The Kraft Group Bundle

What Makes the Kraft Group a Business Powerhouse?

The Kraft Group, a diversified holding company, casts a long shadow across the American business landscape. From paper and packaging to sports and real estate, its influence is undeniable. Notably, it owns the New England Patriots, the New England Revolution, and Gillette Stadium.

With estimated annual revenues of $5 billion as of May 2025, the Kraft Group, led by The Kraft Group SWOT Analysis, demonstrates significant scale and a robust industry standing. Beyond its well-known sports franchises, the Kraft Group company is involved in the forest products, paper, and packaging sectors, as well as strategic real estate ventures and a dynamic portfolio of private equity investments. Understanding the intricate workings of the Kraft Group, including its operational strategies and diverse revenue generation, is crucial for investors, customers, and industry observers seeking to comprehend its sustained success and future trajectory in a competitive market. The Kraft family's impact is felt across numerous sectors, making the Kraft Group a fascinating subject for business analysis.

What Are the Key Operations Driving The Kraft Group’s Success?

The Kraft Group company operates across a diverse range of sectors, creating and delivering value through a synergistic approach. This includes paper and packaging, sports and entertainment, real estate development, and private equity investments. This diversified portfolio allows the company to leverage opportunities across different markets, enhancing its overall resilience and growth potential.

The company's value proposition lies in its ability to integrate its various business segments. For example, the success of its sports franchises, like the New England Patriots, enhances brand recognition and opens doors for its real estate ventures and other investments. This integrated approach allows the Kraft Group to optimize resources and create a strong, interconnected business ecosystem.

The Kraft Group's core operations are multifaceted, encompassing several key areas that drive its value creation. In the paper and packaging sector, the company focuses on manufacturing and distribution, with investments like the new box manufacturing facility in Massachusetts. The sports and entertainment division, featuring the New England Patriots and the New England Revolution, generates substantial revenue through events and stadium operations. Furthermore, the real estate and private equity arms contribute to a diversified investment portfolio, supporting long-term growth and innovation.

The Kraft Group manufactures and distributes forest products. A new box manufacturing facility opened in Boylston, Massachusetts, in 2024, highlighting continued investment in this sector. This segment focuses on operational efficiency and market responsiveness to meet customer demands.

The company owns the New England Patriots (NFL) and the New England Revolution (MLS). Gillette Stadium, a core operational hub, generates approximately $750 million in annual revenue as of May 2025. The New England Revolution is valued at $535 million in 2025, with 2024 revenue of $63 million.

The Kraft Group is involved in real estate development projects. This includes potential new stadium constructions and other commercial real estate ventures. These projects leverage the company's brand and resources to create value in the real estate market.

The family office, founded in 1965, has invested in 40 companies as of May 2025. These investments are primarily in Series A rounds across sectors like life sciences. The latest investment was a $4 million seed round in Claim on December 20, 2023.

The Kraft Group's operational uniqueness stems from its synergistic approach, where success in one division supports others. The high-profile sports franchises boost brand recognition, which benefits real estate development and other ventures. This integrated model enhances resource optimization and creates a strong, interconnected business ecosystem.

- Brand synergy: The success of the New England Patriots enhances the value of other ventures.

- Resource optimization: Shared resources and expertise across divisions.

- Diversified portfolio: Reduces risk and increases opportunities for growth.

- Strategic investments: Focused on long-term value creation.

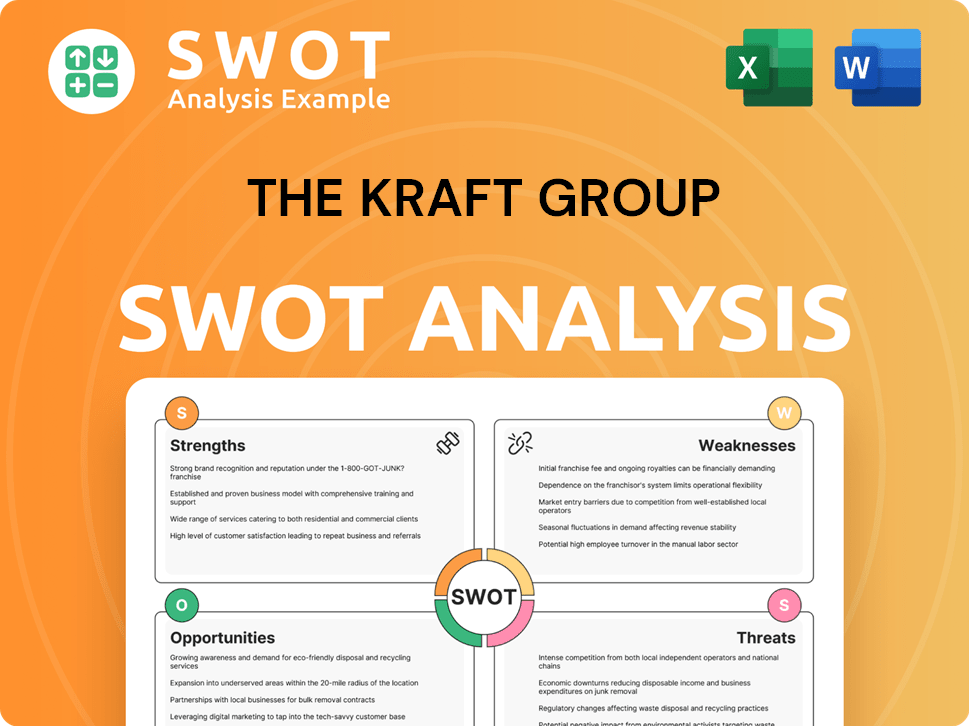

The Kraft Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does The Kraft Group Make Money?

The Kraft Group's revenue streams are diverse, encompassing paper and packaging, sports and entertainment, real estate, and private equity. This diversified approach allows the company to generate income from multiple sources, contributing to its overall financial stability. Understanding these revenue streams is key to grasping how the Kraft Group operates and generates value.

The company's monetization strategies vary across its business segments. From ticket sales and media rights in sports to property sales and investment exits, the Kraft Group leverages different methods to maximize its financial performance. The company also invests in innovative technologies to enhance fan experiences and operational efficiency, which can lead to increased revenue.

The Kraft Group's total annual revenue, as of May 2025, is approximately $5 billion. This figure reflects the combined contributions from its various business segments, highlighting the company's significant financial presence across multiple industries.

The New England Patriots, under the ownership of the Kraft family, are a major revenue driver for the Kraft Group. In 2024, the Patriots generated $712 million in revenue with an operating income of $261 million. Gillette Stadium, a key asset, contributes an estimated $750 million annually as of May 2025. The New England Revolution, another sports entity, brought in $63 million in revenue in 2024. These sports operations monetize through various channels.

- Ticket sales are a primary revenue source.

- Media rights and broadcasting deals contribute significantly.

- Merchandising, including the sale of team apparel and memorabilia, generates income.

- Corporate sponsorships and advertising partnerships provide additional revenue streams.

The paper and packaging division, although not individually quantified, is a core component of the Kraft Group's overall revenue. Real estate development contributes through property sales, leases, and management fees. The private equity arm generates returns through successful investments, including IPOs and acquisitions. For more information on the target market, you can read Target Market of The Kraft Group.

- Paper and packaging sales to various industries.

- Real estate property sales and leasing activities.

- Returns from private equity investments, including capital gains from exits.

- Innovative strategies like technology investments to enhance fan experience.

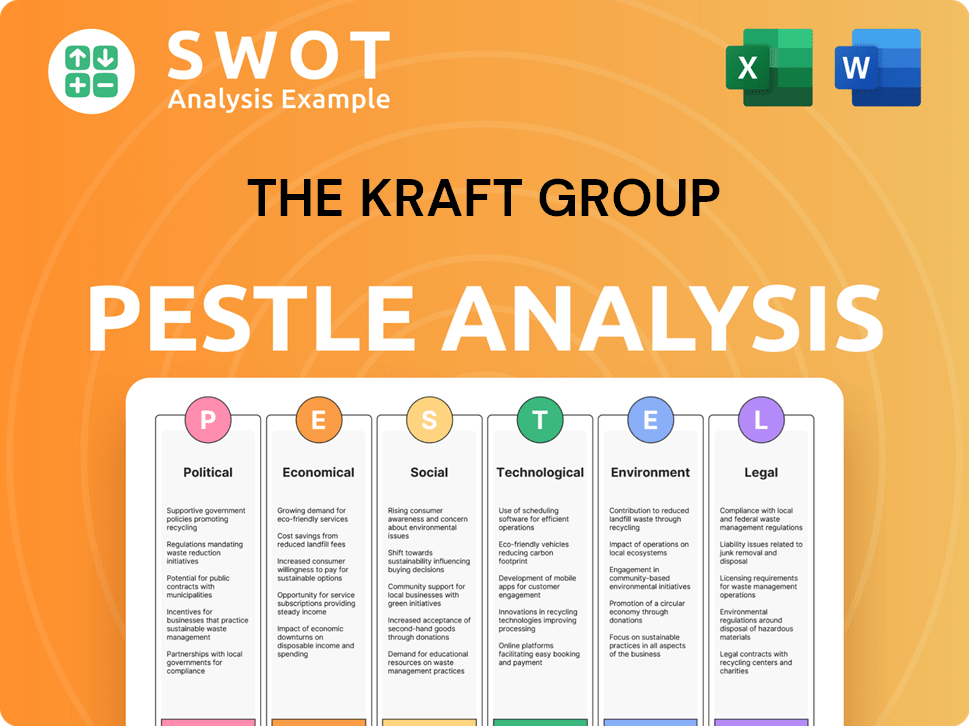

The Kraft Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped The Kraft Group’s Business Model?

The Kraft Group, under the leadership of Robert Kraft, has a history marked by strategic expansion and diversification. The company's evolution showcases a blend of investments across various sectors, including paper and packaging, sports and entertainment, and real estate. Recent developments highlight a continued focus on growth and innovation, particularly in its core areas.

A key element of the Kraft Group's strategy involves significant investments in its existing businesses while exploring new opportunities. This approach is evident in its paper and packaging division, with the opening of a new manufacturing facility in 2024. Simultaneously, the company is actively developing its sports and entertainment assets, as seen in the plans for a new soccer stadium.

The company's commitment to its long-term vision is further demonstrated by its strategic moves in real estate and sports. These initiatives, combined with ongoing IT infrastructure upgrades at Gillette Stadium, position the Kraft Group to enhance its operational capabilities and maintain its competitive edge.

The opening of a new box manufacturing facility in Boylston, Massachusetts, in 2024, is a significant milestone. The advancement of the new soccer stadium project in Everett, Massachusetts, with legislative approval in November 2024, also marks a key development. Additionally, Gillette Stadium being recognized as one of the World's Most Beautiful Sports Venues in 2024 is a notable achievement.

The construction of a new soccer stadium in Everett, Massachusetts, and the investment in IT infrastructure upgrades at Gillette Stadium are strategic moves. The company is also investing in a new training facility for the New England Patriots. These moves aim to enhance fan experiences and improve operational efficiencies.

The Kraft Group's diverse portfolio and established brand strength provide a competitive advantage. Ownership of the New England Patriots, valued at $7.4 billion in 2024, and the New England Revolution, along with Gillette Stadium, creates a synergistic ecosystem. The company's long-standing presence in paper and packaging offers economies of scale and established distribution networks.

Challenges include adapting to technological shifts, as evidenced by continuous IT infrastructure upgrades. The diversified nature of the company helps mitigate risks associated with downturns in any single sector. The Kraft Group adapts by investing in technology and infrastructure, and by strategically expanding its real estate and sports holdings.

The Kraft Group's operations are multifaceted, encompassing paper and packaging, sports and entertainment, and real estate. The company leverages its diverse portfolio to mitigate risks and capitalize on opportunities. The Marketing Strategy of The Kraft Group demonstrates the integrated approach across its businesses.

- Ongoing investments in IT infrastructure at Gillette Stadium, in partnership with NWN.

- Construction of a new, standalone training facility for the New England Patriots.

- Strategic expansion of real estate and sports holdings, including the new soccer stadium.

- Focus on maintaining and expanding its business model through strategic investments.

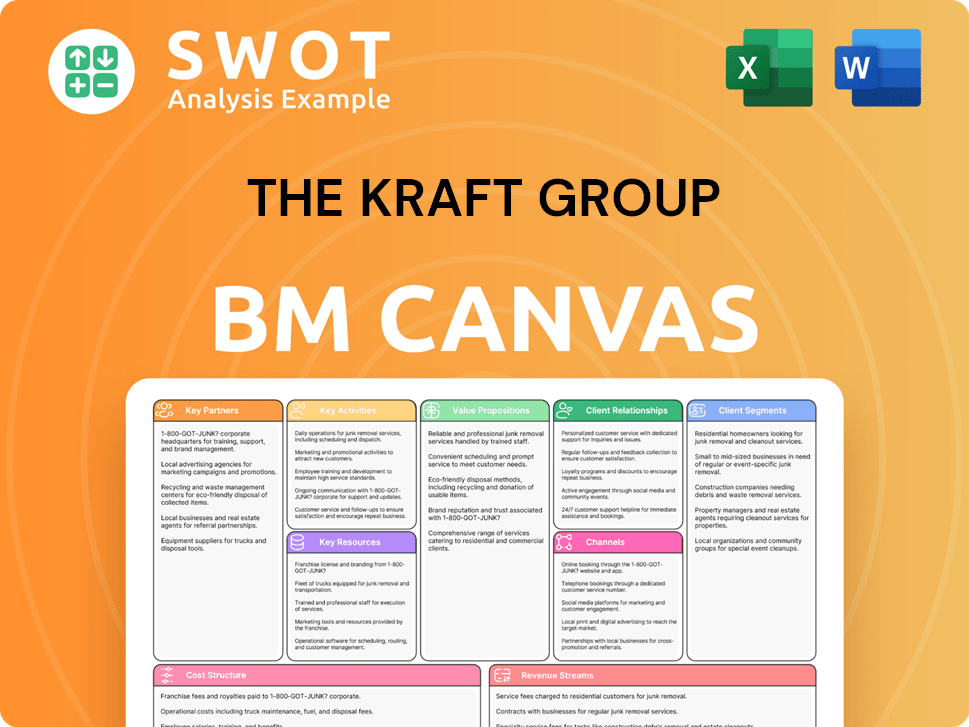

The Kraft Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is The Kraft Group Positioning Itself for Continued Success?

The Kraft Group maintains a strong industry position, particularly in sports and entertainment, owning the New England Patriots and New England Revolution, along with Gillette Stadium. This diversified portfolio, including paper and packaging and real estate, contributes to its significant market presence. The company's strategic investments and focus on technological advancements suggest a positive outlook for continued growth and market leadership.

The Kraft Group company faces risks like economic downturns affecting consumer spending, commodity price fluctuations, and competition. Regulatory changes and technological disruptions also pose challenges. However, the company's proactive investment in technology and strategic initiatives aim to mitigate these risks and sustain revenue generation across its diverse business interests.

The Kraft Group demonstrates a strong industry position, especially in sports and entertainment. The New England Patriots were valued at $7.4 billion in 2024, with $712 million in revenue and $261 million in operating income. The New England Revolution's valuation reached $535 million in 2025. Gillette Stadium alone generated an estimated annual revenue of $750 million as of May 2025.

Key risks include economic downturns, commodity price fluctuations, and intense competition. Regulatory changes, like those impacting stadium development, and technological disruptions also pose challenges. The proposed new soccer stadium in Everett, MA, required legislative approval for rezoning. The company is addressing these through strategic investments.

The future outlook suggests a continued focus on strategic initiatives and leveraging its integrated portfolio. This includes investment in core businesses, such as the new box manufacturing facility opened in 2024 and plans for the New England Revolution's new stadium. The company is also emphasizing technological advancements to enhance fan experiences and operational efficiencies.

Strategic initiatives include continued investment in core businesses and technological advancements. The Kraft Group is also focused on potential real estate development linked to its sports assets. These strategies aim to sustain and expand its ability to generate revenue. For a deeper understanding, explore the Brief History of The Kraft Group.

The New England Patriots generated $712 million in revenue in 2024. The New England Revolution had a revenue of $63 million in 2024. Gillette Stadium's estimated annual revenue was $750 million as of May 2025. The Kraft Group's reported annual revenue was $5 billion as of May 2025, highlighting the company's overall scale and influence.

- The New England Patriots were valued at $7.4 billion in 2024.

- The New England Revolution had a valuation of $535 million in 2025.

- Operating income for the New England Patriots was $261 million in 2024.

- The company is actively investing in IT infrastructure and AI-enabled applications.

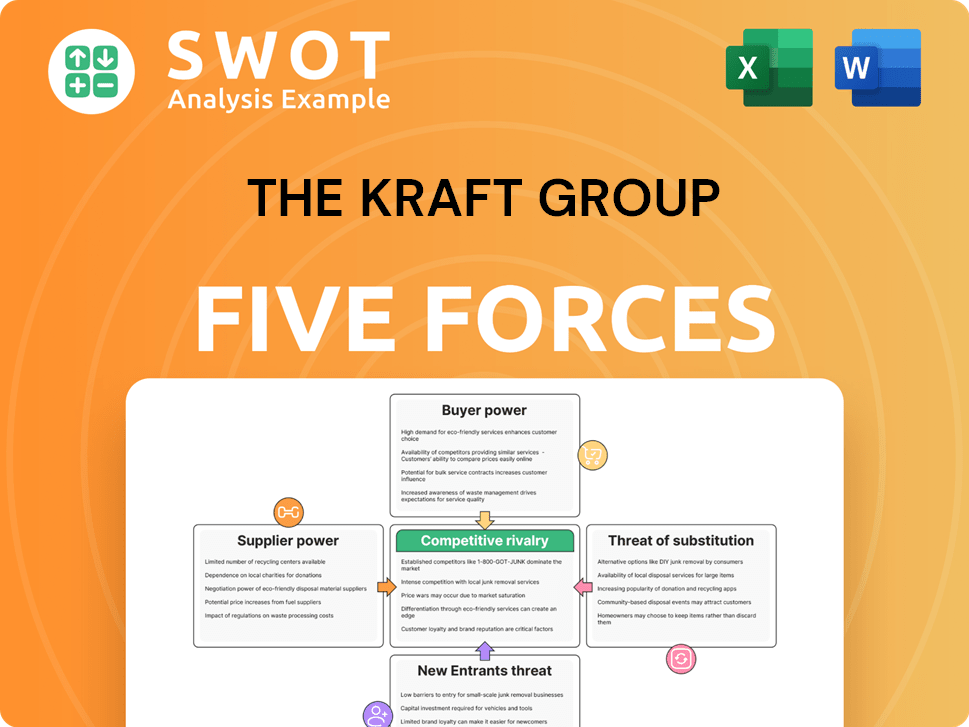

The Kraft Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The Kraft Group Company?

- What is Competitive Landscape of The Kraft Group Company?

- What is Growth Strategy and Future Prospects of The Kraft Group Company?

- What is Sales and Marketing Strategy of The Kraft Group Company?

- What is Brief History of The Kraft Group Company?

- Who Owns The Kraft Group Company?

- What is Customer Demographics and Target Market of The Kraft Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.