Nexa Bundle

How Does Nexa Navigate the Zinc Mining Arena?

The global zinc market is a dynamic battleground, and Nexa Resources is a key player. With fluctuating prices and evolving demands, understanding Nexa's position is crucial for investors and industry watchers alike. This analysis dives deep into the Nexa SWOT Analysis to uncover its strengths and weaknesses.

This exploration of the Nexa competitive landscape will provide a comprehensive Nexa market analysis, dissecting its key competitors and evaluating its competitive advantages. We'll examine Nexa's business strategy, market share analysis, and how it differentiates itself within the Nexa industry. Furthermore, we will discuss Nexa's financial performance and market trends, providing insights into its future growth prospects and challenges, including competitive threats and opportunities.

Where Does Nexa’ Stand in the Current Market?

Nexa Resources holds a prominent market position as a leading polymetallic producer. The company's core operations involve the mining and smelting of zinc, copper, lead, and silver, with a significant presence in Latin America. In 2024, Nexa demonstrated its strength in the Growth Strategy of Nexa, with robust production and sales figures.

The company's value proposition centers on providing essential metals for key industries, including galvanization, automotive, and construction. Nexa's strategic focus on optimizing its asset portfolio and disciplined capital allocation further strengthens its market position. This approach has led to improved financial health and operational efficiency.

Nexa was among the top five global producers of mined zinc and metallic zinc in 2024. Zinc production reached 327 kilotons, while copper production was 36 kilotons. Lead and silver production were 69 kilotons and 12 million ounces, respectively. Metal sales for 2024 totaled 591 kilotons, driven by higher production volumes.

Nexa's operations are primarily concentrated in Latin America. The company operates five long-life mines in Peru and Brazil. It also runs three smelters, two in Brazil and one in Peru. The Cajamarquilla smelter is the largest in the Americas. These strategic locations support the company’s competitive advantage in the Nexa competitive landscape.

Net revenues for 2024 were US$2,766 million, an 8% increase year-over-year. Adjusted EBITDA reached US$714 million, a 76% increase from the previous year. The company’s net leverage ratio improved to 1.7x by the end of 2024, down from 3.3x at the end of 2023. This strong financial performance supports the company's business strategy.

In Q1 2025, Nexa reported a net income of US$29 million, a significant turnaround from losses in Q1 and Q4 2024. Net revenues in Q1 2025 were US$627 million, up 8% year-over-year. These results signal a positive trajectory for the company's future growth prospects and challenges.

Nexa's strategic shifts include optimizing its asset portfolio and disciplined capital allocation, as evidenced by the divestiture of the Morro Agudo Complex in April 2024. The company's focus on operational efficiency and financial health positions it well within the Nexa market analysis.

- Strong position in Peru and Brazil due to strategic mining and smelting locations.

- Diverse customer segments, primarily those reliant on zinc for galvanization, automotive, and construction industries.

- Positive financial indicators, including increased revenues and EBITDA, reflect the company's resilience.

- Focus on reducing debt and improving financial ratios to ensure long-term sustainability.

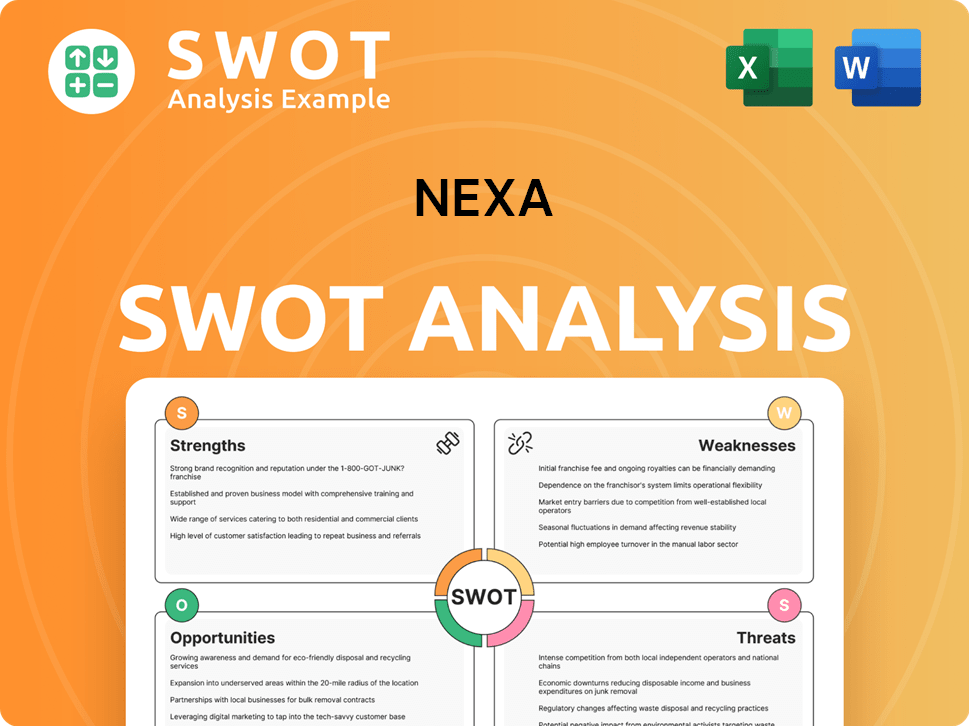

Nexa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Nexa?

The Nexa competitive landscape is shaped by a variety of mining companies that compete in the zinc market. These competitors range from large, diversified mining corporations to specialized zinc producers. Understanding these competitors is crucial for a comprehensive Nexa market analysis.

Nexa's competitors employ different strategies, including geographic diversification, operational efficiency, and strategic partnerships. The dynamics within the Nexa industry are constantly evolving, influenced by market demand, production costs, and technological advancements. This competitive environment directly impacts Nexa's business strategy and its ability to maintain or grow its market share.

Glencore is a major competitor with a global presence in the mining sector. In Q1 2025, Glencore's self-produced zinc production reached 213,600 metric tons. The company's 2025 production guidance targets between 930,000 and 990,000 metric tons for the full year.

Teck Resources is another significant player in the zinc market. The Red Dog mine in Alaska produced 555,600 metric tons of zinc in 2024. Teck's total zinc production guidance for 2024 was between 565,000 and 630,000 metric tons.

Vedanta also holds a significant position in the zinc market. The company's total zinc concentrate production in Q1 2025 was 360,000 metric tons.

Nyrstar is a notable competitor in the zinc market. While specific production figures for recent periods are not detailed in the provided information, Nyrstar's presence indicates a competitive landscape.

Buenaventura's zinc mine production in Q1 2025 was 5,800 metric tons, showing a year-over-year decrease.

Lundin's zinc production in Q1 2025 was 48,900 metric tons.

The competitive landscape is further shaped by strategic decisions and market conditions. For example, Teck is looking to sell its zinc to Asia to avoid U.S. tariffs. The global zinc market faced a deficit of 164,000 metric tons in 2024.

- New Entrants: Ivanhoe Mines' Kipushi mine is expected to produce 278,000 tons per year of zinc.

- Market Trends: Production reductions due to weak prices and high inflation impact the market.

- Strategic Adaptations: Companies are adjusting distribution strategies in response to trade barriers.

- Mergers and Alliances: While not detailed, these consistently reshape the competitive dynamics.

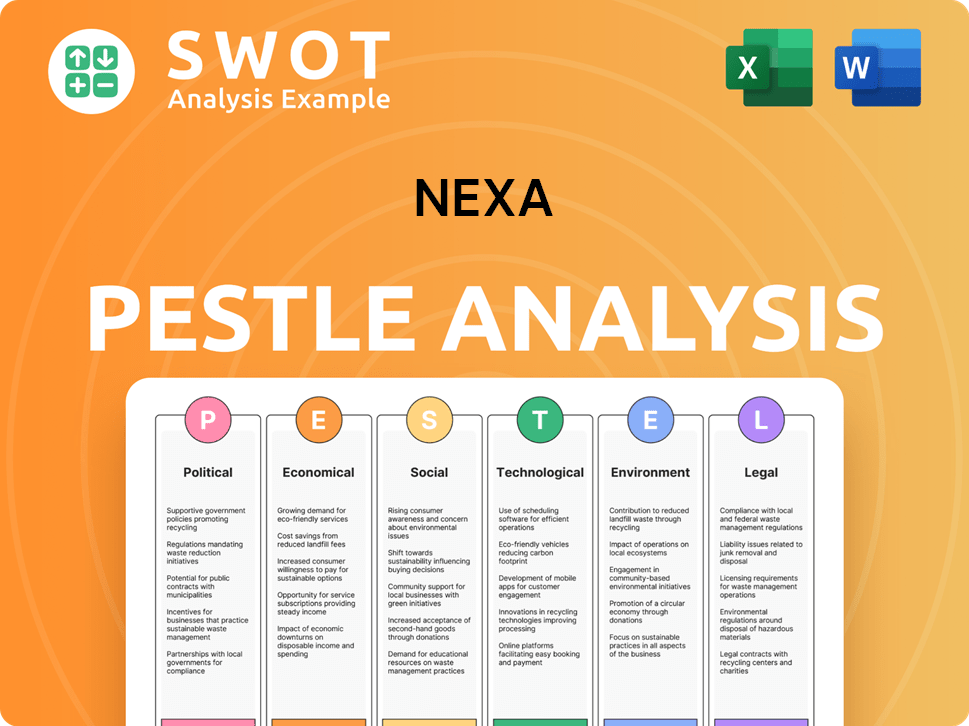

Nexa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Nexa a Competitive Edge Over Its Rivals?

The Owners & Shareholders of Nexa benefit from a company strategically positioned within the competitive landscape. Nexa's competitive advantages stem from its technological innovations, robust asset portfolio, and disciplined financial management. These elements collectively enhance its market position, allowing it to navigate industry challenges effectively.

Nexa's strategic moves, particularly in technology and sustainability, are designed to bolster its competitive edge. The company's focus on operational efficiencies and exploration potential demonstrates its commitment to long-term value creation. Financial health, as evidenced by its recent bond issuance, provides the flexibility needed to capitalize on opportunities and mitigate risks.

The company's ability to consistently deliver strong financial results, such as achieving its second-highest annual Adjusted EBITDA of US$714 million in 2024, underscores its operational excellence. This performance, coupled with strategic investments, positions Nexa favorably within the Nexa industry.

Nexa leverages proprietary technologies and operational efficiencies to reduce costs and align with global decarbonization demands. In December 2024, the company was recognized for its application of Digital Twin technology and predictive maintenance at the Cerro Lindo mine, leading to significant operational improvements. The introduction of hybrid loaders in January 2025 further supports its decarbonization strategy.

Nexa operates five long-life mines and three smelters in Latin America, including Cajamarquilla, the largest smelter in the Americas. Its 2024 Year-End Mineral Reserves and Resources update highlighted successful expansion and replacement of zinc reserves through near-mine exploration and infill drilling, reinforcing asset sustainability. Proven and Probable Mineral Reserves were estimated at 110.3 million tonnes as of December 31, 2024.

Nexa's financial discipline is a key advantage, with its second-highest annual Adjusted EBITDA of US$714 million in 2024. The company generated positive consolidated cash flow, reducing its net leverage ratio to 1.7x. This financial health enables strategic investments, such as the US$500 million bond issuance in April 2025, strengthening financial flexibility.

Nexa is reengineering 12 zinc oxide roasters to run on bio-oil, an industry first, projected to cut CO₂ emissions by 6,440 tons annually starting in 2025. This initiative, along with the adoption of hybrid loaders, demonstrates a strong commitment to sustainability, which enhances its market standing and aligns with global trends.

Nexa's competitive advantages include its proprietary technologies, strategic asset portfolio, and financial discipline. These factors contribute to its operational efficiency, exploration potential, and financial flexibility, enabling the company to maintain a strong market position.

- Technological innovation and operational efficiency, such as the use of Digital Twin technology.

- A strategic asset portfolio with long-life mines and smelters in Latin America.

- Financial health, demonstrated by positive cash flow and a reduced net leverage ratio.

- Sustainability initiatives, including the use of bio-oil and hybrid loaders, to reduce emissions.

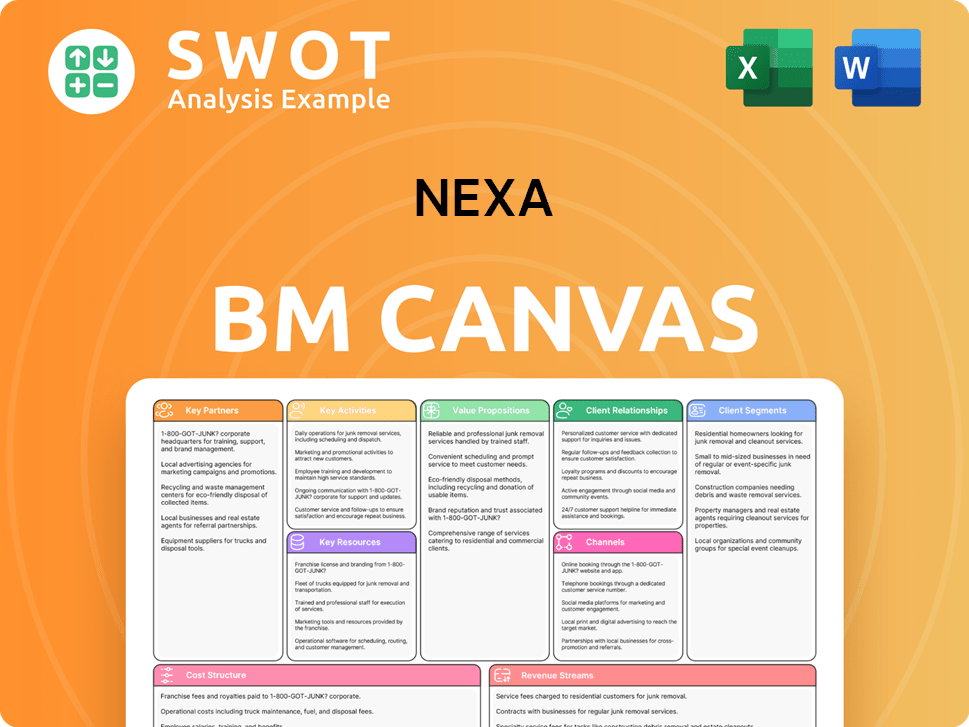

Nexa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Nexa’s Competitive Landscape?

The competitive landscape for Nexa Resources is significantly influenced by industry trends, future challenges, and opportunities. Understanding these elements is crucial for assessing Nexa's strategic position and potential for growth. A detailed Growth Strategy of Nexa analysis provides further insights into the company's approach to navigating these dynamics.

The mining industry is undergoing significant transformation, driven by technological advancements, evolving regulatory requirements, and global economic shifts. These factors present both challenges and opportunities for Nexa, shaping its strategic decisions and future prospects. Nexa's ability to adapt to these changes will be critical for maintaining a competitive edge in the market.

Technological advancements such as autonomous drilling systems, AI-powered mineral exploration, and advanced sensor technologies are revolutionizing mining. The sustainable mining market is projected to reach US$32.5 billion by 2027, driven by consumer preferences and regulatory changes. Global economic shifts and fluctuating commodity prices also play a key role in the industry.

Potential new U.S. tariffs and ongoing supply chain disruptions pose significant risks. New market entrants and evolving business models, especially those leveraging advanced technologies, could challenge Nexa's position. The zinc market experienced a deficit of 164,000 metric tons in 2024, which might impact the market.

Emerging markets, particularly India with its infrastructure development, offer growth prospects. Product innovations, such as new zinc-based products, present new opportunities. Nexa is investing in exploration and open to strategic partnerships in digital mining technologies and sustainable extraction methods.

Nexa is leveraging Digital Twin technology at Cerro Lindo to improve efficiency. The company is committed to decarbonization, reengineering roasters, and introducing hybrid loaders. Nexa is focusing on operational discipline, financial prudence, and deleveraging for sustainable growth in 2025.

The zinc market is projected to increase by US$4.46 billion at a CAGR of 2.8% between 2024 and 2029. The World Bank forecasts a surplus of approximately 350,000 metric tons in 2025, potentially keeping average prices around US$2,550/metric ton. Global zinc mine output is expected to grow by 4.2% to 12.4 million metric tons in 2025.

- US$75-90 million is estimated for Nexa's exploration budget for 2024-2025.

- Demand for galvanized steel is expected to grow by 2.1% in 2025.

- Zinc market experienced a deficit of 164,000 metric tons in 2024.

- India's infrastructure development is projected to increase zinc demand by 12%.

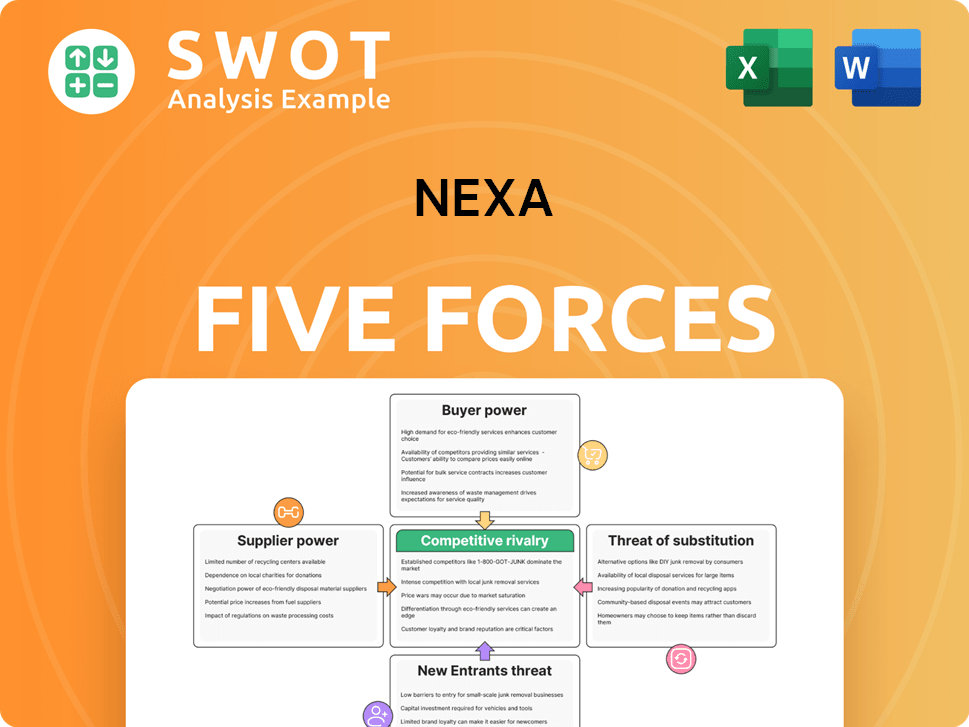

Nexa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nexa Company?

- What is Growth Strategy and Future Prospects of Nexa Company?

- How Does Nexa Company Work?

- What is Sales and Marketing Strategy of Nexa Company?

- What is Brief History of Nexa Company?

- Who Owns Nexa Company?

- What is Customer Demographics and Target Market of Nexa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.