The Kraft Group Bundle

How Did Robert Kraft Build a Business Empire?

From humble beginnings to a diversified powerhouse, the The Kraft Group SWOT Analysis reveals a fascinating journey. Founded by Robert Kraft, this conglomerate has significantly impacted multiple industries. Discover the story of how a single vision transformed into a multifaceted enterprise, encompassing sports, real estate, and more.

Delving into the Kraft Company history unveils a tale of strategic acquisitions and visionary leadership. Robert Kraft's commitment to innovation and diversification has been instrumental in the Kraft Group's success, transforming it into a major player in the business world. Learn about the key milestones and the evolution of this remarkable organization, including its significant role as the New England Patriots owner and its broad Sports and business interests.

What is the The Kraft Group Founding Story?

The story of the Kraft Group begins with Robert Kraft's early entrepreneurial endeavors and strategic acquisitions. Officially established as a holding company in 1998, the Kraft Group manages a diverse portfolio of businesses. The foundation was laid much earlier, starting in 1965 when Robert Kraft entered the business world.

Robert Kraft's journey began with his involvement in the packaging industry. He joined Rand-Whitney Group, a packaging company based in Worcester, which was owned by his father-in-law, Jacob Hiatt. By 1968, Kraft had taken control of Rand-Whitney through a leveraged buyout, a position he continues to hold as chairman. This marked the initial steps towards building what would become a significant business empire.

In 1972, Robert Kraft expanded his ventures by founding International Forest Products, a global trader of paper commodities. These two companies, Rand-Whitney and International Forest Products, have become major players in the paper and packaging industry. The formation of the Kraft Group was driven by a vision to create a diversified and financially robust group of businesses. His educational background, including a B.A. from Columbia University and an MBA from Harvard Business School, provided him with the necessary business acumen.

Robert Kraft's business approach was characterized by calculated risks and a focus on long-term relationships. This strategy has been a cornerstone of the Kraft Group's success.

- In 1968, Robert Kraft gained control of Rand-Whitney Group through a leveraged buyout.

- The founding of International Forest Products in 1972 expanded the group's reach into global paper trading.

- The Kraft Group's strategy emphasizes building mutually beneficial, long-term relationships.

- The Growth Strategy of The Kraft Group highlights the company's diversified investments.

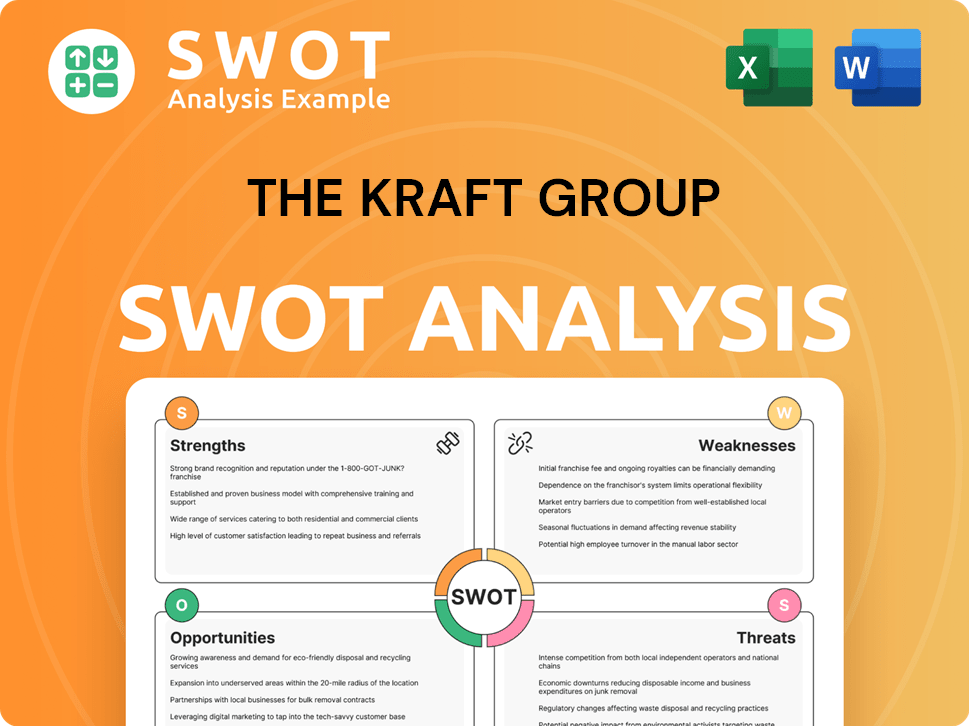

The Kraft Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of The Kraft Group?

The early growth of the Kraft Group, under Robert Kraft, marked a strategic shift beyond its initial paper and packaging business. This expansion involved significant investments and diversification into new sectors. A pivotal moment was the acquisition of the New England Patriots, which transformed the company's trajectory in sports and entertainment.

In 1994, Robert Kraft acquired the New England Patriots for $172 million, a record at the time for an NFL franchise. This bold move proved highly successful, with the franchise's value soaring to over $5 billion by 2024. The Patriots experienced a complete sell-out of their games in the 1994 season, and every home game since has been sold out.

The Kraft Group further expanded its sports portfolio by founding the New England Revolution, a Major League Soccer (MLS) team, in 1996. The company also developed Gillette Stadium, a $325 million facility opened in 2002, and Patriot Place, a $350 million lifestyle and entertainment center. These developments solidified the company's presence in the sports and entertainment industry.

The Kraft Group demonstrated its commitment to sustainability in its paper and packaging operations. They constructed the world's first paper mill capable of producing linerboard from 100% post-consumer waste fiber and water. This initiative highlighted the company's dedication to environmental responsibility during its growth phase.

The early years of the Kraft Group were characterized by a willingness to take risks and a strategic vision. This approach led to a diversified portfolio, including the acquisition of Rand-Whitney in 1968 and the founding of International Forest Products in 1972. These early ventures laid the groundwork for the company's future successes.

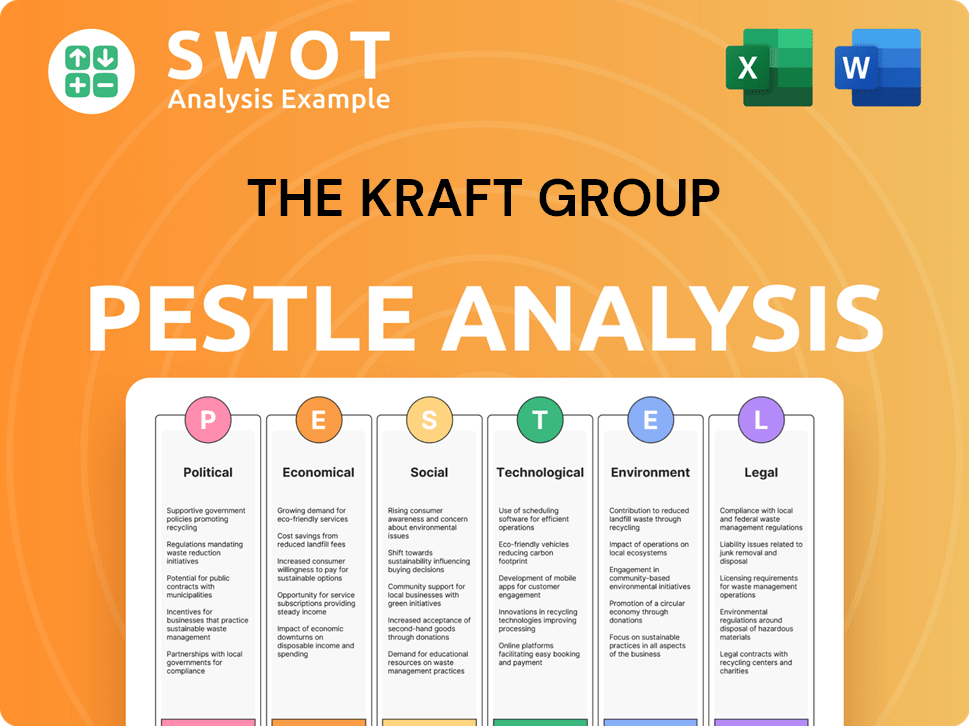

The Kraft Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in The Kraft Group history?

The Kraft Group, under the leadership of Robert Kraft, has achieved significant milestones across various sectors. From sports to real estate and paper manufacturing, the company's journey reflects strategic investments and a commitment to growth. A key element of the

| Year | Milestone |

|---|---|

| 1994 | Robert Kraft acquired the New England Patriots, transforming the team into an NFL powerhouse. |

| 1996 | The Kraft Group founded the New England Revolution, expanding its sports portfolio. |

| 2002 | Gillette Stadium, a state-of-the-art sports venue, was developed, enhancing the fan experience. |

| 2007-2008 | Patriot Place, a mixed-use retail and entertainment complex, was established, showcasing real estate innovation. |

| 2017 | The company acquired the esports-based Boston Uprising, diversifying its sports investments. |

The

The company pioneered sustainable practices in its paper and packaging sector, including a paper mill utilizing 100% post-consumer waste fiber. This commitment reflects a broader emphasis on environmental responsibility and innovation.

The 'Closing the Loop' program for recycling old corrugated cases highlights the company's dedication to reducing waste. This initiative supports a circular economy approach within its operations.

Investment in cutting-edge IT infrastructure and AI-enabled applications for Gillette Stadium and the New England Patriots' new training facility in 2025. This investment is a key example of adapting to technological advancements.

Despite its successes, the

The company has had to navigate market downturns and economic fluctuations, which requires agility and strategic planning across its various business units. Competition in the sports and entertainment industries is also a constant challenge.

The

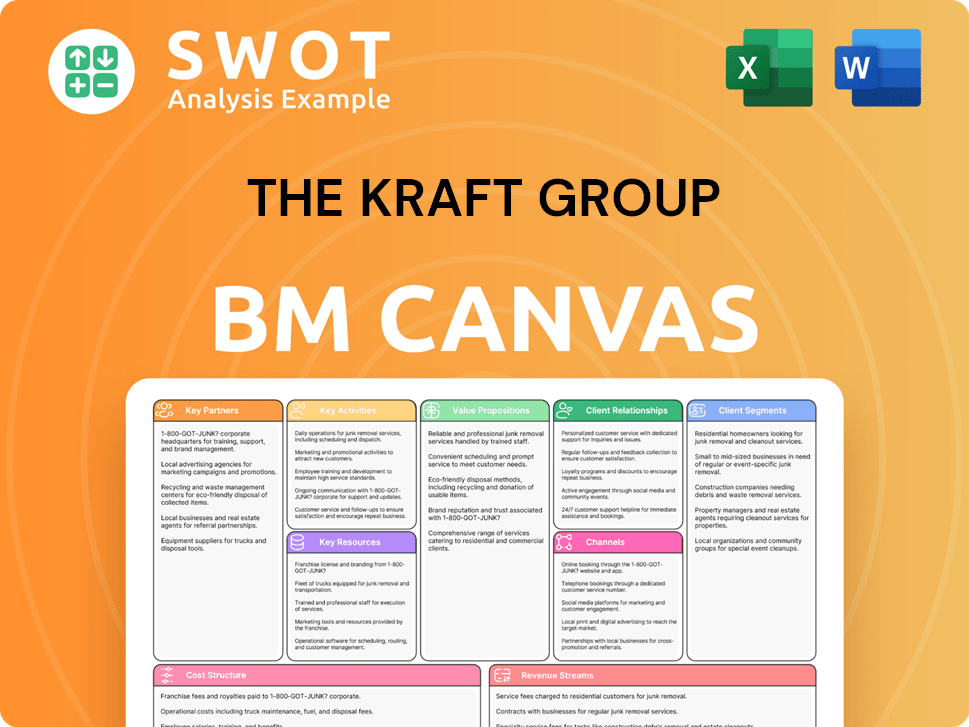

The Kraft Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for The Kraft Group?

The Kraft Group's history is a story of strategic growth and diversification, starting with Robert Kraft's early ventures in packaging and expanding into sports, real estate, and technology. The company's evolution reflects a keen ability to adapt to market trends and capitalize on opportunities, building a diverse portfolio of businesses.

| Year | Key Event |

|---|---|

| 1965 | Robert Kraft began his career by joining Rand-Whitney Group, a packaging company. |

| 1968 | Robert Kraft gained control of Rand-Whitney Group through a leveraged buyout. |

| 1972 | Robert Kraft founded International Forest Products. |

| 1994 | Robert Kraft acquired the New England Patriots for $172 million, marking a significant entry into sports. |

| 1996 | The New England Revolution (MLS team) was founded by Robert Kraft. |

| 1998 | The Kraft Group was officially founded as a holding company for Robert Kraft's various interests. |

| 2002 | Gillette Stadium, privately financed by Kraft, opened, enhancing the fan experience. |

| 2007-2008 | Patriot Place, a lifestyle and entertainment center, opened, expanding the company's real estate portfolio. |

| 2017 | The esport-based Boston Uprising was founded by Kraft, showcasing an interest in emerging markets. |

| 2020 | The Kraft Group added Bloom Energy Servers to Gillette Stadium's clean energy lineup, emphasizing sustainability. |

| 2024 | International Forest Products was recognized as the sixth-largest North American exporter, and Robert Kraft's net worth was estimated at $11.1 billion. |

| 2025 | The Kraft Group announced a five-year strategic partnership with NWN for technology transformation across its enterprise, including new IT infrastructure for the New England Patriots' training facility. |

The Kraft Group is actively leveraging technology to enhance operations and fan experiences. The recent partnership with NWN for IT infrastructure, including virtual reality rooms for the New England Patriots, highlights this focus. This commitment to innovation is expected to drive efficiency and improve the overall quality of its ventures.

Sustainability remains a key strategic pillar for the Kraft Group. The company's paper and packaging operations, along with environmental initiatives at Gillette Stadium, demonstrate a commitment to environmental responsibility. This focus aligns with growing consumer and investor preferences for sustainable practices.

The Kraft Group continues to explore strategic partnerships and diversification to maximize performance. The focus remains on building a diversified and financially strong group of businesses. This approach allows the Kraft Group to adapt to market trends and technological advancements effectively.

With Robert Kraft's net worth estimated at $11.1 billion in 2024, the Kraft Group has a strong financial foundation. The company's strategy of investing in core areas and adapting to market changes supports its long-term financial health. This approach enables the Kraft Group to maintain its competitive edge.

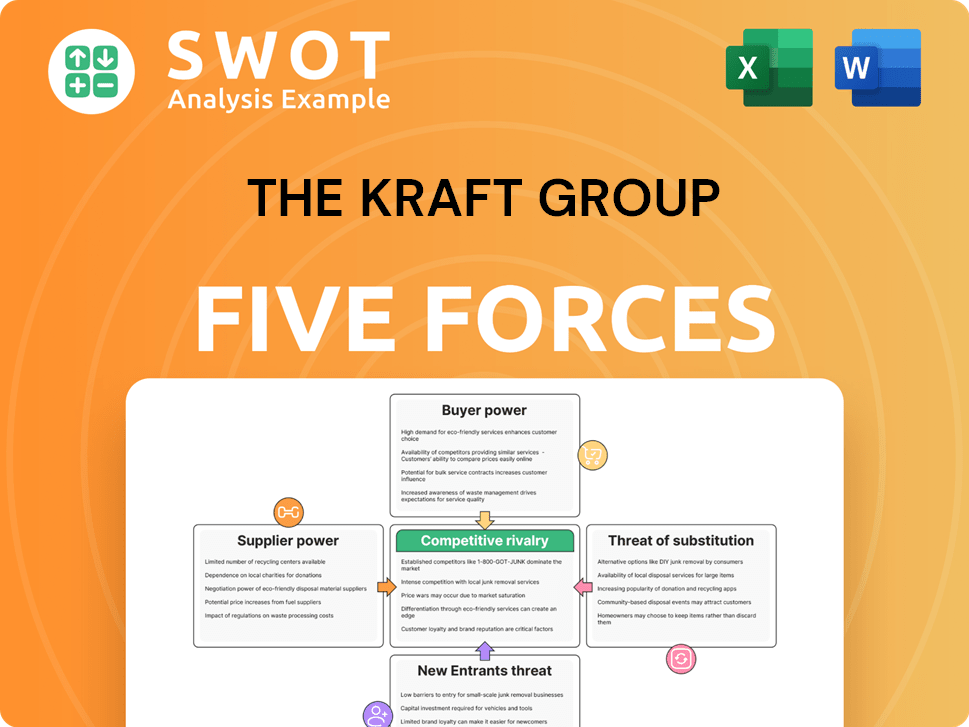

The Kraft Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of The Kraft Group Company?

- What is Growth Strategy and Future Prospects of The Kraft Group Company?

- How Does The Kraft Group Company Work?

- What is Sales and Marketing Strategy of The Kraft Group Company?

- What is Brief History of The Kraft Group Company?

- Who Owns The Kraft Group Company?

- What is Customer Demographics and Target Market of The Kraft Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.