The Kraft Group Bundle

How Does The Kraft Group Dominate Its Diverse Markets?

The Kraft Group, a powerhouse in American business, operates across paper and packaging, sports, real estate, and private equity. Its story, beginning with International Forest Products in 1972, showcases a remarkable evolution into a multi-faceted conglomerate. Understanding the The Kraft Group SWOT Analysis is crucial to grasping its strategic moves.

This exploration delves into the Kraft Group's competitive landscape, identifying its key competitors and analyzing its market position. We'll examine the Kraft Group's business strategy, dissecting its unique advantages and how it navigates its competitive environment. This comprehensive market analysis will reveal how the Kraft Group maintains its formidable presence and continues to thrive in a dynamic business world, providing insights into its financials and future outlook.

Where Does The Kraft Group’ Stand in the Current Market?

The Kraft Group's market position is robust across its diverse business segments. The company's strategic approach involves a diversified portfolio, including paper and packaging, sports and entertainment, and real estate development. This diversification allows the company to mitigate risks and capitalize on opportunities in various sectors. This approach helps define the Brief History of The Kraft Group and its evolution.

In the paper and packaging sector, the subsidiary International Forest Products (IFP) holds a significant global presence. While specific market share data for IFP is not publicly available, it consistently ranks among the top privately held companies in the U.S., indicating a strong position in its segment. The company's global reach in this sector serves a wide range of industrial and commercial customers. Its strategic moves and investments have helped shape its competitive landscape.

In sports and entertainment, The Kraft Group has a dominant presence in the New England region. It owns the NFL's New England Patriots and MLS's New England Revolution, along with Gillette Stadium. The Patriots are consistently among the most valuable sports franchises worldwide, with a valuation estimated at over $7 billion in 2024. This reflects significant market leadership in professional sports. The company's strategic moves and investments have helped shape its competitive landscape.

The Kraft Group's market share varies across its business segments. In the paper and packaging industry, IFP holds a significant global presence, although specific market share data is not publicly available. In sports and entertainment, the New England Patriots have a dominant position in the New England region.

The Kraft Group's key business segments include paper and packaging (through IFP), sports and entertainment (New England Patriots and Revolution), and real estate development (Patriot Place). These segments contribute to the company's diversified revenue streams and market presence.

While specific financial figures for the entire privately held Kraft Group are not public, the high valuations of its sports assets and the sustained operations of its other ventures suggest strong financial health. The Patriots' valuation of over $7 billion in 2024 indicates significant financial strength.

The Kraft Group's competitive advantages include its diversified portfolio, strong market positions in key segments, and ownership of high-value sports franchises. The company benefits from deeply entrenched fan bases and significant infrastructure ownership, particularly in the New England market.

The Kraft Group's strategic positioning involves a shift from its industrial roots to high-profile consumer-facing ventures, especially in sports and entertainment. This diversification has enhanced brand visibility and created new revenue streams. The company's strong presence in the New England market, particularly in sports, provides a significant competitive edge.

- Dominant position in New England sports market.

- Diversified portfolio across paper and packaging, sports, and real estate.

- High valuations of sports assets, reflecting financial strength.

- Strategic shift towards consumer-facing ventures.

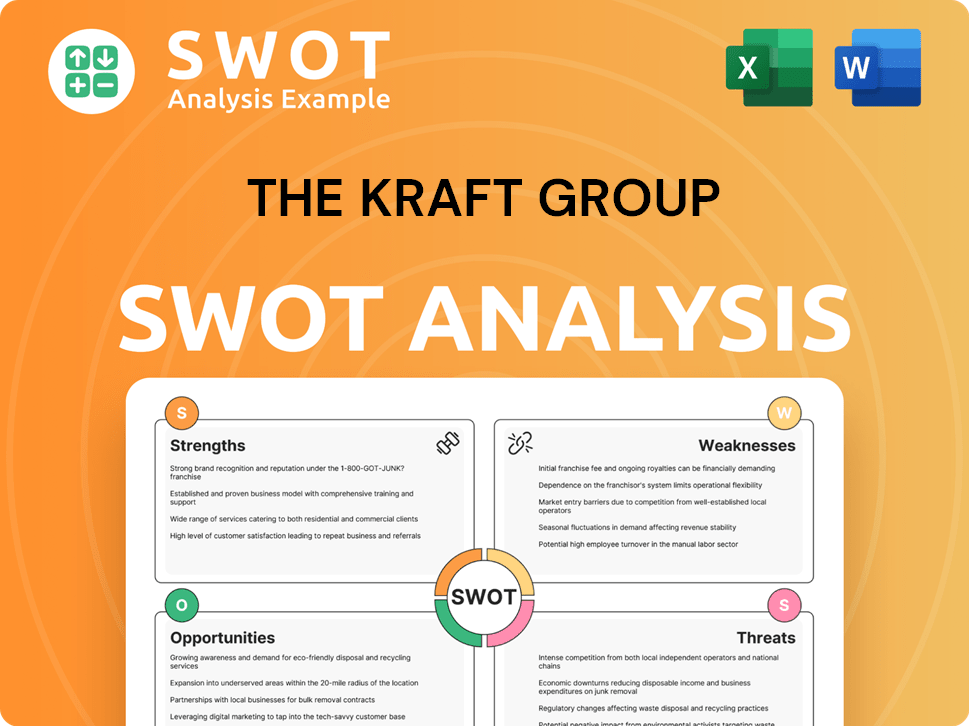

The Kraft Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging The Kraft Group?

Understanding the Target Market of The Kraft Group requires a close look at its competitive landscape. The Kraft Group operates in diverse sectors, each with its own set of rivals. This competitive analysis is crucial for assessing the company’s position and strategic moves.

The competitive environment directly influences the firm's business strategy and financial performance. The Kraft Group must constantly evaluate its position relative to its competitors to maintain and improve its market share. This involves understanding the strengths and weaknesses of its rivals and adapting to industry changes.

The Kraft Group's competitive landscape is dynamic, with various players vying for market share and customer loyalty. The company faces competition from both large, established corporations and smaller, specialized firms, each with its own strategies and advantages. Analyzing these competitive dynamics is key to understanding the challenges and opportunities facing The Kraft Group.

In the paper and packaging industry, The Kraft Group's International Forest Products (IFP) faces competition from major players. These competitors have significant economies of scale and global distribution networks. They compete through pricing, product portfolios, and supply chains.

Key competitors include WestRock, International Paper, and Domtar. These companies have a strong presence in the market. Smaller firms specializing in niche markets or sustainable solutions also pose a threat.

The New England Patriots and New England Revolution compete in the sports and entertainment sector. Their main rivals are other professional sports franchises. They compete for fan engagement, media rights, and sponsorship revenue.

Regionally, they compete with teams like the Boston Celtics (NBA) and Boston Red Sox (MLB). Globally, the sports industry faces competition from streaming services and live events. Promoters and venue operators also compete for events.

Patriot Place competes with other large-scale retail and entertainment complexes. These include regional malls and mixed-use developments. Major commercial real estate developers and property management firms are key competitors.

The private equity investment arm competes with other firms for investment opportunities. These include private equity firms, hedge funds, and venture capital funds. They differentiate themselves through investment strategies and sector focus.

The Kraft Group's competitive landscape is shaped by several factors. These factors influence the company's strategic decisions and market performance. Understanding these dynamics is essential for assessing the company's position.

- Market Share: Analyzing market share helps determine the company's position relative to its competitors.

- Pricing Strategies: Competitive pricing is crucial in the paper and packaging industry.

- Fan Engagement: In sports, engaging fans and securing media rights are key.

- Real Estate: Competition for tenants and consumer traffic is significant in real estate.

- Investment Strategies: The private equity arm competes based on investment strategies and sector focus.

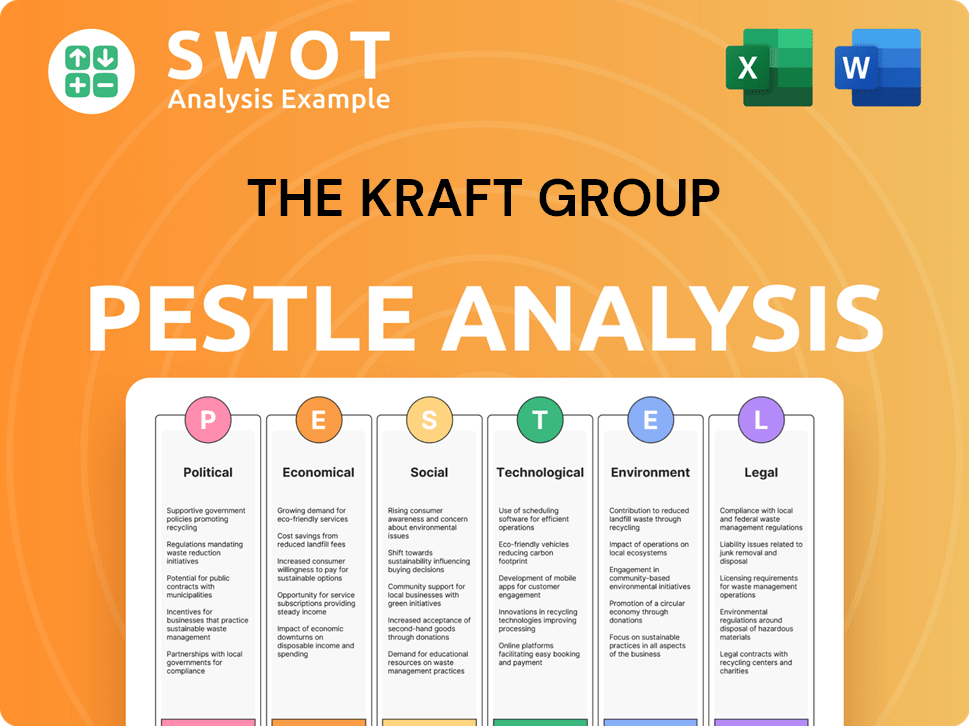

The Kraft Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives The Kraft Group a Competitive Edge Over Its Rivals?

The Kraft Group's competitive advantages are rooted in a diversified business model, strong brand recognition, and strategic asset ownership. The company's success is built upon a foundation of vertical integration, brand equity, and real estate holdings. These elements combine to create a resilient business structure capable of withstanding market fluctuations.

A key factor in its competitive edge is its ability to leverage resources across different sectors, enhancing revenue streams and mitigating risks. The company's strategic moves have been instrumental in shaping its current market position. This integrated approach allows for greater control over operations and a broader market reach.

The company's strategic vision, under family leadership, provides stability and a long-term perspective, which is often a challenge for publicly traded companies. This stability enables consistent strategic planning and investment in long-term growth initiatives. These factors contribute significantly to the company's ability to sustain its competitive advantages.

International Forest Products (IFP) allows for vertical integration, providing control over the supply chain. This control gives the company access to diverse markets and reduces dependency on external suppliers. This strategic advantage enhances operational efficiency and market responsiveness, especially in the paper and packaging sector.

The New England Patriots, a globally recognized NFL franchise, offers immense brand equity. This brand recognition extends beyond sports, benefiting other segments of the company. The Patriots' success translates into strong revenue streams from ticketing, merchandise, and sponsorships.

Ownership of Gillette Stadium and Patriot Place provides a significant real estate advantage. This allows for diverse revenue generation from events, retail, dining, and entertainment. This creates a synergistic ecosystem that enhances customer experience and revenue generation.

Long-standing family ownership and leadership provide stability and a long-term strategic vision. This approach contrasts with the short-term focus often seen in publicly traded companies. This stability supports consistent strategic planning and investment in long-term growth.

The Kraft Group's competitive advantages are multifaceted, including vertical integration, strong brand equity, and strategic real estate holdings. These advantages are enhanced by the company's long-term strategic vision and diversified business model. The company's ability to leverage its brand in sports to attract business partners and enhance its real estate ventures is a key differentiator. For more details, consider reading about the Growth Strategy of The Kraft Group.

- Diversified Portfolio: This includes paper and packaging, sports, and real estate, which mitigates risks and creates multiple revenue streams.

- Brand Equity: The New England Patriots significantly enhance brand recognition and customer loyalty.

- Strategic Asset Ownership: Gillette Stadium and Patriot Place provide real estate advantages and diverse revenue opportunities.

- Financial Performance: In 2024, the NFL generated approximately $13 billion in revenue, reflecting the strength of the sports industry.

- Market Position: The Kraft Group's diversified approach allows it to compete effectively in various markets, enhancing its overall market share.

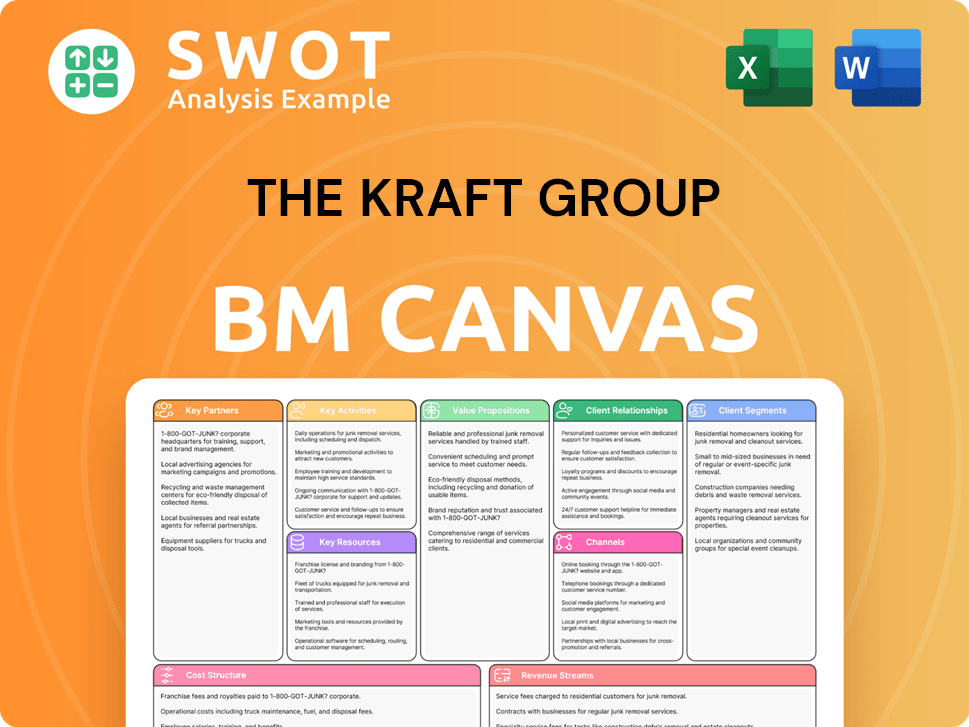

The Kraft Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping The Kraft Group’s Competitive Landscape?

Analyzing the Kraft Group competitive landscape reveals a multifaceted business with interests spanning paper and packaging, sports and entertainment, and real estate. The company's diverse portfolio exposes it to a range of industry trends, risks, and opportunities. Understanding the dynamics within each sector is crucial for assessing its overall market position and future prospects. A comprehensive Kraft Group market analysis is essential for investors and stakeholders.

The Kraft Group industry faces both internal and external challenges, including economic downturns, shifts in consumer behavior, and competitive pressures. However, the company's strategic approach, including diversification, technological adoption, and a focus on sustainability, positions it to navigate these challenges and capitalize on emerging opportunities. Examining Kraft Group's key business segments provides insight into its overall financial health and strategic direction.

The paper and packaging sector is experiencing a surge in demand for sustainable and recyclable materials. Digitalization and the shift towards paperless solutions pose a long-term challenge. Geopolitical factors and supply chain disruptions continue to impact raw material costs.

International Forest Products (IFP) can innovate in eco-friendly packaging, strengthening its position in a growing market. The company can capitalize on the increasing demand for sustainable packaging solutions. Strategic investments in sustainable technologies could yield long-term benefits.

The rise of streaming services and personalized content consumption reshapes the industry. There is an increasing focus on fan experience, both in-stadium and remotely. The evolving media landscape and competition from other entertainment forms are significant.

The New England Patriots and New England Revolution can expand their digital presence and engage fans through new platforms. Technological integration and enhanced amenities at Gillette Stadium can improve fan experience. Exploring innovative content distribution models presents growth opportunities.

The trend towards mixed-use developments and experiential retail continues to shape the real estate market, providing opportunities for Patriot Place. Economic downturns and shifts in retail consumption patterns pose challenges. The private equity arm faces increased competition for attractive investments.

- Patriot Place can enhance its experiential offerings and adapt to changing consumer preferences.

- The private equity arm should carefully evaluate investment opportunities in a competitive market.

- Strategic partnerships across the diverse portfolio can facilitate synergistic growth.

- Focus on sustainability and technological adoption to remain competitive.

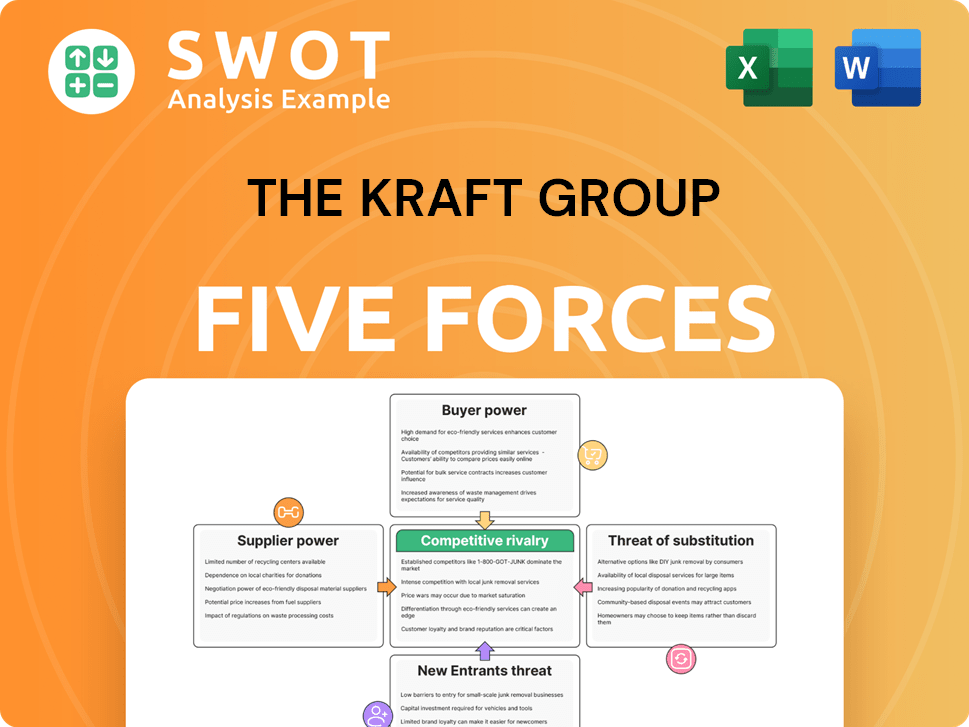

The Kraft Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The Kraft Group Company?

- What is Growth Strategy and Future Prospects of The Kraft Group Company?

- How Does The Kraft Group Company Work?

- What is Sales and Marketing Strategy of The Kraft Group Company?

- What is Brief History of The Kraft Group Company?

- Who Owns The Kraft Group Company?

- What is Customer Demographics and Target Market of The Kraft Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.