SVB Bundle

How did SVB Conquer the Tech World?

Silicon Valley Bank (SVB) revolutionized financial services by focusing on the innovation economy, but how did they actually attract and retain clients? This deep dive explores the SVB SWOT Analysis, examining the bank's original sales and marketing approach, which was pivotal in its rise to prominence. Discover the strategies that made SVB the go-to financial partner for tech startups and venture capital firms.

SVB's success wasn't accidental; it was built on a carefully crafted SVB sales strategy and SVB marketing strategy designed for the unique needs of its SVB target market. From its early days, SVB understood the importance of building relationships, a core element of its SVB business model. This document will dissect the bank's SVB sales and marketing approach, including its SVB sales process for startups, SVB marketing campaigns for tech companies, and how it positioned its SVB brand positioning within the competitive landscape, providing valuable insights into their SVB financial services and overall SVB strategy.

How Does SVB Reach Its Customers?

The sales channels of the bank, reflected its specialized client base within the innovation economy. The core of its sales strategy revolved around direct sales teams, focusing on venture capital firms, private equity firms, and technology startups. This approach was critical in building trust and understanding the unique needs of its clients. The bank's success was significantly tied to its ability to cultivate and maintain strong relationships within the venture capital community.

The bank's sales strategy was primarily direct and relationship-based, which was a key factor in its success. These teams were strategically positioned in innovation hubs such as Silicon Valley, Boston, and New York. Their physical presence allowed for in-person meetings, networking events, and direct consultations. This strategy proved highly effective in attracting and retaining clients within the tech sector.

The evolution of the bank's channels saw a significant emphasis on building a robust network within the venture capital community. Early on, the bank recognized that by serving VCs, they could gain access to a pipeline of their portfolio companies. This led to a strategic focus on developing strong relationships with venture capitalists, often providing banking services to the VC firms themselves, which then naturally led to introductions to their portfolio companies. This 'land and expand' strategy within the innovation ecosystem proved highly effective. While not a traditional retail bank, the bank did leverage its website for information dissemination and client onboarding, though the primary sales conversion still heavily relied on direct human interaction and referrals. The performance of these direct channels was historically strong, contributing significantly to the bank's growth and market share within its niche. For instance, in 2022, before its collapse, the bank's venture capital relationships were a cornerstone of its business, attracting a significant portion of venture capital-backed companies.

The bank’s sales strategy heavily relied on direct sales teams. These teams were organized geographically and specialized by industry vertical within the tech sector. They focused on building relationships with venture capital firms, private equity firms, and startups.

A key aspect of the bank's SVB sales strategy was cultivating relationships with venture capital firms. Serving VCs provided access to their portfolio companies, creating a 'land and expand' strategy. This approach was highly effective in attracting venture capital-backed companies.

The bank had a strong physical presence in key innovation hubs. Locations in Silicon Valley, Boston, and New York facilitated in-person meetings and networking. This geographic focus was crucial for understanding client needs and building trust.

While direct interaction was primary, the bank utilized its website for information. Referrals from venture capital partners played a significant role in client acquisition. The SVB business model benefited from these direct channels.

The bank's sales approach was centered around direct engagement and relationship building, especially within the tech and venture capital sectors. This strategy was crucial for understanding and meeting the specific needs of its clients, which included startups and established tech companies. The bank's focus on direct sales teams and networking events in key innovation hubs, such as Silicon Valley, played a pivotal role in its market presence and customer acquisition.

- Direct Sales Teams: Focused on venture capital firms and tech startups.

- Venture Capital Partnerships: Serving VCs to gain access to their portfolio companies.

- Geographic Presence: Strong presence in key innovation hubs.

- Website and Referrals: Used for information dissemination and client onboarding.

The bank's sales strategy was highly effective due to its focus on direct engagement and relationship building within the innovation economy. This approach, combined with a strong geographic presence in key tech hubs and strategic partnerships with venture capital firms, allowed the bank to establish a significant market share. For more detailed insights into the bank's revenue streams and business model, see Revenue Streams & Business Model of SVB.

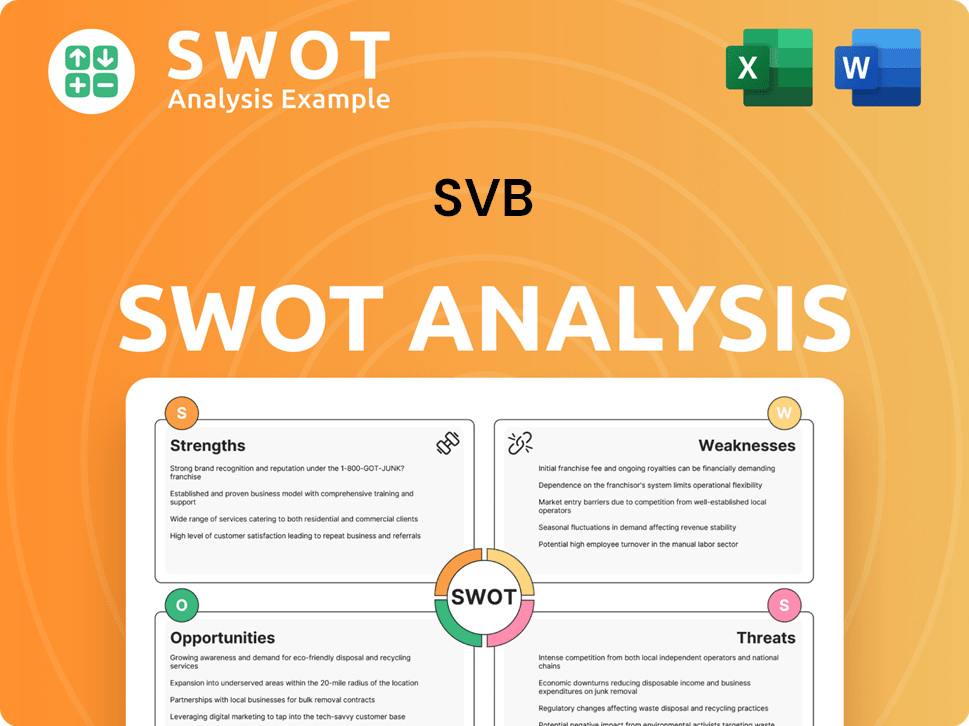

SVB SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does SVB Use?

The marketing tactics of the bank were highly targeted and sophisticated, reflecting its focus on the innovation economy. The bank employed a data-driven approach, utilizing client data to segment its audience and personalize offerings. This was crucial for serving the diverse needs of the innovation economy. The bank's sales and marketing approach was designed to position it as a thought leader and valuable partner for startups and investors.

Content marketing, SEO, paid advertising, and email marketing were all key components of the bank’s strategy. The bank also engaged with influencers and utilized social media platforms like LinkedIn. The marketing mix evolved to become more digitally focused over time, but always maintained a strong emphasis on relationship building and thought leadership. The bank's strategy was designed to capture organic search traffic from its niche audience.

The bank's strategies included a focus on long-tail keywords related to startup financing, venture debt, and banking for tech companies. The bank likely used CRM systems and analytics platforms to track client interactions, measure campaign effectiveness, and identify new opportunities. The bank's sales team structure was designed to cater to the specific needs of its target market.

The bank produced extensive research reports, white papers, and industry analyses on trends in venture capital, technology, and various innovation sectors. This content positioned the bank as a thought leader. The bank's content marketing strategy was designed to attract and engage its target audience.

SEO efforts likely focused on long-tail keywords related to startup financing, venture debt, and banking for tech companies. The goal was to capture organic search traffic from its niche audience. The bank's SEO strategy was part of its broader digital marketing tactics.

Paid advertising was more selective, often appearing in industry-specific publications, online forums, and events frequented by entrepreneurs and VCs. The bank's advertising strategy was designed to reach its target market effectively. The bank's marketing budget allocation was carefully planned.

Email marketing was crucial for nurturing leads and maintaining client relationships, with personalized communications offering insights, event invitations, and tailored financial solutions. The bank's email marketing strategy focused on customer acquisition strategies. The bank's sales cycle length varied depending on the product and client.

The bank engaged with influencers within the venture capital and startup communities, leveraging their credibility to extend its reach. The bank's social media strategy examples included engaging with industry influencers. The bank's lead generation methods included influencer marketing.

Social media platforms like LinkedIn were vital for professional networking and sharing industry insights, reinforcing its brand as a trusted advisor. The bank's social media strategy was designed to build brand awareness. The bank's customer relationship management (CRM) system was integrated with its social media platforms.

Data-driven marketing was central to the bank's approach, utilizing client data to segment its audience and personalize its offerings. This was a critical factor in serving the diverse needs of the innovation economy. The bank's market segmentation strategies were based on client data.

- The bank likely used CRM systems and analytics platforms to track client interactions.

- The bank used data to measure campaign effectiveness.

- The bank identified new opportunities through data analysis.

- The bank's digital marketing tactics were constantly refined based on data insights.

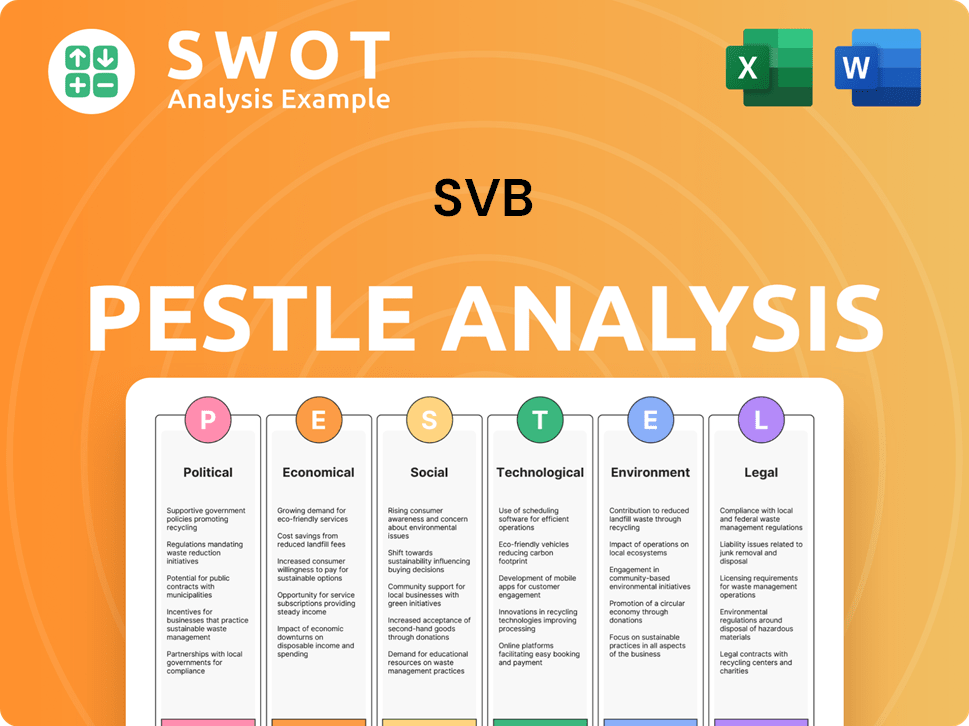

SVB PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is SVB Positioned in the Market?

The brand positioning of the bank was centered on its identity as 'the bank of the innovation economy.' This unique positioning allowed it to differentiate itself from traditional financial institutions. Its specialized services catered specifically to startups, venture capital firms, and technology companies, areas where standard banking models often fell short.

Its core messaging focused on understanding the distinct financial patterns of high-growth, often pre-profit, tech companies. The bank offered tailored solutions, ranging from venture debt to commercial banking and private banking services for founders. The bank's visual identity and overall tone were professional, forward-thinking, and empathetic, reflecting its deep integration within the tech ecosystem. This approach was crucial for its Growth Strategy of SVB.

The bank's strategy was not just about providing financial services; it was about being a strategic partner. It aimed to understand the challenges and opportunities of scaling a tech company. This focus on expertise, flexibility, and a deep network within the innovation sector helped the bank build strong relationships with its target market. The bank consistently highlighted its commitment to innovation, sustainability, and community building within the tech industry.

The bank's unique selling proposition (USP) was built on expertise, flexibility, and a deep network within the innovation sector. This approach allowed it to stand out from other financial institutions. It provided tailored financial solutions that understood the specific needs of tech companies.

The bank's target market comprised startups, venture capital firms, and technology companies. This focused approach allowed it to develop specialized services and expertise. This concentration on a specific niche market was a key aspect of its success.

Maintaining brand consistency across all touchpoints was crucial. This included its online presence, physical offices, and client interactions. This consistency reinforced its identity as a specialist bank for innovators. This approach helped build trust and recognition within its target market.

The bank consistently highlighted its commitment to innovation and sustainability. This included financing green tech initiatives. This commitment helped align the bank with the values of its target audience. This approach helped build a strong brand reputation.

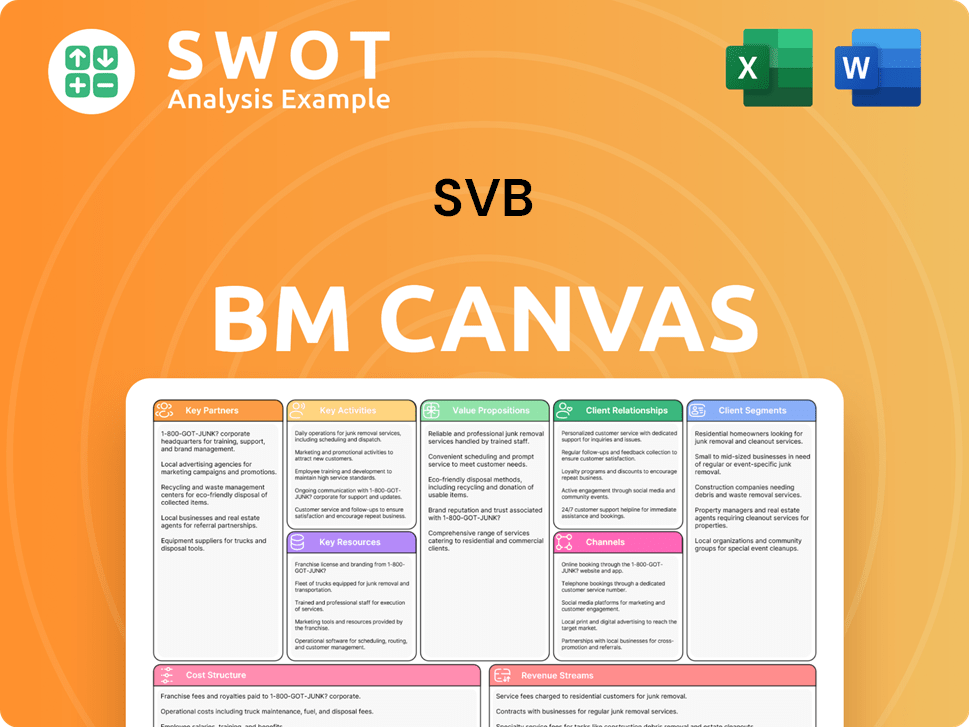

SVB Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are SVB’s Most Notable Campaigns?

The sales and marketing strategy of the company, historically, revolved around targeted initiatives rather than broad advertising. These strategies focused on deepening its integration within the innovation ecosystem. This approach, crucial to its success, involved a combination of strategic partnerships and thought leadership to reach its target market.

Key to its approach were active participation and sponsorship of key industry events. These events served as direct channels to connect with founders, investors, and industry leaders. The goal was lead generation, brand visibility, and reinforcing its position as a central player in the tech landscape. These efforts were measured by long-term relationships and business growth.

Another important element was the creation of thought leadership content, including the 'Startup Outlook Report'. These reports provided valuable insights to the innovation community. The focus was on being a trusted source of data and trends, attracting new clients and strengthening existing relationships. This strategy helped increase brand credibility and drive inbound inquiries.

The company actively sponsored and participated in key industry events such as TechCrunch Disrupt and SXSW. These events enabled direct connections with the target market, supporting lead generation efforts. This approach was essential for building relationships and showcasing expertise.

The company published reports like the 'Startup Outlook Report' to provide valuable insights. These reports aimed to attract new clients and solidify relationships. The goal was to establish itself as a trusted source of industry data and trends.

The sales process for startups involved identifying and engaging potential clients through various channels. Lead generation methods included event participation and content marketing. The focus was on converting leads into long-term clients.

The company's brand positioning centered on being a key player in the tech landscape. This was achieved through consistent messaging and strategic partnerships. The goal was to create a strong brand reputation within the innovation economy.

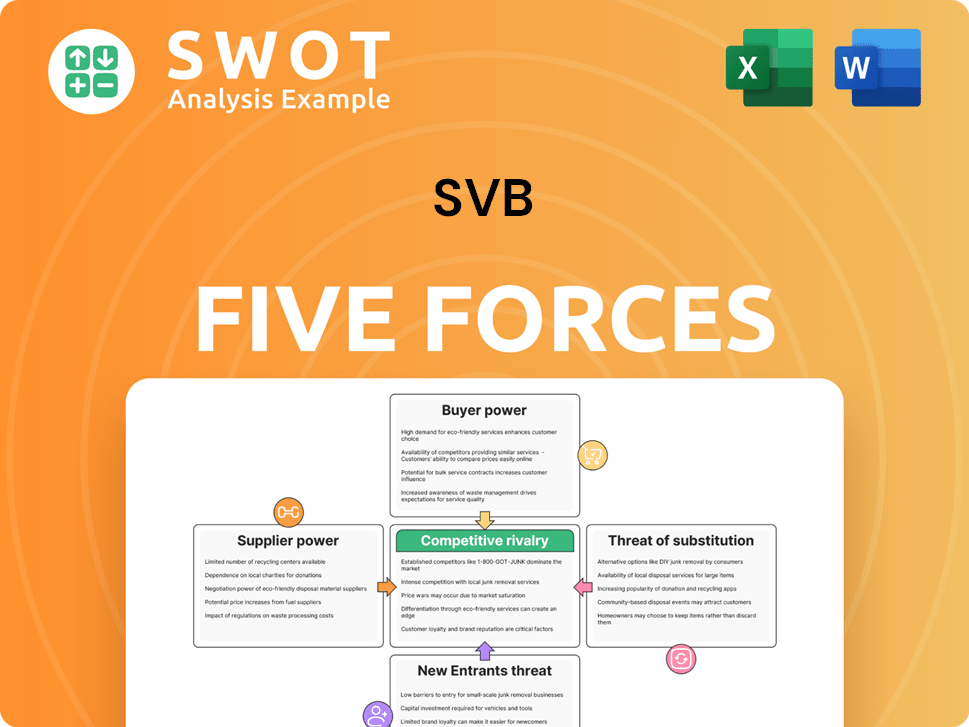

SVB Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SVB Company?

- What is Competitive Landscape of SVB Company?

- What is Growth Strategy and Future Prospects of SVB Company?

- How Does SVB Company Work?

- What is Brief History of SVB Company?

- Who Owns SVB Company?

- What is Customer Demographics and Target Market of SVB Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.