Sears Holdings Bundle

What Went Wrong for Sears Holdings Company?

The story of Sears Holdings Company is a cautionary tale in the retail industry, a stark illustration of how failing to understand your customer can lead to downfall. From its humble beginnings serving rural America, Sears once dominated the market. However, changing consumer preferences and the rise of e-commerce ultimately led to the company's decline.

The Sears Holdings SWOT Analysis reveals the critical role of customer demographics and target market in business success. Understanding the Sears customer age demographics, customer income levels, geographic location, and psychographics is crucial. This article delves into the Sears target market analysis, exploring how shifts in consumer behavior and market segmentation impacted the company's fate, providing valuable insights for any business navigating the complexities of the retail industry.

Who Are Sears Holdings’s Main Customers?

The primary customer segments for the Sears Holdings Company, encompassing both Sears and Kmart, historically centered on middle to lower-income consumers. Due to the company's bankruptcy and cessation of retail operations, specific recent demographic data is limited. However, the target market generally included families, homeowners, and individuals seeking affordable general merchandise, appliances, and apparel. The company's market segmentation catered to a broad audience, with variations in customer profiles between its two main brands.

Kmart, in particular, focused on a more budget-conscious demographic, often located in suburban and rural areas. Sears, while also appealing to value-conscious shoppers, had a stronger position in home appliances and tools, attracting homeowners and DIY enthusiasts. The retail industry faced significant shifts, with big-box retailers and e-commerce giants impacting Sears Holdings Company's market share. The company's ability to adapt to these changes was crucial for retaining customers and attracting new ones.

The company primarily served consumers (B2C), with no significant B2B operations. In its heyday, Sears' revenue came largely from appliances and tools, appealing to a demographic valuing durability and brand recognition. Kmart's strength was in everyday essentials and discount apparel. This Marketing Strategy of Sears Holdings evolved over time as the retail landscape changed, with the rise of competitors like Walmart, Target, and Amazon. These competitors offered similar products at competitive prices, often with a more modern shopping experience, significantly impacting the company's market share.

Sears and Kmart stores were located across the United States, with a significant presence in suburban and rural areas. This geographic distribution was a key factor in reaching their target market. The customer geographic location varied, with Kmart having a stronger presence in certain regions.

The customer income levels of the target market were primarily middle to lower-income households. Both brands offered products at various price points to cater to different income levels. Sears often targeted customers with slightly higher incomes for appliances and tools.

The customer age demographics included a broad range, with a significant portion being families and middle-aged adults. Sears and Kmart aimed to cater to various age groups. The customer preferences and lifestyles influenced their shopping behavior.

The customer gender distribution was relatively balanced, with both men and women being key consumers. Sears and Kmart offered products appealing to both genders. The customer buying behavior was influenced by various factors.

The Sears Holdings Company employed market segmentation based on income, geographic location, and lifestyle. The consumer profile was crucial in shaping the company's marketing strategies. Understanding the customer buying behavior helped tailor product offerings. The retail industry's competitive landscape required continuous adaptation.

- Income levels: Targeting middle to lower-income households.

- Geographic location: Focusing on suburban and rural areas.

- Lifestyle: Catering to families, homeowners, and value-conscious shoppers.

- Buying behavior: Influenced by price, brand recognition, and convenience.

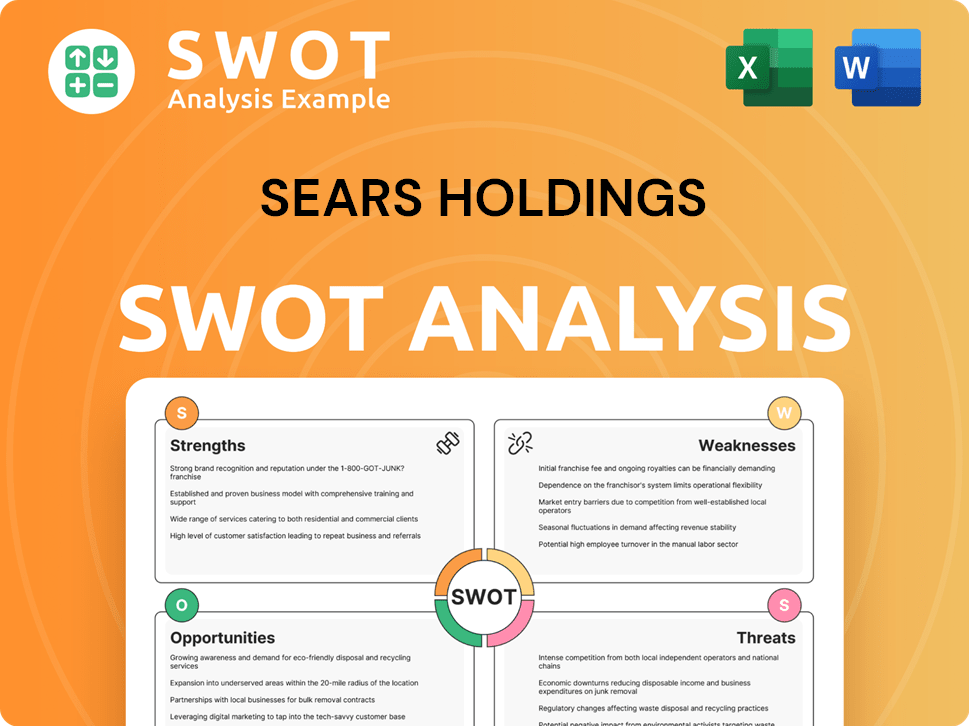

Sears Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Sears Holdings’s Customers Want?

Understanding the customer needs and preferences of the Sears Holdings Company is crucial for analyzing its historical performance and strategic challenges. Historically, the company's success hinged on meeting the demands of a diverse customer base. This involved offering a wide array of products and services that catered to various segments within the retail industry.

The target market for Sears Holdings Company has evolved significantly over time. Initially, the company focused on providing value, convenience, and a broad assortment of goods to its customers. This approach aimed to capture a large segment of the population, including families and individuals seeking practical, affordable products for their homes and daily lives.

However, as consumer behavior shifted towards online shopping and a greater emphasis on brand image, Sears Holdings Company struggled to adapt. The traditional department store model, with its vast but sometimes cluttered inventory, failed to resonate with a new generation of shoppers. The company's inability to effectively leverage customer feedback or quickly adapt to market trends in product development and service offerings contributed to its decline.

The primary customer needs and preferences driving sales at Sears Holdings Company historically revolved around value, convenience, and a wide assortment of goods. Sears customers, particularly in its prime, sought reliable home appliances, tools, and automotive services, valuing durability and the perceived quality associated with brands like Kenmore and Craftsman. These were often practical, long-term investments for homeowners. Purchasing behaviors included a mix of planned purchases for larger items and impulse buys for smaller household goods.

- Value: Customers sought competitive pricing and promotional offers, especially for everyday essentials and larger purchases.

- Convenience: The one-stop-shop model offered a wide range of products, from appliances to apparel, saving customers time.

- Product Quality and Reliability: Brands like Kenmore and Craftsman were associated with durability and reliability, appealing to customers seeking long-term value.

- Accessibility: Physical store locations provided easy access to products and services, particularly for those who preferred to see and touch items before buying.

- Customer Service: Accessible repair services and knowledgeable staff were important for building customer loyalty, especially for appliances and automotive services.

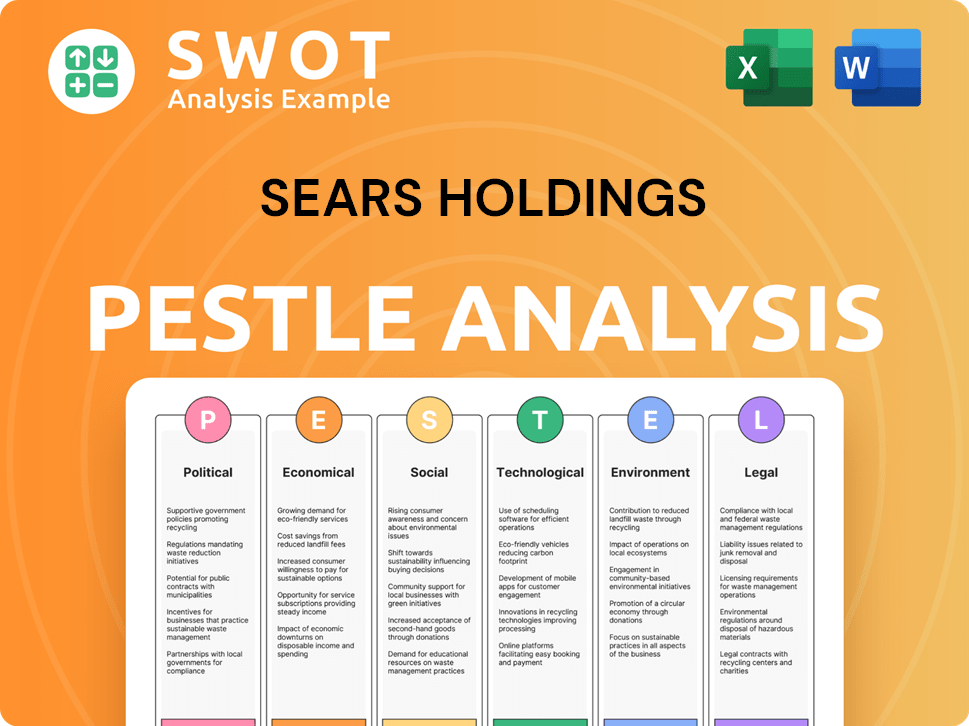

Sears Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Sears Holdings operate?

The geographical market presence of Sears Holdings Company, encompassing both Sears and Kmart, was once extensive across the United States, Canada, and Mexico. In its heyday, Sears boasted a strong presence in major metropolitan and suburban areas, particularly in the Midwest and Northeast. Kmart, on the other hand, often targeted more rural or budget-conscious markets, complementing Sears' reach.

Sears held significant market share and brand recognition in numerous regions, especially for appliances and tools. This widespread presence allowed the company to cater to diverse customer demographics and preferences. However, as the retail landscape shifted, the company struggled to adapt to changing consumer demands and competition.

The company faced challenges in adapting to the unique demands of diverse markets and competing with more agile regional and national retailers. In its later years, the company underwent strategic withdrawals, closing numerous underperforming stores across the U.S. and eventually ceasing operations in Canada. The geographic distribution of its sales and growth became increasingly concentrated in a shrinking number of stores as its financial difficulties mounted.

Sears Holdings attempted market segmentation by adjusting product assortments based on regional preferences and climate. This included tailoring offerings to specific customer demographics, such as homeowners in areas with higher concentrations or budget-conscious shoppers nationwide. However, these efforts were not always successful in the face of evolving consumer trends.

As financial difficulties increased, the geographic distribution of sales and growth became increasingly concentrated in a shrinking number of stores. This shift reflected the closure of underperforming locations and a focus on maintaining operations in more profitable areas. The company's footprint contracted significantly in its final years.

Customer demographics, preferences, and buying power varied across regions. For instance, Sears often performed better in areas with a higher concentration of homeowners, while Kmart appealed to a broader, more budget-conscious demographic nationwide. Understanding these regional differences was crucial for effective marketing and product placement.

In later years, Sears Holdings undertook strategic withdrawals, closing numerous underperforming stores across the U.S. and ceasing operations in Canada. These decisions were a response to financial pressures and the need to streamline operations. This impacted the company's overall geographical presence.

The decline of Sears Holdings Company underscores the importance of adapting to changing consumer behaviors and market dynamics within the retail industry. For a deeper understanding of the company's financial strategies, consider exploring the Revenue Streams & Business Model of Sears Holdings.

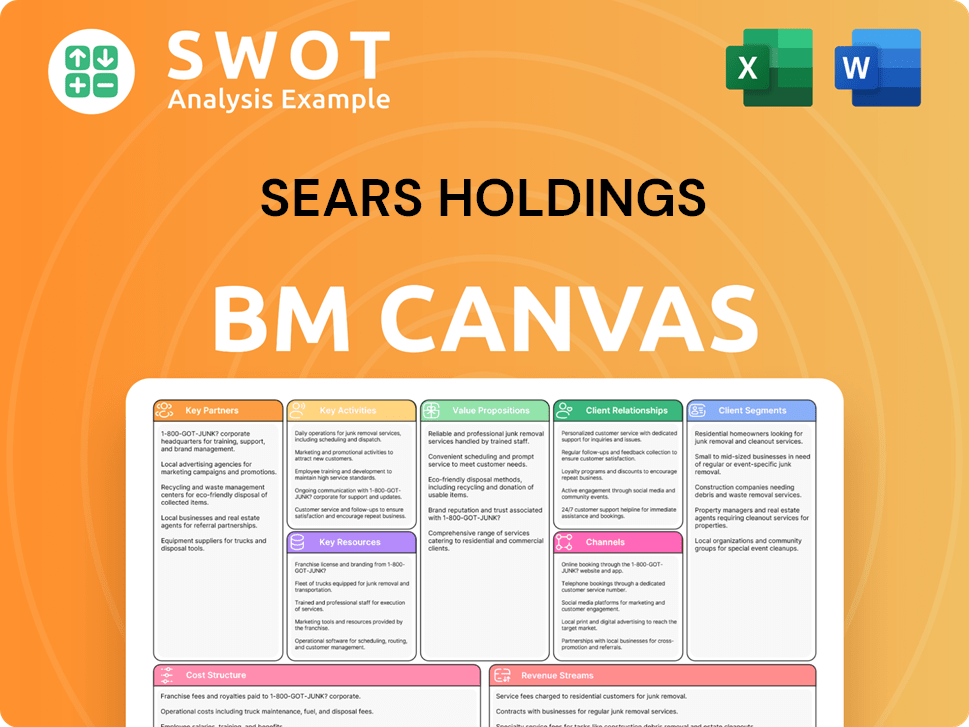

Sears Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Sears Holdings Win & Keep Customers?

Historically, customer acquisition and retention strategies for were multifaceted, evolving from mail-order catalogs to physical retail and e-commerce. Traditional marketing, including print ads and television commercials, was crucial for acquiring new customers, especially during major sales events. The company's credit card program also played a significant role in customer retention, using exclusive offers and financing options to build loyalty.

In physical stores, the company relied on knowledgeable sales associates, particularly in departments like appliances and electronics, to provide personalized service. Loyalty programs, though not as advanced as modern data-driven systems, were present through store credit and member benefits. After-sales service, especially for appliances and automotive, was a key differentiator, fostering trust and repeat business. However, the company faced challenges in adapting its strategies as the retail landscape changed.

Digital marketing efforts lagged behind competitors, failing to effectively leverage online channels, social media, or influencer marketing for customer acquisition. Outdated CRM systems and segmentation capabilities hindered the ability to target campaigns effectively or personalize experiences. While there were attempts at modernization, such as online shopping platforms, these often lacked the seamless experience customers expected from competitors like Amazon. The inability to innovate significantly impacted customer loyalty, contributing to a declining customer lifetime value and an increasing churn rate.

Print advertisements, television commercials, and direct mail were primary tools for reaching potential customers. These channels were particularly effective for promoting major sales events and new product launches. These methods helped to create brand awareness and drive foot traffic to physical stores.

The company's credit card offered exclusive deals and financing options, fostering customer loyalty. This program encouraged repeat purchases and provided valuable customer data. It was a significant retention tool, helping to maintain a consistent customer base.

Knowledgeable sales associates provided personalized service, especially in departments like appliances and electronics. This approach helped build customer trust and increase sales. Personal interaction played a crucial role in the customer experience.

After-sales service, particularly for appliances and automotive, was a key differentiator. It built customer trust and encouraged repeat business. This included warranty services and repair options that enhanced customer satisfaction.

The company's challenges in adapting to the evolving retail landscape significantly impacted its ability to acquire and retain customers. Its digital marketing efforts lagged behind competitors, failing to effectively utilize online channels, social media, or influencer marketing. Outdated CRM systems and segmentation capabilities hindered effective campaign targeting and personalization. For more information on the company's strategic direction, see the Growth Strategy of Sears Holdings.

The company struggled to compete in the digital space, failing to effectively utilize online channels, social media, and influencer marketing. This limited its ability to reach new customer segments and engage with existing customers in a modern way. Competitors like Amazon gained significant advantages through superior digital strategies.

Outdated CRM systems and segmentation capabilities hindered effective campaign targeting and personalization. This made it difficult to tailor marketing messages to specific customer groups, reducing the effectiveness of marketing efforts. Modern CRM systems are essential for customer relationship management.

The company's online shopping platforms were often clunky and did not offer the seamless experience customers expected. This resulted in lost sales and a negative impact on customer satisfaction. Competitors like Amazon provided a far superior user experience.

The inability to innovate acquisition campaigns and retention initiatives significantly impacted customer loyalty. This led to a decline in customer lifetime value and an increasing churn rate. The company's failure to adapt contributed to its financial struggles.

Effective market segmentation was crucial for targeting specific customer groups with tailored marketing messages. However, the company's outdated systems limited its ability to segment its customer base effectively. This resulted in a less efficient use of marketing resources.

The increasing churn rate in the company's final years indicated a loss of customers. This was a result of the inability to retain existing customers. Understanding and addressing the reasons for customer churn is critical for business survival.

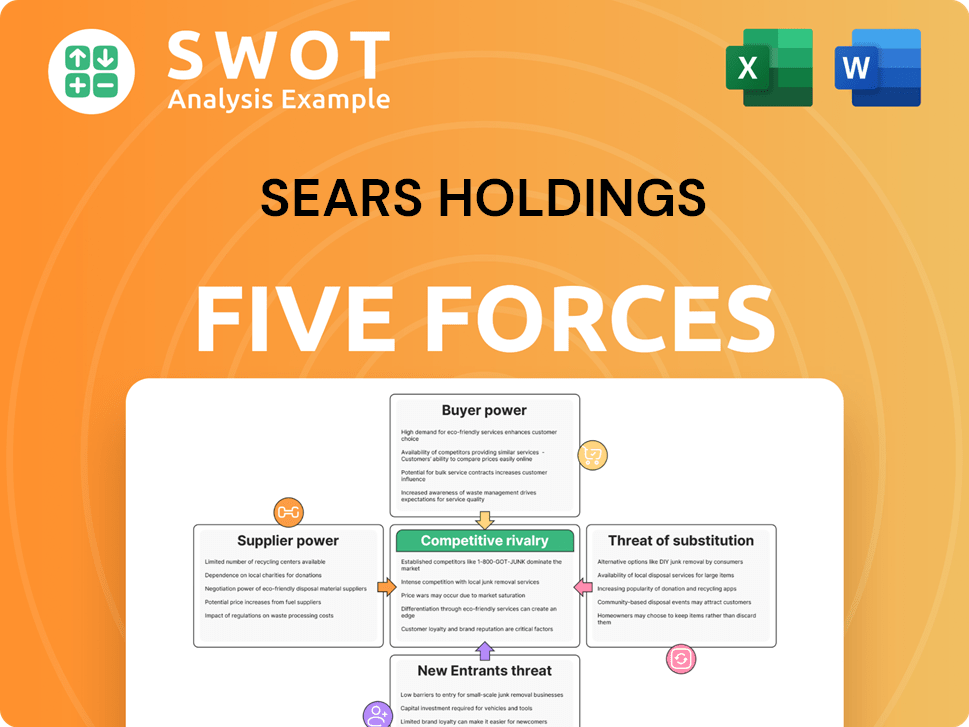

Sears Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sears Holdings Company?

- What is Competitive Landscape of Sears Holdings Company?

- What is Growth Strategy and Future Prospects of Sears Holdings Company?

- How Does Sears Holdings Company Work?

- What is Sales and Marketing Strategy of Sears Holdings Company?

- What is Brief History of Sears Holdings Company?

- Who Owns Sears Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.