Nexa Bundle

Who Buys Zinc from Nexa Resources?

Understanding the Nexa SWOT Analysis is crucial for grasping its market position, but even more vital is knowing its customers. Nexa Resources, a global leader in zinc production, thrives by catering to specific needs within a complex global market. This deep dive explores the Nexa customer profile, revealing the demographics and preferences that drive its success.

The analysis of Nexa target market is essential for investors and strategists alike, providing crucial Nexa consumer insights into the company's operational efficiency and strategic direction. By examining the Customer demographics Nexa, this report offers a comprehensive view of Nexa's market positioning and its ability to adapt to the evolving demands of its diverse customer base, from smelters to industrial manufacturers. This understanding is key to evaluating Nexa's long-term growth potential and its ability to navigate the complexities of the global metals market, including aspects like Nexa customer segmentation analysis and Nexa market research and analysis.

Who Are Nexa’s Main Customers?

Understanding the Customer demographics Nexa involves recognizing its business-to-business (B2B) focus. As a global producer of zinc, copper, lead, silver, and byproducts, Nexa's primary customer segments are industrial clients. These clients require raw materials for manufacturing and development across various sectors.

The Nexa target market is largely defined by the demand for these base metals. Key industries include construction, transportation, energy, agriculture, healthcare, and consumer goods. Nexa's metal sales reached 591 kilotons in 2024, reflecting strong demand and operational stability.

Nexa customer profile is centered around industrial needs. The company's strategic moves, such as portfolio optimization and acquisitions like the increased stake in Tinka Resources in December 2024, highlight its focus on core assets and expanding reserves. These actions reflect a proactive approach to meeting the evolving demands of its target industries.

Nexa's customer base is primarily within the industrial sector, focusing on businesses that require base metals for manufacturing and development. These segments are crucial for various applications, including construction, transportation, and energy. The company's strategic direction reflects an understanding of these core customer needs.

Nexa operates globally, with customers spanning various regions. The demand for its products is influenced by regional industrial activities and infrastructure projects. Market research and external trends drive the company's strategic decisions to serve these diverse markets effectively.

Customers value the quality and reliability of Nexa's products, which are essential for their manufacturing processes. The company's focus on higher-return assets and strategic divestments, as seen in the sale of the Morro Agudo Complex in April 2024, reflects a commitment to meeting these needs. Nexa's customer relationships are critical for its success.

The global zinc market, for example, remained in a deficit throughout 2024 due to limited concentrate availability and supply constraints. This dynamic influences Nexa's Nexa marketing strategy and customer interactions. Nexa adapts to these market conditions through its strategic decisions and operational efficiency.

Nexa's approach to its Nexa audience analysis and Nexa consumer insights involves continuous monitoring of market trends and customer needs. The company's strategic moves, such as portfolio optimization and acquisitions, reflect a commitment to meeting the evolving demands of its target industries. The company's focus on higher-return assets and disciplined capital allocation, as seen in the sale of the Morro Agudo Complex in April 2024, is a key aspect of its customer-centric strategy.

- Nexa's strategic decisions are influenced by market research and external trends.

- The company focuses on higher-return assets and disciplined capital allocation.

- Nexa increased its ownership in Tinka Resources to approximately 19.86% in December 2024, signaling a focus on expanding its zinc and silver reserves.

- These actions reflect a proactive approach to meeting the evolving demands of its target industries. For more insights, see the Growth Strategy of Nexa.

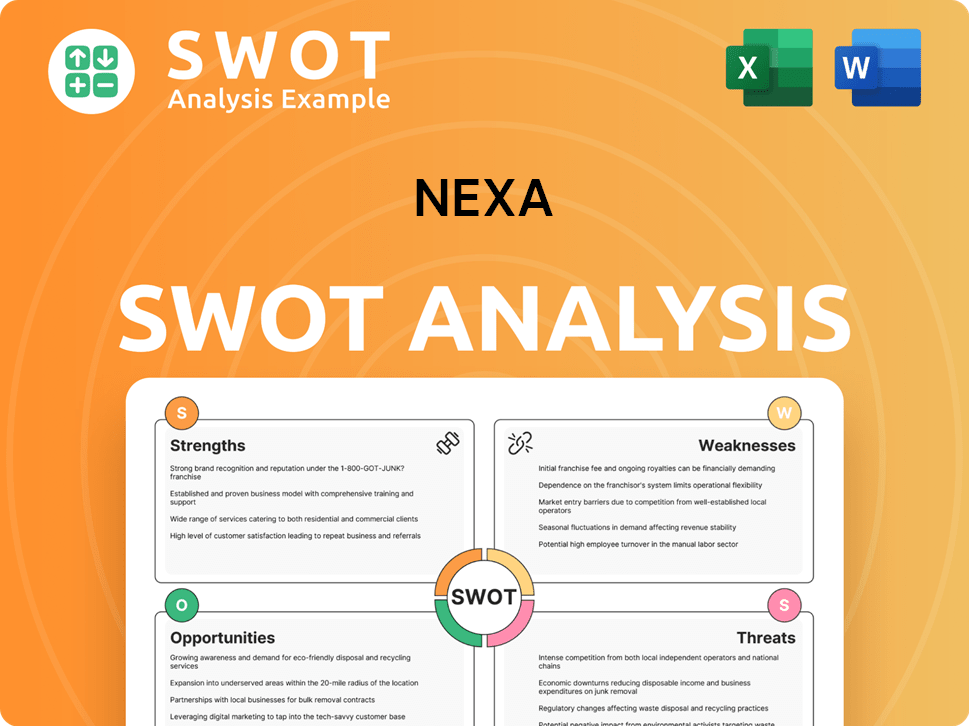

Nexa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Nexa’s Customers Want?

Understanding the customer needs and preferences is crucial for Nexa Resources. Nexa's customer demographics primarily consist of industrial buyers who purchase base metals. These customers are driven by specific requirements, including consistent supply, high-quality products, competitive pricing, and an increasing emphasis on responsibly sourced materials.

The purchasing behaviors of Nexa's target market are significantly influenced by global economic conditions, fluctuating metal prices, and the stability of supply chains. For instance, the global zinc market faced a deficit throughout 2024 due to limited concentrate availability and ongoing supply constraints. This situation underscores the critical need for reliable suppliers like Nexa.

The psychological and practical factors that influence customers to choose Nexa involve the assurance of working with a large-scale, integrated polymetallic producer with over 65 years of experience in Latin America. Customers seek to mitigate supply chain risks and ensure the availability of essential raw materials for their manufacturing processes. Aspirational drivers are increasingly linked to sustainability and ethical sourcing.

Nexa's customers prioritize a reliable and consistent supply of base metals to support their manufacturing processes. This is especially vital given the volatility in the global metals market.

High-quality products are essential for Nexa's customers to meet their own production standards and maintain their competitive edge. Quality assurance is a key factor in their purchasing decisions.

Customers expect competitive pricing to manage their costs and maintain profitability. Nexa must balance pricing with the value it provides in terms of quality and reliability.

Increasingly, customers are demanding responsibly sourced materials, reflecting a growing emphasis on sustainability and ethical practices within the industry. Nexa's commitment to ESG is crucial.

Customers need to mitigate supply chain risks to ensure the availability of raw materials. Nexa's operational efficiency and strategic optimizations help address this.

Customers are looking for suppliers who demonstrate strong environmental, social, and governance (ESG) practices. Nexa's sustainability efforts are increasingly important.

Nexa addresses common pain points such as supply volatility through its operational efficiency and strategic optimizations. In 2024, Nexa achieved its consolidated production guidance across all metals, with copper exceeding the upper range, and zinc production totaling 327kt. This consistent delivery helps alleviate supply concerns for its customers. Feedback and market trends have influenced Nexa's product development and operational focus. For example, in 1Q25, Nexa advanced its circular economy efforts by commercializing bricks made from jarosite residue at its Juiz de Fora smelter, launching community training sessions to support their use in construction. This demonstrates how the company tailors its offerings to address evolving market demands for sustainable solutions and resource efficiency. To learn more about Nexa's history, you can read the Brief History of Nexa.

Nexa's customer profile is shaped by the need for reliable supply, quality products, and competitive pricing. Sustainability and ethical sourcing are also becoming increasingly important.

- Reliable Supply: Customers need a consistent supply of base metals to avoid production disruptions.

- Quality Products: High-quality materials are essential for maintaining product standards.

- Competitive Pricing: Customers seek cost-effective solutions to remain competitive.

- Sustainability: Growing demand for responsibly sourced materials and ESG practices.

- Operational Efficiency: Nexa's focus on operational efficiency to meet customer demands.

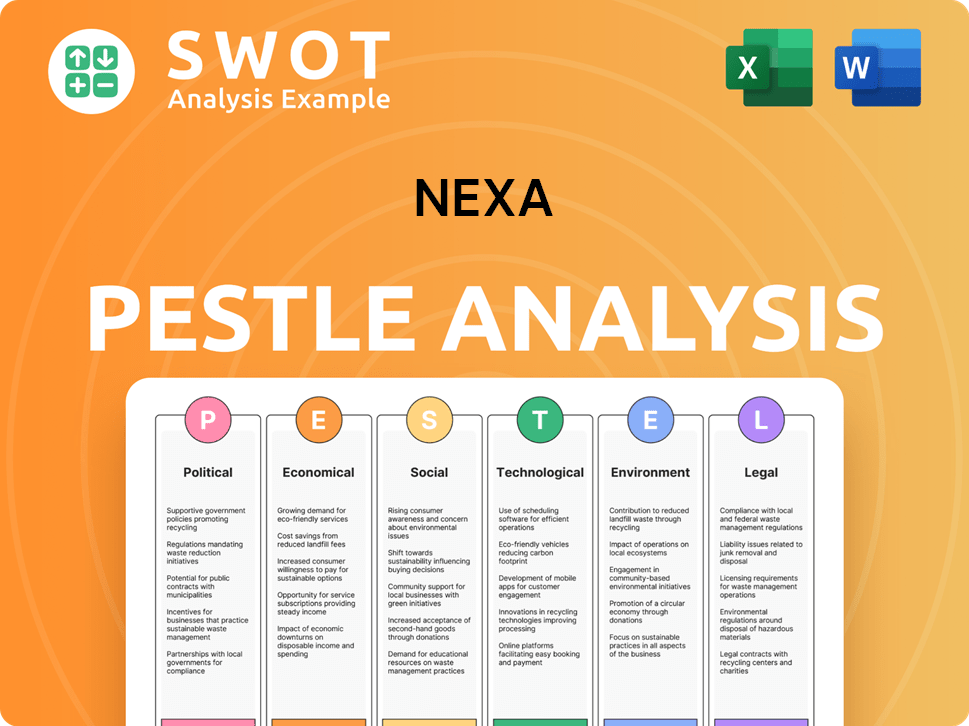

Nexa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Nexa operate?

The geographical market presence of Nexa is primarily concentrated in Latin America, specifically in Peru and Brazil. These countries are key to Nexa's operations, where it owns and operates zinc mines and smelters. This strategic focus allows the company to leverage its resources and expertise within a specific region, enhancing operational efficiency and market penetration. Nexa's commitment to these regions is further demonstrated by its significant investments and expansions.

Nexa's operations in Peru and Brazil include five polymetallic mines and three zinc smelters. The Cajamarquilla smelter in Peru is one of the largest in the world and the biggest in the Americas. This integrated approach, with more than half of the zinc concentrate supplied to its metallurgy units coming from its own mining assets, ensures a stable supply chain and supports its position as a leading global producer. Nexa also has exploration projects in Namibia.

Nexa's strategic market entry strategies include both expansions and divestments. In 2024, the company successfully divested from the Morro Agudo Complex, focusing on higher-return assets. Simultaneously, Nexa increased its ownership in Tinka Resources, reinforcing its presence in Peru's zinc-silver projects. These moves reflect Nexa's dynamic approach to adapting to market conditions and optimizing its portfolio. For a deeper understanding of Nexa's business model, consider reading this article about Revenue Streams & Business Model of Nexa.

Nexa's customer base is largely defined by the industrial demand for metals within its key operating regions. The company's customer profile includes businesses that require zinc and other metals for their manufacturing processes, primarily in Peru and Brazil. Understanding these customer needs is crucial for Nexa's marketing strategy.

The Nexa target market is primarily focused on industrial consumers of zinc and other metals in Latin America. This includes companies in construction, automotive, and other manufacturing sectors. Nexa's marketing strategy aims to reach these key industries by understanding their specific needs and preferences.

The typical Nexa customer is a business that uses zinc and other metals in its production processes. These customers are often located in Peru and Brazil, where Nexa has a strong presence. Analyzing Nexa's consumer insights helps tailor its offerings to meet these specific demands.

Nexa's marketing strategy focuses on building strong relationships with its industrial customers in Latin America. This involves understanding their specific needs and providing high-quality products. The company's approach is localized to succeed in diverse markets.

Nexa conducts audience analysis to understand the needs and preferences of its industrial customers. This involves gathering data on their purchasing behavior and market trends. This helps Nexa tailor its products and services effectively.

Consumer insights are critical for Nexa to understand its customers' needs and expectations. Nexa gathers this data through market research and direct customer feedback. This knowledge informs its product development and marketing strategies.

Nexa uses market research and analysis to stay informed about industry trends and customer needs. This helps the company identify opportunities and adjust its strategies accordingly. This includes analyzing customer preferences and needs.

Understanding customer preferences and needs is essential for Nexa's success. This involves analyzing what customers value in terms of product quality, pricing, and service. Nexa aims to meet these needs to maintain customer loyalty.

Defining an ideal customer persona helps Nexa focus its marketing efforts. This persona represents the characteristics and needs of its most valuable customers. Nexa uses this to refine its customer acquisition strategy.

Nexa's customer acquisition strategy involves targeting industrial customers in Latin America. This includes building relationships and providing high-quality products. The company focuses on acquiring customers who align with its ideal customer persona.

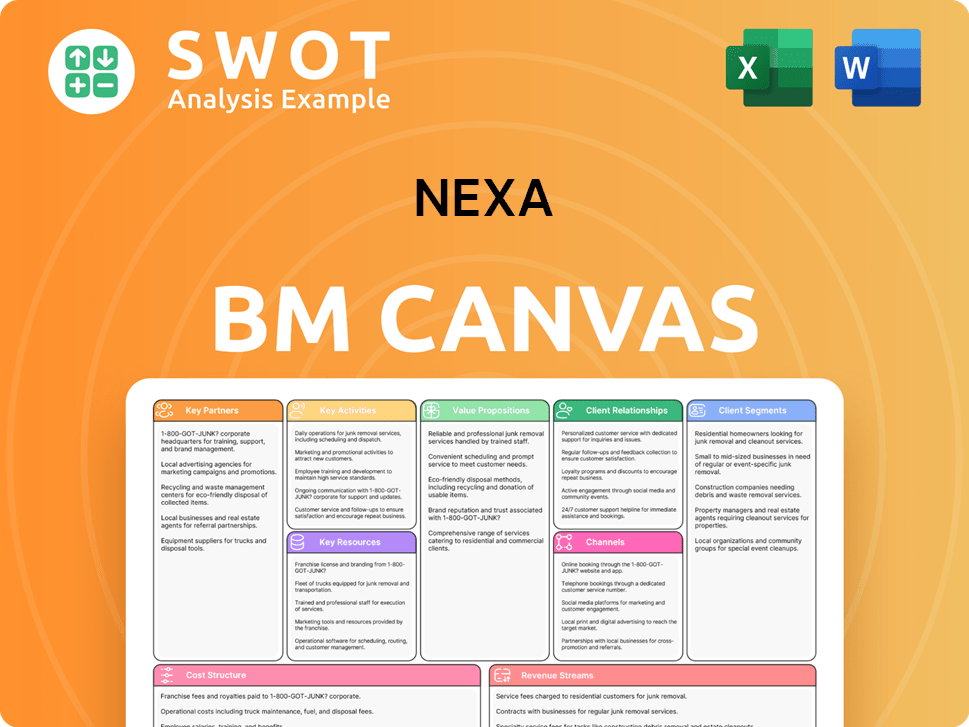

Nexa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Nexa Win & Keep Customers?

Nexa Resources, operating in the B2B mining and metals sector, focuses its customer acquisition and retention strategies on building strong, long-term relationships with industrial clients. Unlike consumer-facing businesses that rely heavily on marketing campaigns, Nexa's approach centers on reliability, operational efficiency, and a commitment to sustainability. This strategy is crucial for attracting and keeping customers in a market where consistent supply and ethical sourcing are highly valued.

Key to Nexa's acquisition strategy is its position as a large-scale, low-cost producer of essential base metals. The company's ability to consistently meet production targets, as demonstrated by achieving its consolidated mining production guidance in 2024 for zinc, lead, and silver, and exceeding copper production, is a significant draw for customers seeking a stable and dependable supply chain. Metal sales totaled 591 kilotons in 2024, showcasing the effectiveness of its production capabilities in securing customer contracts.

Retention strategies are deeply rooted in operational excellence, cost management, and a growing emphasis on sustainable practices. Nexa's successful achievement of reduced C1 cash cost guidance in 2024, driven by improved operational efficiencies and effective cost management, directly benefits customers through competitive pricing and a stable supply chain. The company's commitment to sustainability, as highlighted in its 2024 Sustainability Report, published in April 2025, is increasingly vital for customer retention, especially as industrial clients prioritize ethical and environmentally responsible sourcing.

Nexa's consistent ability to meet and exceed production targets is a key factor in acquiring and retaining customers. The company's operational stability, demonstrated by its performance in 2024, assures clients of a dependable supply of essential metals.

Operational efficiencies and effective cost management, leading to reduced C1 cash costs, translate into competitive pricing for customers. This cost-effectiveness is a significant advantage in the B2B market.

Nexa's commitment to sustainability, as outlined in its 2024 Sustainability Report, is crucial for attracting and retaining customers who prioritize ethical and environmentally responsible sourcing. Initiatives like the commercialization of bricks from jarosite residue demonstrate innovation in circular economy practices.

Investments such as the US$37 million directed to the Cerro Pasco Integration Project showcase Nexa's commitment to long-term operational viability and continued supply. This commitment reinforces customer confidence.

Proactive liability management, including a US$500 million bond issuance in early April 2025, strengthens Nexa's financial flexibility. This ensures business continuity, which is critical for maintaining customer trust and confidence.

Nexa focuses on building strong, long-term relationships with industrial clients. This approach emphasizes reliability, operational efficiency, and a commitment to sustainability to foster enduring partnerships.

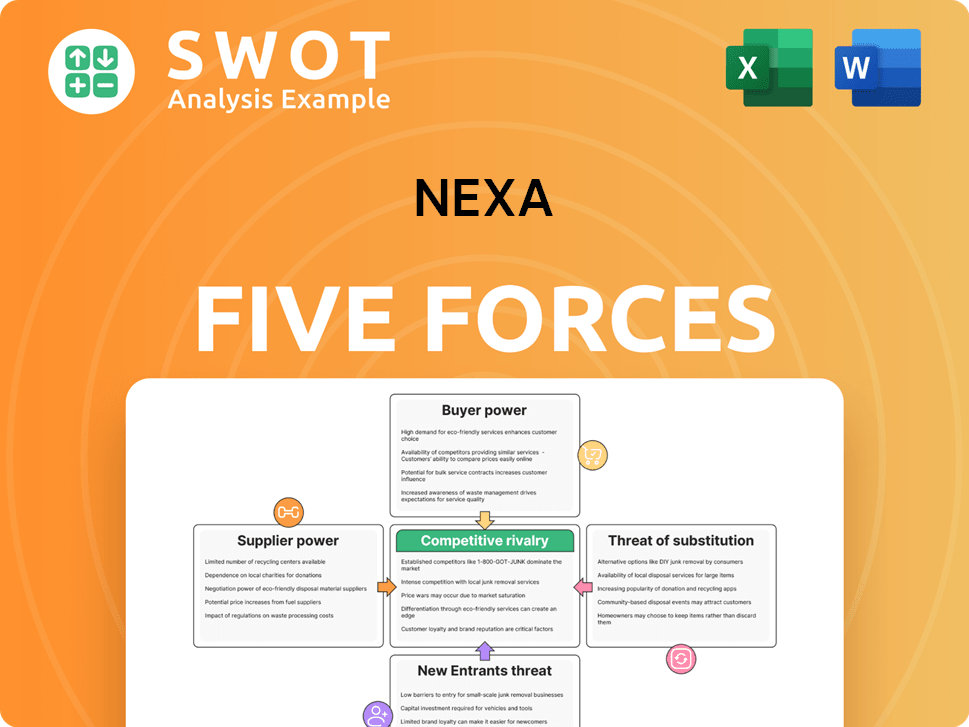

Nexa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nexa Company?

- What is Competitive Landscape of Nexa Company?

- What is Growth Strategy and Future Prospects of Nexa Company?

- How Does Nexa Company Work?

- What is Sales and Marketing Strategy of Nexa Company?

- What is Brief History of Nexa Company?

- Who Owns Nexa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.