Nexa Bundle

How Does Nexa Resources Thrive in the Global Mining Market?

Nexa Resources has redefined its path in the competitive mining sector, focusing on sustainability and operational excellence. This strategic pivot, from traditional mining to a modern, tech-integrated approach, has been key to its success. Discover how Nexa has transformed its brand and market position, becoming a global leader in zinc production.

From its roots as a subsidiary of Votorantim S.A. to its current status as a top global zinc producer, Nexa's journey is a case study in strategic adaptation. This analysis will delve into the Nexa SWOT Analysis, uncovering the sales and marketing strategies that have propelled the company forward. We'll explore Nexa's approach to customer acquisition, its digital marketing strategies, and how it navigates the market to maintain its competitive edge. Understanding Nexa's sales strategy, marketing strategy, and overall Nexa strategy provides valuable insights for any business aiming for sustainable growth.

How Does Nexa Reach Its Customers?

The sales strategy of Nexa Resources involves a multifaceted approach to reach its global customer base, primarily industrial manufacturers. This strategy is designed to ensure broad market coverage and efficient distribution. Nexa's sales channels are crucial for connecting with key industrial sectors such as automotive, construction, manufacturing, and infrastructure.

Nexa's distribution network is robust, covering approximately 85% of global zinc demand markets. The company leverages a mix of direct sales, engagement through metal trading platforms, participation in international commodity exchanges, and long-term supply contracts. This integrated approach supports Nexa's ability to capture value across the entire metals production chain, enhancing efficiency and profitability.

The evolution of Nexa's sales channels reflects a strategic focus on direct engagement and leveraging established commodity markets. Nexa maintains dedicated metal trading teams across different geographical regions to support its sales efforts. The company also utilizes online digital communication channels, which represented 42% of Nexa's customer engagement strategy in 2023.

Nexa's direct sales strategy involves a dedicated team of professionals focused on building relationships with key industrial manufacturers. In 2023, Nexa had approximately 85 direct sales professionals in Brazil and Peru. This channel is vital for securing long-term supply contracts and understanding customer needs. This approach is key for the Growth Strategy of Nexa, ensuring a stable revenue stream.

Nexa actively engages in metal trading platforms, such as the London Metal Exchange (LME), to reach a broader customer base. Participation in international commodity exchanges provides access to global markets and price discovery mechanisms. This channel is critical for managing price volatility and optimizing sales volumes.

Securing long-term supply contracts with global manufacturers is a core component of Nexa's sales strategy. These contracts provide revenue stability and ensure a consistent demand for Nexa's products. They also foster strong relationships with key customers, which is essential for long-term business success.

Nexa leverages digital platforms, including its corporate website, LinkedIn, and industry-specific digital platforms, to engage with customers. In 2023, digital channels accounted for 42% of customer engagement. These channels support lead generation, customer communication, and brand building.

In 2024, metal sales totaled 591 kilotons, driven by higher production volumes at its Cajamarquilla and Juiz de Fora smelters. For 2025, total metal sales are projected to be slightly lower than 2024, at the midpoint of guidance, but are expected to increase by 3% in 2026, ranging between 580-605 kilotons, and remain at similar levels in 2027. This sales performance is supported by improved operational stability, reduced downtime, increased demand, and efficient logistics.

- Direct sales teams focus on building relationships with key industrial manufacturers.

- Metal trading platforms and exchanges provide access to global markets.

- Long-term supply contracts ensure revenue stability.

- Digital channels support customer engagement and brand building.

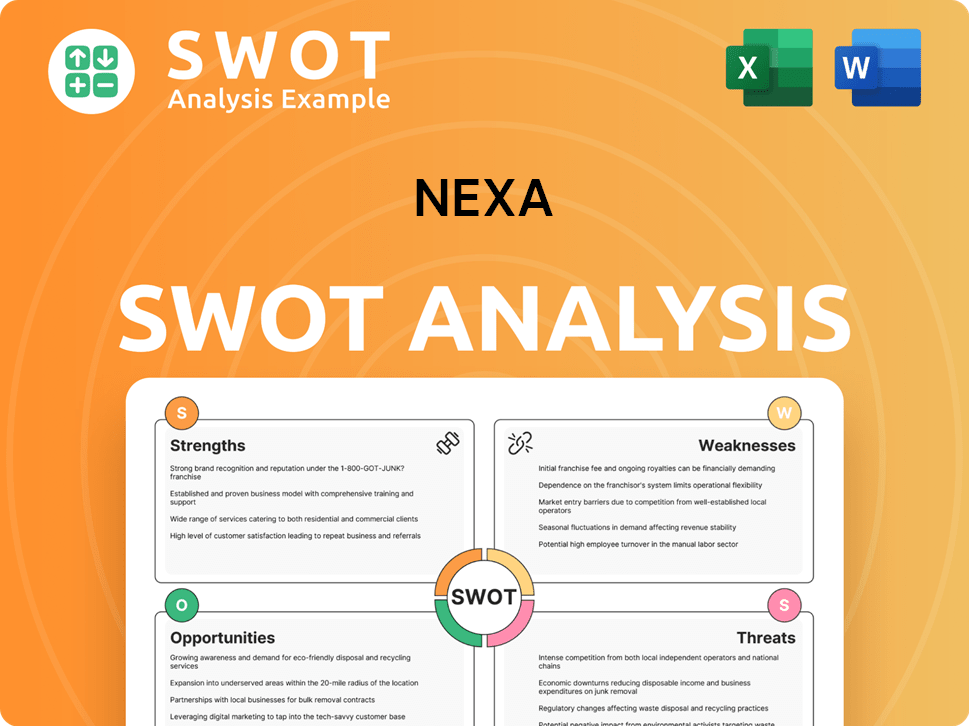

Nexa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Nexa Use?

The marketing tactics employed by Nexa Resources are strategically designed to align with its B2B operational model within the mining sector. A core focus is on transparent communication, particularly through investor relations and sustainability initiatives. This approach aims to build awareness, generate leads, and drive sales by showcasing operational performance, financial health, and a commitment to responsible practices.

Nexa's multifaceted strategy includes digital channels, industry events, and data-driven insights to engage with stakeholders effectively. The company leverages its corporate website, LinkedIn, and other digital platforms to connect with customers. Additionally, Nexa actively participates in international mining and metal conferences to foster industry engagement and explore potential business opportunities.

Data-driven marketing plays a critical role in Nexa's strategy, with a strong emphasis on operational efficiency and cost management. These efforts indirectly contribute to the company's market competitiveness and appeal to stakeholders. Furthermore, Nexa's dedication to ESG principles is evident through significant investments in environmental sustainability, which enhances its reputation and attracts investment.

Nexa provides key metrics and insights into its financial performance through quarterly earnings presentations. In Q1 2025, the company reported a net income of $28.7 million and adjusted EBITDA of $125 million. Net revenues reached $627 million, marking an 8% increase from Q1 2024.

Digital tactics are integral, with the company's corporate website, LinkedIn, and industry-specific digital platforms serving as key channels for customer engagement. Nexa also actively participates in 7-9 international mining and metal conferences annually to engage with the industry and potential customers.

Nexa's focus on operational efficiency and cost management, such as the 65% reduction in C1 cash cost guidance in October 2024, indirectly contributes to its market competitiveness and appeal to stakeholders.

Nexa's significant investment in environmental sustainability initiatives, totaling $87.4 million in 2022, and its 2024 Sustainability Report, published in April 2025, highlight its commitment to ESG principles.

The company is implementing Hydrogen™ technology at its Vazante mine to reduce carbon emissions and the reengineering of zinc oxide roasters to run on bio-oil, projected to slash CO₂ emissions by 6,440 tons annually starting in 2025.

The 2024 Sustainability Report details initiatives like the Hydrogen™ technology at its Vazante mine to reduce carbon emissions and the reengineering of zinc oxide roasters to run on bio-oil, projected to slash CO₂ emissions by 6,440 tons annually starting in 2025.

The company's approach to Nexa marketing strategy includes a strong emphasis on investor relations and sustainability communications. This is particularly important in the B2B mining sector.

Nexa's marketing tactics are designed to build awareness, generate leads, and drive sales through transparent communication and strategic initiatives.

- Quarterly Earnings Presentations: Providing key financial metrics and insights.

- Digital Channels: Utilizing corporate website, LinkedIn, and industry-specific platforms.

- Industry Events: Participating in 7-9 international mining and metal conferences annually.

- Operational Efficiency: Focusing on cost management, such as the 65% reduction in C1 cash cost guidance in October 2024.

- Sustainability Initiatives: Investing in ESG principles, with $87.4 million invested in 2022.

- Emission Reduction: Implementing Hydrogen™ technology and reengineering zinc oxide roasters.

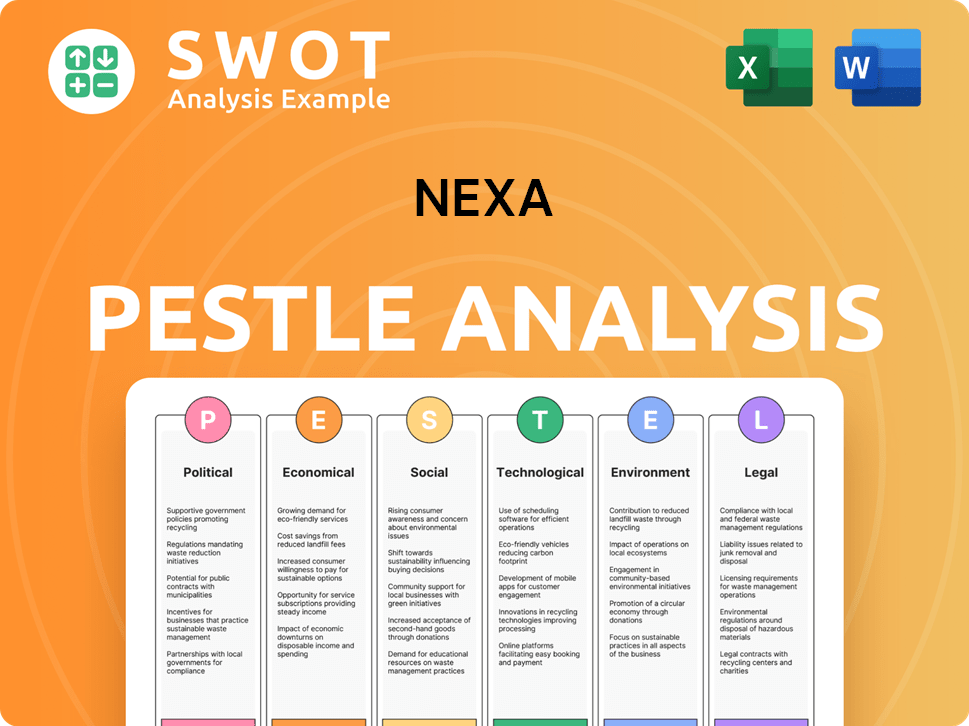

Nexa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Nexa Positioned in the Market?

Nexa Resources strategically positions itself as a leading polymetallic producer, primarily focused on zinc. Its brand is built on its strategic asset locations in Latin America and a strong commitment to sustainability. The core message revolves around 'mining that changes with the world,' highlighting sustainable development and responsible resource production.

The company's brand positioning resonates with investors, industrial customers, and local communities. This is achieved through innovation, efficiency, and social responsibility. Nexa's financial performance, including a 76% surge in Adjusted EBITDA to US$714 million in 2024, reinforces its brand strength.

Nexa's commitment to sustainable practices is evident through its listing on the S&P/BVL Peru General ESG Index for 2024-2025. Its integrated operations, from mining to refining, enhance efficiency and profitability, solidifying its market position. The company's brand consistency is further supported by its recognition as a leader in sustainability.

Nexa's primary message is 'mining that changes with the world,' emphasizing sustainable development. This message is reinforced through its 2024 Sustainability Report, demonstrating environmental stewardship and community engagement. This approach is key to the Target Market of Nexa.

Nexa targets investors, industrial customers, and local communities. The company appeals to these groups through innovation, efficiency, and social responsibility. This focus helps Nexa maintain strong relationships and brand loyalty.

Nexa's strong financial results, such as the increase in Adjusted EBITDA, support its brand. The company's financial resilience enhances its reputation. This financial strength allows Nexa to invest in its operations and sustainability initiatives.

Nexa's inclusion in the S&P/BVL Peru General ESG Index highlights its commitment to sustainability. This recognition reinforces brand consistency and responsiveness to evolving investor sentiment. This commitment is a key element of its Nexa marketing strategy.

Nexa's integrated operations, from mining to refining, enhance efficiency and profitability. This integrated approach is a key element of its Nexa sales strategy.

- Among the top five producers of mined zinc globally in 2024.

- One of the top five metallic zinc producers worldwide in 2024.

- Focused on sustainable development and responsible resource production.

- Strong financial performance with a 76% increase in Adjusted EBITDA.

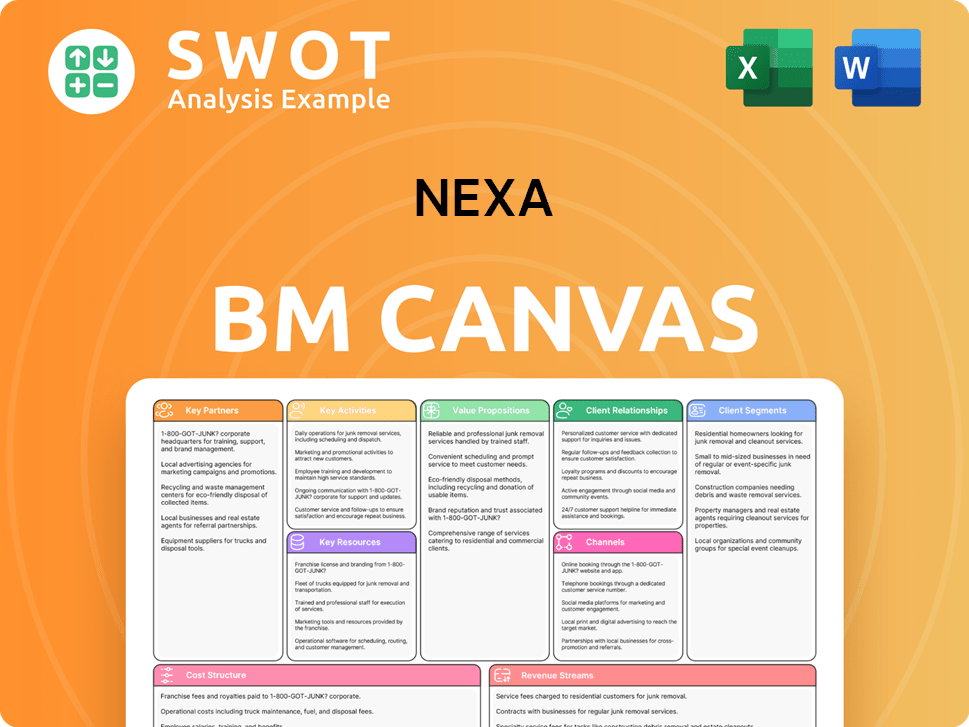

Nexa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Nexa’s Most Notable Campaigns?

The sales and marketing strategy of Nexa Resources, while primarily B2B, is significantly shaped by strategic initiatives and public reporting. These efforts aim to build brand confidence and drive stakeholder value. Nexa's campaigns are geared towards showcasing operational excellence, financial health, and a commitment to sustainability, which collectively influence its market position and attract investors.

A key component of Nexa's strategy involves demonstrating strong operational performance and financial results. The company's ability to meet and exceed production targets, coupled with substantial financial improvements, forms the foundation of its marketing narrative. This approach is designed to build trust with investors and stakeholders by highlighting tangible achievements and financial stability, crucial for long-term growth and market perception.

Nexa's marketing strategy also emphasizes its commitment to sustainability and ESG principles. This is demonstrated through initiatives aimed at reducing environmental impact and promoting responsible practices. These efforts not only enhance Nexa's reputation but also align with the growing demand for sustainable investments, positioning the company favorably among ESG-conscious investors.

In 2024, Nexa achieved its consolidated mining production guidance across all metals. Copper production exceeded the upper range. This operational success was a key element of the Nexa sales strategy. This demonstrates efficiency and reliability, which is crucial for the Revenue Streams & Business Model of Nexa.

Nexa's Adjusted EBITDA increased by 76% to US$714 million in 2024 from US$406 million in 2023, showcasing significant financial growth. This performance enabled Nexa to generate its first positive consolidated cash flow since the Aripuanã investments. This strong financial performance supports the Nexa marketing strategy.

The 2024 Sustainability Report, published in April 2025, highlights Nexa's commitment to ESG principles. The report details the deployment of Hydrogen™ technology and the reengineering of zinc oxide roasters. These initiatives are essential for the Nexa brand.

The reengineering of zinc oxide roasters is projected to cut CO₂ emissions by 6,440 tons annually starting in 2025. Nexa's recognition in the S&P/BVL Peru General ESG Index for 2024-2025 further underscores its dedication to sustainability. This is a key element of the Nexa marketing strategy.

Nexa secured key collaborations in 2024, including with SNSW and BUPA Medical Visa Services (BMVS), strengthening its reputation and expanding its reach. The company also advanced its portfolio optimization strategy in 2024 through strategic divestments, including the Morro Agudo Complex and the Pukaqaqa greenfield project, to focus on higher-return assets. This is essential for Nexa car sales.

- Partnerships are a part of the Nexa sales strategy.

- Portfolio optimization is a part of the Nexa strategy.

- These activities are essential for Nexa brand positioning strategy.

- Divestments help to improve the Nexa customer acquisition strategy.

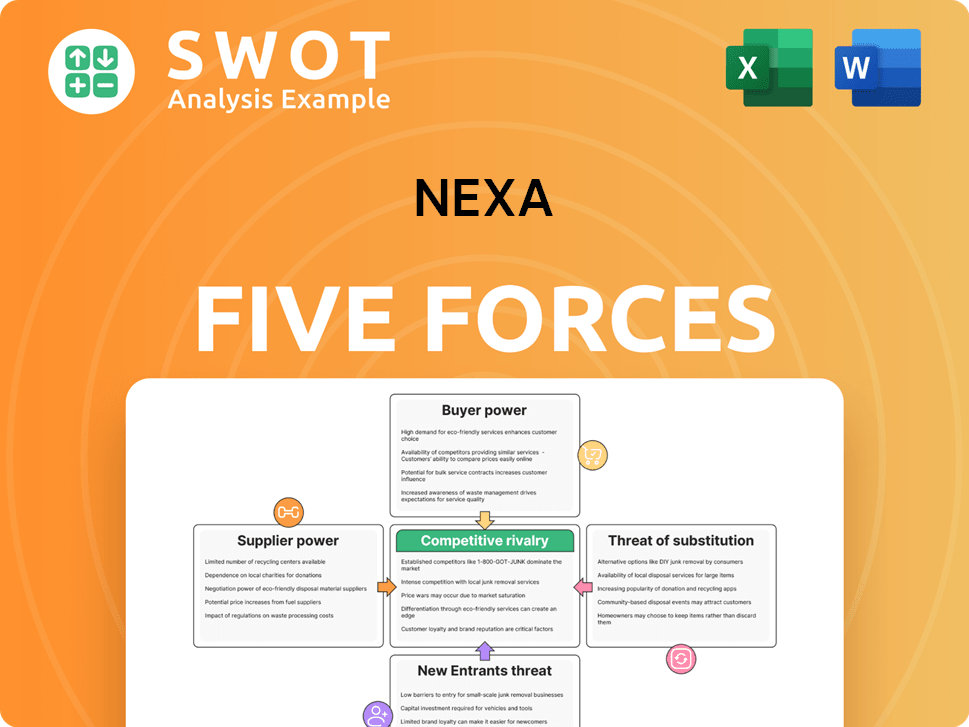

Nexa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nexa Company?

- What is Competitive Landscape of Nexa Company?

- What is Growth Strategy and Future Prospects of Nexa Company?

- How Does Nexa Company Work?

- What is Brief History of Nexa Company?

- Who Owns Nexa Company?

- What is Customer Demographics and Target Market of Nexa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.