The Kraft Group Bundle

Who Really Owns the Empire of the Kraft Group?

The Kraft Group, a name synonymous with success across diverse industries, holds a captivating story of ownership and influence. Understanding the intricate web of its holdings unveils the strategic genius behind its triumphs. From sports and entertainment to real estate and private equity, the company's ownership structure is key to its remarkable journey. Delving into the The Kraft Group SWOT Analysis offers a deeper look into the company's strategic positioning.

Founded by Robert Kraft, the Kraft Company's evolution reflects a dynamic interplay of vision and strategic acumen. Examining the ownership of the Kraft Group provides critical insights into its operational strategies and future prospects. The New England Patriots owner's business ventures have reshaped industries and left an indelible mark on the business landscape. This exploration will reveal the key players and pivotal moments that have shaped The Kraft Group ownership, offering a comprehensive view of its enduring legacy and future trajectory.

Who Founded The Kraft Group?

The Kraft Group, a holding company, was officially established in 1998. This marked a formal consolidation of various business interests that Robert Kraft had been developing since 1968. Robert Kraft's vision and strategic acquisitions laid the foundation for the diverse portfolio of companies that The Kraft Group encompasses today.

Robert Kraft, a graduate of Harvard Business School, began building his business empire in the mid-1960s. His initial foray into business began in 1968 with packaging, and he later established International Forest Products (IFP) in 1972. These early ventures were critical in shaping the future of The Kraft Group.

Through a leveraged buyout in 1968, Robert Kraft gained control of the Rand-Whitney Group, a packaging company. These early acquisitions and entrepreneurial moves formed the basis for what would become The Kraft Group. The company's structure reflects Robert Kraft's commitment to family and long-term sustainability.

Robert Kraft's initial business ventures began in 1968 with a focus on packaging. This early experience provided the foundation for later acquisitions and expansions. These ventures were critical in shaping the future of The Kraft Group.

In 1972, Robert Kraft established International Forest Products (IFP). This move highlighted his foresight in recognizing the importance of forest products. IFP became a key component of The Kraft Group's diversified portfolio.

Kraft acquired the Rand-Whitney Group in 1968 through a leveraged buyout. This acquisition was a significant step in expanding his business holdings. Rand-Whitney, based in Worcester, MA, added to the growing portfolio.

The Kraft Group remains privately owned and family-operated. This structure reflects Robert Kraft's vision for a sustained family legacy. This commitment to family ownership has been a defining characteristic.

Robert Kraft emphasized relationship building and integrity in his business approach. These values became foundational to The Kraft Group's success. They have guided the company's growth and operations.

Robert Kraft was the primary owner and driving force behind these early ventures. His leadership and vision were crucial to the company's initial growth. This role was central to the company's early success.

The Kraft Group's early ownership is characterized by Robert Kraft's vision and strategic acquisitions. The company's structure reflects a commitment to family and long-term sustainability, with Robert Kraft as the primary owner. The Kraft Group's early ventures and acquisitions, including IFP and Rand-Whitney, formed the foundation for its current diversified portfolio. The Kraft Group remains privately owned and family-operated, reflecting Robert Kraft's vision for a sustained family legacy.

- Robert Kraft founded The Kraft Group in 1998, consolidating ventures from 1968.

- He established International Forest Products (IFP) in 1972.

- Kraft acquired Rand-Whitney Group in 1968 through a leveraged buyout.

- The company is privately owned and family-operated.

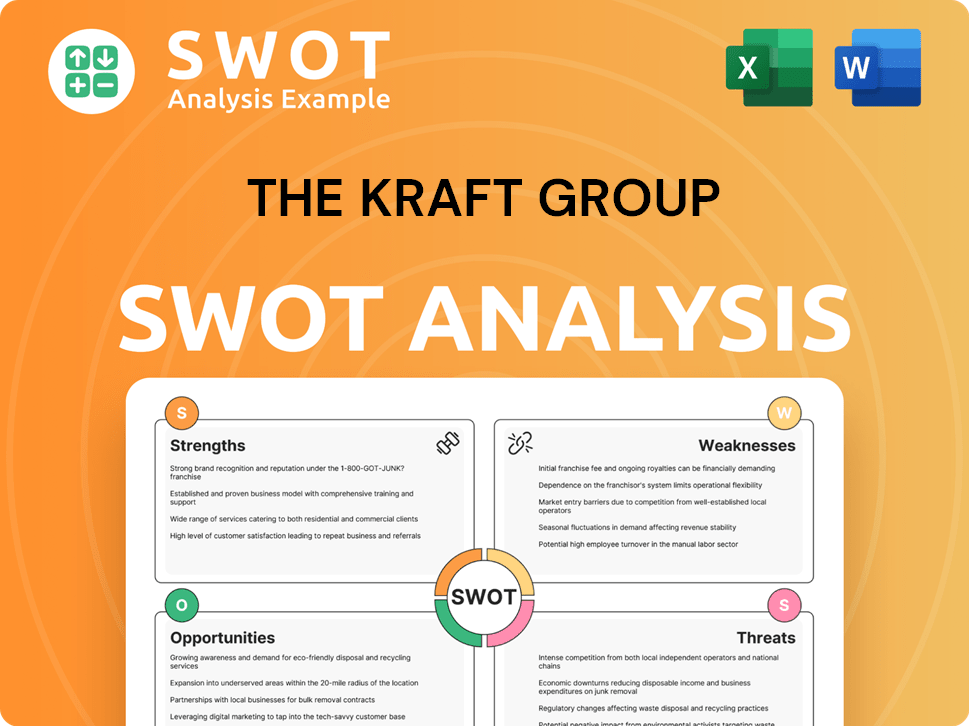

The Kraft Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has The Kraft Group’s Ownership Changed Over Time?

The ownership structure of the Kraft Group, a privately held entity, has been significantly shaped by Robert Kraft's strategic decisions. Initially, Robert Kraft held a substantial stake in the New England Patriots. However, he later restructured the ownership to ensure the team's long-term family ownership, a move partly motivated by estate tax considerations. This restructuring has been a key event impacting the Kraft Group's ownership.

The evolution of the Kraft Group's ownership reflects a deliberate effort to maintain family control and plan for the future. This approach has been crucial in preserving the legacy and financial stability of the Kraft family's assets, including the New England Patriots and other diverse business interests. The current structure ensures that the company remains a family-operated entity for generations to come.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Initial Ownership of New England Patriots | Robert Kraft held a significant percentage. | Prior to restructuring |

| Restructuring of Patriots Ownership | Robert Kraft reduced his stake to 30%; his sons shared the remaining 70%. | Ongoing |

| Diversification into Private Equity | Expanded investment portfolio beyond core businesses. | Ongoing |

Robert Kraft, as the Chairman and CEO, continues to lead the Kraft Group. His sons also hold key positions within the company and its related entities. Jonathan Kraft serves as President and COO, Daniel Kraft leads International Forest Products, and Josh Kraft heads Kraft Family Philanthropies. The Kraft Group's diverse investments, including over 100 private equity ventures, underscore its strategic approach to wealth management and business expansion. According to recent estimates, Robert Kraft's net worth is approximately $11.1 billion as of 2024, and the company's assets are valued at over $10 billion, with the New England Patriots alone valued at around $7 billion.

The Kraft Group, under Robert Kraft's leadership, has strategically maintained family ownership. This has involved restructuring the ownership of key assets like the New England Patriots.

- Robert Kraft remains a central figure as Chairman and CEO.

- His sons hold key executive positions within the company.

- The group's diverse investments, including private equity, demonstrate a strategic approach to wealth management.

- The Kraft Group's ownership structure is designed to ensure long-term family control.

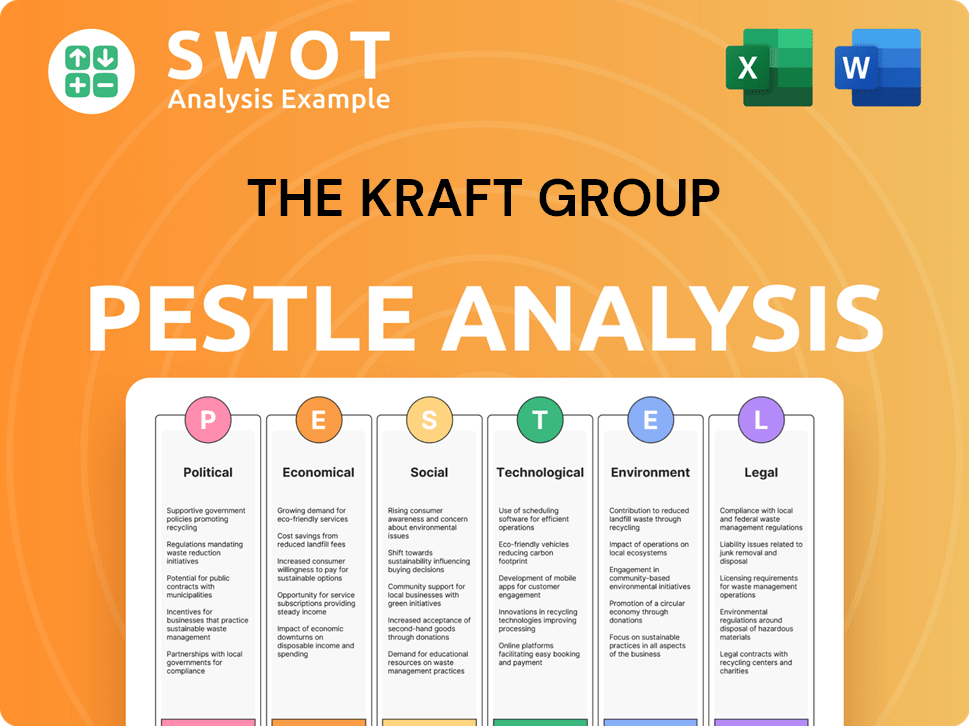

The Kraft Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on The Kraft Group’s Board?

As a privately held entity, the governance of the Kraft Group, including the structure of its board and the distribution of voting power, differs significantly from publicly traded corporations. The leadership is firmly within the Kraft family, reflecting their direct ownership and control of the Kraft Company. Robert K. Kraft, the founder, holds the positions of Chairman and Chief Executive Officer. His sons also play pivotal roles, with Jonathan Kraft serving as President and COO, and Daniel Kraft involved in International Forest Products. Josh Kraft is the chairman of the Executive Board of the Kraft Center for Community Health and President of Kraft Family Philanthropies.

While a formal 'Board of Directors' for the entire Kraft Group isn't detailed publicly in the same way as for a public company, the primary decision-making authority rests with Robert Kraft and his sons. They are deeply involved in various aspects of the business. For instance, Jonathan, Dan, Josh, and David Kraft, alongside Robert Kraft, sit on the New England Patriots' Board of Directors. This family-centric governance ensures that the long-term vision and values of the Kraft family are maintained across their diverse holdings. There are no publicly reported proxy battles or activist investor campaigns, which is typical of private ownership structures.

| Board Member | Role | Affiliation |

|---|---|---|

| Robert K. Kraft | Founder, Chairman, and CEO | The Kraft Group |

| Jonathan Kraft | President and COO | The Kraft Group |

| Daniel Kraft | Involved with | International Forest Products |

| Josh Kraft | Chairman of the Executive Board | Kraft Center for Community Health, President of Kraft Family Philanthropies |

| David Kraft | Board Member | New England Patriots |

Robert Kraft's influence extends across multiple sectors, including sports, real estate, and manufacturing. His significant ownership and control are evident in the governance of the Kraft Group and its subsidiaries. The family's direct involvement in the decision-making processes ensures alignment with their long-term strategic goals. The absence of external shareholders or public market pressures allows for a more focused and long-term approach to business strategy and investment decisions. As of early 2024, the estimated net worth of Robert Kraft is approximately $10.9 billion, reflecting the success of his business ventures and strategic investments.

The Kraft Group ownership structure is family-centric, with Robert Kraft and his sons in key leadership positions.

- Robert Kraft serves as the Chairman and CEO, ensuring his vision guides the company.

- Jonathan Kraft is the President and COO, actively involved in daily operations.

- The family's direct involvement ensures alignment with long-term goals and values.

- This structure allows for focused decision-making without external shareholder pressures.

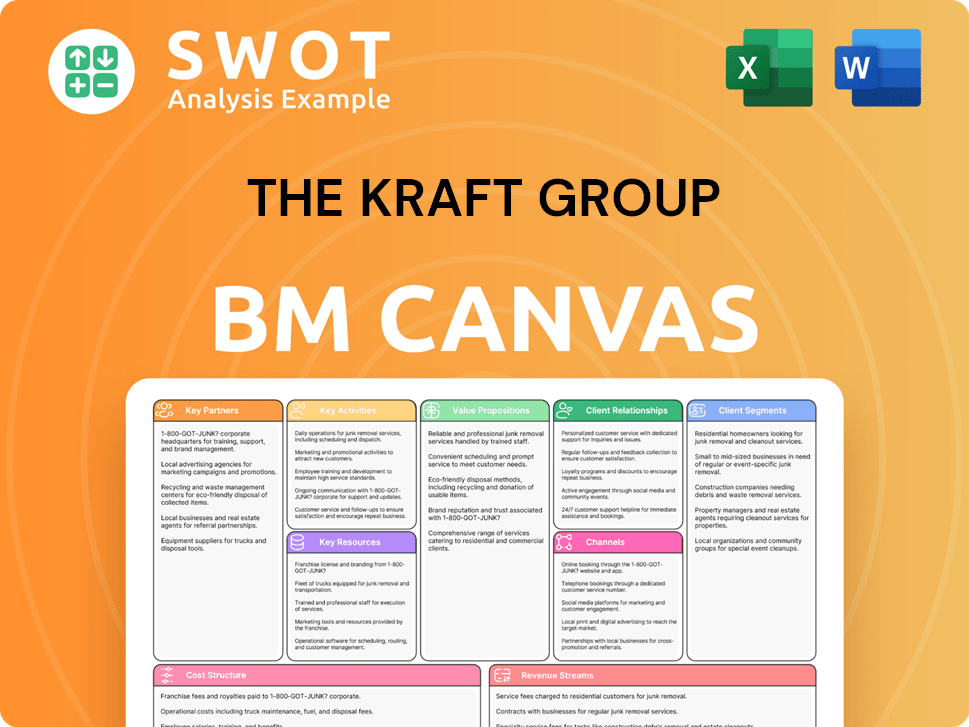

The Kraft Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped The Kraft Group’s Ownership Landscape?

In recent years, The Kraft Group has continued to evolve, adapting to changing market dynamics while maintaining a strong position in various sectors. As of November 2024, the company was ranked #135 among America's Top Private Companies by Forbes, with reported revenues of $5 billion. The total assets of The Kraft Group were estimated to exceed $10 billion in 2024. This financial strength allows the company to pursue strategic investments and maintain its diverse portfolio.

The Kraft Group's focus on strategic investments, particularly in private equity and venture capital, reflects a forward-thinking approach. The private equity market in the U.S. saw approximately $700 billion in deal volume in 2024. Furthermore, venture capital investments in the technology sector globally surpassed $200 billion in 2024, indicating the company's interest in high-growth areas like technology, healthcare, and life sciences. The company's continued investment in its paper and packaging sector, with the global kraft paper market valued at $19.44 billion in 2024, shows its commitment to diverse business interests.

| Key Asset | Valuation/Revenue (2024) | Recent Developments |

|---|---|---|

| New England Patriots | ~$7 billion | Robert Kraft's public desire for playoff success in 2025. |

| Gillette Stadium | ~$250 million (revenue) | Strategic partnership with NWN for technology infrastructure transformation. |

| Global Kraft Paper Market | $19.44 billion (market value) | Projected to reach $26.81 billion by 2032, with a CAGR of 4.1% (2025-2032). |

The Target Market of The Kraft Group includes strategic investments and maintaining its diverse portfolio. The New England Patriots remain a key asset, valued at around $7 billion in 2024. The Kraft Group's commitment to sustainability is evident through investments in environmental responsibility, such as building paper mills that use 100% post-consumer fiber. The company is modernizing operations, as seen in the April 2025 partnership with NWN to transform its technology infrastructure, including at Gillette Stadium and the new Patriots training facility.

The Kraft Group is primarily owned by Robert Kraft and the Kraft family.

The Kraft Group has a diverse portfolio including the New England Patriots, Gillette Stadium, and investments in paper and packaging, real estate, and private equity.

The Kraft Group's total assets were estimated to be over $10 billion in 2024.

Robert Kraft's business ventures span sports, real estate, paper and packaging, and private equity.

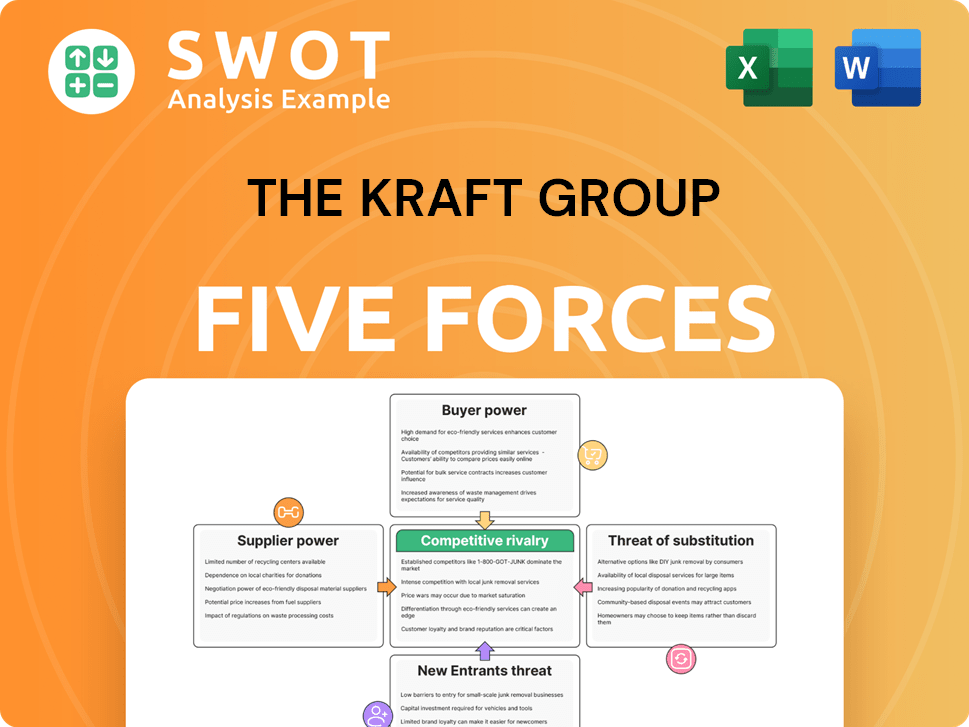

The Kraft Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The Kraft Group Company?

- What is Competitive Landscape of The Kraft Group Company?

- What is Growth Strategy and Future Prospects of The Kraft Group Company?

- How Does The Kraft Group Company Work?

- What is Sales and Marketing Strategy of The Kraft Group Company?

- What is Brief History of The Kraft Group Company?

- What is Customer Demographics and Target Market of The Kraft Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.