its commercial lines segment experiencing robust growth, including an 11% increase in net premiums written in Q3 2024. The company's North America market coverage is estimated at 65%. This strong performance is supported by strategic investments, such as the new innovation hub in Atlanta, set to open in 2026, aiming to integrate underwriting, claims, and operations to enhance digital capabilities.

Beyond North America, AIG maintains a significant presence across other continents. The Asia-Pacific region encompasses 15 countries, with an estimated 42% market coverage. Europe includes 25 countries, with 38% market coverage, and Latin America spans 12 countries, with 27% market coverage. Understanding the nuances of Revenue Streams & Business Model of AIG is crucial for grasping its global strategy.

AIG's North American market is a key area of focus, with significant investments in infrastructure and innovation. The commercial lines segment in this region has shown strong growth, reflecting the importance of this market. This focus is supported by a market coverage estimated at 65%.

The Asia-Pacific region represents a substantial market for AIG, operating in 15 countries. With an estimated market coverage of 42%, AIG tailors its offerings to meet the diverse needs of this region. This includes customized insurance products and localized marketing strategies.

AIG's European operations span 25 countries, with a market coverage of 38%. The company adapts its products and services to align with the regulatory and cultural landscapes of this diverse region. This strategic approach supports its market penetration and customer acquisition efforts.

Latin America is another significant market for AIG, covering 12 countries with a market coverage of 27%. AIG focuses on understanding the specific needs of this region, offering tailored insurance solutions. This strategic focus helps in building strong customer relationships.

AIG's approach to these diverse markets involves localized marketing and partnerships to cater to regional differences in customer demographics, preferences, and buying power. Distribution channels include direct sales (35%), independent agents (45%), and digital platforms (20%). Strategic moves, such as the sale of a 21.6% stake in Corebridge to Nippon Life Insurance Company in December 2024, and the launch of Syndicate 2478 at Lloyd's in January 2025, further refine the company's focus and global reach. These actions highlight AIG's commitment to adapting and growing within the global insurance landscape.

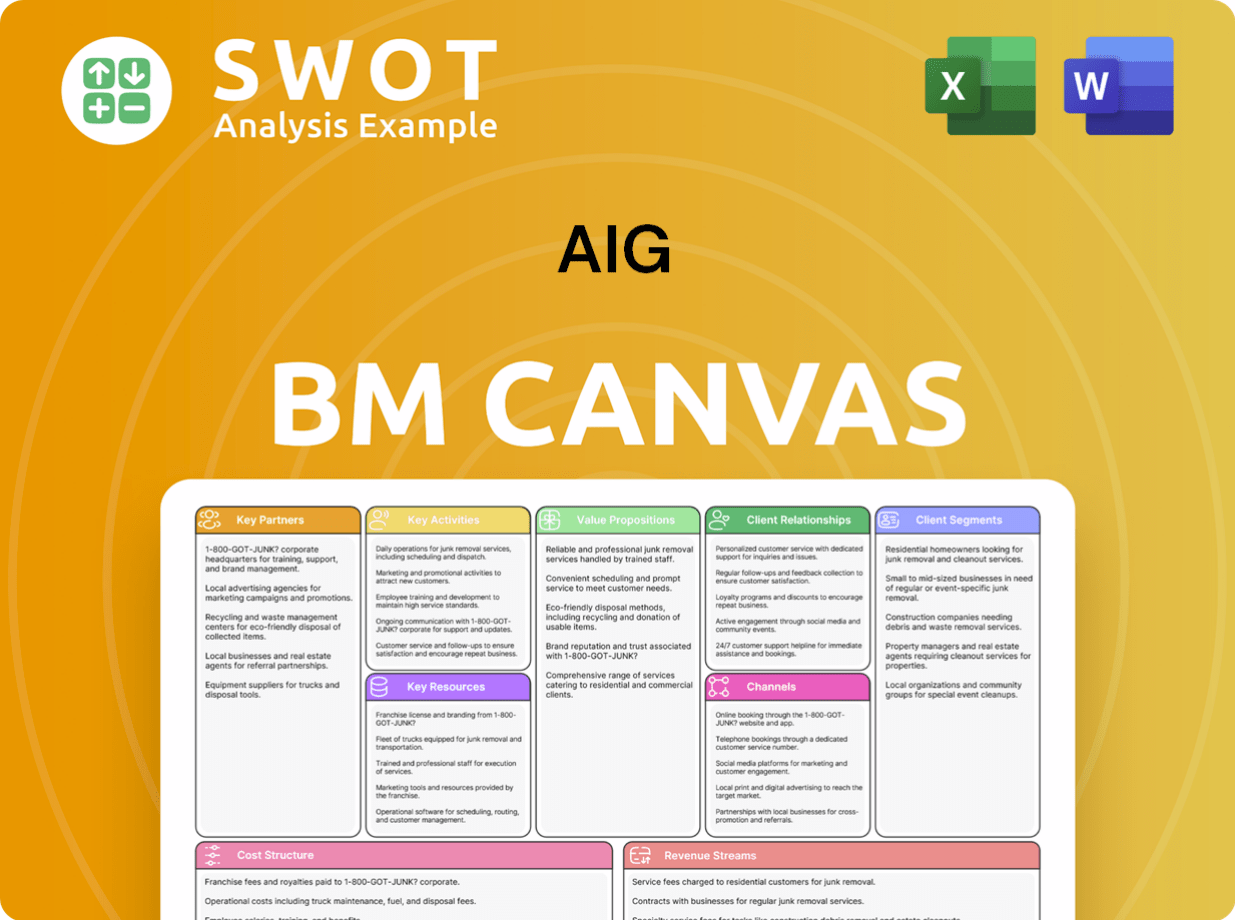

AIG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does AIG Win & Keep Customers?

AIG's customer acquisition and retention strategies are multifaceted, encompassing both traditional and digital marketing channels. Their approach is designed to attract new customers while fostering long-term relationships through exceptional service and innovative solutions. The company focuses on delivering value and maintaining underwriting discipline to ensure customer satisfaction and loyalty.

To acquire new customers, AIG uses a mix of advertising, sponsorships, and digital marketing techniques. Traditional advertising includes television, print media, and billboards. Digital strategies involve a dedicated website with detailed product information and active social media marketing. Email marketing and pay-per-click advertising are also used to generate leads and drive traffic.

Retention efforts at AIG are centered around providing superior claims service and innovative risk solutions. The company is investing heavily in data and digital strategies, including AI-powered tools to enhance customer experience and improve efficiency. These initiatives have shown promising results, with early pilots demonstrating improved data collection accuracy and reduced processing times in underwriting.

AIG uses a variety of channels to attract new customers. These include television and print advertisements, as well as billboards. Sponsorships of sporting events, such as USA Rugby and the All Blacks, are also utilized.

AIG maintains a dedicated website with comprehensive product information. They also use social media marketing extensively. Additionally, they employ email marketing and pay-per-click advertising to drive traffic and generate leads.

Key retention strategies include underwriting discipline and strategic capital deployment. AIG focuses on providing creative risk solutions and superior claims service. They also invest in data and digital strategies to enhance customer experience.

AIG is committed to investing in technology and data analytics. In 2024, they allocated $1.3 billion to technology initiatives. This investment supports underwriting and improves customer experience, contributing to a competitive advantage.

AIG's focus on customer loyalty is evident in its strategic transformation, focusing on a more streamlined global general insurance business. The company's innovation-driven approach aims to mitigate pricing pressures and create a competitive edge. AIG's financial stability, demonstrated by returning $8.1 billion to shareholders in 2024, further supports customer retention. Furthermore, the 'AIG Next' program, targeting significant cost savings, supports operational efficiency, which can lead to enhanced customer value. For a deeper dive into AIG's broader strategic initiatives, consider exploring the Growth Strategy of AIG.

AIG maintains strict underwriting standards to ensure financial stability and manage risk effectively. This discipline helps in providing reliable insurance products and services. It also contributes to customer trust and long-term relationships.

AIG actively manages its capital, returning value to shareholders through dividends and share repurchases. In 2024, the company returned $8.1 billion to shareholders. This financial strategy signals stability and attracts long-term customers.

Investing in data and digital strategies is a key focus for AIG. These initiatives, including AI-powered solutions, enhance customer experience and improve operational efficiency. Early pilots have shown significant improvements in data accuracy and processing times.

AIG prioritizes customer needs through product development and service delivery. This customer-centric approach aims to mitigate pricing pressures and create a competitive moat. The focus is on building lasting relationships.

The 'AIG Next' program is designed to improve operational efficiency and reduce costs. The program is targeting $450 million in exit run-rate savings in 2024, with a goal of $500 million by 2025. These savings can translate into better customer value.

AIG focuses on offering creative risk solutions tailored to meet the evolving needs of its customers. This innovation helps in retaining customers by providing relevant and effective insurance products. It also helps in attracting new customers.

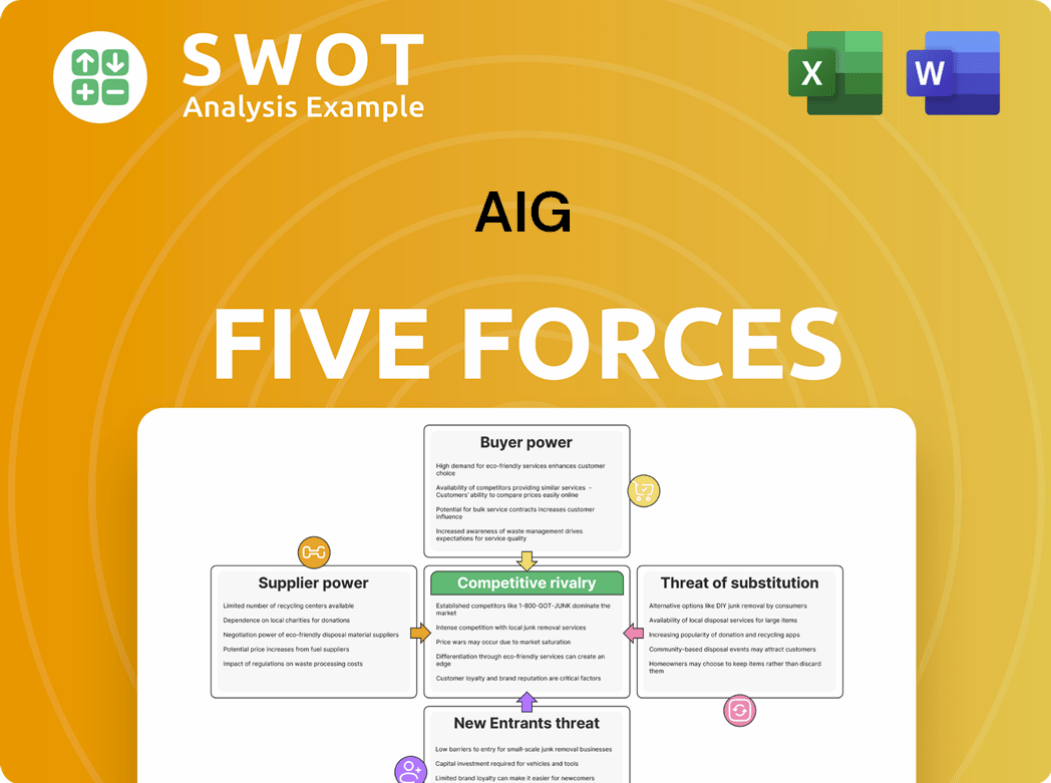

AIG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.