SVB Bundle

How Did Silicon Valley Bank's Rise and Fall Reshape Finance?

Silicon Valley Bank (SVB) once stood as a financial titan, deeply intertwined with the tech and life sciences sectors. Founded in 1983, it became synonymous with supporting startups and venture capital firms, experiencing explosive growth in the late 2010s. But how did this seemingly invincible institution meet its dramatic end?

This SVB SWOT Analysis will delve into the SVB history, exploring its pivotal role in the innovation economy and the factors that led to its SVB collapse. Understanding the bank failure and its impact is crucial for investors and strategists alike, especially given its implications for the broader financial landscape and the venture capital world, as well as the potential for another financial crisis.

What is the SVB Founding Story?

The story of Silicon Valley Bank (SVB) began on October 17, 1983. It was the brainchild of Bill Biggerstaff and Robert Medearis. Their vision was to create a financial institution specifically tailored to the needs of the burgeoning tech and life sciences sectors in Silicon Valley.

The idea originated in 1981 during a poker game in Pajaro Dunes, California. Biggerstaff, an executive from Wells Fargo, and Medearis, a Stanford University professor and former Bank of America manager, identified a gap in the market. They saw that emerging technology and life sciences companies lacked sufficient access to capital and banking services. Roger V. Smith, formerly of Wells Fargo, was brought on board as the first CEO and president.

SVB's initial strategy involved taking deposits from liquid tech companies and lending to traditional businesses and commercial real estate. However, this approach faced challenges during the commercial real estate crisis of the early 1990s. SVB distinguished itself by focusing on the innovation market, supporting startups that other financial institutions often overlooked due to higher perceived risks. The bank's model required borrowers to manage all accounts and excess cash with SVB, using all assets as collateral. This strategy helped SVB become a preferred bank for almost half of all venture-backed tech startups. The company went public in 1988, raising $6 million in equity.

SVB's early focus was on serving the tech and life sciences sectors, an underserved market at the time. The bank's business model was designed to support startups and innovation-driven companies.

- Founded in 1983 by Bill Biggerstaff and Robert Medearis.

- Roger V. Smith served as the first CEO and president.

- Initially focused on lending to traditional businesses and commercial real estate.

- Transitioned to specializing in the innovation market.

- Went public in 1988, raising $6 million in equity.

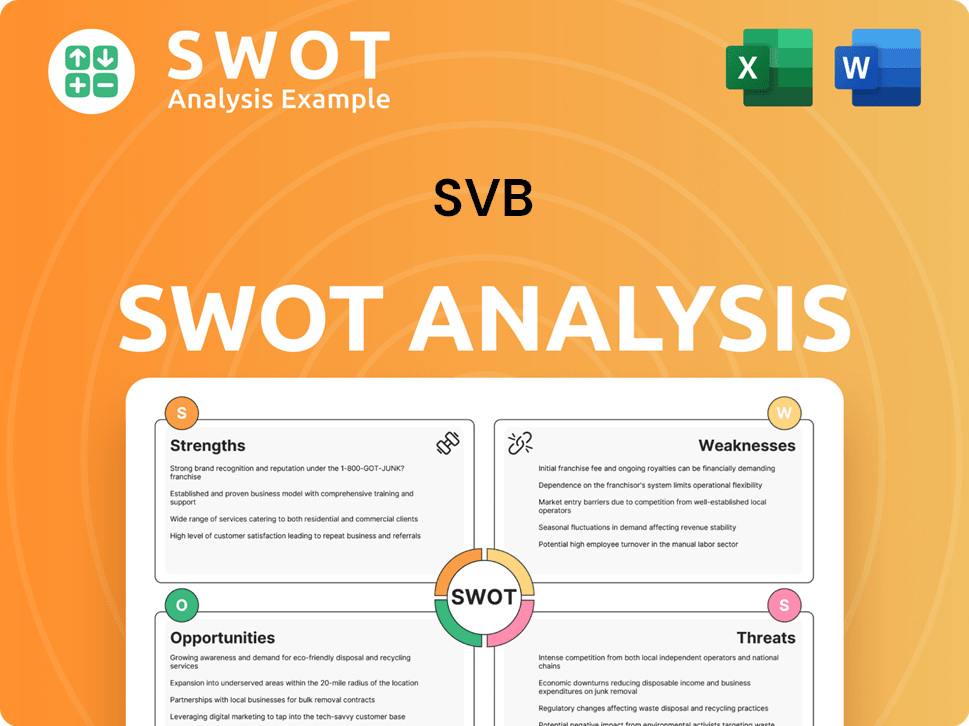

SVB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of SVB?

The early years of Silicon Valley Bank (SVB) marked a period of significant expansion and strategic development. Following its establishment in 1983, SVB rapidly grew, broadening its operational footprint and service offerings. This growth trajectory laid the foundation for its later prominence in the financial sector, particularly within the technology and venture capital ecosystems. Understanding the Growth Strategy of SVB during this phase is key to grasping its eventual rise and fall.

By 1986, SVB had established offices in San Jose, Palo Alto, and Santa Clara, California. The same year, SVB merged with National InterCity Bancorp, broadening its customer base. This strategic move helped SVB to increase its market presence and enhance its service capabilities.

In 1988, SVB completed its Initial Public Offering (IPO), successfully raising $6 million in equity capital. The company's stock began trading on the Nasdaq under the symbol SIVB. This IPO provided SVB with additional capital to fuel further expansion and solidify its position in the market.

Throughout the 1990s, SVB continued to expand across the United States, focusing on startups in need of financing. The bank diversified its services, including niche industries like premium wine. By 2000, SVB operated over 20 offices nationwide and served over a dozen industries, demonstrating its growing influence in the financial sector.

Between 2019 and 2021, SVB experienced substantial growth, with its parent company tripling in size. Deposits increased significantly in 2021, fueled by acquisitions, IPOs, secondary offerings, SPAC fundraising, and venture capital investments. By the end of 2021, SVB's assets grew by 271%, significantly outpacing the 29% growth in the overall banking industry. This rapid expansion, however, led to a high concentration of deposits from venture capital-backed tech and life sciences companies, making its funding growth directly linked to venture capital deal activity.

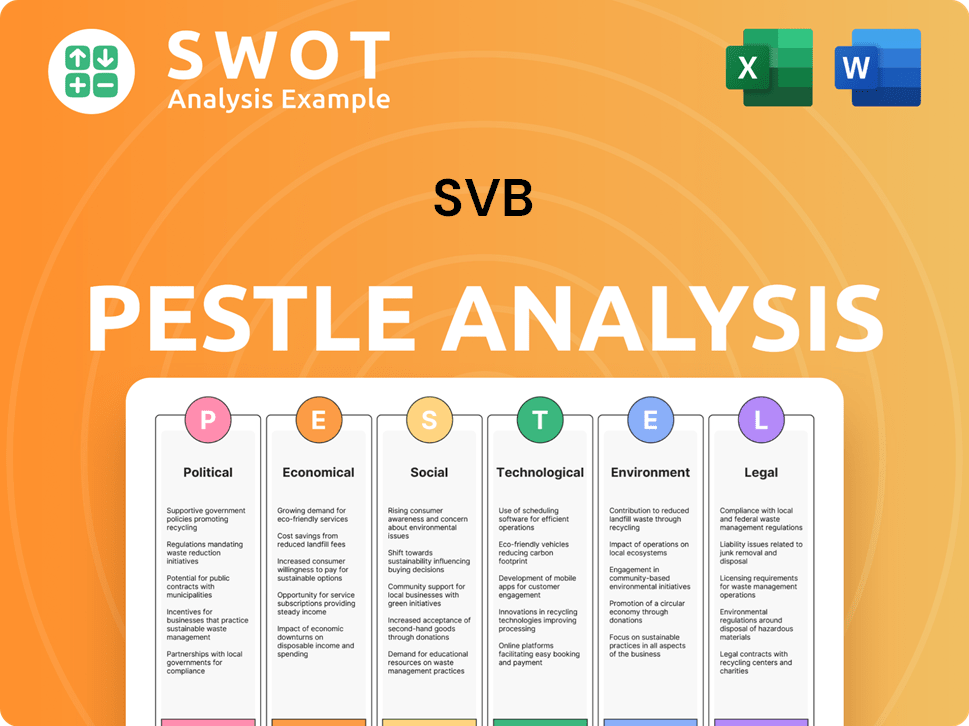

SVB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in SVB history?

The SVB history is marked by significant achievements in catering to the innovation economy, alongside notable challenges, culminating in its SVB collapse. Initially, the bank focused on providing specialized financial services to startups and venture capital firms, a segment largely overlooked by traditional banking institutions. By 2003, Silicon Valley Bank had supported over 30,000 entrepreneurial companies, establishing a strong foothold in the tech and venture capital sectors.

| Year | Milestone |

|---|---|

| 1983 | Founded to serve the venture capital industry and its portfolio companies. |

| 2003 | Supported over 30,000 entrepreneurial companies, solidifying its position in the tech industry. |

| 2010s | Expanded services to include private equity, private banking, and investment services to meet clients' long-term financial needs. |

| March 10, 2023 | Closed by the California Department of Financial Protection and Innovation after a bank run, leading to its acquisition. |

A key innovation was its early recognition of the unmet banking needs of startups and venture capital firms, offering specialized services that traditional banks overlooked. This focus allowed the bank to build a strong niche within the tech industry and become a crucial financial partner for many innovative companies. The bank expanded its offerings beyond commercial banking to include private equity, private banking, merger and acquisition services, and investment services, aiming to meet clients' sophisticated long-term financial needs.

Focused on the unique financial needs of startups and venture capital firms, offering tailored banking solutions. This included providing loans, managing cash flow, and offering advice specific to the tech industry.

Developed deep expertise in the venture capital ecosystem, understanding the funding cycles and financial requirements of high-growth companies. This allowed them to offer relevant financial products and services.

Expanded its offerings beyond commercial banking to include private equity, private banking, merger and acquisition services, and investment services to meet the sophisticated long-term financial needs of its clients.

Expanded its reach internationally, establishing a presence in key markets to support its clients' global operations and facilitate cross-border transactions. This included offices in the UK, Canada, and other countries.

The bank was at the forefront of understanding and supporting the innovation economy. They were early adopters of new technologies and financial products to better serve their clients in the tech and venture capital sectors.

Formed strategic partnerships with venture capital firms, accelerators, and other industry players to gain insights and provide better services to their clients. These partnerships helped them stay ahead of industry trends.

However, SVB faced its most significant challenge in March 2023, leading to its bank failure. This rapid insolvency was primarily attributed to poor risk management, particularly regarding interest rate risk, and a high concentration of uninsured deposits from a single industry—the technology sector. The SVB collapse highlighted the importance of diversification and robust risk management in the banking sector. For more details on the competitive landscape, consider reading about the Competitors Landscape of SVB.

The bank's investment in long-term securities, funded by deposits, was highly susceptible to interest rate fluctuations. As interest rates rose in 2022, the value of these securities plummeted, leading to substantial unrealized losses.

A significant portion of SVB's deposits came from the tech industry, making it vulnerable to industry-specific downturns. The high concentration of uninsured deposits exacerbated the risk during the bank run.

The announcement of losses and a capital raise triggered a rapid bank run, as customers, concerned about the bank's solvency, withdrew their deposits. This was amplified by social media and news outlets.

Questions were raised about the effectiveness of regulatory oversight, as the bank's risk management practices and the concentration of deposits were not adequately addressed before the crisis. This led to scrutiny of the regulatory bodies.

The collapse of SVB sent shockwaves through the financial markets, particularly impacting the tech and venture capital sectors. The financial crisis caused concerns about the stability of other banks with similar profiles.

SVB faced severe liquidity issues as customers withdrew their deposits rapidly. The bank's inability to meet these withdrawal demands led to its ultimate failure and the intervention of regulatory bodies.

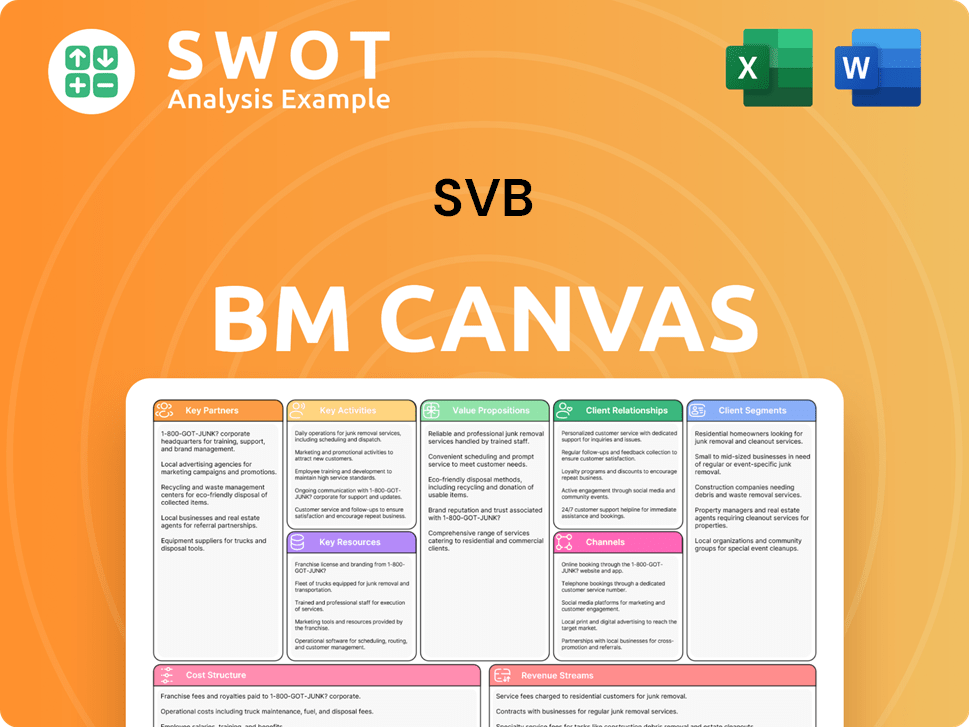

SVB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for SVB?

The history of Silicon Valley Bank (SVB) is marked by periods of significant growth and, ultimately, a dramatic collapse. Founded in 1982 as SVB Financial Group, the bank quickly became a key player in the venture capital ecosystem. Its early focus on supporting technology and life science companies fueled its expansion for decades. However, the bank's trajectory took a sharp turn in March 2023, leading to one of the most significant bank failures in recent history. The Owners & Shareholders of SVB faced severe repercussions.

| Year | Key Event |

|---|---|

| April 23, 1982 | SVB Financial Group (then Silicon Valley Bancshares) is founded by Bill Biggerstaff and Robert Medearis. |

| October 17, 1983 | Silicon Valley Bank is incorporated as a wholly-owned subsidiary, opening its first office in San Jose, California. |

| 1986 | SVB opens offices in Palo Alto and Santa Clara, and merges with National InterCity Bancorp. |

| 1988 | The company completes its IPO, raising $6 million in equity, and begins trading on Nasdaq under the symbol SIVB. |

| Early 1990s | SVB faces challenges during the commercial real estate crisis. |

| 2000 | Ken Wilcox becomes CEO. |

| 2003 | SVB celebrates its 20th anniversary, having supported over 30,000 entrepreneurial companies. |

| 2019-2021 | SVB experiences tremendous growth, tripling in size. |

| December 2021 | SVB acquires MoffettNathanson. |

| March 8, 2023 | SVB announces a $1.8 billion loss on bond holdings and plans for a capital raise, triggering concerns. |

| March 9, 2023 | SVB customers withdraw $42 billion, leading to a bank run. |

| March 10, 2023 | California regulators close SVB and appoint the FDIC as receiver. |

| March 26-27, 2023 | First Citizens Bank acquires SVB's assets and liabilities, including $110 billion in assets, $56 billion in deposits, and $72 billion in loans. |

| August 4, 2024 | SVB's former owner, SVB Financial Group, ends its bankruptcy. |

| May 2, 2024 | SVB Financial Group announces the sale of its investment platform business, SVB Capital, to an affiliate of Pinegrove Capital Partners. |

| March 12, 2025 | Silicon Valley Bank, now a division of First Citizens Bank, announces a strategic lending relationship with Pinegrove Venture Partners, expecting to deploy a combined $2.5 billion in venture debt loans to technology and life science companies over the coming years. |

As a division of First Citizens Bank, SVB is now concentrating on client retention and deposit growth. The bank aims to stabilize and rebuild trust after the bank failure. This involves focusing on its core clientele within the innovation economy.

The 2025 'State of the U.S. Wine Industry' report indicates a 1% decline in total wine value sales in 2025. However, the top 25% of wineries in SVB's data saw a 22% average revenue growth in 2024. The 'Future of Climate Tech 2025 Report' shows consistent growth in US climate tech investments, with a 9% higher IRR in the 2020-2024 fund vintage.

The 'State of the Markets H1 2025' report from SVB suggests a healthy recovery in the innovation economy. AI is a key driver of momentum in 2025, and lower interest rates could end the three-year exit drought. This indicates a positive trend for venture capital-backed companies.

SVB continues to support the innovation economy, with new clients in 2024 and hundreds more in Q1 2025. The strategic lending relationship with Pinegrove Venture Partners, expecting to deploy $2.5 billion in venture debt loans, highlights a commitment to supporting technology and life science companies.

SVB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of SVB Company?

- What is Growth Strategy and Future Prospects of SVB Company?

- How Does SVB Company Work?

- What is Sales and Marketing Strategy of SVB Company?

- What is Brief History of SVB Company?

- Who Owns SVB Company?

- What is Customer Demographics and Target Market of SVB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.