SVB Bundle

Who Were SVB's Customers, and Why Did It Matter?

In the fast-paced world of finance, understanding your customer is key, and for Silicon Valley Bank (SVB), this was especially true. Founded to serve the tech industry, SVB quickly became a financial powerhouse. But who exactly were the clients that fueled SVB's rise, and how did their specific needs shape the bank's strategy?

SVB's focus on SVB SWOT Analysis and its unique customer base, from startups to venture capital firms, made it a vital player in the innovation ecosystem. This exploration of SVB's customer demographics and target market provides a detailed look at the bank's strategic approach. Understanding the SVB company profile and its evolution is crucial for anyone looking to understand the dynamics of the financial services industry and the importance of tailored customer segmentation.

Who Are SVB’s Main Customers?

Understanding the customer demographics of the former SVB is crucial for analyzing its business model and market positioning. The bank's primary focus was on serving specific segments within the financial and technology sectors. This targeted approach allowed it to build strong relationships and provide specialized services tailored to the unique needs of its clients. A deep dive into the SVB company profile reveals a strategic concentration on high-growth, innovative sectors.

The SVB target market was primarily composed of entrepreneurs, venture capitalists, and technology companies. This focused approach drove significant growth, especially in the years leading up to its collapse. The bank's customer segmentation strategy was a key factor in its success, enabling it to offer specialized financial products and services. Analyzing the SVB client base provides insights into the bank's historical performance and the dynamics of the industries it served.

The bank's market analysis reveals a strong presence in sectors characterized by innovation and risk-taking. The bank's customer demographics data shows a concentration in early-stage companies and venture capital-backed firms. This specialization, while beneficial during periods of growth, also exposed the bank to specific risks.

The bank catered to innovative individuals and early-stage companies, particularly in technology, healthcare, and biotech. These clients often required specialized banking services and funding to support their growth. Many were pre-revenue or had annual revenues under $5 million, heavily involved in research and development.

The bank collaborated closely with venture capitalists who invested in early-stage companies. As of December 2022, a significant portion, 56%, of the bank's loan portfolio was directed towards venture capital and private equity firms. This close relationship was a key element of the bank's business model.

This segment included both established tech companies and emerging startups. The bank had a strong presence in these sectors, serving mid-stage companies with annual revenues between $5 million and $75 million, as well as large corporate clients with revenues exceeding $75 million. These companies were often focused on global expansion.

The bank also served the premium wine industry, being one of the largest lenders to premium wineries in the West. This diversification helped to balance the bank's portfolio and reduce its reliance on a single sector.

The bank's customer demographics were heavily concentrated in venture capital-backed and early-stage startup firms. The rapid growth in speculative investment in small technology firms led to significant increases in assets and deposits by the end of 2022. This concentration linked the bank's funding growth directly to VC deal activity. To learn more about the bank's strategies, read about the Marketing Strategy of SVB.

- SVB's customer base was highly concentrated in the technology and venture capital sectors.

- The bank's growth was closely tied to the performance of its core customer segments.

- The bank expanded its services to retain clients as they matured from the startup phase.

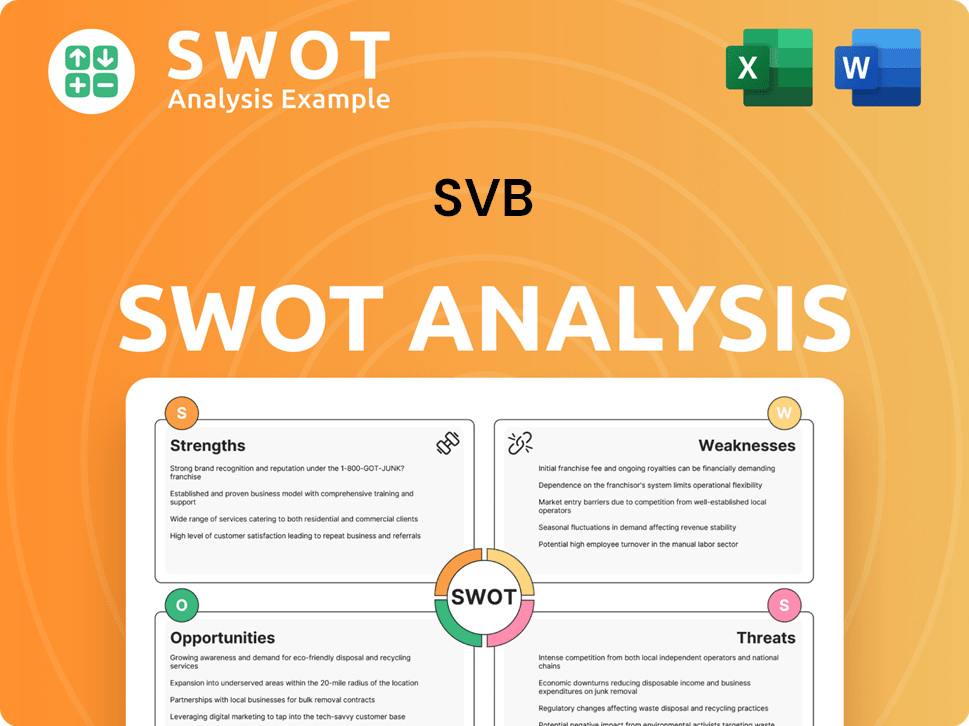

SVB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do SVB’s Customers Want?

Understanding the customer needs and preferences is crucial for any financial institution, and for the [Company Name], this is especially true given its focus on the innovation economy. The bank's success hinges on its ability to meet the unique financial requirements of startups, tech companies, and other businesses operating in fast-paced, high-growth sectors. This article delves into the key aspects of customer needs and preferences, providing an overview of what drives purchasing decisions and how the bank tailors its services to meet these demands.

The SVB target market comprises companies that require specialized financial solutions. These companies often seek a banking partner that understands the intricacies of their industries and can provide tailored products and services to support their growth. The bank's approach is not just about providing financial products; it's about building relationships and offering expertise that helps clients navigate the challenges of their respective sectors.

The SVB client base is diverse, ranging from seed-stage startups to publicly traded firms. The bank aims to support its clients throughout all stages of their business lifecycle, offering comprehensive services that adapt to evolving needs. This long-term perspective is a key factor in the bank's customer-centric approach, ensuring that it remains a valuable partner as its clients grow and evolve.

Clients seek tailored banking products like venture debt, growth capital loans, cash management, and merchant services. These solutions are instrumental for startups and tech firms looking to optimize their financial operations. The bank's SVB Go platform, launched to tens of thousands of clients in 2023, is expected to reach all clients in 2024, simplifying treasury management and enabling real-time payments.

Clients value a banking partner with a deep understanding of the innovation economy. They also need access to an extensive network of venture capital, law, and accounting firms. The bank provides valuable research and analysis on current trends and market conditions, offering actionable insights to its clients.

The bank's clients range from seed-stage companies to publicly traded firms. They require a patient approach to lending that acknowledges market fluctuations. The bank aims to support clients throughout all stages of their business lifecycle, offering comprehensive services that adapt to evolving needs.

Clients leveraging the bank's technology platforms report a 30% reduction in financial management costs. New digital solutions, such as travel and expense management tools and curated tech stack partnerships, are continually being developed to support client operations and growth. These digital tools enhance efficiency and streamline financial processes.

A common pain point for early-stage companies is the 'early-stage bottleneck,' where many startups struggle to secure Series A funding after initial seed investments. The bank aims to address this by providing counsel and insights gleaned from years of experience. In the wine industry, declining consumer demand and grape and wine oversupply are significant concerns. The bank's 2025 wine report suggests that wineries need to develop occasion-based marketing campaigns for younger consumers.

The primary focus of the bank is on the innovation economy, including technology, life sciences, and venture capital-backed companies. The bank's expertise in these sectors allows it to offer specialized financial products and services. The bank's understanding of the unique challenges and opportunities within these industries is a key differentiator.

The purchasing behaviors and decision-making criteria of the bank's clients are driven by a need for financial solutions that support rapid growth. They also need to navigate the unique challenges of their sectors. The bank's ability to provide tailored services and industry expertise is crucial.

- Personalized Service: Clients value a high level of personalized attention and support. The bank's relationship managers work closely with clients to understand their specific needs and provide customized solutions.

- Industry Expertise: Clients seek a banking partner with a deep understanding of their industry. The bank's expertise in the innovation economy is a significant advantage.

- Access to Specialized Financial Products: Clients require tailored banking products like venture debt and growth capital loans. The bank's ability to offer these specialized products is essential.

- Digital Solutions: Clients expect efficient and user-friendly digital tools. The bank continues to invest in its digital platforms to meet these expectations.

- Strategic Partnerships: The bank provides valuable research, perspectives, and analysis on current trends and market conditions. This helps clients make informed decisions.

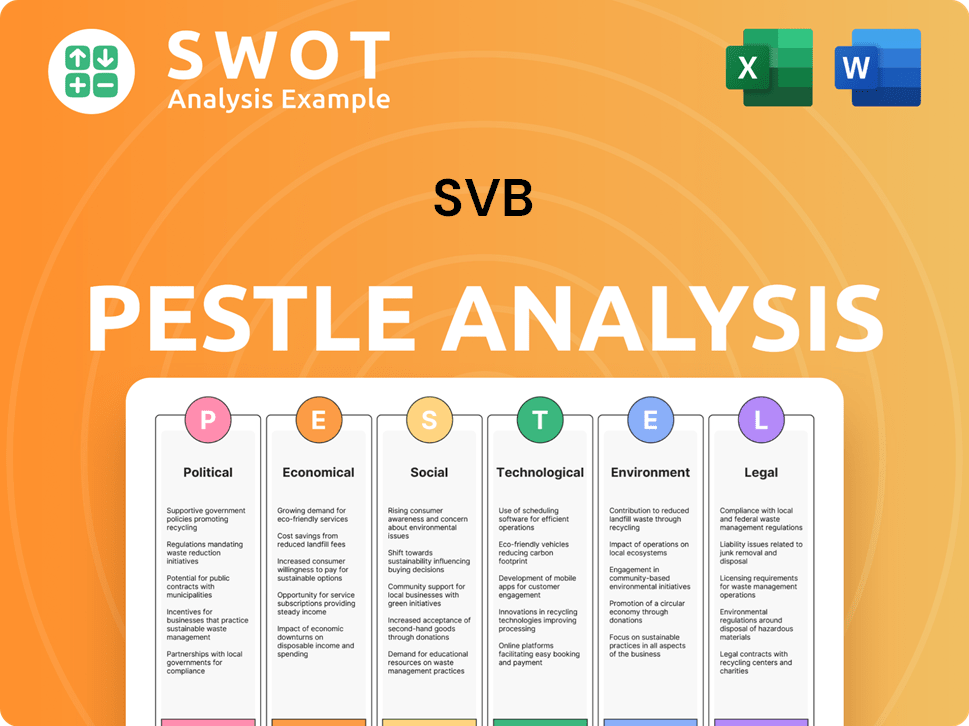

SVB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does SVB operate?

The geographical market presence of SVB, a company with a strong focus on the innovation economy, is primarily concentrated in the United States. Its strategic focus is on areas with high concentrations of technology, life sciences, and venture capital activity. This targeted approach helps SVB serve its specialized client base effectively.

SVB's headquarters are located in Santa Clara, California, but it has expanded its reach across the country. Key markets include Silicon Valley, Boston, and New York, reflecting its dedication to serving the innovation economy in these regions. The company's expansion strategy includes establishing branches in other technology hubs across the U.S.

SVB also maintains an international presence, serving clients through offices in multiple countries. This global footprint allows the company to support its clients' international operations and investments. In 2025, over 14 companies globally were using SVB for investment and finance services.

In 2025, 64.29% of SVB's customers were from the United States, highlighting its strong domestic presence. This concentration allows SVB to deeply understand and cater to the specific needs of the U.S. innovation ecosystem.

SVB also serves clients internationally, with India (14.29%) and Mexico (7.14%) being significant markets. This global reach supports the international ventures of its clients and diversifies its market exposure.

Differences in customer demographics and preferences across these regions are evident. SVB's approach involves localizing its offerings and partnerships to succeed in diverse markets, leveraging its deep sector expertise and connections. For more insights into the competitive landscape, consider exploring the Competitors Landscape of SVB.

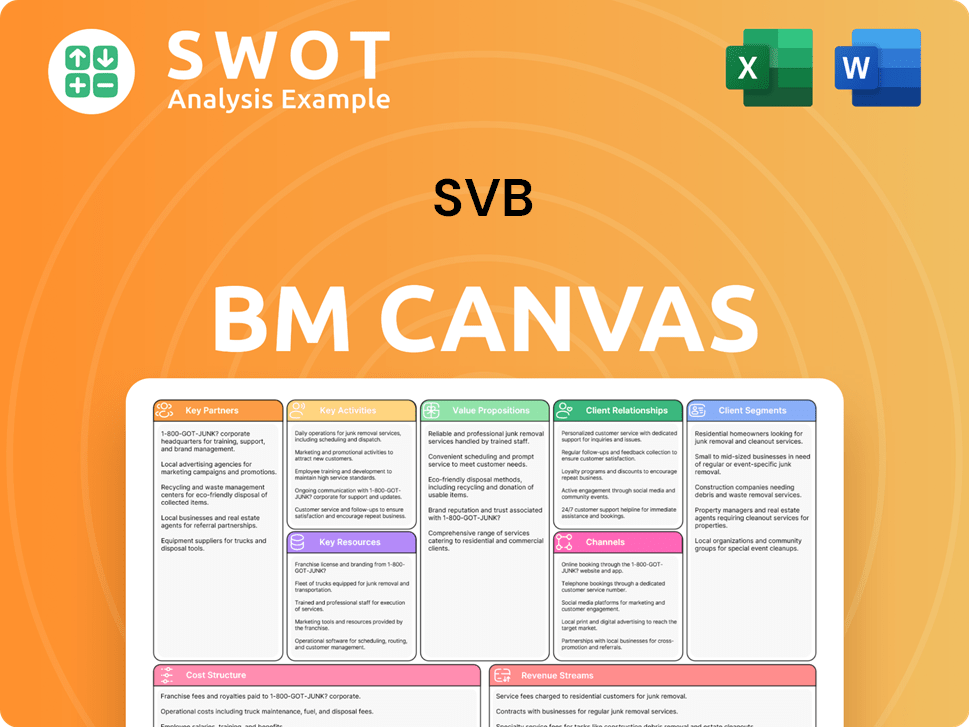

SVB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does SVB Win & Keep Customers?

SVB's approach to customer acquisition and retention is centered on building strong relationships and providing specialized services tailored to its niche market. The bank focuses on the innovation economy, particularly startups and venture-backed companies, offering financial solutions that cater to their unique needs. This strategy involves a combination of relationship-based banking, industry expertise, and targeted digital solutions.

The core of SVB's strategy revolves around establishing long-term relationships with clients. This means providing comprehensive banking and financial services that evolve with the client's growth. SVB's commitment to the innovation economy is further demonstrated through its research, insights, and analysis of market trends, which positions them as a trusted advisor.

Post-acquisition by First Citizens Bank in March 2023, SVB has focused on rebuilding trust and demonstrating its continued commitment to the innovation economy. This involves retaining existing clients and attracting new ones by showcasing the value of its specialized services and industry expertise. Understanding the Owners & Shareholders of SVB and their strategies is essential to understanding the company's direction.

SVB emphasizes building enduring relationships with clients from the start. This approach involves dedicated relationship management and proactive client support to meet their evolving needs. The focus is on providing comprehensive banking and financial services that adapt to the client's growth trajectory, ensuring long-term partnerships.

SVB invests continuously in digital solutions like its digital banking platform, SVB Go, for streamlined treasury management and real-time payments. They offer tools for cash flow management, international payments, and risk mitigation. Efficiency tools like travel and expense management and curated tech stack partnerships are also provided.

SVB leverages its deep understanding of the innovation economy to provide valuable research and analysis on market trends. This positions them as a thought leader and trusted advisor to their clients, helping them navigate the complexities of the tech and venture capital landscape. They offer perspectives on current trends and market conditions.

SVB focuses on niche markets and employs targeted outreach through industry events and partnerships. Referrals within the innovation ecosystem and collaborations with venture capital firms are vital. For example, in the wine industry, they suggest occasion-based marketing campaigns for younger consumers to attract new clients.

Customer data and CRM systems are crucial in B2B environments like SVB's. CRM systems centralize customer information, enabling detailed tracking of contacts and communication history. This facilitates audience segmentation and targeted campaigns. Modern CRM platforms are central to revenue operations and customer success.

Following the acquisition by First Citizens Bank, SVB focused on rebuilding trust and demonstrating its commitment to the innovation economy. As of March 2024, 81% of pre-March 2023 clients maintained active accounts, and thousands of clients who had left have returned. The Tech and Healthcare Banking team made over 500 new loans totaling more than $3 billion in new loan commitments between April and December 2023.

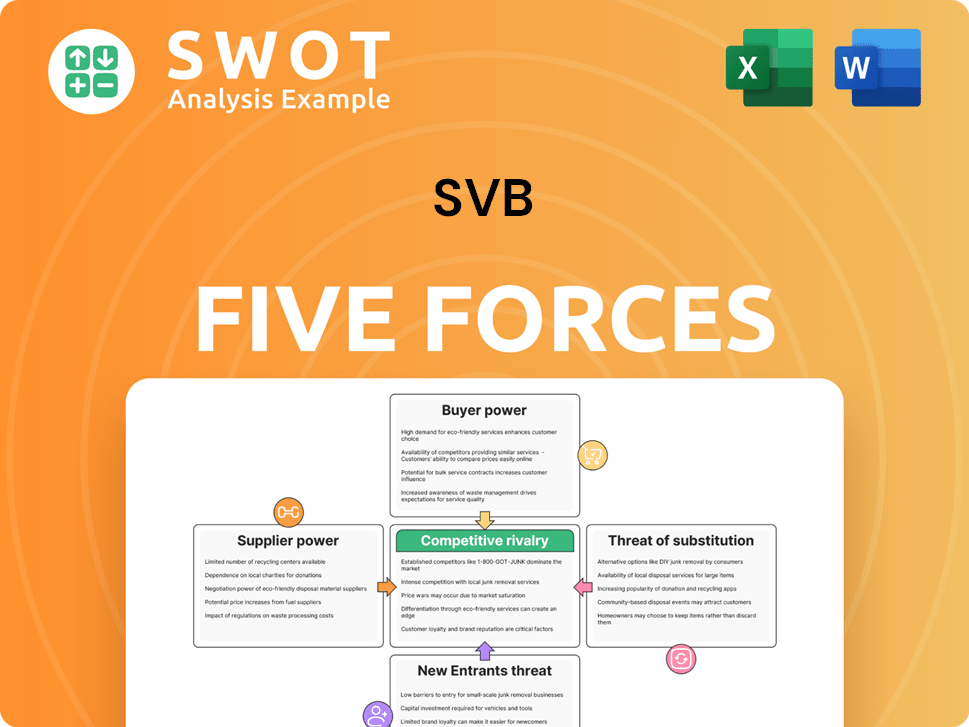

SVB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.