Nexa Bundle

How Does Nexa Company Thrive in the Global Mining Arena?

Nexa Resources stands as a significant force in the global zinc market, but how does this company actually operate? From its extensive mining operations in Latin America to its integrated approach encompassing both mining and smelting, Nexa's structure is designed for efficiency. Understanding the inner workings of Nexa SWOT Analysis is crucial for anyone seeking to navigate the complexities of the base metals sector.

Delving into How Nexa works reveals a strategic focus on controlling its supply chain and maximizing its product quality. Nexa's business model, encompassing zinc and valuable byproducts like copper, lead, and silver, showcases a diversified approach to revenue generation. This examination of Nexa's services will provide valuable insights into its operational framework and its strategic positioning within the competitive global mining landscape, offering a comprehensive understanding of its success.

What Are the Key Operations Driving Nexa’s Success?

The core operations of the Nexa Company revolve around integrated mining and smelting processes. This Nexa business model focuses on extracting and processing polymetallic ores, primarily zinc, but also including copper, lead, and silver. The company's value proposition lies in efficiently converting raw materials into high-quality refined metals and concentrates, catering to diverse industries such as construction and automotive.

How Nexa works involves a vertically integrated approach, starting with the extraction of ore from underground mines in Peru and Brazil. These mines, including Cerro Lindo and Aripuanã, employ advanced techniques to ensure operational efficiency and safety. The extracted ore undergoes beneficiation at concentrator plants, producing valuable concentrates. Nexa then utilizes smelting capabilities to convert these concentrates into refined zinc metal, adding significant value.

The company's strategic advantage is its ability to control product quality and capture additional margins through its integrated model. Nexa’s robust supply chain and established logistics networks support the efficient transport of concentrates and finished products. Nexa’s core strength lies in its efficient extraction and processing of polymetallic ores, strategic location in resource-rich regions, and integrated mining-to-smelting model, ensuring a reliable supply of quality products for its customers. For more insights, consider reading about the Growth Strategy of Nexa.

Nexa's mining operations are crucial for its Nexa services. The company operates underground mines in Peru and Brazil, including Cerro Lindo, El Porvenir, and Vazante. The Aripuanã mine, which commenced commercial operations in 2023, is a significant addition. These mines use advanced technologies to maximize efficiency and safety in ore extraction.

After extraction, the ore undergoes beneficiation at concentrator plants to produce zinc, copper, and lead concentrates. Nexa’s smelting operations, such as the Cajamarquilla smelter in Peru and the Juiz de Fora smelter in Brazil, convert concentrates into high-grade refined zinc metal. This integrated approach enhances product quality and profitability.

Nexa has a robust supply chain that ensures efficient transport of concentrates and finished products. The company leverages established logistics networks within Latin America. Partnerships with various suppliers are essential for maintaining continuous operations and the delivery of Nexa's key products.

Nexa serves diverse customer segments, including industries such as construction, automotive, galvanizing, and chemicals. The company's core offerings, including refined zinc metal and zinc concentrates, are essential raw materials for these sectors. Nexa’s focus on quality and reliability makes it a key supplier in these markets.

Nexa's integrated mining-to-smelting model provides a competitive advantage. This approach allows the company to control product quality and capture additional margins. The strategic location of its operations in resource-rich regions further strengthens its position in the market.

- Integrated Operations: Nexa controls the entire process from mining to smelting.

- Strategic Locations: Operations are based in resource-rich regions.

- Quality Control: The integrated model ensures high-quality products.

- Customer Focus: Nexa serves key industries with essential raw materials.

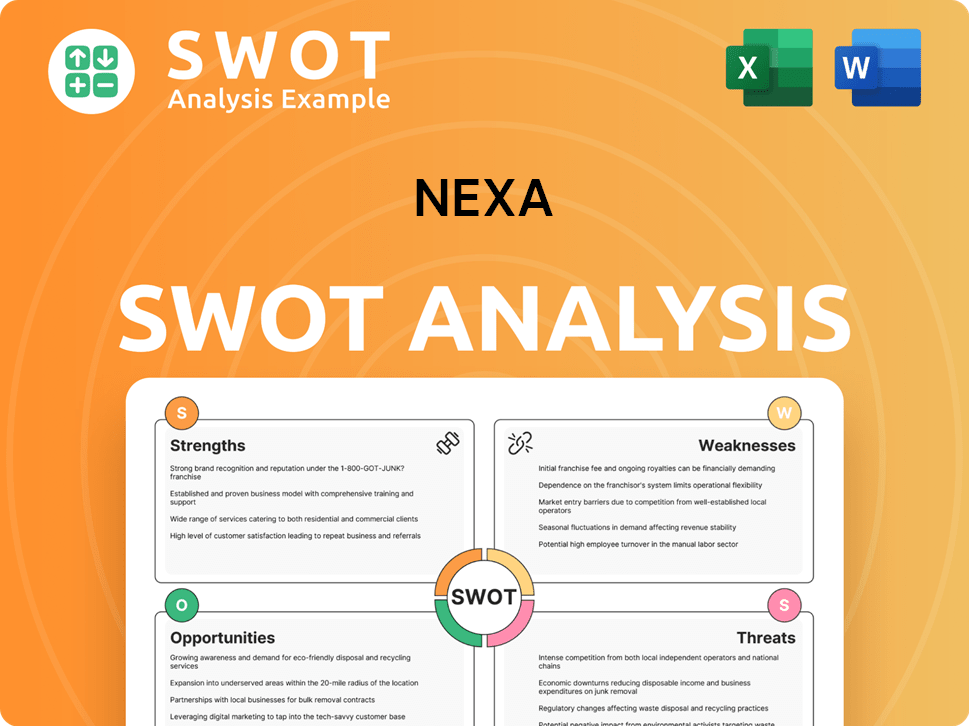

Nexa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nexa Make Money?

The Nexa Company primarily generates revenue through the sale of mined and smelted products, with zinc being the most significant contributor. Understanding how the Nexa business model works involves recognizing its reliance on commodity markets and its integrated operations.

Nexa's revenue streams are diversified across various metals, including refined zinc, zinc concentrates, copper, lead, and silver. These are often sold as byproducts. The company's monetization strategies are directly tied to global commodity prices, which are influenced by supply and demand, economic growth, and geopolitical factors.

In 2023, Nexa reported net revenue of $2,903 million, showcasing the scale of its operations. The company's integrated model allows it to monetize both mining and smelting outputs, offering flexibility in its sales approach. The ramp-up of the Aripuanã mine in Brazil, which started commercial operations in Q4 2023, is expected to increase future revenue streams.

Nexa's monetization strategies revolve around the global commodity markets for base metals. Sales are influenced by international metal prices, global supply and demand, economic growth, and geopolitical factors. Nexa sells its products directly to industrial customers, traders, and through long-term contracts. This approach allows Nexa to adapt to market fluctuations.

- Zinc sales consistently represent the largest portion of the company's top line.

- Changes in revenue sources are primarily driven by commodity price fluctuations, production volumes, and asset optimization.

- The Aripuanã mine's ramp-up is expected to contribute significantly to future revenue.

- Nexa's integrated model enhances its flexibility in sales.

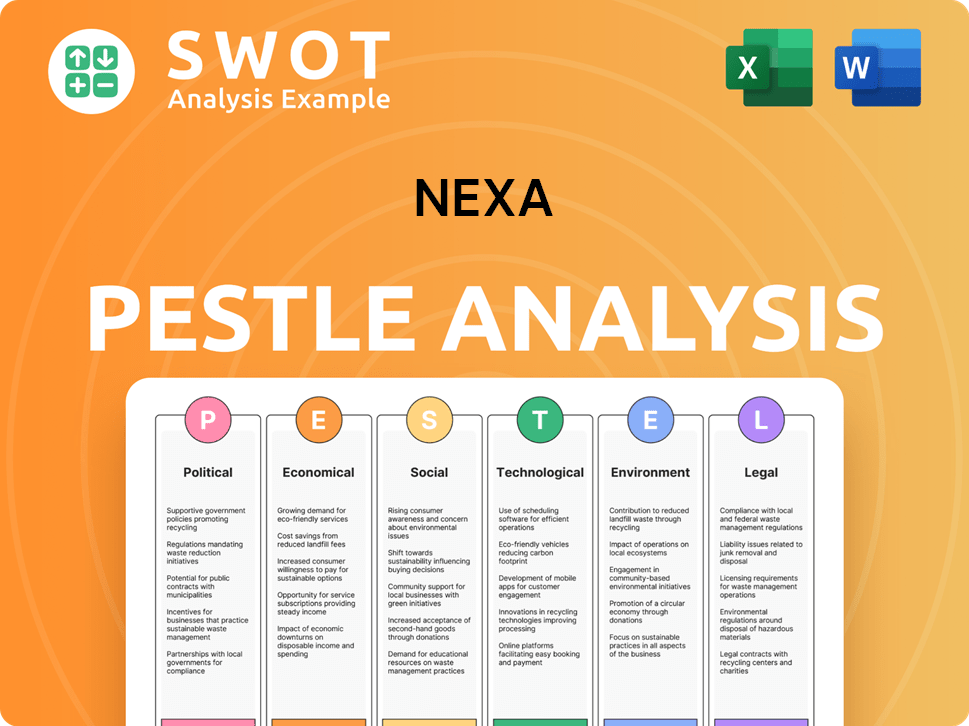

Nexa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Nexa’s Business Model?

Understanding how the Nexa Company works involves examining its key milestones, strategic moves, and competitive advantages. The company's journey is marked by significant achievements and strategic decisions that have shaped its operational and financial landscape. These elements are crucial for grasping the intricacies of the Nexa business model and its position in the market.

A pivotal strategic move for Nexa was the commencement of commercial operations at the Aripuanã mine in Brazil during the fourth quarter of 2023. This initiative is poised to substantially increase Nexa's zinc production capabilities. The project represents a considerable investment and highlights the company's dedication to growth and optimizing its asset portfolio. Nexa's focus on operational efficiency and cost control across its mining and smelting units has also been a key strategic element, especially given the cyclical nature of commodity markets.

Nexa has faced operational challenges, including fluctuating commodity prices and regulatory complexities in Latin America. The company's responses have often involved optimizing existing assets, investing in exploration, and adopting advanced technologies to improve productivity and safety. Nexa's integrated mining and smelting operations provide greater control over the value chain and product quality, offering a competitive edge. Its strategic location in Latin America grants access to significant mineral deposits, and the company benefits from economies of scale due to its large-scale operations.

The commencement of commercial operations at the Aripuanã mine in Brazil in Q4 2023 is a major milestone, significantly boosting zinc production capacity. Nexa's focus on operational efficiency and cost control is essential for navigating the cyclical commodity market. The company has consistently invested in exploration to expand reserves and adopted advanced technologies.

Strategic moves include the Aripuanã mine project, which represents a substantial investment in growth. Nexa actively optimizes its asset portfolio and focuses on operational efficiency across its mining and smelting units. The company adapts to new trends, such as the increasing demand for sustainable mining practices and the adoption of digital technologies.

Nexa's integrated mining and smelting operations provide greater control over the value chain and product quality. Its strategic location in Latin America offers access to significant mineral deposits. The company benefits from economies of scale due to its large-scale operations, enhancing its competitive advantage.

- Integrated operations enhance control and quality.

- Strategic location in Latin America provides access to resources.

- Economies of scale contribute to cost efficiency.

- Focus on sustainable practices and digital technologies.

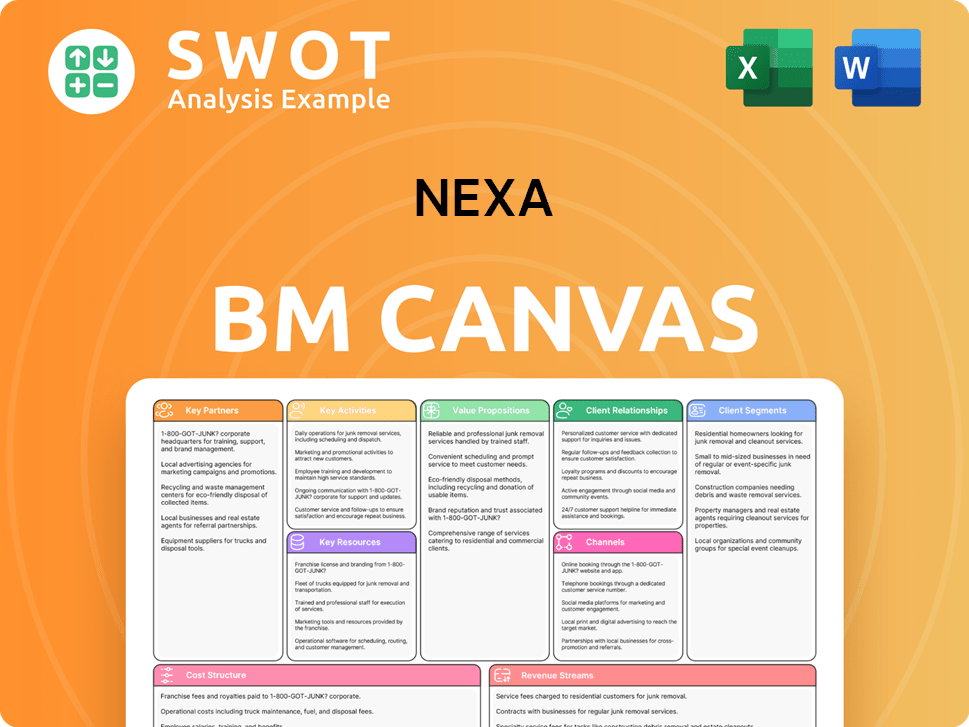

Nexa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Nexa Positioning Itself for Continued Success?

Understanding the operational dynamics of the Nexa Company involves examining its industry standing, the inherent risks it faces, and its future trajectory. Nexa Resources holds a prominent position in the global zinc market, particularly in Latin America. The company's integrated approach, combining mining and smelting, sets it apart from many competitors. Its success is tied to its ability to consistently provide quality products and maintain strong relationships with industrial clients.

However, the Nexa business model is exposed to several risks. Commodity price volatility directly impacts revenue. Regulatory changes, especially concerning environmental rules and mining permits, can affect operations. Furthermore, the emergence of new competitors or technological shifts in metal production poses challenges. Geopolitical instability and the need for a 'social license to operate' in mining regions are also ongoing considerations.

Nexa is a major player in the zinc market, especially in Latin America. Its integrated model, combining mining and smelting, is a key differentiator. Customer loyalty is built on consistent supply and quality products.

Commodity price fluctuations directly impact profitability. Regulatory changes, particularly environmental regulations, pose operational risks. Geopolitical instability and social license issues are constant concerns.

Nexa focuses on optimizing existing assets and exploration for new deposits. The company is investing in sustainable practices and exploring digitalization. Leadership emphasizes operational excellence and shareholder value.

The company is focused on efficient production and disciplined capital allocation. Nexa may explore growth opportunities within its core and byproduct metals. Risk management is a critical component of its strategy.

How Nexa works involves a strategic focus on operational efficiency and responsible mining practices. The company aims to expand its ability to generate revenue through efficient production and strategic investments. Nexa’s innovation roadmap likely includes digitalization, energy efficiency, and reducing its environmental impact.

- Efficient production and cost management are key.

- Exploration to extend mine life and discover new deposits.

- Investment in sustainable practices and technologies.

- Focus on delivering value to shareholders.

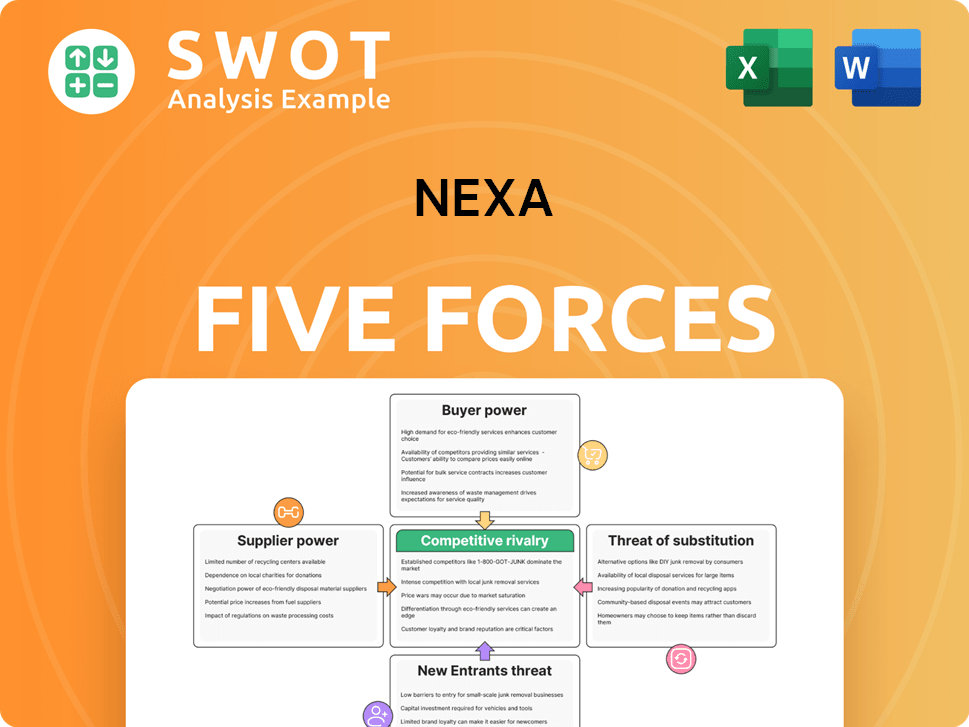

Nexa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nexa Company?

- What is Competitive Landscape of Nexa Company?

- What is Growth Strategy and Future Prospects of Nexa Company?

- What is Sales and Marketing Strategy of Nexa Company?

- What is Brief History of Nexa Company?

- Who Owns Nexa Company?

- What is Customer Demographics and Target Market of Nexa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.