SVB Bundle

How Does Silicon Valley Bank Thrive in the Innovation Economy?

Silicon Valley Bank (SVB), now part of First Citizens Bank, isn't just another financial institution; it's a cornerstone of the tech and venture capital world. Its specialized banking services have long fueled the growth of startups and tech companies, making it a critical player in the innovation ecosystem. Understanding the SVB SWOT Analysis is key to grasping its intricate operations.

This in-depth analysis will explore SVB's SVB business model, examining how it provides banking services and startup funding to its unique clientele. We'll uncover SVB's role in venture capital, its lending practices, and its impact on the broader financial landscape, providing insights crucial for investors and industry watchers alike. Learn how SVB continues to support tech companies and navigate the ever-changing market dynamics.

What Are the Key Operations Driving SVB’s Success?

Silicon Valley Bank (SVB) carved out a unique niche in the financial world by specializing in the innovation economy. SVB's core operations revolve around providing a comprehensive suite of banking and financial services tailored to startups, venture capital firms, and technology and life sciences companies. The SVB business model is built on understanding and catering to the specific needs of high-growth companies, offering services that traditional banks often overlook.

SVB's value proposition lies in its deep sector expertise and its ability to support clients through various stages of growth. From early-stage startups to established corporations, SVB provides specialized banking solutions, venture debt, and cash management services. This approach allows SVB to build strong relationships with its clients and become a trusted partner in their financial journeys. The bank's focus on the innovation economy has allowed it to develop a unique understanding of the challenges and opportunities faced by its clients.

The bank's operational processes are designed to meet the demands of high-growth companies. This includes providing venture debt, lines of credit, and cash management services. SVB also offers startup-specific credit cards and a digital banking platform to streamline financial operations. SVB's supply chain and distribution networks are characterized by a relationship-based approach with dedicated startup bankers and a strong network within the venture capital community. This allows SVB to offer relevant advice and connect clients with peers and investors, fostering growth and navigating complexities.

SVB offers a range of commercial banking services designed to support the financial needs of technology and life sciences companies. These services include deposit accounts, lending solutions, and cash management tools. SVB's commercial banking services are tailored to the unique needs of high-growth companies, providing flexible and scalable financial solutions.

SVB provides investment banking services to technology and life sciences companies, including mergers and acquisitions (M&A) advisory, equity and debt financing, and strategic advisory services. SVB's investment banking team has extensive experience in the innovation economy, providing valuable insights and guidance to its clients. SVB's investment banking services help clients navigate complex financial transactions and achieve their strategic goals.

SVB offers private banking services to high-net-worth individuals and families in the technology and life sciences sectors. These services include wealth management, investment management, and financial planning. SVB's private banking services provide personalized financial solutions tailored to the unique needs of its clients. SVB's private banking services help clients manage their wealth and achieve their financial goals.

SVB provides venture capital services to venture capital firms and their portfolio companies. These services include fund administration, capital call financing, and portfolio company banking. SVB's venture capital services support the entire venture capital ecosystem, providing financial solutions and insights to both investors and their portfolio companies. SVB's venture capital services help venture capital firms manage their funds and support their portfolio companies' growth.

What sets SVB apart is its deep understanding of the startup ecosystem and its ability to provide tailored financial solutions. SVB's 40 years of experience in the sector allowed it to build a business designed specifically for high-growth companies and investors. This specialized knowledge translates into several key customer benefits.

- Flexible Banking and Capital Options: SVB offers a range of financial products and services designed to meet the evolving needs of startups, including venture debt, lines of credit, and cash management solutions.

- Strategic Support: SVB provides strategic advice and insights to its clients, helping them navigate the complexities of the innovation economy.

- Market Trend Insights: SVB's deep sector expertise allows it to provide clients with valuable insights into market trends and opportunities.

- Extensive Network: SVB connects clients with peers and investors, fostering growth and facilitating access to capital.

SVB's focus on the technology and life sciences sectors and its unique approach to banking services were key components of its business model. For more insights into the bank's history, you can read Brief History of SVB.

SVB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SVB Make Money?

The core of Silicon Valley Bank's (SVB) revenue generation stems from its specialized banking and financial services tailored to the innovation economy. This includes commercial banking, investment banking, private banking, and venture capital services. The bank's approach is designed to support companies at various stages of growth, from startups to established tech firms.

While specific, updated revenue breakdowns for 2024-2025 are not publicly detailed, the bank's operational model indicates that interest income from loans and investments, along with fees from various banking and advisory services, forms the core of its monetization strategies. SVB's ability to attract and retain clients within the tech and venture capital ecosystem is crucial to its financial performance. The bank's focus on venture debt, which allows startups to secure funding based on their equity rounds, is a notable strategy that attracts deposits and generates interest income.

SVB's revenue streams are diversified across several key areas, reflecting its comprehensive service offerings. Commercial banking provides lending, cash management, and payment solutions. Investment banking generates revenue through advisory and transaction fees from mergers and acquisitions and capital raises. Private banking and wealth management cater to high-net-worth individuals, and SVB Capital invests in promising businesses.

SVB's revenue model is built on several key pillars, each contributing to its financial success. These include interest income from loans and investments, fees from banking services, and returns from venture capital investments. Understanding these streams is crucial to grasping how SVB's target market drives its financial performance.

- Commercial Banking: Lending (including venture debt and accounts receivable financing), cash management, payment solutions, and commercial cards.

- Investment Banking: Mergers and acquisitions, leveraged finance, private placements, and capital raises for private and public technology companies.

- Private Banking and Wealth Management: Services for high-net-worth individuals within the innovation ecosystem.

- SVB Capital: Investments in promising businesses and fund managers, generating returns through its investment portfolio.

SVB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped SVB’s Business Model?

The story of SVB, now operating as a division of First Citizens Bank, is a study in the volatility of the financial sector and the unique challenges faced by institutions serving the innovation economy. Initially, SVB carved out a niche by focusing on startups, venture capital firms, and technology companies. This specialization propelled its growth, especially during the period leading up to the COVID-19 pandemic, when many venture-backed startups thrived, boosting SVB's stock price to record highs. The bank's business model was built on understanding and catering to the needs of the tech and startup world.

However, the bank's fortunes took a dramatic turn in March 2023. A bank run triggered by concerns over its financial health led to its seizure by California regulators. This event marked the largest bank failure since the 2008 financial crisis, highlighting the risks associated with its concentrated client base and exposure to the tech sector. The collapse was attributed to a combination of factors, including mismanagement, risky lending practices, and overexposure to volatile technology markets, compounded by rising interest rates that devalued its bond portfolio.

First Citizens Bank's acquisition of SVB's deposits and loans aimed to stabilize the bank and leverage First Citizens' diversified platform. This strategic move has allowed SVB to maintain a presence in the market, particularly among its existing client base. Despite the crisis, SVB has retained a significant portion of its clients, with about half of startups still maintaining a funded account. For more insights into the Growth Strategy of SVB, look at the article.

SVB's establishment as a financial partner for startups and tech companies. The surge in clients during the COVID-19 pandemic. The bank's collapse and receivership in March 2023. The acquisition by First Citizens Bank.

Focus on serving the startup ecosystem. Specialized products like venture debt. Adapting to market changes by focusing on efficiency. Monitoring AI sector for growth opportunities.

Deep expertise in the startup ecosystem. Dedicated startup bankers and a strong VC network. Specialized financial products for fintech clients. High customer satisfaction scores, exceeding the industry average in 2023.

Retained market share among existing clients. Strong presence in the venture capital space. Focus on efficiency and adaptability. Significant portion of venture investment in 2024 going to AI-powered companies.

SVB continues to operate as a division of First Citizens Bank, maintaining its focus on the innovation economy. The bank is adapting by focusing on efficiency, with companies that successfully raised capital in 2024 managing their burn rates effectively. SVB is also closely monitoring the technology sector, particularly companies involved in AI, due to its potential for continued innovation and growth, with a significant portion of venture investment in 2024 going to AI-powered companies.

- Focus on the innovation economy.

- Emphasis on efficiency and burn rate management.

- Close monitoring of the AI sector.

- Continued support for venture-backed companies.

SVB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is SVB Positioning Itself for Continued Success?

As a division of First Citizens Bank, SVB currently holds a significant position within the startup ecosystem. It maintains relationships with approximately half of all startups with funded accounts. However, the bank faces increased competition from other financial institutions.

Looking ahead, SVB is concentrating on stabilizing its operations and strengthening its commercial banking services. The bank's strategy includes integrating with First Citizens Bank and enhancing its financial solutions. SVB is also focused on leveraging its expertise and network to support the evolving needs of the innovation economy.

SVB's market share is supported by its specialized products tailored for venture-backed companies and a robust network within the venture capital (VC) community. Key competitors include JPMorgan Chase, Mercury, Brex, and others. The Marketing Strategy of SVB has been crucial in maintaining its position.

Volatile interest rates and marked-to-market losses on securities are key concerns. The risk of unrealized losses across the banking industry reached $482.4 billion in Q4 2024. Regulatory changes and increased competition from fintech firms also pose challenges.

SVB is optimistic about the economy and financial markets in 2025, anticipating growth in venture fundraising. The bank expects the IPO window to open for profitable companies. SVB plans to focus on its sector expertise and tailored financial solutions.

SVB's business model centers on providing banking services to startups and venture-backed companies. It offers specialized financial products, including lending and deposit services. The bank's model is supported by its deep understanding of the tech and innovation sectors.

The innovation economy's uneven recovery, with a boom in AI and slower activity in other sectors, presents both challenges and opportunities for SVB. The bank must manage interest rate volatility and navigate increased regulatory scrutiny while competing with fintech companies. SVB's success depends on its ability to support high-growth areas like AI and climate tech.

- Interest Rate Risks: Managing the impact of fluctuating interest rates.

- Regulatory Changes: Adapting to new stress-testing requirements.

- Competition: Facing challenges from fintech and established banks.

- Sector Focus: Capitalizing on growth in AI and climate tech.

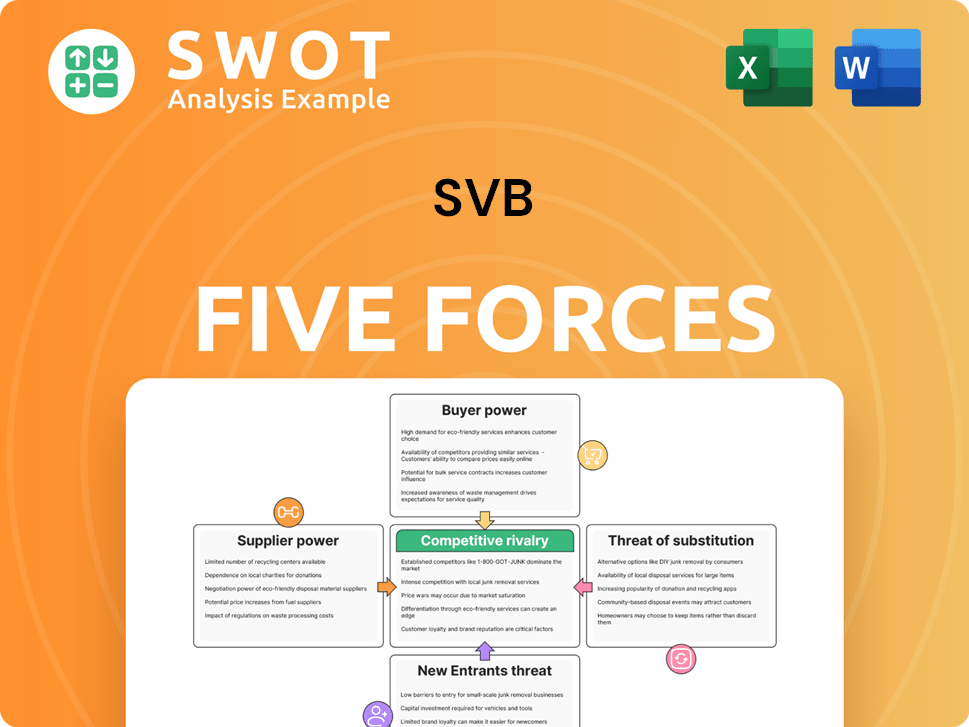

SVB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SVB Company?

- What is Competitive Landscape of SVB Company?

- What is Growth Strategy and Future Prospects of SVB Company?

- What is Sales and Marketing Strategy of SVB Company?

- What is Brief History of SVB Company?

- Who Owns SVB Company?

- What is Customer Demographics and Target Market of SVB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.