Nexa Bundle

How Did Nexa Resources Rise to Global Prominence?

Delve into the fascinating Nexa SWOT Analysis to uncover how this global zinc mining giant has shaped the raw materials landscape. From its humble beginnings in Latin America to its current status as a leading polymetallic producer, Nexa Resources' journey is a testament to strategic vision and operational excellence. Discover the key milestones and challenges that have defined the Nexa company's evolution.

This article will explore the Nexa history, examining its foundational strategies and early development. We'll highlight the innovations and challenges that have shaped its trajectory in the dynamic mining industry, offering valuable insights for investors and industry professionals alike. Learn about Nexa's commitment to sustainability and its impact on the global mining landscape.

What is the Nexa Founding Story?

The story of the Nexa company, now known as Nexa Resources, is rooted in a long history of mining and metallurgy, spanning over 65 years. This journey began with a focus on leveraging Latin America's rich mineral resources. While the exact founding date isn't pinpointed to a single event, the company's origins are closely linked to Votorantim, a Brazilian holding company with over a century of experience.

Nexa's evolution reflects a strategic vision to integrate mining and smelting operations, with zinc as its primary product, alongside valuable byproducts like copper, lead, and silver. This integrated approach aimed to maximize the value derived from the identified mineral opportunities. The company's early structure involved operations in Brazil, managed by Votorantim Metais Zinco SA, and in Peru, through Compania Minera Milpo SAA and Votorantim Metais-Cajamarquilla SA.

Nexa Resources S.A., formerly known as VM Holding SA, focused on the integrated production of polymetallic concentrates. The company's strategy has consistently emphasized operational excellence, sustainability, positive social impact, and innovation. Nexa's strategic advantages include product diversification and strong customer relationships. To learn more about how Nexa approaches its business, check out the Marketing Strategy of Nexa.

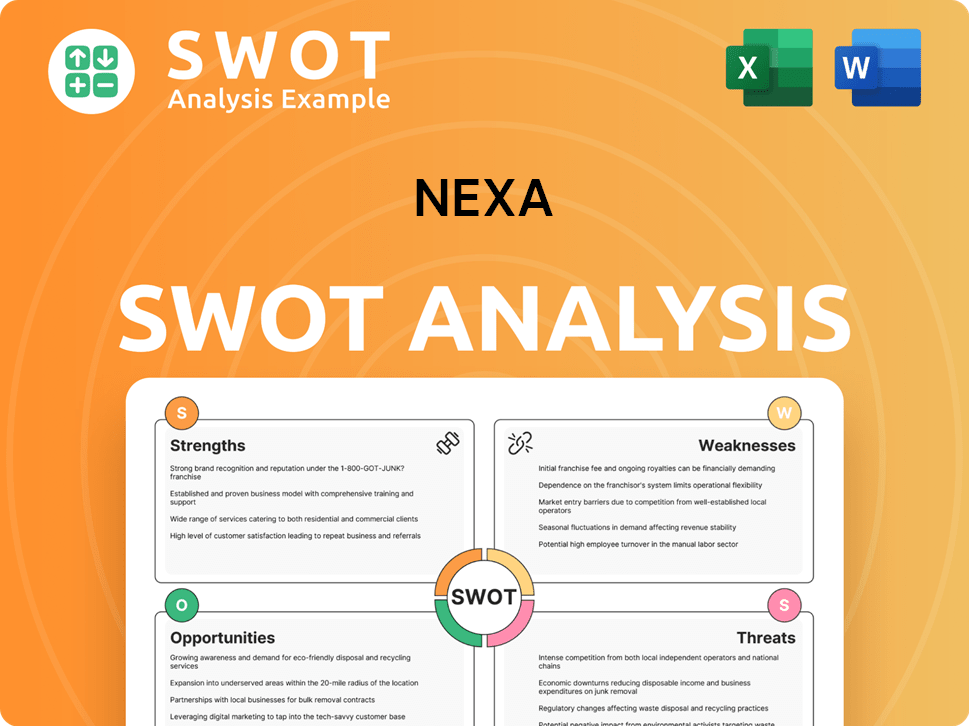

Nexa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Nexa?

The early growth and expansion of Nexa Resources, a prominent player in the mining industry, focused on developing and optimizing its mining and smelting assets across Latin America. This involved a strategic emphasis on enhancing operational efficiency, reducing costs, and improving environmental performance through technological advancements. The company's journey has been marked by significant developments in production, sales, and financial strategies.

In 2024, Nexa met its consolidated mining production guidance. Zinc, lead, and silver production met the annual guidance, while copper production exceeded the upper range, reaching a total of 36kt. Zinc production specifically reached 327kt. Metal sales for the year totaled 591kt, driven by increased production volumes and improved stability at its smelters.

Nexa undertook strategic divestments, including the sale of the Morro Agudo complex in 2024, to optimize its portfolio. The company also secured an ESG-Linked debenture of approximately US$130 million in 2Q24, aimed at improving its debt maturity profile and financial structure.

In 2024, Nexa generated positive consolidated cash flow for the first time since the Aripuanã investments, supported by strong operational performance and optimized working capital management, leading to free cash flow of US$107 million in 4Q24. This allowed for the repayment of US$44 million in short-term debt. The company closed 2024 with a net leverage ratio of 1.7x, down from 3.3x at the end of 2023. Total CAPEX for 2024 was US$277 million, below the revised guidance of US$300 million.

Throughout its early growth, Nexa has prioritized operational efficiency and technological innovation to enhance its environmental performance. This focus has been crucial in navigating the complexities of the mining industry and achieving sustainable growth. The company's strategic initiatives have been key to its performance.

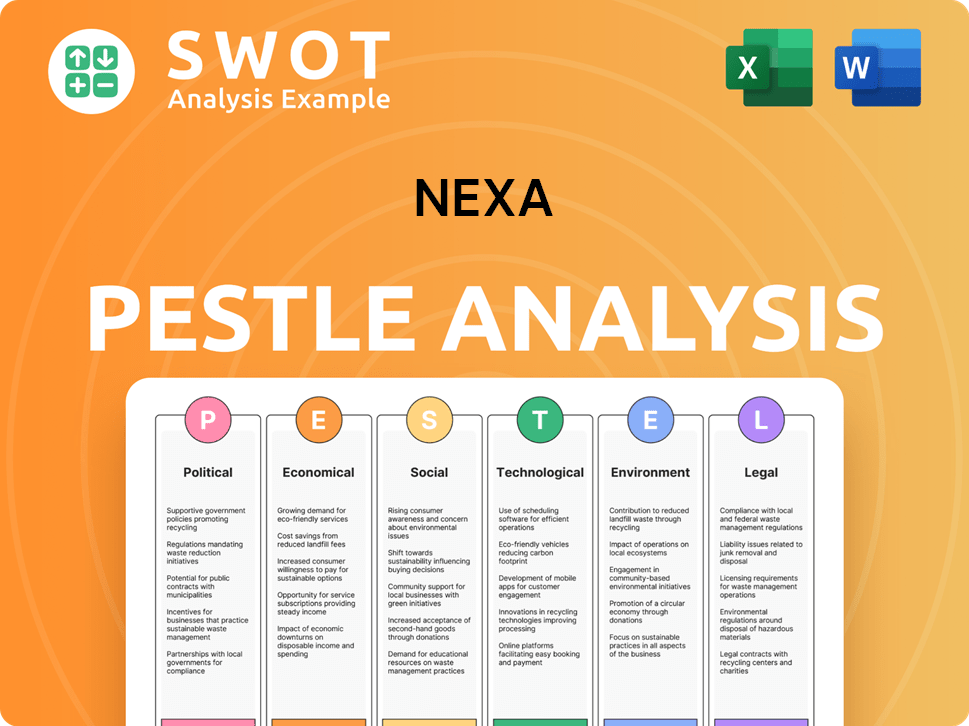

Nexa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Nexa history?

The Nexa Resources' journey includes several key milestones that have shaped its operational and strategic direction. These achievements highlight the company's commitment to innovation and sustainability within the mining sector, while also addressing financial and operational challenges.

| Year | Milestone |

|---|---|

| December 2024 | Completed reengineering of 12 zinc oxide roasters to use bio-oil, an industry first, projecting a reduction of approximately 6,440 tons of CO2 emissions annually starting in 2025. |

| 2024 | Initiated the first phase of the Cerro Pasco Integration Project, a strategic move to enhance operational efficiency and extend the life of the mining complex. |

| April 2025 | Successfully executed a US$500 million bond issuance to extend its debt maturity profile and strengthen financial flexibility. |

Nexa has consistently embraced innovation to improve its operations and reduce its environmental footprint. One notable example is the deployment of Hydrogen™ technology at its Vazante mine, designed to lower carbon emissions and boost fuel efficiency. Furthermore, the application of Digital Twin technology at the Cerro Lindo mine in Peru has significantly enhanced operational efficiency, leading to substantial improvements in milling capacity, water consumption, and waste management.

In December 2024, Nexa reengineered 12 zinc oxide roasters to operate on bio-oil. This is projected to cut annual CO2 emissions by around 6,440 tons, starting in 2025.

Nexa deployed Hydrogen™ technology at its Vazante mine to reduce carbon emissions. This technology also aims to improve fuel efficiency.

Digital Twin technology was applied at the Cerro Lindo mine in Peru. This innovation led to a 7% increase in milling capacity and a 10% reduction in water consumption.

The Digital Twin technology also decreased crusher downtime by 10%. It diverted 340 tons of waste annually.

Despite its advancements, Nexa has faced several challenges that have impacted its performance. The company reported two fatal incidents in 2024 at its El Porvenir and Vazante mines, underscoring the inherent risks in mining. Operational issues, such as heavy rainfall and production instabilities, also affected the company's performance in 1Q25.

Nexa acknowledged two fatal incidents in 2024 at its El Porvenir and Vazante mines. These incidents highlighted the persistent dangers in mining operations.

Production instabilities at Brazilian smelting operations impacted performance in 1Q25. Limited tailings filter capacity at the Aripuanã site is expected to delay full production capacity until 2026.

The company operates with a significant debt burden. Liabilities outweighed cash and near-term receivables by US$2.79 billion as of March 2025.

In 1Q25, zinc metal and oxide production totaled 133kt, a 4% decrease year-over-year. Zinc production decreased 23% to 67kt.

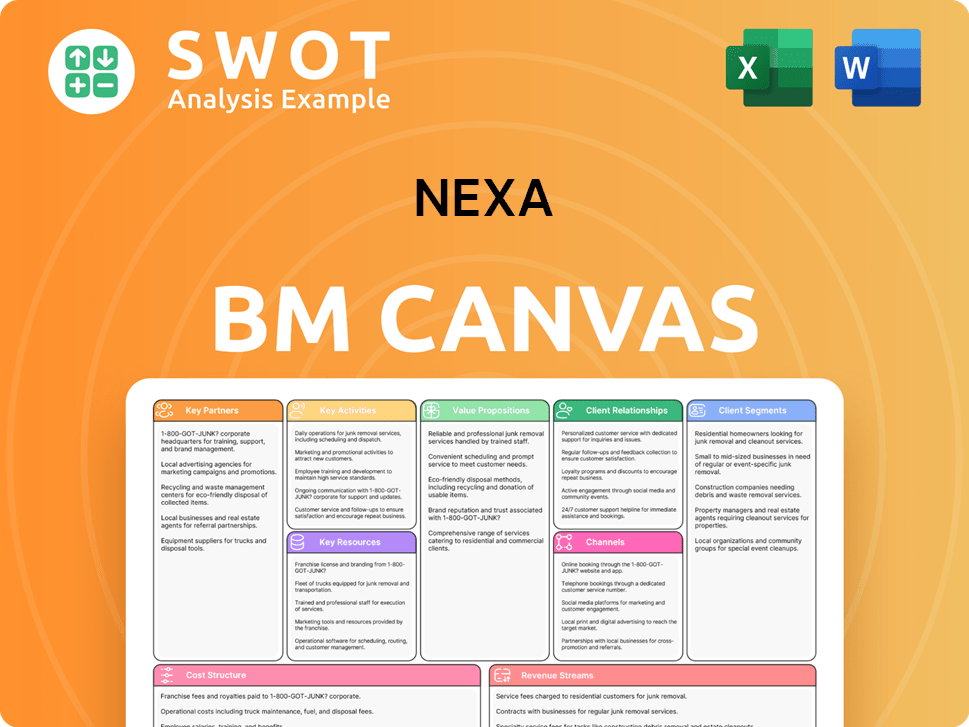

Nexa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Nexa?

The Nexa history is marked by significant developments in recent years, reflecting its strategic adjustments and operational achievements. Key events include production milestones, financial performance, and strategic initiatives aimed at sustainable growth and operational efficiency. The company has shown resilience and adaptability in navigating the complexities of the global market.

| Year | Key Event |

|---|---|

| 2024 | Achieved consolidated mining production guidance, with copper exceeding targets, and zinc production totaling 327kt. |

| April 30, 2024 | Cessation of mining activities at Morro Agudo following its sale. |

| August 1, 2024 | Reported solid operational and financial results for 2Q24, with Adjusted EBITDA reaching US$200 million. |

| December 2024 | Completed reengineering of zinc oxide roasters to run on bio-oil, projected to slash CO2 emissions by 6,440 tons annually starting in 2025. |

| February 6, 2025 | Announced operational results for 2024 and provided production and metal sales guidance for 2025-2027. |

| April 29, 2025 | Reported net income of US$29 million in 1Q25, a significant turnaround from previous losses, with Adjusted EBITDA reaching US$125 million. |

| May 15, 2025 | Announced the sale of its Otavi Project. |

Nexa's focus for 2025 and beyond includes deleveraging and sustainable growth. The company is navigating a global landscape with increased volatility and potential tariff impacts. Updated CAPEX guidance for 2025 is US$347 million.

Zinc production is forecasted to increase slightly in 2025, ranging from 311kt to 351kt. Copper production is expected to decline by 10% in 2025. Total metal sales at the midpoint are projected to be lower in 2025 compared to 2024, with an increase of 3% in 2026.

Key projects include Phase I of the Cerro Pasco Integration Project and the expansion of tailings filter capacity at Aripuanã. Sustaining investments are expected to total US$316 million, primarily allocated to mining and smelting operations. A new filter at Aripuanã is expected to be commissioned in 1H26.

The

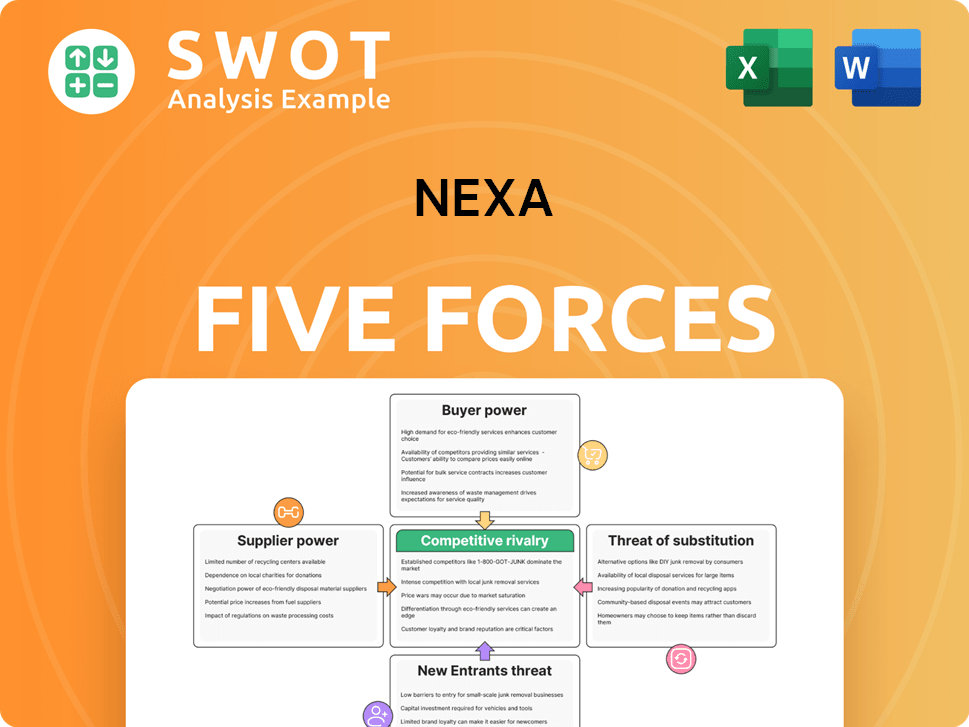

Nexa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Nexa Company?

- What is Growth Strategy and Future Prospects of Nexa Company?

- How Does Nexa Company Work?

- What is Sales and Marketing Strategy of Nexa Company?

- What is Brief History of Nexa Company?

- Who Owns Nexa Company?

- What is Customer Demographics and Target Market of Nexa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.