Nexa Bundle

Who Really Owns Nexa Resources?

The ownership structure of a company is a cornerstone of its strategic direction and operational accountability. For Nexa Resources, a global zinc mining powerhouse, understanding its ownership is key to grasping its future. From its roots as Companhia Mineira de Metais to its current standing, Nexa's ownership evolution tells a compelling story of growth and adaptation in the mining sector.

This article will explore the Nexa SWOT Analysis and delve into the intricate details of Nexa's ownership, from its founders to its current Nexa shareholders. We'll examine the influence of its board of directors and the impact of its Nexa parent company on its trajectory. Discover who the major Nexa investors are and how their stakes shape the future of this leading zinc producer, including details on the Nexa company ownership structure and the Nexa company history and ownership.

Who Founded Nexa?

The story of Nexa Resources, formerly known as Companhia Mineira de Metais, began in 1956 with a focused ownership structure, typical for its time. The early ownership details are not fully available in precise percentages from the start. However, it's known that the company's initial ownership was deeply rooted in Brazilian industrial groups.

The Votorantim Group, a major Brazilian conglomerate, played a key role as a foundational and enduring stakeholder. From the beginning, Votorantim provided the essential capital and strategic direction needed for the mining operations. This reflected a clear vision to build a vertically integrated metals company.

During its initial phase, the ownership remained largely within the private domain. Capital injections primarily came from the founding industrial group, rather than from external angel investors or friends and family. Early agreements likely focused on long-term commitment and reinvestment of profits back into the business. This was to fund exploration and the expansion of its mining and smelting capabilities.

The initial ownership of the company was concentrated within Brazilian industrial groups.

The Votorantim Group was a key stakeholder, providing capital and strategic direction.

Ownership primarily remained private, with capital from the founding industrial group.

The Votorantim Group maintained a controlling interest to align with its broader industrial portfolio.

Early agreements likely focused on long-term commitment and reinvestment of profits.

There is no widely reported information detailing initial ownership disputes or significant founder buyouts during the company's formative years.

Understanding the Nexa ownership structure is crucial for investors and stakeholders alike. The Votorantim Group's influence has been pivotal since the company's inception. For details on Nexa shareholders and the Nexa parent company, it's important to review the company's financial reports and public filings. The Nexa company ownership structure reflects a long-term vision.

- The Votorantim Group's role in Nexa company history is significant.

- Details on Nexa investors can be found in the company's annual reports.

- The Nexa company ownership details are available through official filings.

- For insights into Who owns Nexa, consult financial statements and public records.

Nexa SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Nexa’s Ownership Changed Over Time?

The evolution of Nexa's brief history began with its Initial Public Offering (IPO) on October 27, 2017. This marked a significant shift in the Nexa ownership structure, transforming it from a privately held entity to a publicly traded company. The IPO, which listed shares on both the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the ticker symbol 'NEXA', broadened the shareholder base and introduced new categories of investors. The initial market capitalization at the time of the IPO was approximately $2.6 billion.

Following the IPO, the Nexa company ownership structure diversified to include institutional investors, mutual funds, index funds, and individual insiders, while the influence of its founding entity remained significant. This transition enhanced corporate governance through increased regulatory scrutiny and demands for greater financial transparency, affecting the Nexa shareholders.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | October 27, 2017 | Transitioned from private to public ownership; broadened shareholder base. |

| Post-IPO Ownership Evolution | Ongoing | Inclusion of institutional investors, mutual funds, and index funds. |

| Votorantim S.A.'s Continued Control | Early 2025 | Maintains a controlling stake, ensuring strategic influence. |

As of early 2025, the Nexa parent company, Votorantim S.A., through its subsidiary Votorantim Group, remains the controlling shareholder of Nexa Resources. Votorantim S.A. holds approximately 64.9% of the total share capital and voting rights. Major Nexa investors include institutional holders like BlackRock, Inc., The Vanguard Group, and Dimensional Fund Advisors, as of the end of 2024. The presence of these large institutional investors has introduced a focus on environmental, social, and governance (ESG) factors, influencing company strategy towards sustainable mining practices and enhanced transparency.

The Nexa ownership structure has evolved significantly since its IPO in 2017, with a mix of institutional and individual investors. Votorantim S.A. remains the primary stakeholder, ensuring strategic control. Understanding the Nexa company ownership structure is crucial for investors and stakeholders.

- The IPO in 2017 was a pivotal moment.

- Votorantim S.A. maintains a controlling interest.

- Institutional investors play a significant role.

- ESG factors influence company strategy.

Nexa PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Nexa’s Board?

The Board of Directors of Nexa Resources is pivotal in the company's governance, reflecting its ownership structure and strategic direction. As of early 2025, the board includes representatives from the major shareholder, independent directors, and executive management. The Votorantim Group, as the controlling shareholder, holds a significant presence on the board, ensuring alignment with its strategic objectives. For instance, board members such as João Henrique de Paula Campos, who serves as the Chairman, often have deep ties to Votorantim S.A.

This representation ensures that the controlling shareholder's interests are well-represented in key decision-making processes. The presence of independent directors is also crucial for providing oversight and ensuring good corporate governance practices, balancing the interests of the controlling shareholder with those of public investors. Information about the board's composition and changes can be found in the company's filings with regulatory bodies, such as the SEC in the United States or similar authorities in other jurisdictions where Nexa Resources operates.

| Board Member | Role | Affiliation |

|---|---|---|

| João Henrique de Paula Campos | Chairman | Votorantim S.A. |

| Ricardo Carvalho | CEO | Nexa Resources |

| Independent Director | Independent Director | Independent |

Nexa Resources operates with a one-share-one-vote structure for its common shares. However, the substantial ownership stake of Votorantim S.A., holding approximately 64.9% of the total share capital and voting rights, grants it de facto control over most resolutions requiring shareholder approval. This majority stake effectively provides it with significant influence over the election of directors, major corporate transactions, and amendments to the company's bylaws. You can learn more about the company's financial performance and how it generates revenue by reading Revenue Streams & Business Model of Nexa.

Votorantim S.A. is the major shareholder, controlling a significant portion of Nexa's voting rights.

- The board includes representatives from the major shareholder, independent directors, and executive management.

- Nexa operates with a one-share-one-vote structure.

- Votorantim's majority stake provides significant influence over key decisions.

- Independent directors ensure good corporate governance.

Nexa Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Nexa’s Ownership Landscape?

Over the past few years, Nexa Resources has focused on operational improvements and strategic investments. The company's ownership structure has remained relatively stable, with Votorantim S.A. maintaining a controlling stake. This stability reflects a focus on long-term value creation through organic growth and operational efficiencies, such as the Aripuanã project in Brazil, which began commercial production in 2023.

The mining sector has seen an increase in institutional ownership. For Nexa, this trend has meant a rise in the percentage of shares held by large institutional investors like BlackRock and The Vanguard Group. This shift has led to greater emphasis on ESG performance and corporate governance. Nexa's focus on its core assets and sustainable practices indicates its response to these industry-wide trends. The company’s commitment to maximizing value from its Latin American zinc assets remains a key strategic focus.

| Shareholder | Approximate Ownership | Notes |

|---|---|---|

| Votorantim S.A. | Majority | Controlling Stake |

| BlackRock | Significant | Institutional Investor |

| The Vanguard Group | Significant | Institutional Investor |

Founder dilution has been less pronounced for Nexa due to Votorantim's continued majority ownership. Any future capital expenditures could lead to some level of dilution for existing Nexa shareholders. There have been no recent public announcements regarding privatization or significant changes in the controlling stake held by Votorantim S.A. The company's strategy appears to be centered on sustainable growth within its current ownership framework.

The primary Nexa shareholders include Votorantim S.A., along with significant holdings by institutional investors such as BlackRock and The Vanguard Group. These shareholders influence company strategy and governance.

Votorantim S.A. is the Nexa parent company, holding a controlling stake in the business. This structure provides stability and supports long-term strategic planning.

Nexa investors include both institutional and individual shareholders. Institutional investors, like BlackRock and Vanguard, play a key role in influencing company policies and market performance.

The Nexa company ownership structure is primarily controlled by Votorantim S.A., with significant participation from institutional investors. This structure supports long-term strategic planning.

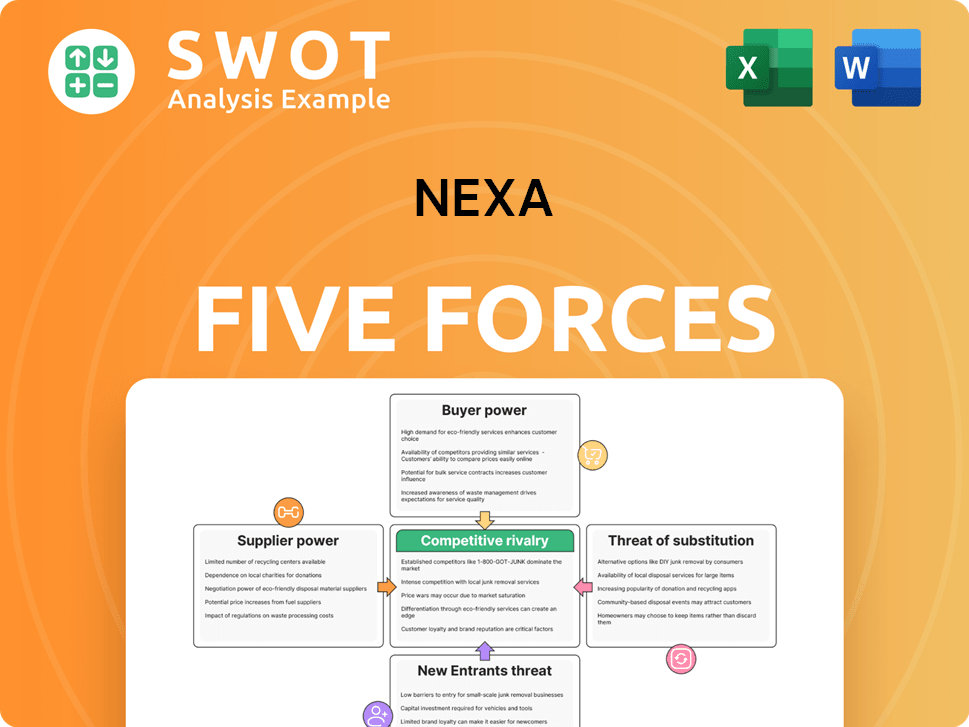

Nexa Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nexa Company?

- What is Competitive Landscape of Nexa Company?

- What is Growth Strategy and Future Prospects of Nexa Company?

- How Does Nexa Company Work?

- What is Sales and Marketing Strategy of Nexa Company?

- What is Brief History of Nexa Company?

- What is Customer Demographics and Target Market of Nexa Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.