Sears Holdings Bundle

How Did Sears Holdings Company Thrive (and Then Fail)?

Once a retail giant, Sears Holdings Company, the parent of Sears and Kmart, offers a fascinating case study in business evolution and decline. From dominating the American retail scene with innovative strategies to facing bankruptcy, its story is filled with valuable lessons. Understanding the Sears Holdings SWOT Analysis is key to grasping the complexities of its journey.

This exploration delves into the Sears business model and Sears operations, revealing the core strategies that once fueled its success. We'll examine how Sears Holdings Company generated revenue, navigated the competitive landscape, and ultimately succumbed to the pressures of the evolving retail industry. This analysis provides crucial insights into the challenges faced by department stores and the importance of adapting to changing consumer demands.

What Are the Key Operations Driving Sears Holdings’s Success?

Prior to its liquidation, Sears Holdings Company operated primarily through its two main retail banners: Sears and Kmart. The value proposition revolved around offering a broad array of products, including apparel, home goods, appliances, and automotive services, aimed at a wide customer base. Sears was particularly known for its Kenmore appliances and Craftsman tools, which were key drivers of customer traffic and loyalty. Kmart, on the other hand, focused on discount general merchandise, providing everyday essentials at competitive prices.

The operational processes supporting these offerings were extensive and complex. This included a vast network of physical retail stores, a sophisticated supply chain for sourcing and distributing products, and robust logistics to manage inventory and deliveries. Manufacturing capabilities, particularly for private-label brands like Kenmore and Craftsman, were also a key component. Sales channels encompassed both brick-and-mortar locations and, increasingly in its later years, online platforms. Customer service was delivered through in-store personnel, call centers, and repair services for appliances and other durable goods. The company's operational model relied heavily on its extensive physical footprint and established brand recognition to attract and retain customers.

However, compared to emerging competitors, Sears' operations faced challenges in adapting to the digital age and evolving consumer preferences. While its established supply chain and distribution networks were once a strength, they became less efficient in a rapidly changing retail landscape. The company's core capabilities, while historically strong in traditional retail, struggled to translate into sustained customer benefits or market differentiation against agile e-commerce players and more focused specialty retailers.

The Growth Strategy of Sears Holdings involved a multi-brand retail strategy, focusing on department stores. Sears and Kmart, the primary brands, offered a wide range of products. The business model aimed to cater to a broad customer base with diverse product offerings, including appliances, apparel, and home goods.

Sears' operations included a vast network of physical stores and a complex supply chain. The supply chain managed sourcing, distribution, and logistics for a wide variety of products. Manufacturing capabilities, especially for private-label brands, were crucial to its operations.

Sears offered a wide array of products, including appliances, apparel, and home goods. Kmart focused on discount general merchandise, aiming to provide everyday essentials. The value proposition centered on offering a wide selection of products to a broad customer base.

Sears faced challenges in adapting to the digital age and evolving consumer preferences. The established supply chain and distribution networks became less efficient. The company struggled to compete with agile e-commerce players and more focused specialty retailers.

Sears Holdings Company's operations included a large physical store footprint and a complex supply chain. The company's primary sales channels were brick-and-mortar stores and online platforms. Customer service was provided through in-store personnel, call centers, and repair services.

- Extensive retail store network across the United States.

- Complex supply chain for sourcing and distributing products.

- Manufacturing capabilities, particularly for private-label brands.

- Online sales platforms to complement physical stores.

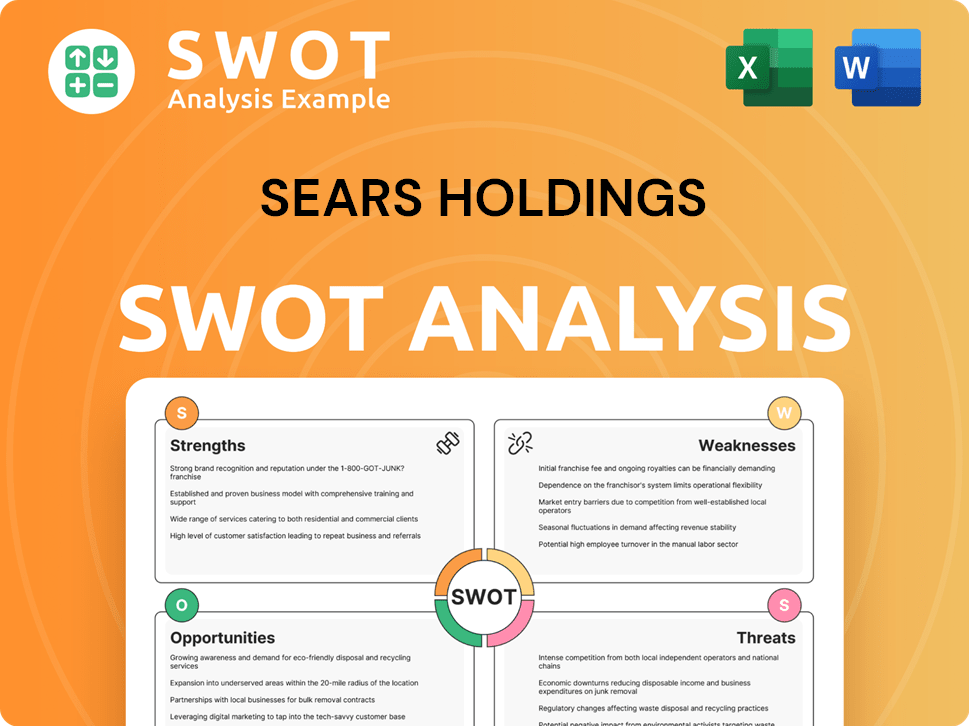

Sears Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sears Holdings Make Money?

The revenue streams and monetization strategies of Sears Holdings Company were primarily centered around retail sales. The company generated the majority of its income through the sale of merchandise across its various departments, including apparel, home goods, and electronics. Additional revenue came from services and financial products.

Sears, along with Kmart, relied heavily on in-store sales of general merchandise. However, it also explored additional revenue sources such as credit card programs and extended warranties. Despite these efforts, the company faced significant challenges in adapting to changing consumer behaviors and the rise of online competitors.

The financial performance of Sears Holdings Company provides a clear picture of its revenue streams. The company's reliance on in-store merchandise sales, and its inability to successfully diversify, ultimately contributed to its financial difficulties. Understanding these revenue streams is crucial for analyzing the Sears business model and its struggles within the retail industry.

The core of Sears Holdings Company's revenue came from the sale of products. The company's primary revenue streams included a variety of merchandise sales, as well as revenues from financial products and services. The decline in sales, particularly in-store, significantly impacted its financial health.

- Merchandise Sales: This included apparel, home furnishings, electronics, appliances (Kenmore), and tools (Craftsman).

- Credit Card Programs: Revenue generated through store-branded credit cards, including interest and fees.

- Extended Warranties: Sales of extended warranties on appliances and electronics.

- In-Store Services: Automotive services and other services offered at store locations.

Sears employed various strategies to monetize its operations and generate revenue. These strategies were aimed at increasing customer spending and loyalty, but they were not enough to offset the challenges faced by the company. For more insights, you can explore the Target Market of Sears Holdings.

- Loyalty Programs: Attempts to drive repeat business and increase customer lifetime value.

- Promotional Offers: Discounts and special offers to attract customers and boost sales.

- Real Estate: Efforts to leverage real estate assets, such as leasing or selling store properties.

- Partnerships: Exploring partnerships to diversify revenue streams.

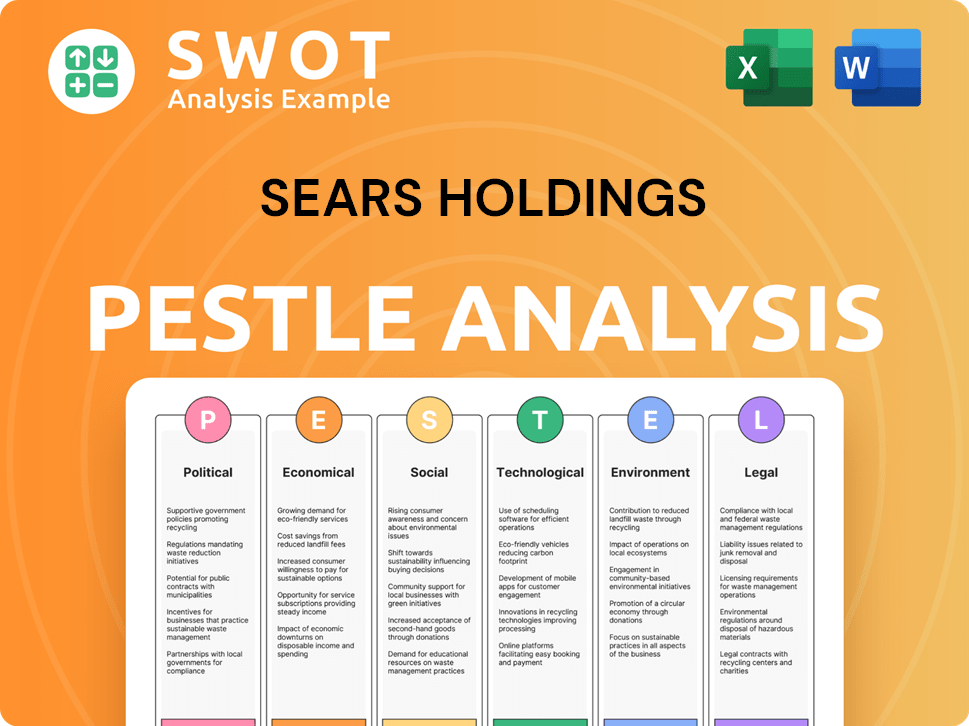

Sears Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Sears Holdings’s Business Model?

The story of Sears Holdings Company is a study in the challenges of adapting to a rapidly changing retail landscape. Key milestones include the 2005 merger of Kmart and Sears, a move orchestrated by Edward Lampert. This union aimed to create a retail powerhouse, but it ultimately struggled to compete with evolving consumer preferences and the rise of e-commerce.

Sears Holdings faced numerous strategic hurdles, including intense competition from Walmart, Target, and Amazon. Operational inefficiencies, an aging store infrastructure, and a failure to invest adequately in its online presence further compounded these problems. The company's response, often involving store closures and asset sales, proved insufficient to reverse its decline, culminating in bankruptcy in 2018.

The Sears business model, once a retail leader, was built on strong brand recognition and an extensive store network. However, these advantages eroded over time. The company struggled to adapt to new trends and competitive pressures, which led to its eventual demise. The Competitors Landscape of Sears Holdings highlights the intense pressure from rivals.

The merger of Kmart and Sears in 2005 was a pivotal, yet ultimately unsuccessful, strategic move. The company's bankruptcy filing in 2018 marked the end of its long history. The sale of the Craftsman brand in 2017 was an attempt to generate cash.

The company focused on store closures and asset sales to streamline operations. They attempted to improve supply chain efficiency. The company struggled to adapt to the rise of e-commerce and changing consumer preferences.

Historically, Sears had strong brand recognition, especially for its private labels like Kenmore and Craftsman. Its extensive store network provided a broad reach. However, these advantages diminished over time due to various factors.

Sears Holdings consistently reported declining revenues in the years leading up to its bankruptcy. The company's financial struggles were evident in its inability to compete with rivals. The company faced significant debt burdens.

Sears faced intense competition from big-box retailers like Walmart and Target. E-commerce giants like Amazon further eroded its market share. The company struggled to adapt to changing consumer behavior and technological advancements.

- Failure to invest in online presence.

- Inefficient supply chain management.

- Aging store infrastructure.

- Inability to compete effectively.

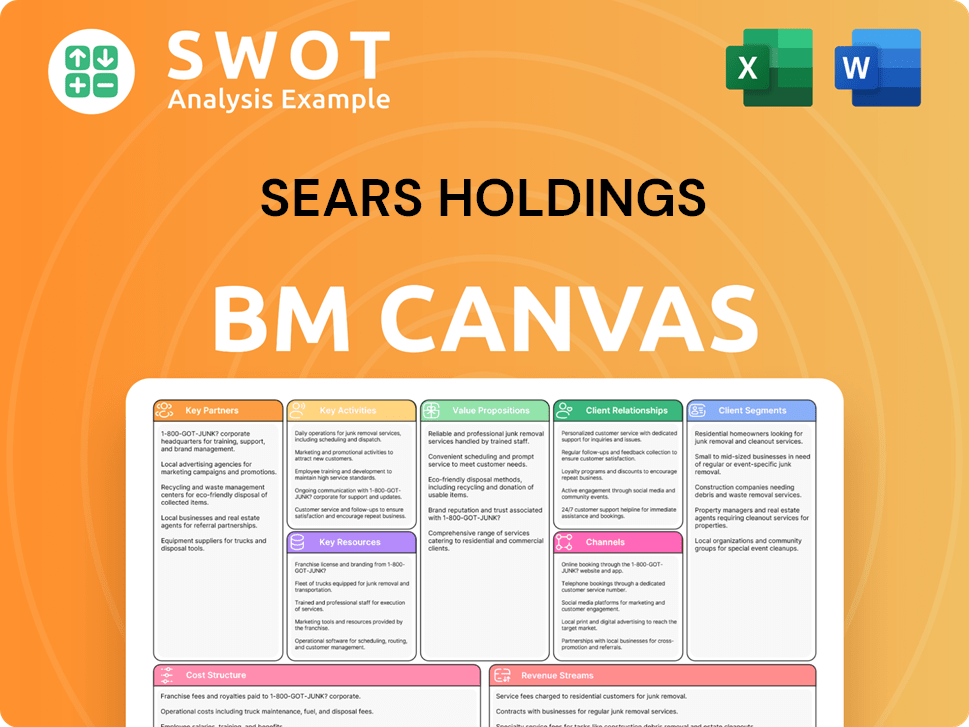

Sears Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Sears Holdings Positioning Itself for Continued Success?

Before its bankruptcy, Sears Holdings Company faced a declining industry position. Its market share in the retail industry decreased due to strong competition from more adaptable competitors, discount stores, and online platforms. Customer loyalty also decreased as consumers chose other shopping options. Before its closure, Sears' operations were largely concentrated in North America.

The company's operations and revenue were significantly impacted by intense competition, shifting consumer preferences towards online shopping, and a large debt burden. The inability to innovate and adapt to the digital age was a crucial risk, leading to significant consequences. Regulatory changes also presented ongoing compliance challenges.

The Sears business model struggled to compete in the dynamic retail landscape. Competitors such as Walmart and Target gained market share. The rise of e-commerce giants like Amazon further challenged Sears' position.

Key risks included changing consumer habits, heavy debt, and strong competition. The company's debt load was a significant burden, impacting its ability to invest in improvements. The failure to adapt to digital trends proved to be a critical issue for Sears operations.

As a liquidated entity, Sears Holdings Company no longer operates as a retailer. Its assets were sold off, and the remaining legal entity handles bankruptcy proceedings. The story of Sears is a reminder of the importance of adapting to market changes.

The main challenges included adapting to online retail, managing debt, and competing with more agile businesses. The merger with Kmart did not provide the expected benefits. The company struggled to evolve its Sears business strategy.

Sears Holdings Company experienced significant financial decline before its bankruptcy. The company's revenue decreased year after year, and it struggled to generate profits. The Sears Holdings Company financial performance was negatively impacted by high operating costs and decreasing sales.

- Declining Sales: Sears experienced a consistent decline in sales, indicating a loss of market share to competitors.

- Debt Burden: The company carried a substantial debt load, which limited its ability to invest in improvements and innovation.

- Store Closures: Sears closed numerous stores across the country as part of its restructuring efforts, reflecting the challenges it faced.

- Online Competition: The growth of online retailers, such as Amazon, significantly impacted Sears' sales and market position.

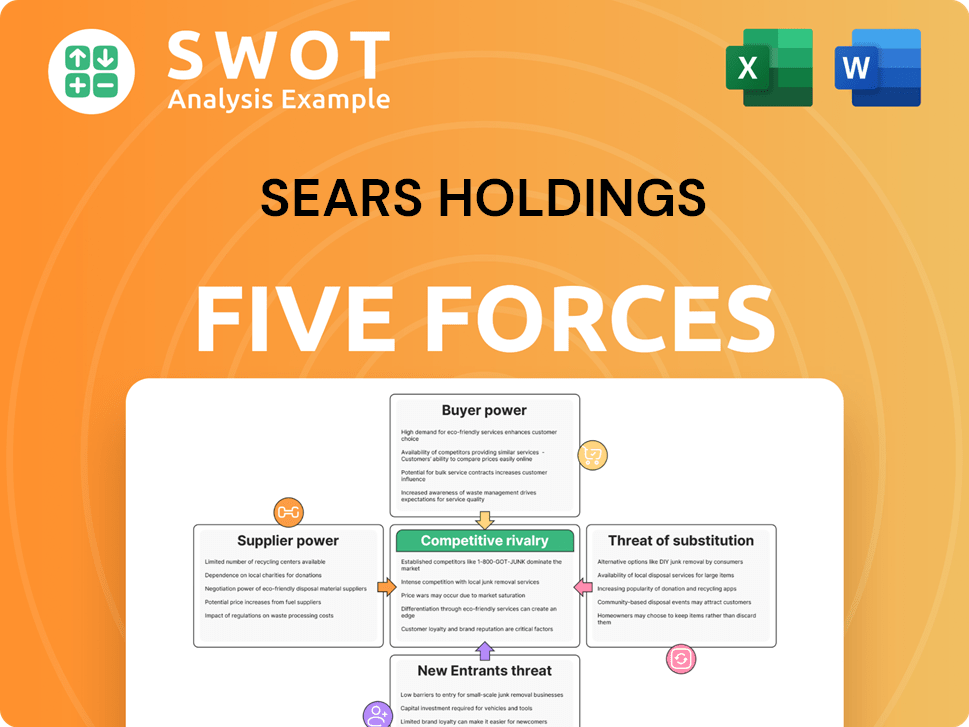

Sears Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sears Holdings Company?

- What is Competitive Landscape of Sears Holdings Company?

- What is Growth Strategy and Future Prospects of Sears Holdings Company?

- What is Sales and Marketing Strategy of Sears Holdings Company?

- What is Brief History of Sears Holdings Company?

- Who Owns Sears Holdings Company?

- What is Customer Demographics and Target Market of Sears Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.