The Kraft Group Bundle

How is the Kraft Group Shaping Its Future?

From its roots in paper and packaging, The Kraft Group has transformed into a diversified powerhouse. This evolution, marked by the pivotal acquisition of the New England Patriots, showcases remarkable strategic foresight. Now, let's examine how The Kraft Group is poised to continue its impressive growth trajectory.

The The Kraft Group SWOT Analysis reveals crucial insights into the company's strengths and future opportunities. Understanding the Kraft Group's growth strategy is essential for grasping its business prospects and anticipating its market moves. This analysis will explore the Kraft Company's strategic initiatives, including its expansion plans and long-term goals, to provide a comprehensive view of its financial performance and industry outlook.

How Is The Kraft Group Expanding Its Reach?

The Kraft Group is actively pursuing multifaceted expansion initiatives to broaden its market reach and diversify its revenue streams. These initiatives span across its core business sectors, including sports and entertainment, paper and packaging, real estate, and private equity investments. The company’s strategic approach focuses on both organic growth and strategic acquisitions to capitalize on emerging opportunities and enhance its long-term value.

The Kraft Group's expansion strategy is designed to leverage its existing assets and expertise while exploring new avenues for growth. This includes enhancing fan experiences, increasing production capacity, developing mixed-use properties, and investing in innovative technologies. These efforts are aimed at strengthening the company's position in its current markets and creating new revenue streams to drive sustainable growth.

The company's commitment to expansion is evident through significant investments and strategic partnerships. These initiatives are supported by a strong financial foundation and a clear vision for the future. The Kraft Group's expansion plans are designed to ensure that the company remains competitive and adaptable in a dynamic business environment.

Ongoing enhancements at Gillette Stadium aim to attract a wider array of events beyond football and soccer. The New England Patriots and New England Revolution are focused on expanding their global brand presence through international marketing and partnerships. These efforts seek to cultivate new fan bases and identify commercial opportunities.

Rand-Whitney Containerboard, a subsidiary, is investing $135 million to upgrade its facility in Montville, Connecticut. This expansion is expected to be completed in late 2024 or early 2025. The upgrade will increase capacity and efficiency to meet growing demand for sustainable packaging solutions.

The real estate arm is exploring development opportunities around Gillette Stadium and other strategic locations. The focus is on mixed-use projects that integrate commercial, residential, and entertainment spaces. These projects are designed to create vibrant, integrated communities.

Private equity investments serve as a vehicle for expansion, allowing the Kraft Group to enter new industries. The company leverages emerging technologies through strategic partnerships and acquisitions. This strategy helps diversify the portfolio and capitalize on innovative opportunities.

The Kraft Group's expansion strategy includes significant investments in infrastructure, brand building, and diversification. These initiatives are supported by a strong financial position and a commitment to long-term growth. The company's approach is designed to create value for its stakeholders.

- Enhancements at Gillette Stadium to attract diverse events.

- A $135 million investment in Rand-Whitney Containerboard's facility.

- Focus on mixed-use real estate developments.

- Strategic private equity investments for diversification.

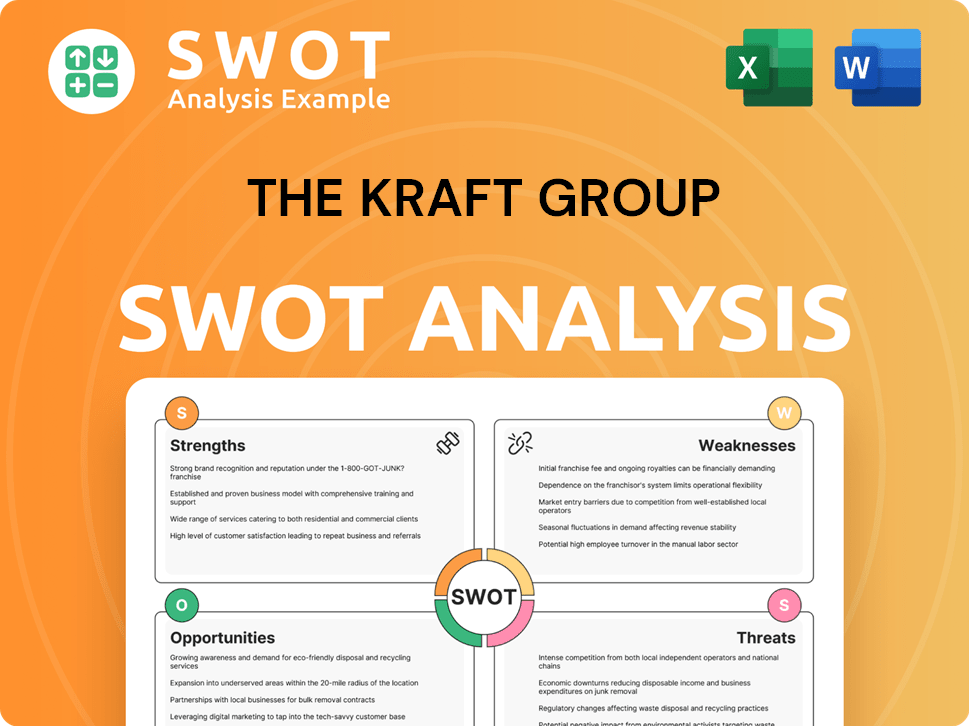

The Kraft Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does The Kraft Group Invest in Innovation?

The Kraft Group demonstrates a strong commitment to innovation and technology across its diverse business segments, aiming to drive sustained growth and operational efficiency. This approach is evident in its investments in advanced manufacturing, digital transformation, and sustainable practices. The company's strategic initiatives are designed to enhance its competitive position and capitalize on emerging opportunities.

The company's focus on technology and innovation is multi-faceted, encompassing improvements in production processes, enhanced customer experiences, and the development of sustainable solutions. This comprehensive strategy underscores The Kraft Group's dedication to adapting to evolving market demands and maintaining its leadership in various industries. The Mission, Vision & Core Values of The Kraft Group reflect this commitment to innovation.

By integrating technology and innovation, The Kraft Group aims to improve its operational efficiency, enhance customer engagement, and promote sustainability. This strategy is central to the company's long-term growth and its ability to adapt to the changing business environment. The Kraft Group's future is closely tied to its ability to leverage these advancements effectively.

The company invests in advanced manufacturing technologies, including automation and AI-driven predictive maintenance. These technologies optimize production processes, reduce waste, and enhance product quality. Rand-Whitney Containerboard's recent upgrade, valued at $135 million, incorporates state-of-the-art machinery to improve energy efficiency and boost output.

The Kraft Group is exploring innovative sustainable packaging solutions. This aligns with growing consumer and regulatory demands for environmentally friendly products. The focus on sustainability is a key element of the company's growth strategy.

Digital transformation initiatives are being implemented to enhance the fan experience at Gillette Stadium. These include advanced ticketing systems, cashless transactions, and improved connectivity. Data analytics and AI are used to personalize fan engagement and optimize game-day operations.

The New England Patriots continuously seek cutting-edge tools for player performance analysis and training. This helps them gain a competitive edge. The use of technology is crucial for improving team performance and strategy.

Smart building technologies, IoT sensors, and energy management systems are integrated into real estate ventures. These technologies create more efficient and sustainable properties. The focus is on reducing environmental impact and improving operational efficiency.

The private equity arm invests in companies at the forefront of technological innovation. These investments are particularly focused on areas that complement existing businesses or offer high growth potential. This strategic approach supports the overall growth strategy of The Kraft Group.

The Kraft Group's innovation strategy is multifaceted, targeting various aspects of its operations and investments. The company is focused on enhancing efficiency, improving customer experience, and promoting sustainability. These initiatives are critical for the future of the Kraft Group's investments and its overall growth.

- Advanced Manufacturing: Implementing automation and AI to optimize production and reduce waste.

- Digital Transformation: Enhancing fan experiences at Gillette Stadium through advanced ticketing and improved connectivity.

- Sustainable Solutions: Exploring environmentally friendly packaging options to meet consumer and regulatory demands.

- Data Analytics: Using data analytics and AI to personalize fan engagement and improve operational efficiency.

- Smart Building Technologies: Integrating IoT sensors and energy management systems in real estate ventures.

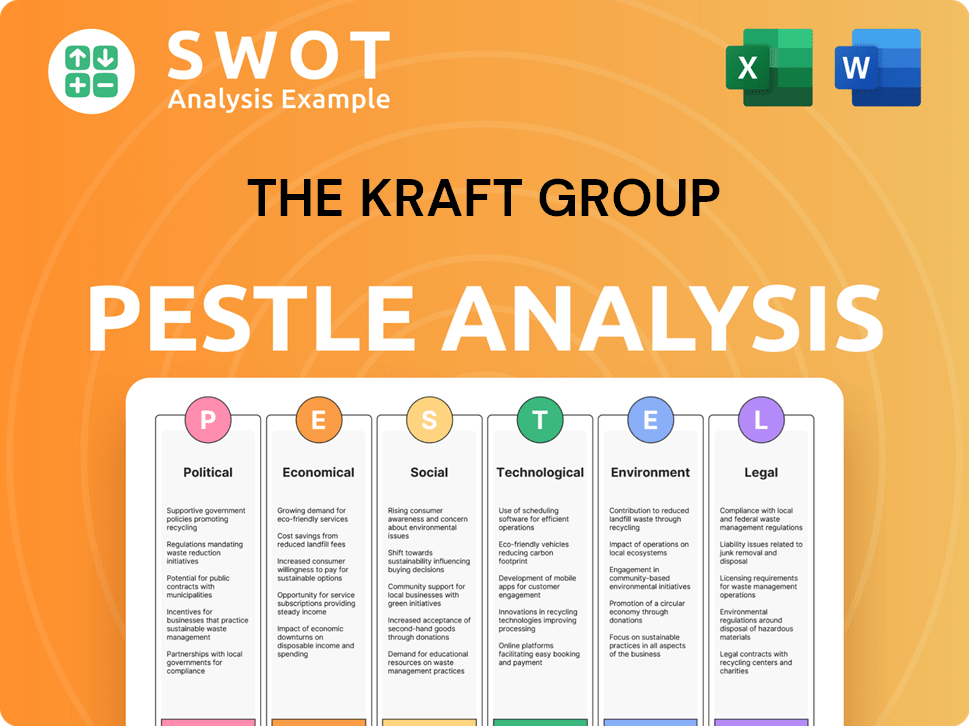

The Kraft Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is The Kraft Group’s Growth Forecast?

The financial outlook for The Kraft Group, a privately held entity, is primarily assessed through its strategic investments and the performance of its publicly visible assets. The company's consistent investment in its core businesses and its diversified portfolio suggests a proactive approach to financial management. This strategy is aimed at long-term capital appreciation and sustained growth, reflecting a positive financial outlook for future expansion. The Marketing Strategy of The Kraft Group includes a focus on reinvesting profits across its varied sectors.

The significant investment in Rand-Whitney Containerboard's Montville facility, with a projected completion by late 2024 or early 2025, underscores a strong financial commitment to its manufacturing sector. This investment is expected to boost revenue and market share in sustainable packaging. The high valuation of the New England Patriots, estimated at $7 billion in 2024, demonstrates the robust financial health and revenue potential of its sports and entertainment division.

Real estate developments around Gillette Stadium further contribute to long-term asset growth and diversified revenue streams. The company's financial strategy involves reinvesting profits across its diversified portfolio, coupled with strategic private equity investments. While specific revenue targets aren't public, consistent investments in infrastructure, technology, and brand expansion across its sectors indicate a positive and aggressive financial outlook.

The $135 million investment in Rand-Whitney Containerboard's Montville facility, expected to be finished by late 2024 or early 2025, highlights the company's commitment to its manufacturing sector. This investment is a key part of the Kraft Group's growth strategy, focusing on sustainable packaging. This strategic move is designed to increase revenue and market share.

The New England Patriots, a significant asset within the Kraft Group, were valued at approximately $7 billion in 2024. This valuation reflects the strong financial performance of the sports and entertainment division. The revenue is driven by media rights, sponsorships, and ticket sales.

Ongoing real estate developments around Gillette Stadium represent substantial long-term asset growth. These developments provide diversified revenue streams. This includes commercial leases and property appreciation.

The Kraft Group's financial strategy involves reinvesting profits across its diversified portfolio. This is combined with strategic private equity investments. This approach aims at long-term capital appreciation and sustained growth.

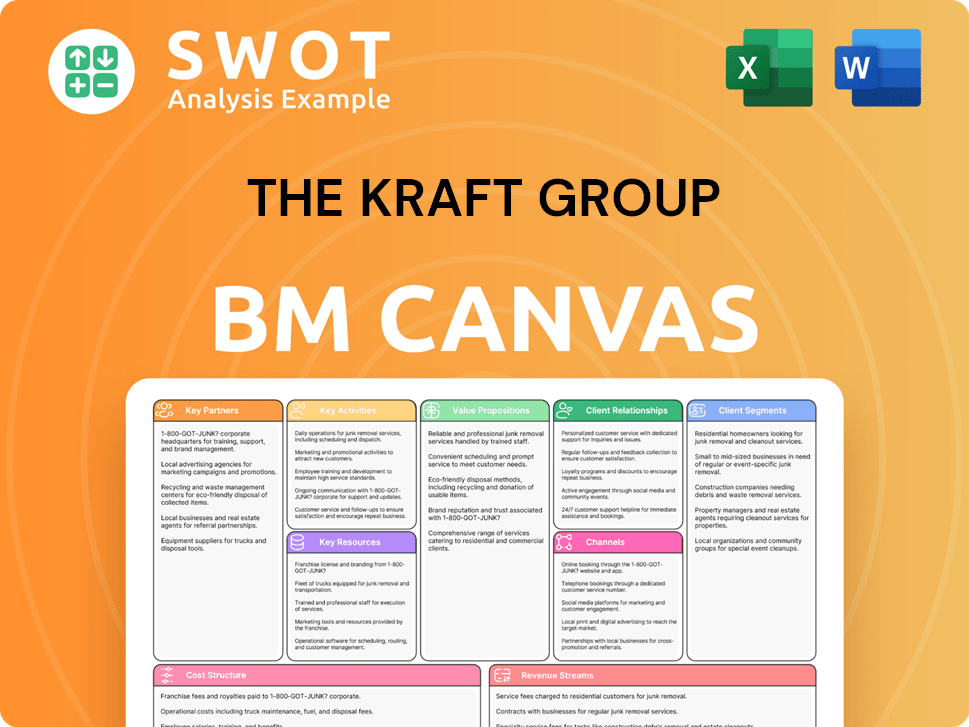

The Kraft Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow The Kraft Group’s Growth?

The Kraft Group's ambitious growth strategy faces various potential risks and obstacles across its diverse business segments. Understanding these challenges is crucial for assessing the company's long-term prospects. These risks range from market volatility to regulatory changes, impacting financial performance and strategic planning.

In the paper and packaging sector, volatile raw material costs and intense market competition pose significant challenges. The sports and entertainment division faces fluctuations in team performance, impacting revenue. Cybersecurity threats and evolving environmental regulations add further complexity.

Real estate development is subject to market cycles and interest rate changes. Across all segments, regulatory changes and economic conditions influence operations and profitability. These multifaceted risks require careful management and proactive strategies.

The paper and packaging sector faces volatile raw material costs. Intense market competition and evolving environmental regulations also present challenges. These factors can impact profit margins and require continuous investment in sustainable practices.

Team performance fluctuations can significantly impact fan engagement and revenue. Rising player salaries and competition for media rights also increase costs. Economic downturns can influence consumer spending on sports and entertainment.

Real estate development is exposed to market cycles and interest rate fluctuations. Permitting complexities and construction delays can also impact project timelines. These factors can influence project profitability and investment returns.

Cybersecurity threats pose a significant risk to all segments, requiring continuous investment in IT infrastructure. Regulatory changes across various industries can impact operations and profitability. Compliance costs can also increase.

Supply chain disruptions can impact manufacturing and distribution. Recent global events have highlighted these vulnerabilities. Diversifying suppliers and maintaining robust inventory management are crucial.

The economic climate influences consumer spending, particularly in sports and entertainment. Economic downturns can lead to reduced ticket sales and sponsorship revenue. Monitoring economic indicators is essential for forecasting.

The

Long-term planning for projects like Gillette Stadium reflects an understanding of market dynamics. This commitment to phased growth is a key element of their strategy. Strategic investments are made to navigate market fluctuations.

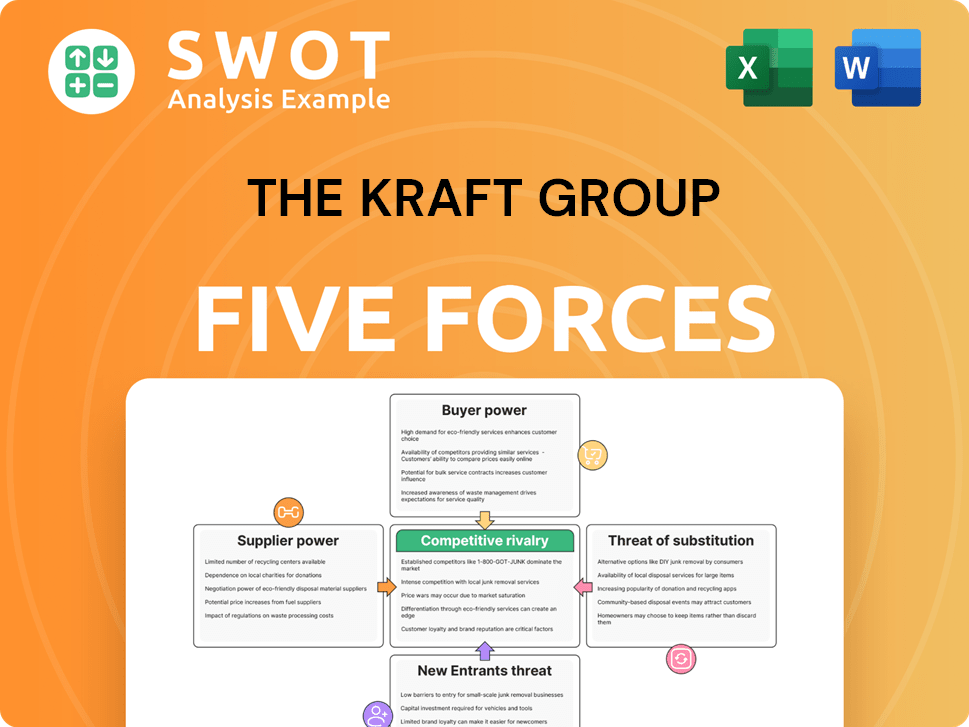

The Kraft Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of The Kraft Group Company?

- What is Competitive Landscape of The Kraft Group Company?

- How Does The Kraft Group Company Work?

- What is Sales and Marketing Strategy of The Kraft Group Company?

- What is Brief History of The Kraft Group Company?

- Who Owns The Kraft Group Company?

- What is Customer Demographics and Target Market of The Kraft Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.