Sears Holdings Bundle

Can the Rise and Fall of Sears Holdings Company Teach Us About Business Survival?

Imagine a retail giant that once defined American consumerism, pioneering the mail-order catalog and dominating the market. Sears, Roebuck and Co., a name synonymous with quality and affordability, fundamentally altered how people shopped. From its humble beginnings in 1893 Chicago, Sears expanded to become the largest retailer in the United States, a testament to its innovative spirit.

This Sears Holdings SWOT Analysis delves into the Sears history, examining the pivotal moments that shaped its trajectory. Exploring the brief history Sears reveals a fascinating story of adaptation, competition, and the changing dynamics of the retail landscape. Understanding the Sears retail journey, from its early days to its eventual struggles, provides valuable insights into the challenges faced by businesses in a rapidly evolving market, including Sears brands and the Kmart Sears merger.

What is the Sears Holdings Founding Story?

The story of Sears Holdings Company, or more specifically, its predecessor, Sears, Roebuck and Co., begins with Richard Warren Sears. In 1886, while working as a railroad station agent in North Redwood, Minnesota, Sears seized an opportunity to sell watches, which led to the founding of the R.W. Sears Watch Company.

This initial venture quickly evolved. Sears moved to Chicago in 1887 and brought on Alvah C. Roebuck, a watch repairman, to help with the burgeoning business. The partnership solidified in 1893, giving rise to Sears, Roebuck and Co.

The early focus of Sears, Roebuck and Co. was to solve a significant problem: providing rural consumers with access to a wide variety of goods. The company's mail-order catalog became a revolutionary way to bypass traditional retail limitations. It offered a diverse range of products directly to customers, starting with watches and jewelry and later expanding to include everything from clothing and tools to furniture.

The early success of Sears, Roebuck and Co. was built on a simple yet effective business model: offering a wide variety of products through a mail-order catalog, reaching customers in rural areas who had limited access to goods. This approach allowed the company to quickly grow and gain a significant market share.

- The company's initial funding came from Sears' early profits, demonstrating an organic growth approach.

- The partnership between Richard Sears and Alvah Roebuck combined entrepreneurial drive with technical expertise, which was crucial for the company's success.

- The late 19th-century context, marked by westward expansion and a growing rural population, provided a perfect environment for Sears' innovative retail model to thrive.

- The Mission, Vision & Core Values of Sears Holdings highlight the company's evolution and its attempts to adapt to changing market conditions.

Sears Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Sears Holdings?

The early growth of the Sears Holdings Company was remarkable, fueled by its expansive mail-order catalog. This catalog, a cornerstone of the Sears history, offered a vast array of products, making it a convenient shopping destination for many. This approach helped establish the company as a retail giant, especially in areas with limited access to traditional stores. The brief history of Sears is marked by this early success.

By 1895, the catalog had grown to 507 pages, offering everything from bicycles to sewing machines. This comprehensive selection and home delivery resonated with consumers, particularly in rural areas. Sears quickly became a household name, often referred to as 'the Consumers' Bible'. The catalogs drove significant sales, marking the company's early financial milestones.

The company expanded its team to handle increasing orders, establishing large warehouses and distribution centers. Sears aggressively entered new product categories, often manufacturing its goods to control quality and cost. This vertical integration included ventures into automotive accessories, farm equipment, and kit homes. Key acquisitions were less a feature of its early growth than organic expansion.

In 1895, Richard Sears sold his interest to Aaron Nusbaum and Julius Rosenwald. Rosenwald, a skilled administrator, took over leadership, standardizing operations and diversifying product lines. This era saw significant improvements in efficiency and further expansion of product offerings. The market's response to Sears' model was overwhelmingly positive, providing an affordable alternative to traditional shopping.

The mail-order approach initially faced limited competition, though local general stores remained a factor. Sears's growth efforts fundamentally shaped its trajectory, establishing it as a national retail powerhouse. The company's early success laid the groundwork for its later expansion into physical stores and the development of various Sears brands. To understand the competitive environment that Sears faced, you can explore the Competitors Landscape of Sears Holdings.

Sears Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Sears Holdings history?

The Sears history is marked by significant milestones that shaped its trajectory in the retail industry, from its early days as a mail-order business to its expansion into physical stores and eventual decline. The company's journey reflects the changing landscape of American consumerism and retail practices. Understanding the brief history of Sears provides insights into the evolution of retail strategies and the challenges faced by traditional brick-and-mortar stores in the face of e-commerce and shifting consumer preferences.

| Year | Milestone |

|---|---|

| 1886 | Richard Warren Sears founded the R.W. Sears Watch Company in Minneapolis, Minnesota, which later became Sears, Roebuck and Company. |

| 1893 | The first Sears, Roebuck and Co. catalog was published, revolutionizing retail by bringing a vast array of products to rural customers. |

| 1925 | Sears opened its first retail store in Chicago, marking a strategic shift from mail-order to a hybrid retail model. |

| 1931 | Sears introduced the "Allstate" brand, expanding its product offerings to include tires and other automotive products. |

| 1993 | Sears spun off its financial services business, including the Discover Card, to focus on its core retail operations. |

| 2005 | Sears merged with Kmart to form Sears Holdings Corporation, aiming to create a stronger retail competitor. |

| 2018 | Sears Holdings Corporation filed for Chapter 11 bankruptcy protection. |

Sears was a pioneer in several areas, significantly impacting the retail landscape. The company's early adoption of mail-order catalogs and its expansion into physical stores were innovative strategies. The introduction of private-label Sears brands, such as Kenmore and Craftsman, provided consumers with reliable, value-driven products, fostering brand loyalty.

Sears revolutionized retail with its mail-order catalog, which provided access to a wide variety of products for customers across the country. This catalog served as a primary source of sales for many years, particularly in rural areas where access to retail stores was limited.

The opening of physical retail stores in 1925 marked a significant shift in Sears's business model. This move allowed the company to reach a broader customer base and capitalize on the growing popularity of automobiles and suburban living.

Sears developed strong private-label brands like Kenmore (appliances) and Craftsman (tools), which became synonymous with quality and value. These brands not only generated substantial revenue but also fostered customer loyalty.

Sears established product testing laboratories to ensure the quality and reliability of its merchandise. This commitment to quality helped build trust with consumers and contributed to the success of its private-label brands.

Sears was an early adopter of technology in its operations, including the use of data analytics to understand customer behavior and improve inventory management. This helped the company optimize its supply chain and tailor its offerings to customer preferences.

Sears implemented various customer service initiatives, such as generous return policies and warranties, to enhance the shopping experience. These efforts helped build customer loyalty and differentiate Sears from its competitors.

Despite its innovations, Sears Holdings Company faced significant challenges. The rise of discounters like Walmart and Target, along with the growth of e-commerce, eroded Sears's market share. The merger with Kmart, intended to strengthen the company, ultimately exacerbated its financial difficulties. In the fourth quarter of 2017, Sears Holdings reported a net loss of $178 million, reflecting the severity of its financial struggles.

The emergence of discount retailers like Walmart and Target presented a major challenge to Sears. These competitors offered lower prices and a wider selection of merchandise, attracting customers away from Sears stores.

Sears struggled to adapt to changing consumer preferences and the shift towards online shopping. The company's vast physical footprint and outdated store formats became a liability as more consumers chose to shop online.

Despite being an early innovator in catalog sales, Sears failed to establish a strong online presence. This inability to compete effectively in the e-commerce market further contributed to its decline.

The 2005 merger with Kmart aimed to create a stronger competitor, but it ultimately compounded the challenges. Both companies were already struggling, and the combined entity faced massive debt and declining sales.

Sears's store formats became outdated, failing to provide the modern shopping experience that consumers expected. The stores often lacked the amenities and visual appeal of its competitors.

Sears faced mounting debt and persistent losses, leading to its Chapter 11 bankruptcy filing in October 2018. The company's inability to adapt to changing market conditions and compete with online retailers proved to be insurmountable.

Sears Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Sears Holdings?

Let's explore the Growth Strategy of Sears Holdings, beginning with a look at the key milestones in the Sears Holdings Company’s journey. From its humble beginnings as a mail-order watch business to its rise as a retail giant and eventual decline, the Sears story reflects the changing dynamics of the retail industry. The Sears history is a fascinating case study in business evolution and the challenges of adapting to market changes.

| Year | Key Event |

|---|---|

| 1886 | Richard Warren Sears began selling watches by mail order, marking the start of the company. |

| 1893 | Sears, Roebuck and Co. was officially established in Chicago, setting the foundation for its future. |

| 1895 | Julius Rosenwald joined the company, significantly impacting its operations and growth. |

| 1925 | The first Sears retail store opened in Chicago, signaling a shift towards physical retail. |

| 1931 | The Sears Tower (now Willis Tower) opened in Chicago, becoming the world's tallest building, symbolizing the company's prominence. |

| 1973 | Completion of the Sears Tower further cemented the company's status. |

| 1980s | The company faced increasing competition from discount retailers, starting a period of challenges. |

| 1993 | The iconic general merchandise catalog was discontinued after 97 years, a major strategic shift. |

| 2005 | Kmart and Sears merged to form Sears Holdings Corporation, aiming to create a retail powerhouse. |

| 2012 | Eddie Lampert became CEO of Sears Holdings, leading the company through a tumultuous period. |

| 2018 | Sears Holdings filed for Chapter 11 bankruptcy protection, a pivotal moment in its decline. |

| 2019 | Sears Holdings emerged from bankruptcy with a significantly reduced footprint, primarily under ESL Investments. |

| 2020-2024 | Continued store closures, with only a handful of Sears and Kmart locations remaining open as of early 2024. |

The future of Sears Holdings as a major retail entity is limited. The company has largely liquidated its assets post-bankruptcy. The remaining Sears and Kmart stores operate under Transformco, controlled by Eddie Lampert's ESL Investments.

Industry trends favor e-commerce and omnichannel retail, areas where Sears struggled to compete. Analyst predictions do not foresee a resurgence of the Sears brand to its former prominence. The focus is now on maximizing the value of remaining assets.

The future for the Sears brand may involve licensing its private labels or a very limited, niche retail presence. This contrasts sharply with its original vision of providing goods for every American household. The Sears brands are now primarily focused on maximizing value.

The financial troubles of Sears Holdings are well-documented, with the company facing bankruptcy in 2018. The Sears stock history reflects the challenges faced by the company. The Sears retail strategy changes were not enough to overcome the competition.

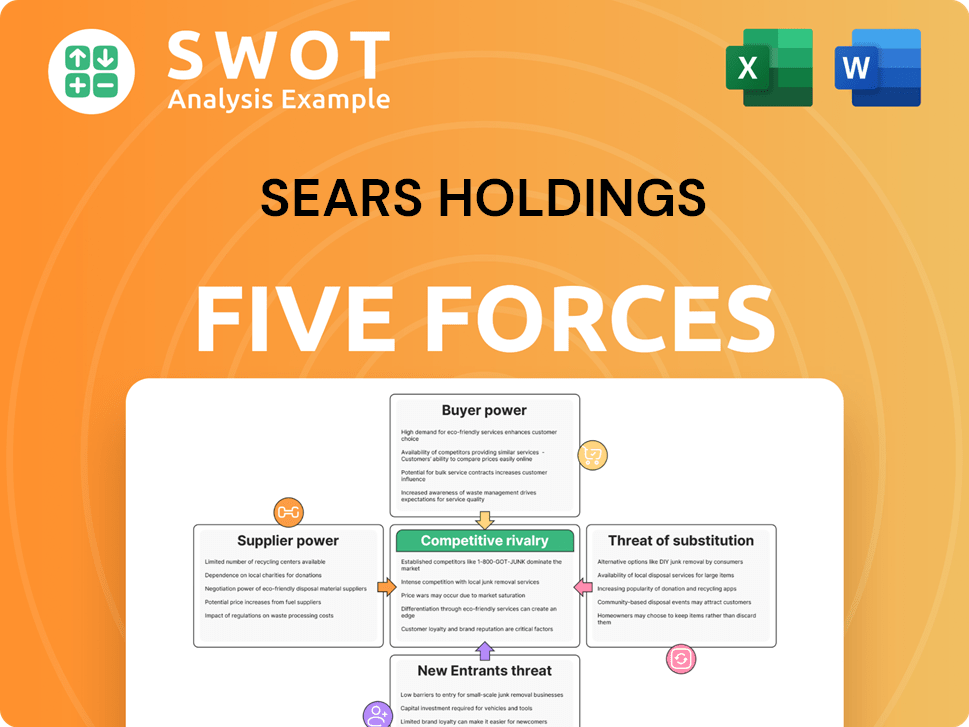

Sears Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Sears Holdings Company?

- What is Growth Strategy and Future Prospects of Sears Holdings Company?

- How Does Sears Holdings Company Work?

- What is Sales and Marketing Strategy of Sears Holdings Company?

- What is Brief History of Sears Holdings Company?

- Who Owns Sears Holdings Company?

- What is Customer Demographics and Target Market of Sears Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.